ARCHIVED - Canada Border Services Agency Quarterly Financial Report

For the quarter ended September 30, 2014

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

1. Introduction

This quarterly financial report (QFR) has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates, Supplementary Estimates A, as well as Canada’s Economic Action Plan 2012 (Budget 2012), Canada’s Economic Action Plan 2013 (Budget 2013) and Canada’s Economic Action Plan 2014 (Budget 2014).

A summary description of the Canada Border Services Agency (CBSA) program activities can be found in Part II of the Main Estimates, and a detailed description in Part III – Report on Plans and Priorities.

1.1 Basis of Presentation

This QFR has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities (Table 1) includes the CBSA’s spending authorities granted by Parliament and those used by the Agency, consistent with the 2013-2014 and 2014-2015 Main Estimates and Supplementary Estimates A.

Parliamentary spending authority is required before monies can be spent by the Government. Approvals are given in the form of approved limits through appropriation acts or through other legislation providing statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The CBSA uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

The QFR has not been subjected to an external audit or review.

1.2 Financial Structure

The CBSA has a financial structure composed of voted budgetary authorities that include Vote 1 Operating Expenditures and Vote 5 Capital Expenditures, while the statutory authorities consist mainly of contributions to the employee benefit plans.

In addition, the Agency has the authority from Parliament to expend certain revenues that it receives in a fiscal year through the conduct of its operations to offset expenditures that it incurs in that fiscal year. As a result of this respendable authority, some of the Agency’s programs are partially funded through User Fees (e.g. Nexus).

The CBSA currently operates on the basis of a two-year appropriation, whereby any unused spending authority at the end of a fiscal year is available to be used the following year. However, any portion of the spending authority not used at the end of the second year is lapsed.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

This section highlights the significant items that contributed to the net increase or decrease in resources available for the year and actual expenditures as of the quarter ended September 30, 2014.

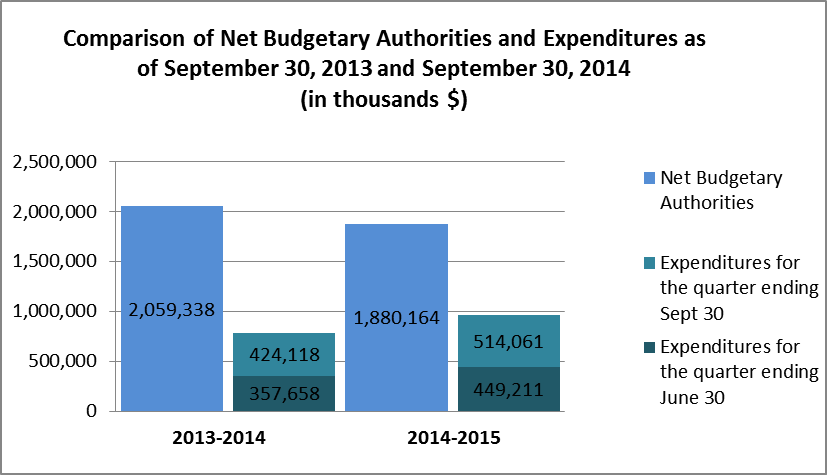

Graph 1 - Comparison of Net Budgetary Authorities and Expenditures as of September 30, 2013 and September 30, 2014 (in thousands $)

| 2013–2014 | 2014–2015 | |

|---|---|---|

| Net Budgetary Authorities | 2,059,338 | 1,880,164 |

| Expenditures for the quarter ending September 30 | 424,118 | 514,061 |

| Expenditures for the quarter ending June 30 | 357,658 | 449,211 |

2.1 Significant Changes to Authorities

For the period ending September 30, 2014, the authorities provided to the CBSA are comprised of the Main Estimates and the 2013-2014 unused spending authority, the same as for the period ending September 30, 2013.

As at September 30, 2014, the Statement of Authorities (Table 1) reflects total authorities available of $1,880.2 million, compared to $2,059.3 million at the same quarter last year. The result is a net decrease of $179.1 million or (8.7%) in authorities due to the decrease in the unused spending authority from the previous year ($143.8 million vs $379.2 million) offset by an increase of $56.2 million as highlighted in the 2014-2015 Main Estimates.

The Agency’s Vote 1 Operating Expenditures decreased by $166.3 million or (10%), which is mainly attributed to the net effect of the following significant items:

- Increases totaling $103.1 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2014.

- Decreases totaling $269.4 million mainly due to:

- Decrease of $167.6 million due to a smaller carry forward of unused spending authorities. $93.6 million of unused spending authorities at the end of 2013-2014 were carried into 2014-2015 as compared to $261.2 million of unused spending authorities from 2012-13 carried forward into 2013‑2014; and

- Decreases totaling $101.8 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2014.

The Agency’s Vote 5 Capital Expenditures decreased by $10.2 million or (4.6%), which is mainly attributed to the net effect of the following significant items:

- Increases totaling $74.3 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2014.

- Decreases totaling $84.5 million due to:

- Decrease of $67.8 million due to a smaller carry forward of unused spending authorities. $50.2 million of unused spending authorities at the end of 2013-2014 were carried into 2014-2015 as compared to $118.02 million of unused spending authorities from 2012-13 carried forward into 2013‑2014; and

- Decreases totaling $16.7 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2014.

The Agency’s Statutory Authority related to the employee benefit plan decreased by $2.6 million, or 1.4% from the previous year.

2.2 Explanations of Significant Variances in Expenditures from Previous Year

As indicated in the Statement of Authorities (Table 1), the Agency’s expenditures for the quarter ending September 30, 2014 was $514.1 million, as compared to $424.1 million for the quarter ending September 30, 2013. The Agency’s year-to-date expenditures total $963.3 million as compared to $781.8 million at the same time last year. The increase in expenditures is due to the following:

- The Vote 1 Operating Expenditures year-to-date used at quarter end increased by $174.6 million or 27% - $826.6 million as compared to $652.0 million last year. $38.5 million of the increase can be attributed to the Government of Canada’s one-time transitional payment as it moves to a pay-in-arrears pay system, while the remainder is mainly due to one-time severance payouts as a result of the recent collective agreement for Border Services Officers (FB classification). It is important to note that the Agency will be reimbursed for the severance payouts through the Treasury Board Central Vote 30 later in the fiscal year.

- The Vote 5 Capital Expenditures year-to-date used at quarter end increased by $8.2 million or 21% - $48.1 million as compared to $39.9 million last year. The increase is primarily due to increased investments in initiatives announced as part of the Beyond the Border Action Plan.

The Departmental Budgetary Expenditures by Standard Object (Table 2) indicates the following most notable variances by standard object:

- Increase of $142.6 million year-to-date in personnel expenditures mainly due to severance payouts as a result of the recently signed collective agreement for Border Services Officers (FB classification); and

- Increase of $34.8 million in other subsidies and payments mainly due to the one-time transition payment for implementing salary payment in arrears by the Government of Canada.

The planned revenue from the sales of services reflects the Agency’s revenue respending authority which has increased from $12.13 million in 2013-2014 to $16.43 million in 2014-2015. The year-to-date revenue from the sales of services is up by $1.2 million or 23% ($6.2 million as compared to $5.0 million in 2013-2014) due to the timing in the collection of payments and volume increases in the Nexus program.

3. Risks and Uncertainties

The complexity of the operating environment of the CBSA can be seen in the broad scope of external drivers. Developments in the global economy cascade down into Canada’s trade, immigration, tourism and refugee patterns, affecting volumes and introducing security and facilitation challenges. Continued growth in both global trade and the virtual economy has benefitted legitimate business and criminal enterprises alike, and presents more complexity in managing Canada’s supply chain and physical borders. Similarly, the rapid evolution of technology presents opportunities for the fortification of border controls and identity verification, but it also presents opportunities to circumvent border controls for those who are so inclined.

In considering these factors, the CBSA has embarked on various initiatives, including those identified in the Beyond the Border Action Plan, that will allow the organization to be even more efficient and effective in the way it does business through increased efforts to address threats early and facilitate trade and travel.

To improve its ability to successfully deliver on its initiatives, the Agency regularly examines its enterprise risk landscape, the results of which are published in the CBSA Enterprise Risk Profile (ERP). The ERP identifies and ranks the top risks to the Agency’s strategic outcome and undergoes a full revision every two years. Risks are divided into one of two categories: business risks and enabler risks. Business risks are the risks that the Agency is mandated to address on behalf of Canada (e.g. contraband, irregular migration, etc.) while enabler risks are risks to the Agency’s ability to deliver on its mandate (e.g. risks related to human resources, information technology, etc.).

The most recent full revision to the ERP occurred in spring 2013, while an ERP Risk Status Update was developed in spring 2014. The Risk Status Update provides an update on the progress of mitigation activities, identifies significant changes observed in the environment over the past 12 months, as well as risk trend information indicating whether exposure to a given risk has increased, decreased, or remained the same. While exposure to the Agency’s business risks has remained relatively stable, several of the Agency’s enabler risks were assessed as having decreased slightly in severity. This reduction in exposure is attributable to progress made in mitigation activities over the past 12 months and to positive effects starting to be felt as a result of controls implemented prior to the 2013 ERP.

4. Significant Changes in Relation to Operations, Personnel and Programs

4.1 Key Senior Personnel

There have been no changes to key senior personnel in the second quarter of 2014-2015.

4.2 Operations

In addition to the Agency’s Report on Plans and Priorities (RPP) priorities, the Agency is pursuing its Transformation Agenda driven by both the Beyond the Border Action Plan and Blueprint 2020, complemented by Border Modernization. While there have been no significant changes in relation to the Agency’s operations, some changes have occurred in the organizational structure. This has resulted in the establishment of the Trade and Anti-Dumping Programs directorate, as well as realignment and consolidation of several other directorates.

Budget 2014 announced an immediate increase to the rates of excise duty applicable to tobacco products to account for a decade of inflation, as well as permanently eliminated tariffs on mobile offshore drilling units used in offshore oil and gas exploration and development on or after May 5, 2014. While both announcements resulted in numerous systems changes to ensure the appropriate duty and tariff rates are being assessed, there was no effect on CBSA operations to travellers and commercial goods.

4.3 New Programs

There have been no significant changes in relation to programs. The Agency continues to play an instrumental role in implementing the Beyond the Border Action Plan initiatives as announced by the Prime Minister and the U.S. President in December 2011. This Action Plan provides a practical road map for speeding up legitimate trade and travel. The CBSA is leading ten initiatives, plays a key supporting role in nine initiatives, and has an interest in another nine initiatives.

4.4 Budget 2012 Implementation

This section provides an overview of the savings measures announced in Budget 2012 that have been implemented in order to refocus government and programs: make it easier for Canadians and business to deal with their government and to modernize and reduce the back office operations.

The CBSA has achieved its Budget 2012 ongoing savings of $143.4 million starting in fiscal year 2014-2015 through efficiency measures by restructuring, modernizing programs and transforming business practices in selected areas by introducing following savings measures:

- a streamlined and simplified its approach to internal services through the use of more technology and less cumbersome processes;

- the optimization of programs to get better results at reduced costs;

- the transformation of programs in order to eliminate red tape, provide better services to Canadians and reduce costs; and

- the adjustment of front-line service delivery where adjustments can be made without impacting service levels.

The Budget 2012 initiatives enabled the CBSA to focus and align resources to its key priorities and core mandate. The CBSA is committed to meeting current and future security and service requirements to serve Canadians and provide them with a modern, dynamic border.

The impacts of Budget 2012 have been reflected in the financial information for the 1st quarter and the budgets and expenditures have been reduced accordingly.

Supplementary data on Budget 2012 savings by program activity is included in Table 3.

5. Approval by Senior Officials

Approved by:

Luc Portelance

President

Ottawa, Canada

Date: November 12, 2014

Claude Rochette

Chief Financial Officer

Ottawa, Canada

Date: October 31, 2014

6. Table 1: Statement of Authorities (Unaudited)

| Total available for use for the year ending March 31, 2015* | Used during the quarter ended September 30, 2014 | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,491,492 | 431,328 | 826,589 |

| Vote 5 - Capital Expenditures | 212,102 | 38,394 | 48,119 |

| Statutory Authority - Contributions to employee benefit plans | 176,570 | 44,143 | 88,285 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 96 | 137 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 100 | 142 |

| Total budgetary authorities | 1,880,164 | 514,061 | 963,272 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 1,880,164 | 514,061 | 963,272 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter end.

| Total available for use for the year ending March 31, 2014* | Used during the quarter ended September 30, 2013 | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 10 - Operating Expenditures | 1,657,843 | 343,666 | 652,027 |

| Vote 15 - Capital Expenditures | 222,331 | 35,520 | 39,866 |

| Statutory Authority - Contributions to employee benefit plans | 179,164 | 44,791 | 89,582 |

| Statutory Authority – Court awards – Crown Liabilities Act | 0 | 14 | 14 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 9 | 24 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 118 | 263 |

| Total budgetary authorities | 2,059,33 | 424,118 | 781,776 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 2,059,338 | 424,118 | 781,776 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter end.

7. Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited)

| Planned expenditures for the year ending March 31, 2015 * | Expended during the quarter ended September 30, 2014 | Year-to-date used at quarter end |

|

|---|---|---|---|

| Expenditures | |||

Personnel |

1,247,346 | 422,120 | 779,604 |

Transportation and communications |

67,365 | 12,049 | 19,304 |

Information |

1,823 | 275 | 614 |

Professional and special services |

285,818 | 60,366 | 98,961 |

Rentals |

27,089 | 2,681 | 4,411 |

Repair and maintenance |

28,926 | 3,380 | 6,541 |

Utilities, materials and supplies |

24,557 | 3,295 | 5,547 |

Acquisition of land, buildings and works |

55,724 | 4,048 | 5,618 |

Acquisition of machinery and equipment |

139,923 | 6,724 | 7,092 |

Transfer payments |

0 | 0 | 0 |

Other subsidies and payments |

18,023 | 3,051 | 41,687 |

| Total gross budgetary | 1,896,594 | 517,989 | 969,379 |

| Less revenues netted against expenditures | |||

Sales of Services |

16,430 | 4,024 | 6,244 |

Other Revenue |

0 | -96 | -137 |

| Total revenues netted against expenditures | 16,430 | 3,928 | 6,107 |

| Total net budgetary expenditures | 1,880,164 | 514,061 | 963,272 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by parliament at quarter-end.

| Planned expenditures for the year ending March 31, 2014 * | Expended during the quarter ended September 30, 2014 | Year-to-date used at quarter end | |

|---|---|---|---|

| Expenditures | |||

Personnel |

1,219,391 | 335,995 | 637,005 |

Transportation and communications |

107,370 | 10,764 | 18,534 |

Information |

2,406 | 219 | 695 |

Professional and special services |

474,340 | 54,514 | 93,970 |

Rentals |

15,926 | 2,047 | 3,775 |

Repair and maintenance |

42,794 | 2,561 | 7,010 |

Utilities, materials and supplies |

35,635 | 4,088 | 6,299 |

Acquisition of land, buildings and works |

73,735 | 5,238 | 5,575 |

Acquisition of machinery and equipment |

82,898 | 4,630 | 7,104 |

Transfer payments |

0 | 0 | 0 |

Other subsidies and payments |

16,973 | 7,409 | 6,867 |

| Total gross budgetary expenditures | 2,071,468 | 427,465 | 786,834 |

| Less revenues netted against expenditures | |||

Sales of Services |

12,130 | 3,356 | 5,082 |

Other Revenue |

0 | -9 | -24 |

| Total revenues netted against expenditures | 12,130 | 3,347 | 5,058 |

| Total net budgetary expenditures | 2,059,338 | 424,118 | 781,776 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter-end.

8. Table 3: Departmental Budget 2012 Planned Savings by Program (Unaudited)

| Program | 2012-2013 | 2013-2014 | 2014-2015 & Ongoing* |

|---|---|---|---|

| Risk Assessment | 5,452 | 10,168 | 11,209 |

| Admissibility Determination | 7,254 | 21,170 | 31,194 |

| Criminal Investigations | 15 | 73 | 118 |

| Immigration Enforcement | 103 | 1,152 | 3,432 |

| Secure and Trusted Partnerships | 158 | 327 | 7,706 |

| Revenue and Trade Management | 1,753 | 3,994 | 9,816 |

| Recourse | 129 | 302 | 609 |

| Internal Services | 16,415 | 35,594 | 79,323 |

| Total for CBSA | 31,279 | 72,780 | 143,407 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* includes statutory employee benefit plan savings

- Date modified: