Canada Border Services Agency: Quarterly Financial Report — For the quarter ended June 30, 2024

On this page

- 1. Introduction

- 2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

- 3. Risks and uncertainties

- 4. Significant changes in relation to operations, personnel and programs

- 5. Approval by senior officials

- 6. Table 1: Statement of authorities (unaudited)

- 7. Table 2: Departmental budgetary expenditures by standard object (unaudited)

1. Introduction

This Quarterly Financial Report (QFR) has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates.

Information on the ‘raison d’être,’ mandate, role and core responsibilities of the Canada Border Services Agency (CBSA) can be found in Part III Departmental Plan and Part II of the Main Estimates.

The QFR has not been subjected to an external audit or review, but has been reviewed internally by the departmental Audit Committee.

1.1 Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying statement of authorities (Table 1) includes the department's spending authorities granted by Parliament, and those used by the department consistent with the Main Estimates for the to and to fiscal years. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by Government departments. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the consolidated revenue fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

This section highlights the significant items that contributed to the net increase or decrease in resources available for the year and actual expenditures as of the quarter ended .

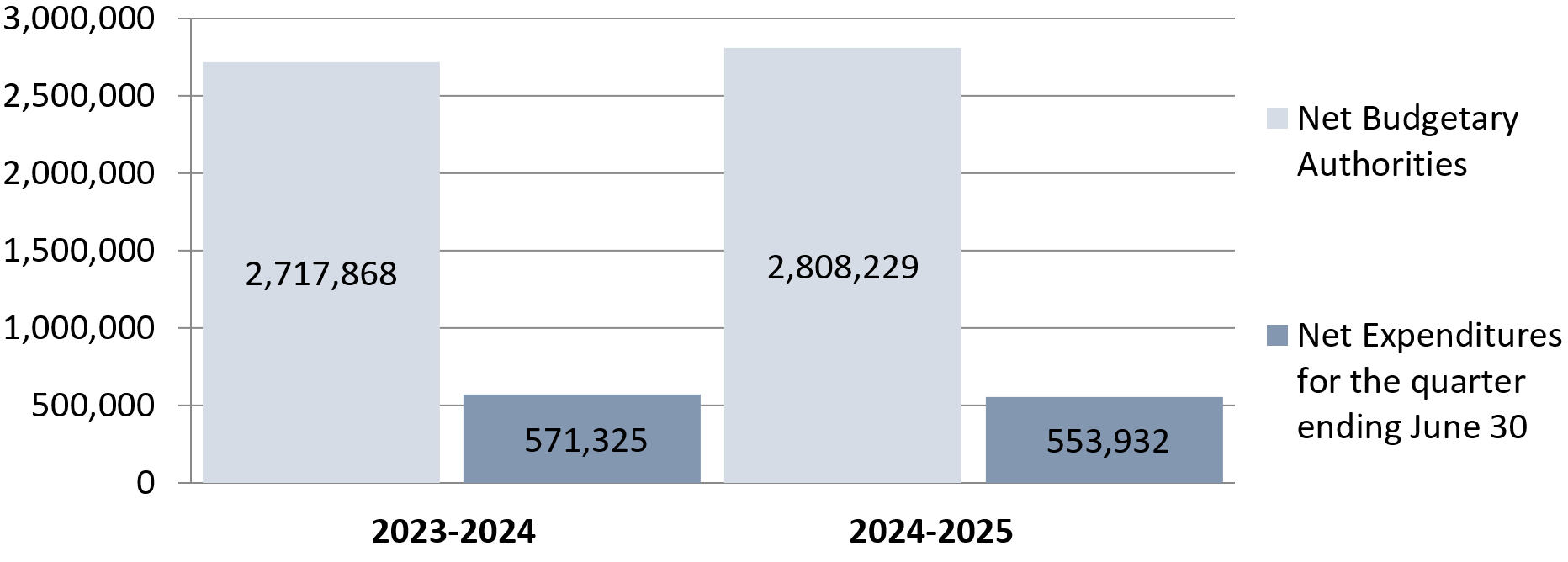

Graph 1: Comparison of net budgetary authorities and expenditures as of , and (in thousands $)

Image description

Comparison of Net Budgetary Authorities and Expenditures as of and (in thousands $)

| - | - | |

|---|---|---|

| Net Budgetary Authorities | 2,717,868 | 2,808,229 |

| Net Expenditures for the quarter ending June 30 | 571,325 | 553,932 |

2.1 Significant changes to authorities

For the period ending , the authorities provided to the CBSA comprise the Main Estimates, and any unused spending authorities carried forward from the previous fiscal year.

The statement of authorities (Table 1) presents a net increase of $90.3 million or 3.3% of the Agency’s total authorities of $2,808.2 million on , compared to $2,717.9 million total authorities at the same quarter last year.

This net increase in the authorities available for use is the result of an increase in Vote 1 — Operating Expenditures of $41.9 million, an increase in Vote 5 — Capital Expenditures of $61.1 million and a decrease in budgetary statutory authorities of $12.7 million, as detailed below.

Vote 1: Operating

The Agency’s Vote 1 increased by $41.9 million or 1.8% (excluding the statutory authorities), compared to the same period last fiscal year. The increase is attributed to the net effect of the following significant items:

- $120.7 million increase due to the timing of receiving the carry forward of unused spending authorities; and

- $78.8 million net decreases in Main Estimates.

- The main increases contributing to the changes in operating funding include:

- $42.6M for Compensation adjustments

- $17.7M for Temporary Resident Processing

- $16.9M for Strengthening the Front Line Capacity

- $12.2M for Gordie Howe International Bridge (GHIB)

- $7.4M for Immigration Levels Plan

- $2.7M for Implementation of Canada's Indo-Pacific Strategy

- $1.4M for National Security Intelligence Review

- $0.8M for Canada’s Trade Remedy System

- $0.5M for National Guards Contracts

- $0.3M for Modernize, & sustain travel and trade at Canadian borders

- $0.2M for Funding to Replace Large-Scale Imaging Equipment

- The main decreases contributing to the changes in operating funding include:

- $74.0M reduction for Canada’s asylum irregular migration system

- $50.1M reduction in Base funding, mainly related to the Refocusing Government Spending exercise

- $26.5M reduction for Reprofiled funding for various initiatives to future fiscal years

- $12.8M reduction for Various Transfers

- $7.6M reduction for Resettlement of Afghan refugees

- $3.0M reduction for Safe Third Party Country Agreement

- $2.0M reduction for Ukrainian Nationals

- $1.9M reduction for Security Screening Automation (SSA) Project

- $1.2M reduction for Cross Border Currency Reporting (CBCR) automation

- $1.1M reduction for Guns and Gangs (G&G)

- $0.5M reduction for Opioids

- $0.4M reduction for Trade Fraud/Trade Based Money Laundering

- $0.3M reduction for Canada’s Firearm Control Framework

- $0.1M reduction for Land Border Crossing Project (LBCP)

- The main increases contributing to the changes in operating funding include:

Vote 5: Capital

The Agency’s Vote 5 increased by $61.1 million or 33.5% (excluding the statutory authorities), compared to the same period last fiscal year. The increase is attributed to the net effect of the following significant items:

- $37.9 million in increase due to the timing of receiving the carry forward of unused spending authorities; and

- $23.2 million net increases in Main Estimates.

- The main increases contributing to the changes in capital funding include:

- $27.5M for Reprofiled funding for various initiatives to future fiscal years

- $17.6M for Land Border Crossing Project (LBCP)

- $6.2M for Border Infrastructure (Lacolle)

- $6.0M for Funding to Replace Large-Scale Imaging Equipment

- $1.6M in Base funding

- The main decreases contributing to the changes in capital funding include:

- $17.2M reduction for Gordie Howe International Bridge (GHIB)

- $11.5M reduction for Modernize, & sustain travel and trade at Canadian borders

- $2.3M reduction for Security Screening Automation (SSA) Project

- $2.1M reduction for Canada’s asylum irregular migration system

- $1.1M reduction for Safe Third Party Country Agreement

- $1.0M reduction for Marine Container Examination Facility (MCEF)

- $0.4M reduction for Guns and Gangs (G&G)

- The main increases contributing to the changes in capital funding include:

Budgetary statutory authorities

The Agency’s Statutory Authority related to the employee benefit plan (EBP) decreased by $12.7 million, or 5.6% from the previous year, due to an EBP adjustment set by the Treasury Board.

2.2 Explanations of significant variances in expenditures from previous year

As indicated in the statement of authorities (Table 1), the Agency’s year-to-date expenditures, at quarter end , were $553.9 million, compared to $571.3 million for year-to-date, quarter ending . The net decrease of $17.4 million or 3.0% in expenditures is mainly due to the following items:

- Decrease of $16.2 million or 3.2% in Vote 1 Operating Expenditures. The decrease in expenditures is mainly attributed to increase in salaries and meal premiums and an increase for prepaid legal services offseted by decrease in Operating expenses

- Increase of $1.7 million or 19.4% in Vote 5 Capital Expenditures, mainly attributed to expenses for facilities capital projects, such as Port of Entry Infrastructure and Land border crossing project

- Decrease of $2.9 million in statutory expenditures

As indicated in the departmental budgetary expenditures by standard objects (Table 2), the net decrease by standard object is mainly attributed to:

- Increase of $20.8 million for Personnel due to salaries and meal premiums. Salaries were increased due to the newly negotiated collective agreements for the following groups: Public Service Alliance of Canada (PSAC), Information Technology (IT), Executive (EX) and Financial Management (FI)

- Decrease of $29.7 million for Professional and special services, which can be mainly attributed to reductions in IT shared services, IT consultants, other consulting services and building protection services

- Decrease of $6.4 million for Acquisition of machinery and equipment, which is related to computer software and equipment, office furniture and fixtures and image/video equipment expenses

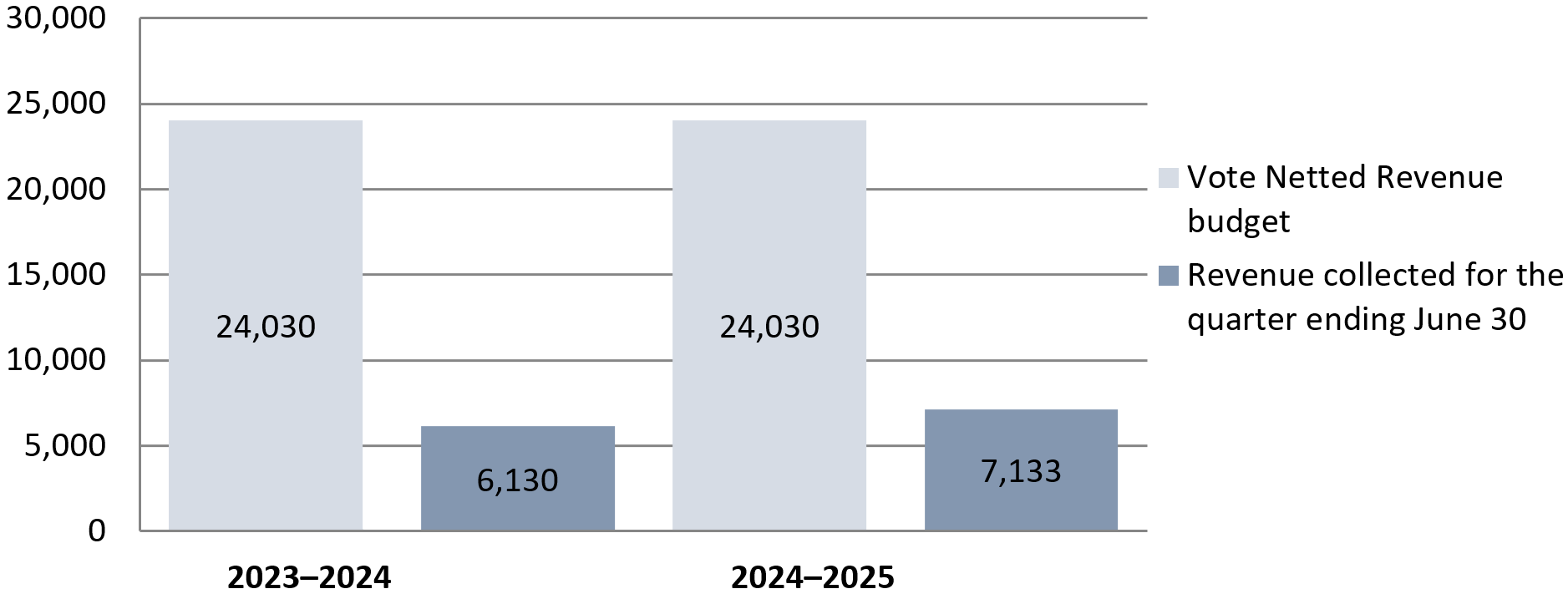

Graph 2: Comparison of vote netted revenue budget and revenue collected as of , and (in thousands $)

Image description

Comparison of Vote Netted Revenue budget and Revenue collected as of and (in thousands $)

| - | - | |

|---|---|---|

| Vote Netted Revenue budget | 24,030 | 24,030 |

| Revenue collected for the quarter ending June 30 | 6,130 | 7,133 |

The planned revenue from the sales of services reflects the Agency’s revenue respending authority. The year-to-date revenue from services has increased by $1.0 million or 16.4% due to the reopening of borders and increased travel after the lifting of COVID-19 restrictions. The increased travel has resulted in higher regular revenues collected in programs such as Nexus.

3. Risks and uncertainties

CBSA maintains an Enterprise Risk Profile (ERP) which highlights the most important risks that could impact the Agency’s objectives. ERP updates are presented quarterly to the CBSA Executive Committee and include mitigation strategies for the Agency’s top risks. Risks that could have a financial impact on CBSA’s operations include:

3.1 Delivery of Major Projects

The Agency is pursuing several large information technology (IT) and physical infrastructure projects; most are multi-year in nature and represent substantial investments. Since the CBSA depends on other government departments and/or external stakeholders for the development and implementation of many of these projects, any delays due to limited labour availability and affordability within and outside the Agency can have an impact on these major projects. Even short delays may lead to additional costs for materials, commodities and other market rate priced services.

Despite these conditions, the Agency has met key deadlines and deliverables on many of the major projects currently underway and is on track for the next set of deliverables. The Agency strives to mitigate financial risks by risk-rating its projects, conducting periodic project reviews, and by holding regular budget discussions. Such activities are informed and supported by the Agency’s quarterly integrated project reporting processes.

3.2 Current Fiscal Context

Following a significant peak in 2022, the consumer price index has decreased in 2023 and stabilized at a rate slightly above pre-pandemic levels in 2024, sitting at 2.7% in June. Despite showing signs of levelling off in Q1 2024-25, there has been upward pressure on certain costs. Persistent inflation combined with the Government of Canada’s continued Refocusing Spending exercise over the next few years could lead to additional financial pressure for the Agency.

The Agency is working to limit exposure to this risk by maintaining a robust quarterly financial forecasting process and 3-year financial plan. In addition, the implementation of the Refocusing Government Spending exercise is being carefully monitored across the Agency.

3.3 Reliance on Temporary Funding

The Agency has a mix of permanent and temporary funding and is increasingly relying on temporary funding to manage on-going pressures. To mitigate this risk, the Agency develops flexible plans through its annual Integrated Business Planning process by reviewing all activities and prioritizing those that have a critical need for funding. The Agency is also working to resolve ongoing structural deficits in some branches through prioritization and reallocation of funding.

4. Significant changes in relation to operations, personnel and programs

4.1 Key senior personnel

Darryl Vleeming, Vice President of the Information, Science and Technology Branch (ISTB) and Chief Information Officer, left the Agency on . His replacement, Peter Littlefield, was announced on June 20.

New Vice President of the Travellers Branch, Rob Chambers, was announced . He replaced Denis Vinette who retired on .

4.2 Operations

The CBSA Assessment and Revenue Management (CARM) system was launched internally on as planned to advance the Agency’s compliance and enforcement efforts, as well as assume the responsibility for the administration of import-export program accounts, a role previously held by the Canada Revenue Agency (CRA). The Order in Council that brings CARM into force was amended to reflect the launch of CARM for external clients on .

On , the mid-span connection of the Gordie Howe International Bridge was completed. As it is now possible to cross the Canada-U.S. border on the bridge, border services officers began to utilize a temporary port of entry to facilitate the movement of workers and materials at the construction site which effectively became an international zone with the completion of the mid-span connection.

The Government of Canada and the Public Service Alliance of Canada reached a tentative agreement for the Border Services group (FB) on , averting a potential strike.

The CBSA invests in a number of information technology (IT) projects as part of its transformation agenda towards creating a more modernized organization. Please find enclosed a list of key IT projects with a budget over $1 million.

5. Approval by senior officials

Approved by:

Erin O'Gorman

President

Ted Gallivan

Executive Vice-President

Ottawa, Canada

Date:

Med Ahmadoun

On behalf of the Chief Financial Officer

Ottawa, Canada

Date:

6. Table 1: Statement of authorities (unaudited)

| (in thousands of dollars) | Total available for use for the year ending ,* | Used during the quarter ended | Year-to-date used at quarter end |

|---|---|---|---|

| Vote 1: Operating expenditures | 2,349,587 | 489,662 | 489,662 |

| Vote 5: Capital expenditures | 243,613 | 10,493 | 10,493 |

| Statutory authority: Contributions to employee benefit plans | 215,029 | 53,757 | 53,757 |

| Statutory authority: Refunds of amounts credited to revenues in previous years | 0 | 13 | 13 |

| Statutory authority: Spending of proceeds from the disposal of surplus Crown assets | 0 | 7 | 7 |

| Total budgetary authorities | 2,808,229 | 553,932 | 553,932 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 2,808,229 | 553,932 | 553,932 |

Note: Numbers may not add due to rounding.

* Includes only authorities available for use and granted by Parliament at quarter ends.

| (in thousands of dollars) | Total available for use for the year ending ,* | Used during the quarter ended | Year-to-date used at quarter end |

|---|---|---|---|

| Vote 1: Operating expenditures | 2,307,629 | 505,831 | 505,831 |

| Vote 5: Capital expenditures | 182,508 | 8,786 | 8,786 |

| Statutory authority: Contributions to employee benefit plans | 227,732 | 56,933 | 56,933 |

| Statutory authority: Refunds of amounts credited to revenues in previous years | 0 | 10 | 10 |

| Statutory authority: Spending of proceeds from the disposal of surplus Crown assets | 0 | -235 | -235 |

| Total budgetary authorities | 2,717,868 | 571,325 | 571,325 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 2,717,868 | 571,325 | 571,325 |

Note: Numbers may not add due to rounding.

* Includes only authorities available for use and granted by Parliament at quarter ends.

7. Table 2: Departmental budgetary expenditures by standard objects (unaudited)

| (in thousands of dollars) | Planned expenditures for the year ending March 31, 2025,* | Expended during the quarter ended June 30, 2024 | Year-to-date used at quarter end |

|---|---|---|---|

| Expenditures | |||

| Personnel | 1,784,923 | 481,718 | 481,718 |

| Transportation and communications | 88,047 | 11,127 | 11,127 |

| Information | 3,566 | 740 | 740 |

| Professional and special services | 592,691 | 49,624 | 49,624 |

| Rentals | 19,125 | 1,473 | 1,473 |

| Repair and maintenance | 63,621 | 3,582 | 3,582 |

| Utilities, materials and supplies | 37,321 | 2,991 | 2,991 |

| Acquisition of land, buildings and works | 82,255 | 1,839 | 1,839 |

| Acquisition of machinery and equipment | 122,508 | 4,552 | 4,552 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 38,202 | 3,419 | 3,419 |

| Total gross budgetary expeditures | 2,832,259 | 561,065 | 561,065 |

| Less revenues netted against expenditures | |||

| Sales of services | 24,030 | 7,146 | 7,146 |

| Other revenue | 0 | -13 | -13 |

| Total revenues netted against expenditures | 24,030 | 7,133 | 7,133 |

| Total net budgetary expenditures | 2,808,229 | 553,932 | 553,932 |

Note: Numbers may not add due to rounding.

* Includes only authorities available for use and granted by Parliament at quarter ends.

| (in thousands of dollars) | Planned expenditures for the year ending ,* | Expended during the quarter ended | Year-to-date used at quarter end |

|---|---|---|---|

| Expenditures | |||

| Personnel | 1,725,966 | 460,892 | 460,892 |

| Transportation and communications | 93,052 | 12,339 | 12,339 |

| Information | 3,113 | 1,249 | 1,249 |

| Professional and special services | 551,358 | 79,294 | 79,294 |

| Rentals | 19,004 | 1,943 | 1,943 |

| Repair and maintenance | 49,263 | 2,335 | 2,335 |

| Utilities, materials and supplies | 39,888 | 3,791 | 3,791 |

| Acquisition of land, buildings and works | 74,508 | 762 | 762 |

| Acquisition of machinery and equipment | 126,408 | 10,979 | 10,979 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 59,338 | 3,871 | 3,871 |

| Total gross budgetary expenditure | 2,741,898 | 577,455 | 577,455 |

| Less revenues netted against expenditures | |||

| Sales of services | 24,030 | 6,140 | 6,140 |

| Other revenue | 0 | -10 | -10 |

| Total revenues netted against expenditures | 24,030 | 6,130 | 6,130 |

| Total net budgetary expenditures | 2,717,868 | 571,325 | 571,325 |

Note: Numbers may not add due to rounding.

* Includes only authorities available for use and granted by Parliament at quarter ends.

Page details

- Date modified: