Statement of Reasons—Expiry review determination: Hot-rolled Steel Plate 3 (PLA3 2023 ER)

Concerning an expiry review determination under paragraph 76.03(7)(a) of the Special Import Measures Act respecting hot-rolled carbon steel plate and high-strength low-alloy steel plate originating in or exported from China.

Decision

Ottawa,

On December 7, 2023, pursuant to paragraph 76.03(7)(a) of the Special Import Measures Act, the Canada Border Services Agency determined that the expiry of the Canadian International Trade Tribunal’s order made on August 9, 2018, in Expiry Review No. RR-2017-004, is likely to result in the continuation or resumption of dumping of certain hot-rolled carbon steel plate and high-strength low-alloy plate, originating in or exported from China.

On this page

Executive summary

[1] On July 10, 2023, the Canadian International Trade Tribunal (CITT), pursuant to subsection 76.03(1) of the Special Import Measures Act (SIMA), initiated an expiry review of its order issued on August 9, 2018, in Expiry Review No. RR-2017-004, concerning the dumping of certain hot-rolled carbon steel plate and high-strength low-alloy plate originating in or exported from China.

[2] For the purposes of this Statement of Reasons, the subject goods shall be referred to as “hot-rolled steel plate” or “certain hot-rolled steel plate”, with “certain” limiting the corresponding plate to the product definition.

[3] As a result of the CITT’s notice of expiry review, on July 11, 2023, the Canada Border Services Agency (CBSA) initiated an expiry review investigation to determine, pursuant to paragraph 76.03(7)(a) of SIMA, whether the expiry of the CITT’s order is likely to result in the continuation or resumption of dumping of the subject goods.

[4] The CBSA received responses to the Canadian producer Expiry Review Questionnaire (ERQ) from Algoma Steel Inc. (Algoma)Footnote 1 and Evraz Inc. NA Canada (Evraz),Footnote 2 two fully integrated producers of certain hot-rolled steel plate in Canada. Algoma also provided the CBSA with additional information prior to the close of the record.Footnote 3

[5] The CBSA also received responses to the Canadian producer ERQ from the following Canadian service centres that produce certain hot-rolled steel plate: Acier Nova Inc. (Acier Nova)Footnote 4, and SSAB Central Inc. (SSAB)Footnote 5.

[6] The CBSA received a response to the Importer ERQ from Olbert Metal Sales LimitedFootnote 6.

[7] A case brief was received on behalf of the Canadian producer, Algoma.Footnote 7 In addition, letters of endorsement for the case brief filed by Algoma were received from EvrazFootnote 8 and SSAB.Footnote 9 No other case briefs from any party were received by the CBSA. The case brief submitted by Algoma included information supporting their position that continued or resumed dumping of subject goods is likely if the CITT’s order is rescinded.

[8] The CBSA did not receive any response to the ERQ from the producers/exporters of certain hot-rolled steel plate in China. None of the producers/exporters provided a case brief or expressed a position on the likelihood of continued or resumed dumping.

[9] No interested parties submitted a reply submission in response to Algoma’s case brief.

[10] Analysis of information on the administrative record in respect of the commodity nature of hot-rolled steel plate, the capital intensive nature of steel production, the steel market developments and trends, China’s excess production capacity and resulting export dependence, Chinese exporters’ interest in the Canadian market and inability to compete at non-dumped prices, and the propensity of Chinese exporters to dump hot-rolled steel plate, all of which taken together indicate a likelihood of continued or resumed dumping into Canada should the CITT’s order be rescinded.

[11] For the foregoing reasons, the CBSA, having considered the relevant information on the administrative record, made a determination under paragraph 76.03(7)(a) of SIMA that the expiry of the CITT’s order in respect of the dumping of certain hot-rolled steel plate originating in or exported from China is likely to result in the continuation or resumption of dumping of the goods into Canada.

Background

[12] On February 13, 1997, following a complaint filed by Canadian industry, the original anti-dumping investigation was initiated concerning certain hot-rolled steel plate originating in or exported from Mexico, China, Poland, South Africa, and Russia.

[13] The complaint was made by Stelco Inc. (now United States Steel Canada Inc.) of Hamilton, Ontario, and was supported by the other Canadian manufacturers of the subject goods at that time. The company ceased operation in June 2004.

[14] On June 27, 1997, the Deputy Minister of National Revenue terminated the investigation with respect to the subject goods from Poland. On September 25, 1997, the Deputy Minister made a final determination of dumping in respect of certain hot-rolled steel plate originating in or exported from Mexico, China, South Africa, and Russia.

[15] On October 27, 1997, the CITT found that the dumping of the subject goods from Mexico, China, South Africa, and Russia threatened to cause injury to the domestic industry.

[16] On June 11, 2002, following the initiation of an expiry review of the CITT’s finding, the Commissioner of Customs and Revenue determined that the expiry of the finding was likely to result in the continuation or resumption of dumping of certain hot-rolled steel plate originating in or exported from Mexico, China, South Africa, and Russia.

[17] On January 10, 2003, in Expiry Review No. RR-2001-006, the CITT continued its finding concerning certain hot-rolled steel plate originating in or exported from China, South Africa and Russia, but rescinded its finding with respect to Mexico.

[18] On April 26, 2007, following the initiation of an expiry review of the CITT’s order made on January 10, 2003, the CBSA determined pursuant to paragraph 76.03(7)(a) of SIMA that the expiry of the CITT’s order was likely to result in the continuation or resumption of dumping of the goods from China, South Africa and Russia.

[19] On January 9, 2008, in Expiry Review No. RR-2007-001, the CITT continued its order in respect of certain hot-rolled steel plate originating in or exported from China but rescinded its order in respect of the subject goods originating in or exported from South Africa and Russia.

[20] On August 23, 2012, following the initiation of an expiry review of the CITT’s order made on January 9, 2008, the CBSA determined pursuant to paragraph 76.03(7)(a) of SIMA that the expiry of the order was likely to result in the continuation or resumption of dumping of certain hot-rolled steel plate from China.

[21] On January 8, 2013, in Expiry Review No. RR-2012-001, the CITT continued its order in respect of certain hot-rolled steel plate originating in or exported from China.

[22] On March 2, 2018, following the initiation of an expiry review of the CITT’s order made on January 8, 2013, the CBSA determined pursuant to paragraph 76.03(7)(a) of SIMA that the expiry of the order was likely to result in the continuation or resumption of dumping of the subject goods from China.

[23] On August 9, 2018, in Expiry Review No. RR-2017-004, the CITT continued its order in respect of certain hot-rolled steel plate originating in or exported from China.

[24] On July 10, 2023, the CITT initiated an expiry review of its order pursuant to subsection 76.03(1) of SIMA.

[25] On July 11, 2023, the CBSA commenced an expiry review investigation to determine whether the expiry of the order is likely to result in continued or resumed dumping of certain hot-rolled steel plate from China.

Product definition

[26] The goods subject to this expiry review investigation are defined as:

Additional product information

[27] Certain hot-rolled steel plate is manufactured to meet certain Canadian Standards Association (CSA) and/or ASTM specifications or equivalent specifications.

[28] The CSA specification G40.21 covers steel for general construction purposes. In the ASTM, for instance, specification A36M/A36 comprises structural plate; specifications A572M/A572 comprises high strength low alloy steel plate; and specification A516M/A516 comprises pressure vessel quality plate.

[29] ASTM standards, such as A6/A6M and A20/A20M, recognize permissible variations for dimensions.

[30] It should be noted that the metric equivalent dimensions in the definition of the goods are rounded numbers as indicated by the “+/-” symbols.

Classification of imports

[31] Prior to January 1, 2022, the subject goods were usually classified under the following tariff classification numbers:

- 7208.51.00.10

- 7208.51.00.91

- 7208.51.00.92

- 7208.51.00.93

- 7208.51.00.94

- 7208.51.00.95

- 7208.52.00.10

- 7208.52.00.91

- 7208.52.00.92

- 7208.52.00.93

- 7208.52.00.96

[32] Beginning January 1, 2022, under the revised customs tariff schedule, the subject goods are normally classified under the following tariff classification numbers:

- 7208.51.00.11

- 7208.51.00.12

- 7208.51.00.19

- 7208.51.00.21

- 7208.51.00.22

- 7208.51.00.23

- 7208.51.00.24

- 7208.51.00.25

- 7208.51.00.31

- 7208.51.00.32

- 7208.51.00.33

- 7208.51.00.34

- 7208.51.00.35

- 7208.51.00.41

- 7208.51.00.42

- 7208.51.00.43

- 7208.51.00.44

- 7208.51.00.45

- 7208.51.00.51

- 7208.51.00.52

- 7208.51.00.53

- 7208.51.00.54

- 7208.51.00.55

- 7208.51.00.61

- 7208.51.00.62

- 7208.51.00.63

- 7208.51.00.64

- 7208.51.00.65

- 7208.52.00.11

- 7208.52.00.12

- 7208.52.00.19

- 7208.52.00.81

- 7208.52.00.82

- 7208.52.00.83

- 7208.52.00.84

- 7208.52.00.85

[33] The listing of tariff classification numbers is for convenience of reference only.

Period of review

[34] The period of review (POR) for the CBSA’s expiry review investigation is January 1, 2020 to March 31, 2023.

Canadian industry

[35] The Canadian industry for hot-rolled steel plate production is comprised of the following two integrated steel mills:

- Algoma Steel Inc. of Sault Ste. Marie, Ontario

- Evraz Inc. NA Canada of Regina, Saskatchewan

and the following nine service centresFootnote 10:

- Acier Nova Inc.

- Alliance Steel Corporation

- Coilex Inc.

- Del Metals

- Janco Steel Ltd.

- Russels Metal Inc.

- Samuel, Son & Co., Limited

- SSAB Central Inc.

- Varsteel Ltd.

[36] Although steel services centres’ production processes differ to some extent from those of Algoma and Evraz, steel service centres produce and sell the same products in the Canadian market, to the same end-users, for essentially the same application.Footnote 11 Therefore, the Canadian industry for certain hot-rolled steel plate production is also comprised of the steel service centres.

Algoma Steel Inc.Footnote 12

[37] Algoma Steel Corporation, Limited was originally established in 1901. On June 1, 1992, under the Ontario Business Corporations Act, Algoma Steel Inc. acquired all of the assets and some of the liabilities of the old Algoma Steel Corporation, Limited. On January 29, 2002, the company was further reorganized under a plan of Arrangement and Reorganization pursuant to the Companies’ Creditors Arrangement Act (“CCAA”).

[38] In June 2007, Algoma Steel Inc. was acquired by Essar Steel Holdings Ltd., a division of the multi-national conglomerate, Essar Global. On May 8, 2008, the company was renamed Essar Steel Algoma Inc.

[39] On November 9, 2015, Essar Steel Algoma Inc. commenced court-supervised restructuring proceedings under the CCAA protection. On November 30, 2018, a group of creditors purchased the company’s assets. With the company emerging from CCAA protection as Algoma Steel Inc.

[40] On May 24, 2021, Algoma announced that it had entered into merger agreement with Legato Merger Corp., that would result in Algoma becoming a publically listed company with its common shares traded on the Nasdaq Stock Market. On October 21, 2021, Algoma became public and common shares began trading on the Nasdaq Stock Market and the Toronto Stock Exchange.

[41] In 2022, Algoma completed Phase 1 of the Plate Mill Modernization project and will complete Phase 2 in 2024. The Plate Mill Modernization project will increase Algoma’s production capacity and improve the quality of the plate produced.

[42] Algoma is a primary iron and steel producer. It has a present capacity to produce approximately 3.7 million metric tonnes (mmt) of raw steel annually. Expressed in terms of finished steel products, the annual capacity is approximately 3.4 mmt consisting of carbon steel plate, hot-rolled steel sheet and cold-rolled sheet. The company’s production facility is located in Sault Ste. Marie, Ontario and regional sales offices are located in Burlington, Ontario and Calgary, Alberta.

Evraz Inc. NA CanadaFootnote 13

[43] Evraz Inc. NA Canada (the Western Canadian operations of the former IPSCO Inc.) was originally incorporated as the Prairie Pipe Manufacturing Co., Ltd. in 1956. The company commenced production of its own flat-rolled steel, including hot-rolled steel sheet in 1960. Evraz Inc. NA Canada continues to produce hot-rolled carbon and alloy steel plate in addition to other flat-rolled steel, including hot-rolled steel sheet products, oil country tubular goods, standard pipe and piling pipe.

[44] On July 17, 2007, SSAB, a subsidiary of SSAB Svenskt Stahl of Sweden, acquired IPSCO Inc. and its subsidiaries. A further reorganization led to IPSCO Inc. owning only the Canadian operations, excluding the coil processing facility in Scarborough, Ontario. On June 12, 2008, Evraz Group S.A. acquired from SSAB all of its IPSCO Inc. shares and all of its subsidiaries. SSAB retained a number of U.S. facilities and the coil processing facility in Scarborough, Ontario.

[45] On October 15, 2008, the name IPSCO Inc. was changed to Evraz Inc. NA Canada and the name of its wholly owned subsidiary IPSCO Canada Inc. was changed to Evraz Inc. NA Canada West. On January 1, 2009, Evraz Inc. NA Canada West was amalgamated into Evraz Inc. NA Canada.

[46] Evraz produces steel plates, steel sheets, tubular products, and processes coils in four locations across Canada, including, Calgary, Red Deer, Camrose and Regina. Evraz’s facilities in Alberta produce tubular products. Evraz’s Regina facility is the largest steel industrial complex in Western Canada, and produces steel plates, steel sheets, and tubular products. It is also the sole producer of steel plates out of the four manufacturing locations.

Canadian market

[47] The apparent Canadian market for certain hot-rolled steel plate over the POR is presented in Table 1 and Table 2 below.

| Source | 2020 | 2021 | 2022 | 2023 (Jan - March) | ||||

|---|---|---|---|---|---|---|---|---|

| Quantity | % | Quantity | % | Quantity | % | Quantity | % | |

| Canadian domestic sales | 300,695 | 49.5% | 241,913 | 43.4% | 158,771 | 61.5% | 44,026 | 54.5% |

| China | 0 | 0.0% | 12 | 0.0% | 55 | 0.0% | 10 | 0.0% |

| Brazil | 0 | 0.0% | 0 | 0.0% | 1 | 1 | 0 | 0.0% |

| Bulgaria | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| Chinese Taipei | 10,350 | 1.7% | 5,423 | 1.0% | 13,968 | 5.4% | 2,520 | 3.1% |

| Czech Republic | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| France | 409 | 0.0% | 11,522 | 2.1% | 14,996 | 5.8% | 3,757 | 4.7% |

| Denmark | 84 | 0.0% | 84 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| Germany | 17,592 | 2.9% | 2,179 | 0.4% | 45 | 0.0% | 0 | 0.0% |

| Indonesia | 0 | 0.0% | 87 | 0.0% | 1 | 1 | 0 | 0.0% |

| Italy | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| Japan | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 1 | 1 |

| Romania | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| South Korea | 1,428 | 0.2% | 20,917 | 3.8% | 29,138 | 11.3% | 5,785 | 7.5% |

| Ukraine | 1 | 1 | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| United States | 271,701 | 44.7% | 226,386 | 40.6% | 22,321 | 8.6% | 22,389 | 27.7% |

| All other countries | 4,900 | 0.8% | 49,192 | 8.8% | 19,006 | 7.4% | 885 | 1.1% |

| Total imports | 306,468 | 50.5% | 315,802 | 56.6% | 99,548 | 38.5% | 36,706 | 45.5% |

| Total Canadian market | 607,163 | 100% | 557,714 | 100% | 258,319 | 100% | 80,732 | 100% |

|

||||||||

| Source | 2020 | 2021 | 2022 | 2023 (Jan - March) | ||||

|---|---|---|---|---|---|---|---|---|

| Value | % | Value | % | Value | % | Value | % | |

| Canadian domestic sales1 | 298,463,948 | 51.5% | 412,361,711 | 50.6% | 355,154,182 | 69.7% | 88,509,807 | 58.9% |

| China | 0 | 0.0% | 52,323 | 0.0% | 127,873 | 0.0% | 5,988 | 0.0% |

| Brazil | 0 | 0.0% | 0 | 0.0% | 1 | 1 | 0 | 0.0% |

| Bulgaria | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| Chinese Taipei | 8,257,586 | 1.4% | 5,855,674 | 0.7% | 21,417,603 | 4.2% | 3,202,529 | 2.1% |

| Czech Republic | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| France | 406,857 | 0.1% | 14,225,740 | 1.7% | 23,123,138 | 4.5% | 6,960,923 | 4.6% |

| Denmark | 146,428 | 0.0% | 145,976 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| Germany | 18,601,058 | 3.2% | 3,343,435 | 0.4% | 76,526 | 0.0% | 0 | 0.0% |

| Indonesia | 0 | 0.0% | 118,223 | 0.0% | 1 | 1 | 0 | 0.0% |

| Italy | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| Japan | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 1 | 1 |

| Romania | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| South Korea | 1,386,927 | 0.2% | 26,345,919 | 3.2% | 46,722,468 | 9.2% | 7,964,183 | 5.3% |

| Ukraine | 1 | 1 | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% |

| United States | 246,367,469 | 42.5% | 300,800,101 | 36.9% | 34,444,939 | 6.8% | 40,264,543 | 26.8% |

| All other countries | 5,568,833 | 1.0% | 51,633,070 | 6.3% | 28,547,381 | 5.6% | 1,318,951 | 0.9% |

| Total imports | 280,740,128 | 48.5% | 402,520,461 | 49.4% | 154,481,566 | 30.3% | 61,738,676 | 41.1% |

| Total Canadian market | 579,204,076 | 100% | 814,882,172 | 100% | 509,635,747 | 100% | 150,232,531 | 100% |

|

||||||||

[48] Based on the information in the administrative record and presented in Tables 1 and 2 above, the Canadian producers’ domestic sales of hot-rolled steel plate has been decreasing since 2020 in terms of quantity. The domestic sales increased in 2021 and then decreased in 2022 in terms of value. As detailed below, the percentage changes year-over-year (y-o-y) were not as significant in terms of volume as compared to the changes in value. This is likely a result of the significant price changes for Canadian produced certain hot-rolled steel plate sold domestically during the POR.

[49] In terms of value, total domestic sales made by the Canadian producers rose 16% in 2021 to reach CAD $412 million. While total domestic sales fell 7% to CAD $355 million in 2022, this figure was still 9% higher than total sales in 2020 of almost CAD $298 million. The higher sales value in 2021 as compared to 2020 despite there being less volume sold in 2021 can be attributed to higher prices. As shown in Table 3 below, the Canadian producers’ weighted average price increased considerably in 2021 and 2022 before decreasing in 2023.

| 2020 | 2021 | 2022 | Q1 2023 | ||||

|---|---|---|---|---|---|---|---|

| CAD/MT | % Change y-o-y | CAD/MT | % Change y-o-y | CAD/MT | % Change y-o-y | CAD/MT | % Change y-o-y |

| $993 | N/A | $1,705 | 71.7% | $2,237 | 31.2% | $1,861 | -16.8% |

[50] Algoma indicated that COVID-19 resulted in temporary, atypical non-cyclical conditions in plate markets around the world and caused a significant price volatility. Prices rose to record highs in 2022 after the initial COVID-19-driven downturn. Furthermore, prices spiked again in 2022 following the Russian invasion of Ukraine.Footnote 17

[51] With respect to market share in terms of volume, the Canadian producers represented 50% of the total apparent Canadian market in 2020. In 2021, the Canadian producers’ share of the total apparent Canadian market decreased to 43% and has been increasing since 2022.

[52] The Canadian producers’ market share in terms of value shows a trend similar to the one respecting volume. In 2020, the Canadian producers held 52% of the total apparent Canadian market based on value. In 2021, their share of the total apparent Canadian market decreased to 51% before increasing in 2022 to reach 70%.

Imports: China

[53] During the POR, the total value of the imports of certain hot-rolled steel plate were $52,323 in 2021, $127,873 in 2022 and $5,988 in Q1 of 2023. This represents an increase of 144.4% between years 2021 and 2022. In terms of market share, the imports of subject goods were negligible when compared to the total apparent Canadian market during the POR.

Imports: Other countries

[54] In 2020, the total volume of imports of certain hot-rolled steel plate from all countries into Canada equalled 306,468 MT. In 2021, the total volume of subject imports into Canada increased by 9,322 MT to 315,790 MT, representing an increase of 3.0% y-o-y. In 2022, the total volume of imports of certain hot-rolled steel plate into Canada declined by 216,297 MT to 99,493 MT, resulting in a decrease of 68.5% y-o-y. As such, the total volume of imports of hot-rolled steel plate from other countries as a percentage of the apparent Canadian market was 50.5% in 2020, 56.6% in 2021, 38.5% in 2022 and 45.5% in Q1 of 2023.

[55] In terms of value, imports of certain hot-rolled steel plate into Canada from all countries followed a similar trend to the one respecting volume. Imports of hot-rolled steel plate went from just over CAD $281 million in 2020 to CAD $403 million in 2021, resulting in a increase of 43.4% y-o-y. In 2022, the value of imports of hot-rolled steel plate from all countries was just over CAD $154 million, representing a decrease of 61.8% y-o-y. As such, the total value of imports of hot-rolled steel plate from other countries as a percentage of the apparent Canadian market was 48.5% in 2020, 49.4% in 2021, 30.3% in 2022 and 41.1% in Q1 of 2023.

[56] Also as shown in Table 4 below, the weighted average price of certain hot-rolled steel plate imported into Canada from all sources significantly increased in 2021 followed by more increases in 2022 and 2023.

| 2020 | 2021 | 2022 | Q1 2023 | ||||

|---|---|---|---|---|---|---|---|

| CAD/MT | % Change y-o-y | CAD/MT | % Change y-o-y | CAD/MT | % Change y-o-y | CAD/MT | % Change y-o-y |

| $916 | N/A | $1,274 | 39.1% | $1,551 | 21.7% | $1,682 | 8.4% |

Enforcement data

[57] Table 5 below reports the total amount of anti-dumping duties assessed on imports of subject goods during the POR.

| Country | 2020 | 2021 | 2022 | Q1 2023 |

|---|---|---|---|---|

| China | 0 | $35,226 | $95,892 | $4,802 |

Parties to the proceedings

[58] On July 11, 2023, a notice concerning the initiation of the expiry review investigation and the ERQs were sent to the known Canadian producers, potential importers and potential producers/exporters. The CBSA also offered the opportunity to participate in the expiry review investigation to any other interested parties.

[59] The ERQ requested information relevant to the CBSA’s consideration of the expiry review factors, as listed in subsection 37.2(1) of the Special Import Measures Regulations (SIMR).

[60] Four Canadian producers (two integrated steel mills and two service centres) and one importer participated in the expiry review investigation and responded to the ERQs.

[61] None of the producers/exporters contacted for purposes of this expiry review investigation provided a response to the ERQs.

[62] A case brief was received on behalf of Algoma while Evraz and SSAB provided letters in support of Algoma’s case brief. No other case briefs or reply submissions were received.

Information considered by the CBSA

Administrative record

[63] The information considered by the CBSA for purposes of this expiry review investigation is contained in the administrative record. The administrative record includes the information on the CBSA’s exhibit listing, which is comprised of the CBSA’s exhibits and information submitted by interested persons, including information which the interested parties feel is relevant to the decision as to whether dumping is likely to continue or resume, if the CITT’s order is rescinded. This information may consist of expert analyst reports, excerpts from trade publications and articles, orders and findings issued by authorities of Canada or of a country other than Canada, documents from international trade organizations such as the World Trade Organization and responses to the ERQs submitted by domestic producers, importers, exporters and foreign governments.

[64] For purposes of an expiry review investigation, the CBSA sets a date after which no new information may be placed on the administrative record or considered as part of the CBSA’s investigation. This is referred to as the closing of the record date. This allows participants time to prepare their case briefs and reply submissions based on the information that is on the administrative record as of the closing of the record date. For this investigation, the administrative record closed on September 6, 2023.

Position of the parties

Parties contending that continued or resumed dumping is likely

[65] Case briefs were received from three Canadian producers, Algoma, Evraz and SSAB. Algoma submitted detailed arguments supporting their position that dumping from China is likely to continue or resume in the event the CITT’s order is allowed to expire. Evraz and SSAB presented letters in support of Algoma’s detailed submissions. A fourth Canadian producer, Acier Nova, which is a service centre, also indicated its position supporting the continuation of the CITT’s order in its ERQ response. Acier Nova stated in their response that:[Translation] “if the dumping order were revoked, …Chinese steel plate imports will return to the Canadian market at low prices, which would cause damage to Acier Nova.”Footnote 20

[66] The main factors identified by AlgomaFootnote 21 can be summarized as follows:

- International market conditions

- Chinese economic conditions and plate market

- Behaviour of Chinese exporters while the CITT’s order has been in effect;

- Propensity to dump

- Product shifting

- Canadian market conditions

International market conditions

[67] Algoma expressed concern over global steel market conditions and more specifically, conditions in the steel plate market being weak and uncertain in 2024 and 2025. Algoma have noted that recent market conditions and market forecasts for the near-term identify conditions that would leave the Canadian domestic industry susceptible to resumed dumping should the CITT’s order be allowed to expire. The sections summarize the Canadian producers’ arguments supporting their position regarding global steel and steel plate market.

[68] In its case brief, Algoma indicates that the global economic recovery after the COVID-19 pandemic and Russian invasion of Ukraine is slowing down. Furthermore, a combination of tighter monetary policy, high inflation rates, weak consumption, and higher energy prices are negatively impacting the steel demand.Footnote 22

[69] Citing the International Monetary FUND (IMF) report, Algoma notes that due to COVID-19 setbacks, the global GDP contracted by 3.1% in 2020. As a result of the recovery from COVID-19, the global GDP rose by 6% in 2021 before decreasing to 3.5% in 2022. The global economic growth is projected to fall again to 3% in both 2023 and 2024, remaining below the historical annual average (2000-2019) of 3.8%. Algoma also notes that the Organization for Economic Cooperation and Development (OECD) shared the IMF’s pessimism and had lowered its outlook for the global GDP growth in 2023, indicating that downstream steel industries will continue to decline.Footnote 23

[70] In brief, Algoma contends that a depressed global economic and steel market outlook for the near-term is turbulent. As a result, it will limit the selling opportunities available to Chinese exporters and increase the likelihood that these exporters will target the Canadian market if the CITT’s order is rescinded.Footnote 24

Chinese economic conditions and plate market

[71] Algoma submits that China’s economic growth is slowing due to weak construction activity, which is particularly weighing on the steel plate market. In addition, the growing excess production capacity between 2023 and 2025 will encourage Chinese producers to resume selling steel plate at dumped prices into the Canadian market if the CITT’s order is rescinded.Footnote 25

[72] Citing the World Bank’s report issued in June 2023, Algoma notes that China’s GDP grew by 3% in 2022 with expected growth of 5.6% in 2023. In addition, the World Bank forecasts that China’s GDP growth will slow to 4.6% in 2024 and 4.4% in 2025.Footnote 26 Furthermore, the IMF echoes the World Bank’s outlook and reports that due to a series of stringent lockdowns and falling private consumption, the growth in China’s GDP will remain under pressure.Footnote 27

[73] According to the World Bank, the economic activity in China started to recover in early 2023 after the easing of COVID-19 lockdowns. However, economic activity and demand are supported more by domestic services than activity in the infrastructure and manufacturing sectors, which are more steel intensive. As previously mentioned, China’s total steel demand contracted in both 2021 and 2022 amid negative momentum in the construction sector. Algoma also notes that a June 2023 report published by WorldSteel expected to see 2% growth in 2023 and no growth in 2024 in Chinese steel demand.Footnote 28

[74] Algoma argues that as the steel demand continues to slow down globally, China has continued to build up its steel production capacity. Citing the OECD, Algoma states that China’s steelmaking capacity will increase by 7.9 mmt by the end of 2022 reaching 1.25 billion MT in 2023.Footnote 29

[75] According to the OECD, China’s construction industry accounts for 57% of its steel demand. The OECD also reported that investment in Chinese real estate had plunged by 10% from December 2022 and is predicted to have a difficult recovery in 2023.Footnote 30 This is further exacerbated by National People’s Congress’ failure to come up with a major real estate stimulus package instead of focusing on upcycling older residential real estate, which will likely require less plate production.Footnote 31

[76] Algoma contends that weakening domestic demand with lower prices, combined with significant excess capacity, will promote export sales to higher-priced markets by the plate producers in China.Footnote 32

[77] Furthermore, Algoma notes that with a faltering domestic demand for plate, China’s steel exports reached a seven-year high for its steel export volumes in the first five months of 2023, when exports jumped over 40% year-over-year. It is further predicted that China will export 77 mmt of steel in 2023.Footnote 33

| 2020 | 2021 | 2022 | |

|---|---|---|---|

| China | 53.2 | 66.4 | 68.4 |

| Japan | 31.0 | 33.7 | 31.6 |

| South Korea | 28.5 | 26.7 | 25.6 |

[78] In its case brief, Evraz also states that Chinese producers of steel plate are highly export-oriented. Evraz submits that a weakening capacity utilization in its manufacturing and other sectors, along with a decline in domestic construction development, China saw its steel exports during Q1 2023 increase by 50 percent year-over-year. Furthermore, steel exports reached 8.36 mmt in May 2023, the highest level since September 2016.Footnote 35

[79] Algoma submits that South Korea, Vietnam and Saudi Arabia represents 40% of China’s export volumes of plate in 2022.Footnote 36 However, Algoma suggests that South Korea and Saudi Arabia will not be growth markets for China in the next 12 to 24 months. According to OECD reports, in Q2 2023 South Korean steel trade had contracted due to a downturn in the construction sector that pushed down demand for steel. In addition, Saudi Arabia is actively trying to reduce steel imports by 50% through building up its domestic production in its Vision 2030 targets by establishing three steel production facilities, with one intended to have the capacity to produce four million tons of hot-rolled steel (whether this figure is metric or net is not specified).Footnote 37 As such, Algoma contends that with China’s top two export markets not being able to absorb growing Chinese plate production, Chinese producers will likely seek to export their excess plate production into the Canadian market if the CITT’s order is rescinded.

[80] Algoma also argues that China’s policy to consolidate steel producers into large state-owned enterprises (SOEs) results in price undercutting by these companies in the export markets. SOEs represents approximately half of all steel making capacity in China.Footnote 38 Algoma contends that these consolidations increases the likelihood that Chinese plate producers will make decisions based on government policies rather than market signals. As a result, this increases the likelihood that these Chinese producers export steel plate to the Canadian market with no regards for Canadian market price or profitability.Footnote 39

Behaviour of Chinese exporters while the order has been in effect

[81] Algoma states that since the CITT’s order has been in effect, the Chinese exporters remain interested in selling plate at low prices in the Canadian market. As such, they will resume dumping plate in the Canadian market if the CITT’s order is rescinded.

China’s inability to sell at normal values

[82] Algoma notes that, according to CBSA import statistics, only negligible volumes of subject goods from China were imported into Canada over the past four years. Algoma submits that the lack of imports demonstrates that Chinese plate producers have been unable to compete in the Canadian market at non-dumped prices. Algoma then argues that subject goods from China will likely re-enter the Canadian market should the CITT’s order be allowed to expire and dumping can resume.Footnote 40

China’s presence in the Canadian non-subject plate market

[83] Algoma submits that Statistics Canada import data demonstrates significant volumes of plates imported from China in 2020 and 2021 at below the average import value and pricing of the largest import source to Canada, the United States of America (US) shown in Table 7 and Table 8 below.

| 2020 | 2021 | 2022 | 2023 YTD | |

|---|---|---|---|---|

| China | 11,536 | 19,676 | 5,452 | 2,541 |

| 2020 | 2021 | 2022 | 2023 YTD | |

|---|---|---|---|---|

| China | 891 | 1,129 | 1,571 | 1,639 |

| US | 898 | 1,431 | 2,418 | 2,153 |

| Total imports | 922 | 1,342 | 1,981 | 1,767 |

[84] As shown above, China’s average price was $213/MT less than the average for total imports in 2021 and $410/MT in 2023 YTD, undercutting the average total imports by 36%. In addition, in comparing China’s prices with the US, average price in 2023 YTD was $1,639/MT for China and $2,153/MT for the US. China’s price represents just 65% of the price of the US.

[85] Algoma argues that since China is restricted from dumping all of the major flat-rolled steel produced in Canada, it has continued to be one of the most significant sources of imported alloy plate and pre-painted steel sheet in Canada. Alloy plate is excluded from the product definition of subject goods due to its alloy content. As such, China accounted for 3.1% of imports to Canada in 2020 and grew this share to 4.6% in 2021, 7% in 2022 and 11% in Q1 2023 as per Statistics Canada data.Footnote 43 In addition, China represented a large share of Canadian imports of pre-painted steel since the last CITT’s order. Algoma submits that China continues to target Canada’s flat-rolled steel market in any area where SIMA measures are not in force.Footnote 44

Propensity to dump

[86] Algoma claims that the propensity of Chinese exporters to dump plate in the Canadian market is evident by several anti-dumping and countervailing measures in Canada against China.

[87] Algoma argues that Chinese producers of steel plate have demonstrated a propensity to dump as evidenced by the number of current SIMA measures imposed against China: hot-rolled steel sheet, cold-rolled steel sheet (CRS), corrosion-resistant steel sheet (COR) and plate. It is to be noted that CRS and COR measures were put in place since last renewal of the CITT’s order (2018 and 2019, respectively).

[88] Algoma also contends that Chinese producers of steel plate have demonstrated a propensity to dump as evidenced by the number of current trade remedies imposed against China by many World Trade Organization (WTO) members. As of July 2023, Algoma indicates that there were six anti-dumping measures in place against steel plate from China based on WTO reports. The five countries that have imposed anti-dumping measures include European Union (EU), Taiwan, Indonesia, Türkiye, and the US with two measures.Footnote 45

Product shifting

[89] Algoma states that Chinese producers could allocate production capacity from hot-strip mills to the production of plate. Hot-strip mills produce plate in coil, which can then be cut-to-length and become subject/like goods.Footnote 46 Algoma also claims that both production and demand of hot-rolled sheet and coil plate in China are expected to decline between 2023 and 2025.Footnote 47 As a result, Chinese producers are inclined to allocate additional capacity on hot-strip mills to the production of coil plate.

Canadian market conditions

[90] Algoma submits that the Canadian economic is weak, which is exacerbated with continued uncertainty as to whether Canada is currently in or has entered a recession. According to an outlook published by the Bank of Canada in July 2023, the real GDP growth slowed to 1.5% in the second quarter of 2023 and is anticipated to remain at an average of 1% through the rest of 2023 and first half of 2024. The Bank of Canada contends that this slowdown is due to higher interest rates on household spending and business investments. However, the Bank of Canada points that the GDP growth is predicted to increase in the second half of 2024, rising to 1.2% in 2024 and 2.4% in 2025.Footnote 48

[91] Information from the Bank of Canada report also indicates a strong overall demand in the labour market while the unemployment rate remains low based on historical standards.Footnote 49 Canada’s economic reopening from the COVID-19 pandemic in 2022 helped boost the Canadian economy to pre-pandemic employment levels.Footnote 50

[92] According to the IMF, the Canadian economy is projected to grow at 1.7% in 2023 and 1.4% in 2024. However, this is a continued drop in growth from 5% in 2021 and 3.4% in 2022.Footnote 51

[93] Algoma argues that as a result of the COVID-19 pandemic, the Canadian market saw significant volatility over the POR. As a result, plate prices declined throughout 2020 and by Q4 2020, due to activity in the construction sector and strong demand, plate prices began to rise significantly. This increase in plate prices continued throughout 2021 and peaked in mid-2022. Moreover, strong demand from all plate end-users resulted in tight supply which promoted an increase of import volumes of plate in 2021. After pricing peaked in 2022, it remained flat for the rest of 2022 as demand stabilized while freight and shipping problems inhibited an increase in import volumes. Demand has been stable in 2023 relative to 2022, which promotes greater import competition.Footnote 52 Algoma states that this is evident by the significant increase in import volumes from France and South Korea in the first half of 2023.Footnote 53

[94] According to Algoma, demand levels will improve slightly from 2024 through 2026 in the North American market. As such, Chinese producers would likely find the Canadian market beneficial to export.Footnote 54

[95] Citing the most recent plate expiry review Order and Reasons by the CITT, concerning certain hot-rolled steel plate from Ukraine, Algoma claims that the Canadian market will continue to be attractive to Chinese plate producers given the higher hot-rolled steel plate prices in Canada than the global average. Moreover, Algoma submits that CRUFootnote 55 publishes plate pricing for the US Midwest, which tend to track and move together with the Canadian prices. Furthermore, according to the CITT, the US Midwest plate pricing is a reasonable proxy for assessing future Canadian market pricing trends.Footnote 56 As such, Algoma notes that based on CRU data, the US Midwest pricing has been consistently higher than other markets since 2020 and is forecasted to continue through 2025. Algoma contends that the higher US Midwest prices will incentivize the Chinese plate exporters to target the Canadian market if the CITT’s order is rescinded.Footnote 57

Parties contending that resumed or continued dumping is unlikely

[96] None of the parties to the proceeding contended that resumed or continued dumping is unlikely.

Consideration and analysis

[97] In making a determination under paragraph 76.03(7)(a) of SIMA as to whether the expiry of the CITT’s order is likely to result in the continuation or resumption of dumping of the goods, the CBSA may consider factors identified in subsection 37.2(1) of the SIMR, as well as any other factors relevant under the circumstances.

[98] Before presenting the specific analysis with respect to China concerning the likelihood of continued or resumed dumping in absence of the CITT order, there are certain issues that relate to the goods on a broader scale which are addressed as follows:

- the commodity nature of hot-rolled steel plate

- the capital intensive nature of steel production

- steel market developments and trends

Commodity nature of hot-rolled steel plate

[99] The significant number of anti-dumping measures involving steel products, both in Canada and several other jurisdictions, can be related, in large part, to the very nature of the product and the industry.

[100] Generally speaking, hot-rolled steel plate produced to a given specification by a producer in a given country is physically interchangeable with hot-rolled steel plate produced to the same specification in any other country. As such, the goods compete amongst themselves regardless of the origin and share the same channels of distribution and the same potential customers. This characteristic means that hot-rolled steel plate must compete in a market that is extremely price sensitive, where price is one of the primary factors affecting purchasing decisions from customers. Furthermore, because of this high degree of price sensitivity, prices in a given market may tend to converge over time towards the lowest available price offerings.

[101] There is a history of plate dumping cases in Canada. Since 1992, there have been seven inquiries concerning similar steel plate products from various countries, each resulting in the imposition of either anti-dumping measures or both anti-dumping and countervailing measures against these products. The seven steel plate cases are informally referred to as Plate I, Plate II, Plate III, Plate IV, Plate V, Plate VI and Plate VII. The measures resulting from four of the seven investigations, Plate III, Plate V, Plate VI and Plate VII with respect to China, Bulgaria, Czech Republic, Romania, Ukraine, Brazil, Denmark, Indonesia, Italy, Japan and South Korea remain in force.

[102] Given the commodity nature of the subject goods, when the measures are in place for one country, other sources of hot-rolled steel plate emerge. This is evident from the number of measures in place in Canada, both historically and currently, with respect to hot-rolled steel plate.

Capital-intensive nature of steel production

[103] As previously noted by the CITT, “Steel mills are capital intensive with high fixed costs. In order to recover fixed expenses, steel mills must run at high levels of production capacity. When demand in the domestic market decreases, producers will search out foreign markets to maintain capacity utilization to ensure that these fixed costs are recovered.”Footnote 58 This is often referred to as the “economics of steel production.” Conditions of overcapacity exacerbate this characteristic as a producer may find it more feasible to sell excess production in foreign markets at depressed prices rather than reduce production, as long as the producer’s variable costs are covered.

Steel market developments and trends

[104] According to the OECD, the world GDP growth rate in 2022 is estimated at 3.1% and 2.2% in 2023. The OECD notes that the worldwide economy recovery is subdued due to higher than anticipated inflation, which has led to restrictive monetary policy, Russia’s war against Ukraine, and China’s zero-COVID-19 policy. The OECD also reports that despite an increase in steel demand observed in 2021 post COVID-19 pandemic recovery, the global steel demand and global crude steel production has fallen in 2022.Footnote 59

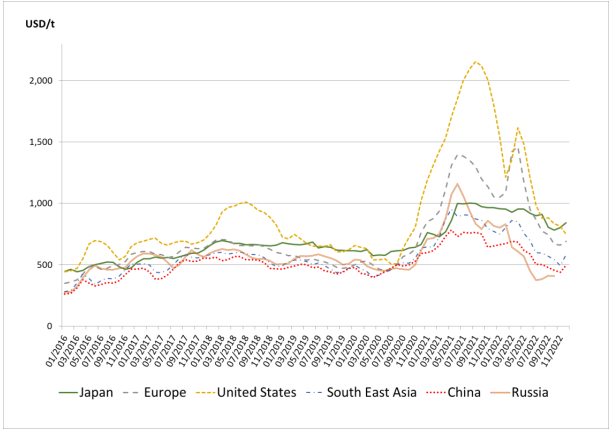

Text description: Flat steel product pricesFootnote 61

This chart displays the flat steel product prices for Japan, Europe, the United States, South East Asia, China, and Russia from January 2016 through November 2022.

[105] As reported by the OECD, steel prices have erased most of their 2021 gains, but have been sharply diverging across regions. For instance, US, EU and Japan flat steel prices remain high compared to their historical levels, whereas Southeast Asian and Chinese flat steel prices have fallen below their historical levels. However, as of end of December 2022, global flat steel prices stood at 54% lower than one year earlier. Chart 1 shows the flat steel prices across regions.Footnote 60

[106] Notwithstanding the average fallen prices, such price differentials can change trading patterns by making steel imports from regions with lower prices more competitive. In brief, in China, flat steel prices are low with rising inventory levels and increase in production, which should maintain downward pressure on prices going forward.Footnote 62

[107] Overall, the OECD states that it is probable that the regional price differentials will continue in 2023 as they seem to be due to different factors specific to each region: high energy price and energy uncertainties for the EU coupled with mitigated sentiment and uncertainty on the health of the EU industry in general, domestic demand with high scrap costs in the US, and an ailing real estate sector amid an easing of COVID-19 restrictions and a boost of sentiment in China.Footnote 63

[108] Since the beginning of the year 2022, prices for steelmaking raw materials such as scrap and iron ore have been largely in range with their historical levels. As of end of December 2022, iron ore prices are only 5% higher than their historical average over the period of 2008 to 2022 while scrap prices are a meagre 4% higher than the historical average. However, a possibly crucial development for iron ore prices going forward has been the setup of a new state-owned Chinese agency, the China Mineral Resources Group (CMRG), whose aim is to increase market power of Chinese buyers of iron ore by centralising all their bids for the raw material. By significantly increasing Chinese buyers’ bargaining power, downward pressures on price are certain to materialise.Footnote 64

Likelihood of continued or resumed dumping

[109] Guided by the factors in subsection 37.2(1) of SIMR and having considered the information on the administrative record, the ensuing list represents a summary of the CBSA’s analysis conducted in this expiry review investigation:

- China’s excess production capacity and resulting export dependence

- Chinese exporters’ interest in the Canadian market and inability to compete at non-dumped prices

- propensity of Chinese exporters to dump hot-rolled steel plate

China’s excess production capacity and resulting export dependence

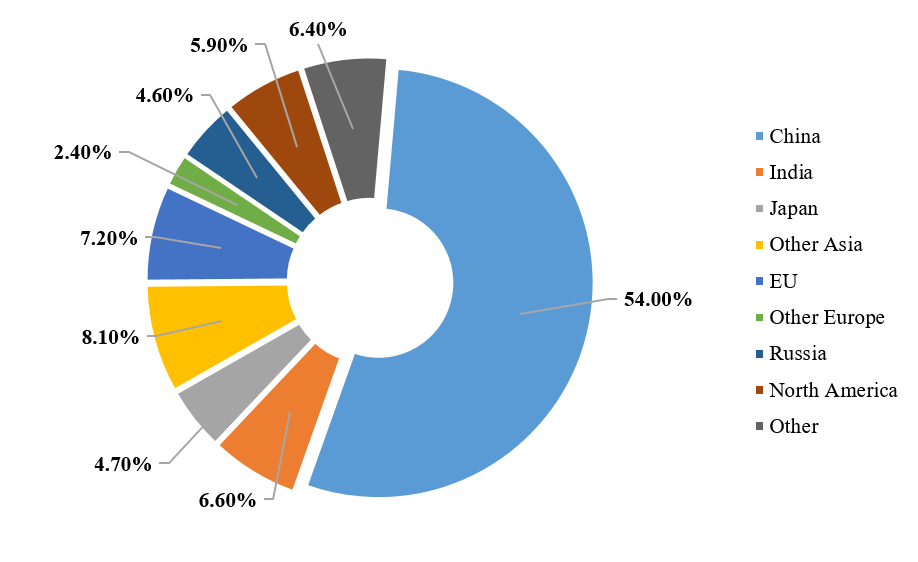

[110] China is the biggest producer of crude steel in the world. In 2022, a total of 1,018 mmt of crude steel were produced by Chinese steel producers and accounted for approximately 54% of the world’s total steel production as can be seen in the figure below.Footnote 65

Text description: Figure 1Footnote 66

| Source | Percentage |

|---|---|

| China | 54.00% |

| India | 6.60% |

| Japan | 4.70% |

| Other Asia | 8.10% |

| EU | 7.20% |

| Other Europe | 2.40% |

| Russia | 4.60% |

| North America | 5.90% |

| Other | 6.40% |

[111] China’s crude production outpaced the rest of the world with an 11.5% increase in production.Footnote 67 China’s excess capacity for reversing plate mill is projected to increase by 2025. In addition, on all equipment that can be used to produce plate, Chinese excess capacity is predicted to increase by 2025 as well. Despite the government of China’s efforts to reduce capacity, China’s steel output has increased in 2023 and is forecasted to remain at same capacity throughout 2025.Footnote 68

[112] By comparison, the CBSA’s estimate of the apparent Canadian market for hot-rolled steel plate was 607,163 MT in 2020, 557,714 MT in 2021 and 258,319 MT in 2022. Consequently, Chinese hot-rolled steel plate producers have sufficient excess capacity to supply the Canadian market many times over.Footnote 69

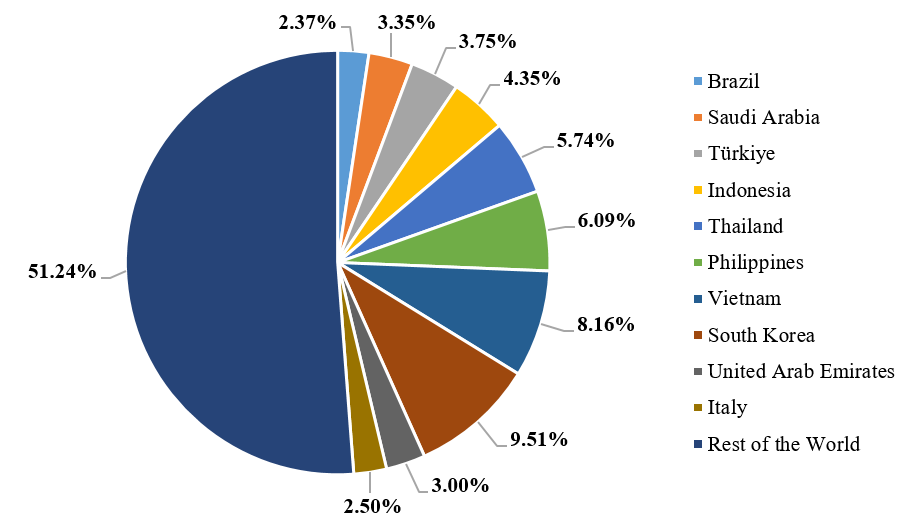

[113] Excess capacity creates significant incentive for Chinese producers to pursue export sales, at low prices, in order to maintain high capacity utilization. China’s steel exports totalled 51.6 mmt in 2020 and 64.9 mmt in 2021, which represents a 25.8% increase. China exported to 215 countries in 2021. Exports to China’s top 10 steel markets represented 49% of China’s steel export volume in 2022 as shown belowFootnote 70:

Text description: Figure 2Footnote 71

| Source | Percentage |

|---|---|

| Brazil | 2.37% |

| Saudi Arabia | 3.35% |

| Türkiye | 3.75% |

| Indonesia | 4.35% |

| Thailand | 5.74% |

| Philippines | 6.09% |

| Vietnam | 8.16% |

| South Korea | 9.51% |

| United Arab Emirates | 3.00% |

| Italy | 2.50% |

| Rest of the world | 51.24% |

[114] From 2020 to 2021, the volume of Chinese exports increased to all of China’s top ten export recipients as shown above. Notably, the volume of exports increased by 74% to Saudi Arabia and 54% to Italy, which may indicate the diversion of steel exports to other markets with no anti-dumping measures in place.Footnote 72

[115] Flat products accounted for 60% of China’s steel exports in 2022 with 14.6 mmt. South Korea received the largest share of China’s flat products for this period with 3.8 mmt.Footnote 73 According to CRU data, reversing mill plate demand in South Korea will improve in 2023 but will then contract in 2024 and remain flat in 2025. As such, Chinese exporters will not find an opportunity for growth in South Korea plate market and will seek out new export markets, such as Canada.Footnote 74

[116] Chinese exporters continue to demonstrate their willingness and ability to divert their growing excess production to any country with suitable demand. Furthermore, the increased competition and weakening demand in China’s traditional markets will push Chinese exporters to seek other export markets. As a result, should the CITT order be rescinded, the Chinese excess production capacity and the resulting export dependence may increase the likelihood of continued or resumed dumping of certain hot-rolled steel plate from China.

Chinese exporters’ interest in the Canadian market and inability to compete at non-dumped prices

[117] While China did not export a large volume of hot-rolled steel plate to Canada during the POR, the subject goods it did export in 2021, 2022 and Q1 2023 of the POR were dumped. CBSA enforcement statistics presented in Table 5 earlier in the report showed that 12 MT of subject goods valued at CAD $52,323; 55 MT of subject goods valued at CAD $127,873 and 10 MT of subject goods valued at CAD $5,988 were imported in 2021, 2022 and Q1 of 2023, respectively. Accordingly, anti-dumping duties assessed on those goods were CAD $35,226 in 2021, CAD $95,892 in 2022 and CAD $4,802 in Q1 2023.

[118] As presented earlier with the arguments submitted by Algoma, China has continued to be one of the most significant sources of imported alloy plate and pre-painted steel sheet in Canada. Alloy plate is excluded from the product definition of subject goods due to its alloy content. China accounted for 3.1% of imports to Canada in 2020 and grew this share to 4.6% in 2021, 7% in 2022 and 11% in Q1 2023 as per Statistics Canada data.Footnote 75 This demonstrates that Chinese exporters of subject goods have not only maintained interest in the Canadian market, but continues to target Canada’s flat-rolled steel market.

[119] The CBSA’s import and enforcement statistics also demonstrate that Chinese exporters were unable to sell commercially significant quantities of subject goods to Canada during the POR due to the CITT order currently in place. This combined with the Chinese exporters reliance on export markets discussed earlier, demonstrates that Chinese exporters of subject goods have an inability to compete in the Canadian market by selling at non-dumped prices. As a result should the CITT order be rescinded, the Chinese exporters’ interest in the Canadian market and their inability to compete at non-dumped prices may increase the likelihood of continued or resumed dumping of certain hot-rolled steel plate from China.

Propensity of Chinese exporters to dump hot-rolled steel plate

[120] In addition to the small quantity of dumped hot-rolled steel plate that entered Canada during the POR, the propensity of Chinese exporters to dump hot-rolled steel plate is further demonstrated by the numerous anti-dumping measures imposed against them by other countries.

[121] It is to be noted that CRS and COR from China were put in place since last renewal of the CITT’s order (2018 and 2019, respectively).

[122] In addition to Canada’s current anti-dumping measures, the EU and six other nations also currently have anti-dumping measures in place against steel plate from China including Brazil , Mexico, Indonesia, Türkiye, the United Kingdom and the US.Footnote 76

[123] As discussed above, given China’s continued and growing export dependency of hot-rolled steel plate together with the increased competition and weakening demand in China’s traditional markets, Chinese exporters may have no choice but to dump into their unrestrained export markets.

[124] In addition to the CITT’s order concerning hot-rolled steel plate, producers from China are subject to anti-dumping duty measures on the following steel products exported to Canada:

- Carbon steel welded pipe

- Cold-rolled steel (CRS)

- Concrete reinforcing bar

- Corrosion-resistant steel sheet (COR)

- Flat hot-rolled steel sheet

- Large line pipe

- Line Pipe 1

- Oil country tubular goods

- Piling pipe

- Pup joints

- Seamless casing

- Steel grating

[125] The numerous anti-dumping measures of hot-rolled steel plate from China in other countries and Canada’s numerous measures on other steel products indicates that Chinese exporters have a propensity to dump these products into their export markets, which may increase the likelihood of continued or resumed dumping of certain hot-rolled plate from China, should the CITT’s order be rescinded.

Determination regarding likelihood of continued or resumed dumping

[126] Based on the evidence on the administrative record in respect of the commodity nature of hot-rolled steel plate, the capital intensive nature of steel production, the steel market developments and trends, China’s excess production capacity and resulting export dependence, Chinese exporters’ interest in the Canadian market and inability to compete at non-dumped prices, and the propensity of Chinese exporters to dump hot-rolled steel plate, it is recommended that the CBSA determine that the expiry of the order is likely to result in the continuation or resumption of dumping into Canada of certain hot-rolled steel plate originating in or exported from China.

Conclusion

[127] For the purpose of making a determination in this expiry review investigation, the CBSA conducted its analysis within the scope of the factors found under subsection 37.2(1) of the SIMR. Based on the foregoing consideration of pertinent factors and an analysis of the evidence on the administrative record, on December 7, 2023, the CBSA made a determination pursuant to paragraph 76.03(7)(a) of SIMA that the expiry of the CITT’s order made on August 9, 2018 in Expiry Review No. RR-2017-004 in respect of the dumping of certain hot-rolled carbon steel plate and high-strength low-alloy plate originating in or exported from China is likely to result in the continuation or resumption of dumping into Canada.

Future action

[128] On July 10, 2023, the CITT commenced its inquiry to determine whether the expiry of the order with respect to the dumping of the goods from China is likely to result in injury. The CITT’s Expiry Review schedule indicates that it will make its decision by May 25, 2024.

[129] If the CITT determines that the expiry of the order with respect to the goods is likely to result in injury, the CITT will make an order continuing the order in respect of those goods, with or without amendment. If this is the case, the CBSA will continue to levy anti-dumping duties on dumped importations of the subject goods.

[130] If the CITT determines that the expiry of the order with respect to the goods is not likely to result in injury, the CITT will make an order rescinding the order in respect of those goods. Anti-dumping duties would then no longer be levied on importations of the subject goods, and any anti-dumping duties paid in respect of goods that were released after the date that the order was scheduled to expire will be returned to the importer.

Contact us

[131] For further information, please contact the officer listed below:

- Telephone:

- Khatira Akbari: 343-553-1892

Doug Band

Director General

Trade and Anti-dumping Programs Directorate

Page details

- Date modified: