Statement of reasons—expiry review determination: Stainless steel sinks (SSS 2022 ER)

Concerning an expiry review determination under paragraph 76.03(7)(a) of the Special Import Measures Act respecting certain stainless steel sinks originating in or exported from the People's Republic of China.

Decision

Ottawa,

On April 27, 2023 pursuant to paragraph 76.03(7)(a) of the Special Import Measures Act, the Canada Border Services Agency determined that the rescission of the Canadian International Trade Tribunal’s order made on February 8, 2018, in Expiry Review No. RR-2017-001:

- is likely to result in the continuation or resumption of dumping of the goods from China; and

- is likely to result in the continuation or resumption of subsidizing of the goods from China

On this page

Executive summary

[1] On November 28, 2022, the Canadian International Trade Tribunal (CITT), pursuant to subsection 76.03(1) of the Special Import Measures Act (SIMA), initiated an expiry review of its order made on February 8, 2018, in Expiry Review No. RR-2017-001, concerning the dumping and subsidizing of certain stainless steel sinks (“stainless steel sinks”) originating in or exported from the People’s Republic of China (China).

[2] As a result of the CITT’s notice of expiry review, on November 29, 2022, the Canada Border Services Agency (CBSA) initiated an expiry review investigation to determine, pursuant to paragraph 76.03(7)(a) of SIMA, whether the rescission of the order is likely to result in the continuation or resumption of dumping and/or subsidizing of the subject goods from China.

[3] The CBSA received a response to its Canadian Producer Expiry Review Questionnaire (ERQ) from Franke Kindred Canada LimitedFootnote 1 (Franke) and Novanni Stainless Inc.Footnote 2 (Novanni), producers of stainless steel sinks in Canada. The submissions made by Franke and Novanni also included information supporting the position that the continued or resumed dumping and subsidizing of stainless steel sinks from China is likely if the CITT’s order is rescinded.

[4] The CBSA received responses to the Importer ERQ from Canac-Marquis Grenier Ltée (“Canac-Marquis”)Footnote 3, Deccor Living Innovations Inc. (“Deccor”)Footnote 4, Tec Vanlife Ltd. (“TecVan”)Footnote 5, Stone Gallery Ltd. (“Stone”)Footnote 6 and Superprem Industries Ltd. (“Superprem”)Footnote 7. Canac-Marquis, Deccor and Superprem expressed an opinion on the likelihood of continued or resumed dumping and/or subsidizing of subject goods. The other importers did not express an opinion on the likelihood of continued or resumed dumping and/or subsidizing of subject goods.

[5] The CBSA received a response to its Exporter ERQ from IKEA Supply AG (IKEA)Footnote 8, a global wholesaler and exporter of subject goods. IKEA did not express an opinion on the likelihood of continued or resumed dumping and/or subsidizing of subject goods.

[6] The CBSA did not receive a response to the Foreign Government ERQ from the Government of China (GOC).

[7] No parties provided case briefs or reply submissions.

[8] Analysis of information on the administrative record indicates a likelihood of continued or resumed dumping into Canada of stainless steel sinks from China should the CITT’s order be rescinded. This analysis relied upon the following factors:

- Competition from hand-fabricated sinks

- Commodity nature of stainless steel sinks

- Chinese producers have excess production capacity

- Chinese producers are export-oriented

- Chinese producers have propensity to dump

- Weak market conditions and demand for stainless steel sinks in China; and

- Continued dumping of stainless steel sinks from China while the order was in effect

[9] In addition, analysis of information on the administrative record indicates a likelihood of continued or resumed subsidizing of stainless steel sinks from China should the CITT’s order be rescinded. This analysis relied upon the following factors:

- Continued availability of subsidy programs for stainless steel sink producers in China

- Imposition of countervailing measures on stainless steel sinks from China by authorities in other countries

- Imposition of anti-dumping and countervailing measures on Chinese stainless steel sheet and strip

- Continued subsidizing of stainless steel sinks from China while the order was in effect; and

- The volume of subsidized goods exported to Canada is large

[10] For the forgoing reasons, the CBSA, having considered the relevant information on the record, determined on April 27, 2023, pursuant to paragraph 76.03(7)(a) of SIMA, that the rescission of the order in respect of stainless steel sinks:

- is likely to result in the continuation or resumption of dumping of the goods from China; and

- is likely to result in the continuation or resumption of subsidizing of the goods from China

Background

[11] On October 27, 2011, following a complaint filed by Franke and Novanni, the CBSA initiated investigations, pursuant to subsection 31(1) of SIMA, into whether stainless steel sinks from China had been dumped and/or subsidized.

[12] On April 24, 2012, the CBSA made final determinations of dumping and subsidizing, pursuant to paragraph 41(1)(a) of SIMA, in respect of stainless steel sinks from China.Footnote 9

[13] On May 24, 2012, the CITT found, pursuant to subsection 43(1) of SIMA, that injury had been caused by the dumping and subsidizing of stainless steel sinks from China. The CITT’s Statement of Reasons for the finding on stainless steel sinks was issued on June 8, 2012.Footnote 10

[14] On April 1, 2014, the CBSA concluded a re-investigation to update the normal values, export prices and amounts of subsidy of stainless steel sinks from China.Footnote 11

[15] On July 7, 2016, the CBSA concluded a re-investigation to update the normal values, export prices and amounts of subsidy of stainless steel sinks from China.Footnote 12

[16] On February 8, 2018, the CITT issued an order continuing the finding pursuant to paragraph 76.03(12)(b) of SIMA.Footnote 13

[17] On November 28, 2022, the CITT, pursuant to subsection 76.03(1) of SIMA, initiated an expiry review of its order made on February 8, 2018, in Expiry Review No. RR-2017-001.

[18] On November 29, 2022, the CBSA initiated an expiry review investigation to determine whether the rescission of the order is likely to result in the continuation or resumption of dumping and/or subsidizing of the stainless steel sinks from China.

Product definition

[19] The goods subject to this expiry review investigation are defined as:

“Stainless steel sinks with a single drawn bowl having a volume between 1,600 and 5,000 cubic inches (26,219.30 and 81,935.32 cubic centimetres) or with multiple drawn bowls having a combined volume between 2,200 and 6,800 cubic inches (36,051.54 and 111,432.04 cubic centimetres), excluding sinks fabricated by hand, originating in or exported from the People’s Republic of China.”

Exclusions

[20] The CITT excluded the following goods from its injury findings:

“Stainless steel sinks with a single drawn bowl or double drawn bowls and a 1 1/4-inch by 3/4-inch (32 millimetres by 19 millimetres) cast-resin matrix rim that replaces a stainless steel rim, for undermount seamless installation in countertops.”

[21] For purposes of this expiry review investigation, “stainless steel sinks” also refers to goods produced in Canada that meet the above product definition.

Additional product information

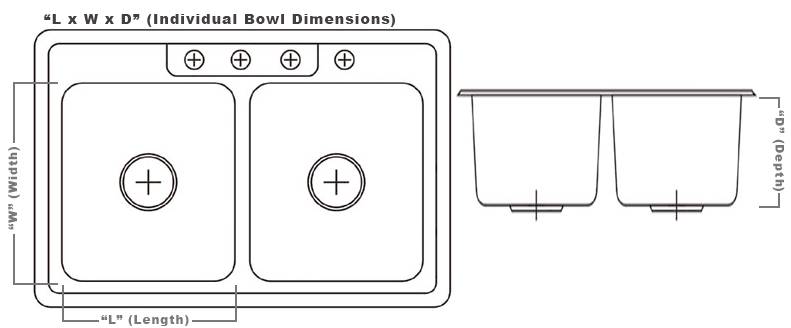

[22] For purposes of the definition of the subject goods, volume is calculated as the product of the length, width and depth of the bowl, regardless of the taper and radius of the bowl, where length and width are measured from front to back and left to right of the bowl rim, and where depth is measured from the bowl rim to the bottom of the sink at the point closest to the drain.

[23] For purposes of the definition of the subject goods, “sinks fabricated by hand” refers to the process by which sinkware is formed by hand. The sink stock is notched and folded, and sides are then welded and hand-polished to form a box-like shape. Hand-fabricated sinks may also be referred to as handcrafted or handmade sinks.

[24] The subject goods may be supplied with seals, strainer or strainer sets, mounting clips, fasteners, sound-deadening pads, cut-out templates, and additional accessories such as rinsing baskets and bottom grids.

[25] Stainless steel sinks are commonly used in residential and non-residential installations including in kitchens, bathrooms, utility and laundry rooms. They are available in a variety of shapes and configurations. Stainless steel sinks may have single or multiple bowls, and may be undermount, top mount, or designed as work tops.

[26] The image below illustrates how bowl measurements are used to calculate volume.

Text version: How we measure sinks

Individual bowl dimensions

- “Length x width x depth”

- “L” (Length)

- “W” (Width)

- “D” (Depth)

Classification of imports

[27] The subject goods are normally imported into Canada under the following tariff classification numbers:

- 7324.10.00.10

- 7324.10.00.90

[28] This listing of tariff classification numbers is for convenience of reference only. The tariff classification numbers provided may include goods that are not subject goods and subject goods may be imported into Canada under tariff classification numbers other than those provided. Refer to the product definition for authoritative details regarding the subject goods.

Period of review

[29] The period of review (POR) for the CBSA’s expiry review investigation is from January 1, 2019 to September 30, 2022.

Canadian industry

[30] The Canadian industry for stainless steel sinks is currently comprised of Franke Kindred Canada Limited (Midland, ON) and Novanni Stainless Inc. (Coldwater, ON).

Franke Kindred Canada Limited

[31] Franke is part of the Kitchen Systems Division of Franke Holdings AG in Midland, ON. Franke’s roots date back to 1946 when Kitchen Installations Inc. (KIL) began operations as a small metal products manufacturing facility in Toronto. In 1960, KIL moved its operations to the current location in Midland, Ontario and in 1962, KIL changed its name to Kindred Industries Limited. In November 1998, Kindred Industries Limited was acquired by Franke Holdings AG.Footnote 14

Novanni Stainless Inc.

[32] Novanni is a privately held company with manufacturing facilities in Coldwater, Ontario. Novanni's roots date back to 1955 when Wessan Plumbing Manufacturing (Wessan) began manufacturing stainless steel sinks in Brampton, Ontario. Wessan's manufacturing facility was relocated to Coldwater, Ontario in 1965. In 1999, Wessan was acquired by Elkay Manufacturing Company, a privately held plumbing products manufacturer in the United States (US) and operated as Elkay Canada Ltd. On March 20, 2008, Elkay Canada Ltd. was acquired by Novanni.Footnote 15

Canadian market

[33] The CBSA cannot release specific quantitative data regarding the value and volume of Canadian production of stainless steel sinks sold for domestic consumption as it would lead to the disclosure of confidential information of Franke and Novanni, the only two Canadian producers of stainless steel sinks. Therefore, only the imports of stainless steel sinks during the POR are presented below in Table 1.

| Source | 2019 | 2020 | 2021 | Jan-Sep 2022 | ||||

|---|---|---|---|---|---|---|---|---|

| Volume (units) | Value ($) | Volume (units) | Value ($) | Volume (units) | Value ($) | Volume (units) | Value ($) | |

| ChinaFootnote 17 | 163,571 | 9,251,828 | 157,602 | 9,107,271 | 198,762 | 11,450,990 | 148,919 | 9,852,132 |

| Other countriesFootnote 18 | 85,150 | 10,735,848 | 124,928 | 9,958,850 | 174,671 | 12,677,929 | 176,091 | 9,290,926 |

| Total imports | 248,721 | 19,987,676 | 282,530 | 19,066,121 | 373,433 | 24,128,919 | 325,010 | 19,143,058 |

[34] Based on information on the administrative record, the total apparent Canadian market, in terms of value and volume, increased overall from 2019 to 2021.

[35] Based on information on the administrative record, the Canadian producers’ share of the apparent Canadian market, in terms of value and volume, decreased during the POR. The market share of imports, in terms of volume, from China decreased during the POR. In terms of value, the market share of imports from China increased. The market share of imports from other countries, in terms of value and volume, showed an overall increase during the POR.

[36] As a result, the information demonstrates that during the POR imports from China and other countries have increasingly captured a greater share of the total apparent Canadian market in detriment to the Canadian producers.

Enforcement data

[37] In the enforcement of the CITT’s order during the POR, as detailed in Table 2 below, the total amount of anti-dumping and countervailing duties assessed on subject imports from China were approximately $7.3 million. As a percentage of the total value for duty, the total anti-dumping and countervailing duties assessed during the POR were equal to 18.5%.

| 2019 | 2020 | 2021 | Jan–Sep 2022 | |

|---|---|---|---|---|

| Quantity (units) | 163,571 | 157,602 | 198,762 | 148,919 |

| Value for duty ($) | 9,251,828 | 9,107,271 | 11,450,990 | 9,852,132 |

| SIMA duties ($) | 863,647 | 1,225,892 | 2,391,748 | 2,855,798 |

Parties to the proceedings

[38] On November 29, 2022, the CBSA sent notices concerning the initiation of the expiry review investigation and ERQs were sent to the known Canadian producers, importers and exporters of subject goods. The GOC was also sent a Foreign Government ERQ relating to the subsidizing of the subject goods.

[39] The ERQs requested information relevant to the CBSA’s consideration of the expiry review factors, as listed in subsection 37.2(1) of the Special Import Measures Regulations (SIMR).

[40] The two Canadian producers, Franke and Novanni, participated in the expiry review investigation and provided a response to the Canadian Producer ERQ.

[41] One distributor/vendor, IKEA, responded to the Exporter ERQ.

[42] Five Canadian importers: Canac-Marquis, Deccor, TecVan, Stone and Superprem responded to the Importer ERQ.

[43] The GOC did not provided a response to the CBSA’s Foreign Government ERQ.

[44] No parties provided a case brief or reply submission.

Information considered by the CBSA

[45] The information considered by the CBSA for purposes of this expiry review investigation is contained in the administrative record. The administrative record includes the information on the CBSA’s exhibit listing, which is comprised of the CBSA exhibits and information submitted by interested parties, including information which the interested parties feel is relevant to the decision as to whether dumping and subsidizing are likely to continue or resume absent the CITT order. This information may consist of expert analysts’ reports, excerpts from trade magazines and newspapers, orders and findings issued by authorities of Canada or of a country other than Canada, documents from international trade organizations such as the World Trade Organization (WTO) and responses to the ERQs submitted by the Canadian producer, exporters, importers and governments.

[46] For purposes of an expiry review investigation, the CBSA sets a date after which no new information submitted by interested parties will be placed on the administrative record or considered as part of the CBSA’s investigation. This is referred to as the “closing of the record date” and is set to allow participants time to prepare their case briefs and reply submissions based on the information that is on the administrative record as of the closing of the record date. For this investigation, the administrative record closed on January 18, 2023.

Position of the parties: Dumping

Parties contending that continued or resumed dumping is likely: Franke

[47] Franke made representations through its ERQ response in support of its position that the dumping of stainless steel sinks from China is likely to continue or resume should the CITT’s order be rescinded. Consequently, Franke argued that the anti-dumping measures should remain in place.

[48] The main factors identified by Franke can be summarized as follows:

- Competition from hand-fabricated sinks

- Customers in different distribution channels seek the lowest price

- At the low end of the market, stainless steel sinks are viewed as commodities

- The Canadian market is extremely small relative to the production capacity of exporters in China

- Stainless steel sink producers in China are export-oriented; and

- US trade measures on stainless steel sinks from China

Competition from hand-fabricated sinks

[49] Franke submitted that the Canadian market for stainless steel sinks has continued to shift towards hand fabricated sinks from China. These sinks are offered at lower prices. Franke referenced the GMP Research Report which indicated that imports of hand fabricated sinks between 2019 and 2021 ranged between approximately 481,000 units and 700,000 units, which are substantially higher than the previous period of review.Footnote 20

Customers in different distribution channels seek the lowest price

[50] Franke explained that historically the suppliers of stainless steel sinks generally sell under a “list and discount” pricing model which starts with the published price list and a discount multiplier is applied, resulting in the invoice price. Customers are also eligible for prompt payment discounts and periodic rebates and other price incentives.Footnote 21

[51] Franke noted that pricing competition in the Canadian market has moved away from the “list and discount” pricing model and towards the “net sheet” model which is often used to aggressively promote a narrow range of products.Footnote 22 In the net sheet model, prices are stated net of discounts and rebates.

[52] Franke indicated that these pricing models are generally used to compete in the wholesale business.Footnote 23

[53] Further, Franke noted that in recent years, solid surface countertops have become more affordable and increased the demand for undermount sinks. To compete, countertop fabricators have sought to incorporate the supply of stainless sinks as part of their fabrication services. The ability to offer a low-priced sink, or giving away a free sink, together with the countertop gives the countertop fabricator a competitive advantage. Countertop fabricators are incentivized to source the cheapest stainless steel sinks either through other importers or through direct imports. In turn, prices in all distribution channels have decreased and has caused Franke to lose market share to imports of subject goods.Footnote 24

At the low end of the market, stainless steel sinks are viewed as commodities

[54] Franke argued that lower-end products represent the majority of the volume of the Canadian market and these products can be essentially viewed as commodities. As commodity products, there is little to no regard for features, product certification, or country of origin.Footnote 25

[55] In support of its argument, Franke indicated that countertop fabricators will often include stainless steel sinks at no charge, and therefore lead countertop fabricators to seek the lowest prices for stainless steel sinks.Footnote 26

[56] Further, in support of its argument Franke also noted that larger retail chains within Canada have procurement personnel in China to search for low cost products. These retailers offer significant volume opportunities to Chinese producers.Footnote 27

The Canadian market is extremely small relative to the production capacity of exporters in China

[57] While it did not provide supporting documentation, Franke believes that the production capacity of Chinese exporters of stainless steel sinks is large compared to the size of the Canadian market. Franke argued that with the domestic construction market in China slowing considerably, and many Chinese producers having significant production capacity, an increasing number of Chinese producers will be looking at export markets to keep their factories operating at high capacity utilization.Footnote 28

Stainless steel sink producers in China are export-oriented

[58] Franke argued that Chinese producers of stainless steel sinks are export-oriented and view Canada as a market of interest. In support of this argument, Franke expressed that many Chinese producers participate in Canadian local trade shows to identify new customers in Canada. Franke also indicated that it receives regular communications from Chinese producers searching for business opportunities in Canada.Footnote 29

[59] While it did not provide supporting documentation, Franke noted that its sister companies located in various countries around the world have observed that volumes of stainless steel sinks from China have experienced increases in the markets of those countries as well, particularly in the European and the South American markets.Footnote 30

US trade measures on stainless steel sinks from China

[60] Franke noted that the anti-dumping and countervailing duties implemented in the US on stainless steel sinks have limited the export opportunities for Chinese producers. Franke argued that as a result of these duties, Canada has become and continues to be a target for Chinese exports. Franke further argued that the US decision to continue the measure is indication of the continued threat of the dumped goods.Footnote 31

Parties contending that continued or resumed dumping is likely: Novanni

[61] Novanni made representations through its ERQ response in support of its position that the dumping of stainless steel sinks from China is likely to continue or resume should the CITT’s order be rescinded. Consequently, Novanni argued that the anti-dumping measures should remain in place.

[62] The main factors identified by Novanni can be summarized as follows:

- Competition from hand-fabricated sinks

- Customers in different distribution channels seek the lowest price

- Chinese producers have excess production capacity

- Chinese producers have a propensity to dump stainless steel sinks; and

- Import volumes from China have remained relatively stable

Competition from hand-fabricated sinks

[63] Novanni submitted that in all the sales channels that it participates in, competition from hand-fabricated sinks from China have impacted the market. Not only have hand-fabricated sinks skewed sales away from drawn stainless steel sinks, Novanni expressed that hand-fabricated sinks have greatly affected its ability to compete in each of the different sales channels.Footnote 32 Novanni noted that hand-fabricated sinks are excluded from the product definition and alleged that hand-fabricated sinks are being dumped into the Canadian market. Novanni expressed that hand-fabricated sinks have affected Novanni’s opportunity to supply the industry with mid-range products. In particular, Novanni submitted that hand-fabricated sinks are sold at prices that are lower than domestically produced subject goods.Footnote 33 Novanni also observed that retail prices for hand-fabricated sinks have decreased five times.Footnote 34

Customers in different distribution channels seek the lowest price

[64] Novanni submitted that it sells stainless steel sinks in five different distribution channels including retail, plumbing wholesale, kitchen and bath dealers, countertop fabricators and e-commerce.Footnote 35

[65] Novanni noted that the initial imposition of dumping duty caused certain retailers to source stainless steel sinks domestically. However, Novanni argued that these retailers have extensive sourcing teams in China and would easily and quickly resort to importing directly from Chinese producers should the CITT’s order be rescinded.Footnote 36

[66] Novanni explained that in the plumbing wholesale channel, specifically in the entry level products supplied to new home construction, wholesalers continue to undercut each other in order to secure sales, forcing prices downwards. In order to undercut prices, wholesalers search for dumped goods from Chinese producers.Footnote 37

[67] In the kitchen and bath dealers channel, Novanni expressed that dealers purchase imported mid-range to high-end stainless steel sinks from importers that are nearly identical to the products it produces. In addition, Novanni indicated that the importers sell the products without any features or benefits, do not incur significant sales and marketing expenses and simply sell at the lowest possible price to the dealers. Novanni argued that importers will continue to undercut the domestically produced products through procurement of dumped goods should the CITT’s order be rescinded.Footnote 38

[68] Novanni noted that the countertop fabricators channel has emerged over the past ten years and represents a significant share of the market. Importers of stainless steel sinks supply this channel almost exclusively. In many cases, countertop fabricators offer free stainless steel sinks with the purchase of countertops. Novanni believes that this channel will likely expand as they will continue to provide “free sinks” with their countertops through procurement of dumped goods should the CITT’s order be rescinded.Footnote 39

[69] In the e-commerce channel, Novanni submitted that it supplies stainless steel sinks to certain online retailers. However, based on its market intelligence, Novanni noted that upwards of twenty imported sink brands are also available on the same websites. Novanni believes these sink brands are supplied by importers of dumped stainless steel sinks from China.Footnote 40

Chinese producers have excess production capacity

[70] Novanni submitted that the housing market in the US has recovered from the crash in 2008 with annual new home construction exceeding 1.5 million units. Novanni also indicated that the repair and renovation market is performing well.Footnote 41 Despite the recovery, Novanni noted that the number of new construction is still 500,000 units less than its all-time high in 2008.Footnote 42

[71] Novanni argued that the number of new construction in the US was primarily supplied by Chinese producers of stainless steel sinks. As such, given the demand for stainless steel sinks in the US is significantly below potential, Novanni deduced that there is excess production capacity in the factories of Chinese producers. Therefore, should the CITT’s order be rescinded, Canadian retailers would import directly and have easier access to the dumped goods from China.Footnote 43

Chinese producers have a propensity to dump stainless steel sinks

[72] Novanni submitted that the Chinese producers of stainless steel sinks have a propensity to dump.

[73] Novanni noted that stainless steel sinks are regional in shape, size and utility and that sinks produced and sold in one country are unique compared to sinks produced and sold in another country.Footnote 44 Novanni argued that in order for Chinese producers to penetrate mature and existing markets, they must undercut prices which would lead to the likelihood of dumping.Footnote 45

[74] In support of its argument Novanni noted that Chinese producers have been found to be dumping stainless steel sinks in the US, Mexico and Australia. Novanni also suspects that Chinese producers are dumping stainless steel sinks in other countries as well.Footnote 46

Import volumes from China have remained relatively stable

[75] Novanni submitted import statistics from Statistics Canada demonstrating volumes and values of subject and non-subject sinks over the period of 2019 to 2022.Footnote 47 Novanni noted that, during each year of the period of review, imports of subject and non-subject sinks from China exceeded 450,000 units.Footnote 48 Novanni emphasized that imports of subject and non-subject sinks from China exceeded 700,000 units in 2021.Footnote 49

[76] Novanni noted that the total imports of subject and non-subject sinks from non-named countries such as Vietnam, Malaysia, Thailand, Greece and Turkey have increased from 74,000 to 150,000 units between 2019 to 2021 and 63,000 in 2022.Footnote 50

[77] Novanni argued that should the CITT’s order be rescinded, the Chinese exporters would compete with producers from these other countries and the competition would lead to prices driven downwards which would likely lead to dumping.Footnote 51

Parties contending that continued or resumed dumping is unlikely: Canac-Marquis

[78] Canac-Marquis made representations through its ERQ response in support of its position that the dumping of stainless steel sinks from China is unlikely to continue or resume should the CITT’s order be rescinded.

[79] The main factor identified by Canac-Marquis is as follows:

COVID-19 restrictions are impacting Chinese production capacity

[80] Canac-Marquis argued that due to strong COVID-19 restrictions in China, Chinese producers are unable to operate their factories at high capacity as a result of shutdowns and labour shortages. As such, Chinese producers do not have the capacity to supply the demand for stainless steel sinks.Footnote 52 The CBSA notes that Canac-Marquis did not provide additional information to support this statement.

Parties contending that continued or resumed dumping is unlikely: Deccor

[81] Deccor made representations through its ERQ response in support of its position that the dumping of stainless steel sinks from China is unlikely to continue or resume should the CITT’s order be rescinded.

[82] The main factor identified by Deccor is as follows:

The Canadian retail market has shifted to hand-fabricated sinks

[83] Deccor submitted that its company focuses predominantly on hand-fabricated sinks, faucets and kitchen accessories. Deccor indicated that stainless steel sinks accounts for less than 20% of the total sales in Canada.Footnote 53 Further, Deccor noted that when it started importing in 2017, stainless steel sinks represented 40% of its shipping containers. However, since 2020, about 80% to 90% of its shipping containers were filled with hand-fabricated sinks.Footnote 54

[84] While Deccor acknowledged that stainless steel sinks are still significant in the housing and condominium development industry,Footnote 55 Deccor argued that the demand for stainless steel sinks is low and rescission of the CITT’s order is unlikely to lead to continued or resumed dumping.Footnote 56

Parties contending that continued or resumed dumping is unlikely: Superprem

[85] Superprem made representations through its ERQ response in support of its position that the dumping of stainless steel sinks from China is unlikely to continue or resume should the CITT’s order be rescinded.

[86] The main factor identified by Superprem is as follows:

COVID-19 restrictions have impacted Chinese production capacity

[87] Superprem submitted that Chinese producers have been impacted by COVID-19 restrictions. Superprem argued that production capacity of Chinese producers are shrinking due to cost and inflationary pressures. Superprem also argued that the reduced production capacity is complemented with weaker demands for stainless steel sinks.Footnote 57 The CBSA notes that Superprem did not provide additional information to support these statements.

Consideration and analysis: Dumping

[88] In making a determination under paragraph 76.03(7)(a) of SIMA whether the rescission of the order is likely to result in the continuation or resumption of dumping of the goods, the CBSA may consider the factors identified in subsection 37.2(1) of the SIMR, as well as any other factors relevant under the circumstances.

[89] Guided by these aforementioned factors, the CBSA conducted its review based on the documentation submitted by the various participants and its own research, all of which can be found on the administrative record. The following list represents a summary of the CBSA’s analysis conducted in this expiry review investigation with respect to dumping:

- Competition from hand-fabricated sinks

- Commodity nature of stainless steel sinks

- Chinese producers have excess production capacity

- Chinese producers are export-oriented

- Chinese producers have a propensity to dump

- Weak market conditions and demand for stainless steel sinks in China; and

- Continued dumping of stainless steel sinks from China while the order was in effect

[90] The CBSA notes that proceedings to update normal values and export prices have not been conducted since the CITT’s issuance of the order to continue the finding on February 8, 2018. Further, as the CBSA did not receive ERQ responses from any Chinese producers/exporters of stainless steel sinks, the CBSA relied on information available at the time of the conclusion of the last expiry review investigation on stainless steel sinks on September 1, 2017 and information from its own research in assessing the likelihood of continued or resumed dumping should the CITT’s order be rescinded.

Competition from hand-fabricated sinks

[91] A growing trend of product substitution for mid-range stainless steel sinks in the Canadian market has occurred in recent years and is expected to continue. This trend was acknowledged by the complainants during the time of the last expiry review investigation and reaffirmed by the complainants during the current expiry review investigation. This trend is also corroborated by the representations of Deccor, an importer and retailer of stainless steel sinks, hand-fabricated sinks and plumbing accessories in the current expiry review investigation. Evidence provided by Franke indicates that between 2019 and 2021, importations of hand-fabricated sinks increased from 481,000 units to 700,000 units or 45.5%.

[92] The trend is driven by the significant reduction in the already lower prices of hand-fabricated sinks supplied by Chinese exporters. As observed by Novanni, the retail prices of some hand-fabricated sinks have reduced to one-fifth of their retail prices since the last expiry review investigation and even sold at retail prices that are lower than the Canadian domestically produced stainless steel sinks.

[93] The CBSA finds that the shift from stainless steel sinks to hand-fabricated sinks has not only resulted in increased competition but is also likely to reduce the size of the Canadian market for stainless steel sinks. The CBSA also finds that given the continued trend towards hand-fabricated sinks in the Canadian market, Chinese producers of stainless steel sinks may be forced to compete more aggressively in order to maintain market share and prevent lost sales. As such, should the CITT rescind the order, competition from hand-fabricated sinks may increase the likelihood of continued or resumed dumping of stainless steel sinks.

Commodity nature of stainless steel sinks

[94] According to the complainants, the majority of the stainless steel sinks sold in Canada, which are in the lower end of the market, are considered to be commodity products. As such price is the determining factor in the purchasing decision of customers. The complainants argued that competition within all different distribution channels is intense and that importers seek the lowest prices, including the procurement of dumped goods, in order to undercut each other’s prices and gain a competitive advantage.

[95] Table 3 below is a summary of average unit prices of the importations of stainless sinks from China and other countries based on CBSA customs import data and enforcement statistics.

| 2019 | 2020 | 2021 | 2022 (Jan-Sep) | |

|---|---|---|---|---|

| China | $56.56 | $57.79 | $57.61 | $66.16 |

| Other countries | $126.08 | $79.72 | $72.58 | $52.76 |

[96] As can be observed in Table 3, while the average price per unit of stainless steel sinks from China remained flat between 2019 and 2021, with a slight increase in 2022, the average price per unit of stainless steel sinks from other countries decreased during the same period. The reduction in the average unit prices of stainless steel sinks imported from other countries corresponds to an increase in the market share of stainless steels sinks from other countries during the same period.

[97] As discussed under the Canadian market section, during the POR, the share of imports from China, in terms of volume, decreased between 2019 and 2021. During the same period, the share of imports from other countries, in terms of volume increased.

[98] Given the price sensitive nature of the subject goods, the CBSA finds that the shift in import volume into Canada from China to imports from other countries can be reasonably attributed to the competition from lower-priced imports in Canada from these other countries.

[99] Due to the commodity nature of stainless steel sinks, in order to regain lost market share, stainless steel sinks from China would need to compete with the lower prices of imports from other countries. As such, should the CITT rescind the order, the commodity nature of stainless steel sinks may increase the likelihood of continued or resumed dumping of stainless steel sinks.

Chinese producers have excess production capacity

[100] According to the complainants, the total production capacity of Chinese producers/exporters is large compared to the size of the apparent Canadian market and that excess production capacity in stainless steel sinks exists in China. Given the production capacity of Chinese producers of stainless steel sinks, the complainants argued that the producers seek sales in export markets in order to maintain their capacity utilization.

[101] Table 4 below provides a summary of total production capacity available for four cooperative exporters, Dongyuan Kitchenware, Yingao Kitchen, New Star Hi-Tech and Komodo Kitchen. Due to the lack of response from these four exporters in the current expiry review investigation, information available at the time of the conclusion of the last expiry review investigation on stainless steel sinks is reported as follows:

| 2011 | 2013 | 2016 | |

|---|---|---|---|

| Total production capacity (units) | 3,530,500 | 3,730,500 | 4,330,000 |

[102] Collectively, the annual production capacity of the four cooperative exporters in 2016 was 4.3 million units. The data suggests that Chinese producers have historically increased production capacity over time. However, even under the assumption that there have been no additional investments in production capacity since 2016, the production capacity of these four Chinese exporters alone represent approximately seven times the total size of the current apparent Canadian market for stainless steel sinks.

[103] The CBSA’s estimate of total production capacity is conservative due to the limited number of cooperative exporters. In the US International Trade Commission’s (USITC) determinations on August 14, 2018,Footnote 60 the USITC noted that Chinese producers reported a total production capacity of 9,260,00 units as of 2017.

[104] While the CBSA acknowledges that the COVID-19 pandemic may have lead to temporary factory shutdowns and temporary labour shortages and that Chinese producers may be experiencing cost and inflationary pressures as argued by Canac-Marquis and Superprem, the CBSA is of the position that Chinese producers will be motivated to produce and export to the global market as China’s economy continues to recover fully over the long run.

[105] Further, analysis of the CBSA’s enforcement statistics pertaining to imports of stainless steel sinks from China in Table 2 shows that while Chinese imports decreased from 163,571 units in 2019 to 157,602 units in 2020, growth in the volume of imports has rebounded to 198,762 units in 2021 and already 148,919 units in only the first three quarters of 2022.

[106] Available evidence to the CBSA also indicates that cooperative Chinese exporters have operated with excess production capacity in the past. Table 5 below provides a summary of the capacity utilization rates available for Dongyuan Kitchenware, Yingao Kitchen, New Star Hi-Tech and Komodo Kitchen. Due to the lack of response from these four exporters in the current expiry review investigation, information available at the time of the conclusion of the last expiry review investigation on stainless steel sinks is reported as follows:

| 2011 | 2013 | 2016 | |

|---|---|---|---|

| Actual production (units) | 2,139,483 | 2,021,931 | 2,966,050 |

| Capacity utilization (%) | 60.6% | 54.2% | 68.5% |

[107] Based on information in Table 5, the cooperative exporters have operated at a weighted average capacity utilization rate between 54.2% and 68.5%. In terms of the number of units of sinks, the excess capacity represents 1.4 million to 2.0 million.

[108] Under the assumption that cooperative exporters are currently experiencing the highest production capacity utilization rate as reported in Table 5 and the total production capacity of 2016 as reported in Table 5, the volume of excess capacity represents over two times the current size of the Canadian apparent market for stainless steel sinks.

[109] Based on the available evidence, the CBSA finds that production capacity of stainless steel sinks is extremely large and that excess production capacity exists in China. As such, should the CITT rescind the order, Canada represents an attractive market for stainless steel sink producers in China to eliminate excess production capacity which may increase the likelihood of continued or resumed dumping of stainless steel sinks.

Chinese producers are export-oriented

[110] The complainants claimed that stainless steel sink producers in China are export-oriented and that imports of stainless steel sinks to Canada remained stable during the POR.

[111] Table 6 below provides a summary of sales reported by four cooperative exporters, Dongyuan Kitchenware, Yingao Kitchen, New Star Hi-Tech and Komodo Kitchen in their domestic and export markets. Due to the lack of response from these four exporters in the current expiry review investigation, information available at the time of the conclusion of the last expiry review investigation on stainless steel sinks is reported as follows:

| 2011 | 2013 | 2016 | ||||

|---|---|---|---|---|---|---|

| QTY | Value | QTY | Value | QTY | Value | |

| China | 93,389 | 19,522,878 | 93,799 | 19,166,065 | 443,794 | 86,845,489 |

| Canada | 113,766 | 27,393,133 | 210,440 | 59,645,577 | 155,192 | 36,569,822 |

| Other export sales | 1,791,549 | 357,159,356 | 1,643,716 | 289,958,138 | 903,645 | 195,537,544 |

| Total | 1,998,704 | 404,075,366 | 1,947,955 | 368,769,780 | 1,502,631 | 318,952,855 |

[112] In terms of value, total domestic sales as a percentage of total sales to all markets represent 4.8% in 2011, 5.2% in 2013 and 27.2% in 2016. Due to lack of responses from the cooperative exporters, there does not appear to be any information that suggests that there have been changes in the trading patterns of the Chinese producers. The CBSA finds that the share of domestic sales in comparison to total sales indicate that Chinese producers are export-oriented and are dependent on export markets for sales.

[113] Further, based on the CBSA’s enforcement statistics pertaining to imports of stainless steel sinks from China in Table 2, Chinese imports increased by 21.5% from 163,571 units in 2019 to 198,762 units 2021 with a slight decrease in 2020. This decrease can be attributed to the effects of the COVID-19 pandemic. So far, 148,919 units have been imported into Canada in only the first three quarters of 2022.

[114] The CBSA finds that the rate of increase and the increased volume of exports to Canada of stainless steel sinks during the period the order was in effect indicates a continued interest in the Canadian market on behalf of the Chinese exporters. Should the CITT rescind the order, increasing imports of stainless steel sinks into Canada from export-oriented producers in China may increase the likelihood of continued or resumed dumping of stainless steel sinks.

Chinese producers have a propensity to dump

[115] The complainants argued that Chinese producers of stainless steel sinks have propensity to dump into foreign markets.

[116] On February 26, 2013, the USDOC made a final determination of dumping in respect of drawn stainless steel sinks from China. According to the investigation results, exporters of drawn stainless steel sinks from China received weighted-average dumping margins ranging from 27.1% to 76.5%.Footnote 63 It is important to note that Dongyuan Kitchenware, Yingao Kitchen and New Star Hi-Tech were among twenty-five exporters that cooperated in the USDOC investigation.

[117] On August 14, 2018, the USDOC and USITC made determinations that revocation of the countervailing and antidumping duty orders on drawn stainless steel sinks from China would likely lead to the continuation or recurrence of material injury to an industry in the US within a reasonably foreseeable time.Footnote 64

[118] On March 26, 2015, the Australian Anti-dumping Commission (ADC) made a final determination of dumping on certain deep drawn stainless steel sinks from China. According to the investigation results, certain deep drawn steel sinks from China were dumped with margins ranging from 5.0% to 49.5%.Footnote 65 It is important to note that New Star Hi-Tech and Komodo Kitchen were among eleven exporters that cooperated in the ADC investigation.

[119] On February 28, 2020, the ADC made determinations that the expiration of the measures would lead, or would be likely to lead, to a continuation of, or a recurrence of, dumping and subsidisation and the material injury that the measures are intended to prevent.Footnote 66

[120] On April 22, 2015, the Mexican Ministry of Economy made a final determination of dumping on stainless steel sinks from China. On June 7, 2021, the Mexican authorities concluded its sunset review and maintained the anti-dumping measures against stainless steel sinks from China.Footnote 67

[121] The CBSA finds that the imposition of anti-dumping measures on stainless steel sinks from China by the US, Australian and Mexican authorities demonstrates that Chinese exporters have a propensity to dump. Should the CITT rescind the order, as a result of their propensity to dump, Chinese exporters would divert stainless steel sinks from the US, Australia and Mexico to the Canadian market which may increase the likelihood of continued or resumed dumping of stainless steel sinks.

Weak market conditions and demand for stainless steel sinks in China

[122] For stainless steel sinks producers, construction starts are important indicators of stainless steel sinks sales trends. Future demand for stainless steel sinks is considered to be weak in the Chinese market. Several reports indicate that economic growth in China is slowing.

[123] In August 2022, Goldman Sachs cut its forecast for China’s GDP growth in 2022 to 3.0% from 3.3%, after taking into account weaker-than-expected economic data and energy constraints in previous months. This marks the third cut by the bank since May 2022.Footnote 68

[124] Export Development Canada (EDC) indicated that the outlook for China’s economy calls for historically weak growth of 3% in 2022 and 4.9% in 2023. According to the EDC, China is one of the few countries where monetary policy is likely to be eased rather than tightened. The economic impacts of the country’s zero-COVID-19 policies are not expected to improve in 2023. At the same time, ongoing debt accumulation and overcapacity in the property sector will require policy support to stem wider economic impacts.Footnote 69

[125] In its July 2022 World Economic Outlook Report, the International Monetary Fund’s (IMF) growth outlook for China is marked down from 8.1% in 2021 to 3.3% and 4.6% in 2022 and 2023, respectively. The IMF also mentions large-scale disorderly corporate debt defaults and restructuring, for instance in China’s property sector, that could lead to market volatility.Footnote 70

[126] New estimates from S&P Global Ratings forecasts China’s property sales to plunge in 2022 by 30%, more than they did during the 2008 financial crisis.Footnote 71

[127] According to data published on March 16, 2023 by the National Bureau of Statistics of China, China’s real estate climate index stood at 94.67 as of February 2023 up from a low of 94.36 at the end of December 2022. The real estate climate remains weak, as readings below 100 indicate a slowdown in the Chinese real estate industry while readings above 100 indicate economic growth.Footnote 72

[128] Against this weak outlook, the CBSA finds that Chinese producers may become increasingly export oriented as they face diminishing demand in their domestic market. As well, given the softening of the construction sector in China, there is a likelihood that Chinese exporters will have to look to other export markets like Canada to replace lost sales to customers within China. As such, should the CITT rescind its order, weak market conditions and demand for stainless steel sinks in China may increase the likelihood of continued or resumed dumping of stainless steel sinks.

Continued dumping of stainless steel sinks from China while the order was in effect

[129] As reported in Table 2, during the POR, a total of $7.3 million of anti-dumping and countervailing duties (SIMA duties) were assessed on a total of 668,854 units (VFD $39,662,221) of stainless steel sinks from China imported into Canada. Based on the underlying data, of this total, $241,872 of SIMA duties were assessed on subject goods from cooperative exporters, representing 3.3% of all SIMA duties assessed during the POR. The majority of SIMA duties were assessed on goods from non-cooperative exporters.

[130] The enforcement data also shows that as a percentage of the total value for duty, the total combined SIMA duties assessed during the POR were equal to 18.5%, which is not insignificant.

[131] The CBSA finds that Chinese exporters, including cooperative exporters with established normal values, have continued to export subject goods to Canada at dumped prices while the order was in effect. The CBSA also finds that should the CITT rescind the order, the continued dumping of stainless steel sinks from China while the order was in effect may increase the likelihood of continued or resumed dumping of stainless steel sinks.

Determination regarding likelihood of continued or resumed dumping

[132] Based on the information on the record in respect of: increased competition from hand-fabricated sinks; the majority of the volume of sinks imported into Canada is at the lower end of the market and are considered to be commodity products and therefore sold on the basis of price; Chinese exporters have substantial production capacity and are struggling with factory capacity under-utilization; Chinese producers are export-oriented and have a propensity to dump stainless steel sinks; Chinese producers face weak market conditions and demand for stainless steel sinks in China; and Chinese exporters, including exporters with established normal values, have continued to export subject goods to Canada at dumped prices while the order was in effect, the CBSA has determined that the rescission of the order is likely to result in the continuation or resumption of dumping of stainless steel sinks from China.

Position of the parties: Subsidizing

Parties contending that continued or resumed subsidizing is likely

[133] None of the parties contended that resumed or continued subsidizing of subject goods from China is likely if the order is rescinded.

Parties contending that continued or resumed subsidizing is unlikely

[134] None of the parties contended that resumed or continued subsidizing of subject goods from China is unlikely if the order is rescinded.

Consideration and analysis: Subsidizing

[135] In making a determination under paragraph 76.03(7)(a) of SIMA whether the rescission of the order is likely to result in the continuation or resumption of subsidizing of the goods, the CBSA may consider the factors identified in subsection 37.2(1) of the SIMR, as well as any other factors relevant under the circumstances.

[136] Guided by the aforementioned regulations and having examined the information on the administrative record, the following is a list of the factors considered in the analysis with respect to the likelihood of continued or resumed subsidizing:

- Continued availability of subsidy programs for stainless steel sink producers in China

- Imposition of countervailing measures on stainless steel sinks from China by authorities in other countries

- The imposition of anti-dumping and countervailing measures on Chinese stainless steel sheet and strip

- Continued subsidizing of stainless steel sinks from China while the order was in effect; and

- The volume of subsidized goods exported to Canada is large

[137] The CBSA notes that proceedings to update amounts of subsidy have not been conducted since the CITT’s issuance of the order to continue the finding on February 8, 2018. Further, as the CBSA did not receive ERQ responses from any Chinese producers/exporters of stainless steel sinks or the GOC in this expiry review investigation, the CBSA relied on information available at the time of the conclusion of the last expiry review investigation on stainless steel sinks on September 1, 2017 and information from its own research in assessing the likelihood of continued or resumed subsidization should the CITT’s order be rescinded.

The continued availability of subsidy programs for stainless steel sink producers in China

[138] At the final determination of the original subsidy investigation in 2011, the CBSA found 15 subsidy programs that benefited the cooperative exporters of stainless steel sinks. The weighted average amount of subsidy, expressed as a percentage of the export price was 38.8%.Footnote 73

[139] In the 2013 re-investigation, the CBSA found 7 subsidy programs that benefited the cooperative exporters of stainless steel sinks. The CBSA determined that the three cooperative exporters received amounts of subsidy between 4.53 CNY per unit and 6.58 CNY per unit.Footnote 74

[140] In the 2016, re-investigation, the CBSA found 11 subsidy programs that benefited the cooperative exporters of stainless steel sinks. The CBSA determined that the four cooperative exporters received amounts of subsidy between 0.001 CNY per unit and 2.27 CNY per unit.Footnote 75

[141] In addition to stainless steel sinks, the CBSA found that Chinese producers in the plumbing sector including copper tube and copper pipe fittings also received subsidies from the GOC. In the 2015 re-investigation of copper tube from China, as no responses were received from Chinese exporters, the CBSA determined amounts of subsidy for all exporters from China in accordance with a ministerial specification and was equal to 25,239 CNY per metric tonne.Footnote 76 In the 2019 re-investigation of copper pipe fittings from China, the CBSA determined that two cooperative exporters received amounts of subsidy between 0.18 CNY per kilogram and 2.28 CNY per kilogram.Footnote 77

[142] In addition to the plumbing sector, the CBSA also found that Chinese producers in other consumer goods sectors including upholstered domestic seating and mattresses received subsidies from the GOC. In the 2020 investigation of upholstered domestic seating from China, the CBSA found 15 subsidy programs that benefited the cooperative exporters. The weighted average amount of subsidy, expressed as a percentage of the export price was 12.7%.Footnote 78 In the 2022 investigation of mattresses from China, the CBSA found 23 subsidy programs that benefited the cooperative exporters. The weighted average amount of subsidy, expressed as a percentage of the export price was 24.1%.Footnote 79

[143] On August 27, 2021, the GOC submitted its most recent notification to the World Trade Organization (WTO) in which the GOC reported programs granted during the period from 2019 to 2020.Footnote 80 The POR for this expiry review investigation encompasses the period covered in the GOC’s notification. In its notification, the GOC identifies subsidies available at the central and sub-central levels of government which take the form of cash grants, land-use rights, discounted inputs, preferential loans and directed credit, special tax rebates, and VAT and tariff exemptions.

[144] Based on a review of the document, the CBSA identified 11 programs which may potentially confer benefits to stainless steel sink producers in China as listed below:

- Preferential tax treatment of additional calculation and deduction of research and development expenses

- Preferential tax policies for enterprises transferring technology

- General-benefit tax exemption for micro and small enterprises

- Exemption of employment security fund as for people with disabilities

- Exemption of government-managed fund

- Preferential VAT policies for enterprises that employ people with disabilities

- Preferential income tax policies for enterprises that employ people with disabilities

- Preferential tax treatment for import of equipment

- Special fund for foreign economic and trade development

- Award and subsidy for reducing the fees for the financing guarantee businesses of small and micro enterprises; and

- Preferential tax treatment on financing

[145] Based on the above, the CBSA finds that since the final determination of the original investigation and throughout the period the order was in effect, the GOC has continued to make subsidy programs available to producers/exporters of goods in the plumbing sector and consumer goods sector, including stainless steel sinks. The CBSA finds that should the CITT rescind the order, the continued availability of subsidy programs for stainless steel sink producers in China may increase the likelihood of continued or resumed subsidizing of stainless steel sinks.

Imposition of countervailing measures on stainless steel sinks from China by authorities in other countries

[146] While Mexican authorities have only imposed anti-dumping duties on importation of stainless steel sinks from China, authorities in the US and Australia have also imposed countervailing measures on importation of stainless steel sinks from China.

[147] On February 26, 2013, the USDOC made a final determination of subsidizing in respect of drawn stainless steel sinks from China. Countervailable subsidy rates determined for Chinese exporters of drawn stainless steel sinks ranged from 4.8% to 12.26%.Footnote 81 As noted in the analysis of the likelihood of continued or resumed dumping, Dongyuan Kitchenware, Yingao Kitchen and New Star Hi-Tech were among twenty-five exporters that cooperated in the USDOC investigation.

[148] On August 14, 2018, the USITC made determinations that revocation of the countervailing and antidumping duty orders on drawn stainless steel sinks from China would likely to lead to continuation or recurrence of material injury to an industry in the US within a reasonably foreseeable time.Footnote 82

[149] On March 26, 2015, the ADC made a final determination of subsidizing on certain deep drawn stainless steel sinks from China. Subsidy margins established for exporters of drawn stainless steel sinks from China ranged from 3.3% to 6.4%.Footnote 83 It is important to note that New Star and Komodo were among eleven exporters that cooperated in the ADC investigation.

[150] On February 28, 2020, the ADC made determinations that the expiration of the measures would lead, or would be likely to lead, to a continuation of, or a recurrence of, dumping and subsidisation and the material injury that the measures are intended to prevent.Footnote 84

[151] The CBSA finds that the imposition of countervailing measures on stainless steel sinks from China by the US and Australian authorities demonstrate that the GOC makes available subsidy programs that confer benefits to producers of stainless steel sinks in China. The CBSA finds that should the CITT rescind the order, the imposition of countervailing measures on stainless steel sinks from China by authorities in other countries may increase the likelihood of continued or resumed subsidizing of stainless steel sinks.

The imposition of anti-dumping and countervailing measures on Chinese stainless steel sheet and strip

[152] On February 8, 2017, the USDOC made a final determination of subsidy on stainless sheet and strip from China. Countervailable subsidy rates established for exporters ranged from 45.6% to 190.7%.Footnote 85

[153] Recently on November 4, 2022, the USDOC and USITC made determinations that the revocation of the anti-dumping duty and countervailing duty orders on stainless steel sheet and strip from China would be likely to lead to the continuation or recurrence of dumping, countervailable subsidies, and material injury to an industry in the US.Footnote 86

[154] As stainless steel sheet/strip is the main raw material input in the production of subject goods, potentially all or part of the subsidy could be attributable to the stainless steel sinks in the form of indirect pass-through subsidies. As determined in the CBSA’s original investigation and subsequent re-investigations of stainless steel sinks, the GOC through state-owned and/or state controlled enterprises of suppliers/manufacturers have provided raw material inputs to producers of stainless steel sinks at less than adequate remuneration. In those proceedings, the CBSA determined that a financial subsidy existed and that the subsidy has benefitted the producers/exporters of stainless steel sinks.

[155] Based on the evidence above, the CBSA finds that should the CITT rescind the order, the imposition of anti-dumping and countervailing measures on Chinese stainless steel sheet and strip may increase the likelihood of continued or resumed subsidizing of stainless steel sinks.

Continued subsidizing of stainless steel sinks from China while the order was in effect

[156] As reported in Table 2, a total of $7.3 million of SIMA duties were collected on subject goods imported during the POR.Footnote 87 The enforcement data also shows that as a percentage of the total value for duty, the total combined SIMA duties assessed during the POR were equal to 18.5%, which is not insignificant.

[157] While the payment of countervailing duties cannot be avoided, the data in Table 2 suggests that importers in Canada have taken countervailing duties into consideration as part of their purchasing decision of stainless steel sinks. During the time the order was in effect, it appears that importers have continued to purchase large volumes of stainless steel sinks from both cooperative and non-cooperative Chinese exporters at subsidized prices. The CBSA finds that should the CITT rescind the order, the continued subsidizing of stainless steel sinks from China while the order was in effect may increase the likelihood of continued or resumed subsidizing of stainless steel sinks.

The volume of subsidized goods exported to Canada is large

[158] As reported in Table 2, during the POR, a total of 668,854 units (VFD $39,662,221) of stainless steel sinks from China were imported into Canada. Chinese imports increased by 21.5% from 163,571 units in 2019 to 198,762 units in 2021 with a slight decrease in 2020. This decrease can be attributed to the effects of the COVID-19 pandemic. So far, 148,919 units have been imported into Canada in only the first three quarters of 2022.

[159] The CBSA finds the rate of increase to be significant and the total volume of subsidized goods imported into Canada during the POR was substantial given the size of the apparent Canadian market. The CBSA also finds that should the CITT rescind the order, the rate of increase and volume of subsidized goods exported to Canada may increase the likelihood of continued or resumed subsidizing of the stainless steel sinks.

Determination regarding likelihood of continued or resumed subsidizing

[160] Based on the information on the record in respect of: continued availability of subsidy programs for producers/exporters in China; evidence of imposition of countervailing measures on Chinese stainless steel sinks by authorities in other countries; evidence of the imposition of anti-dumping and countervailing measures on Chinese stainless steel sheet and strip by US authorities; continued subsidizing of stainless steel sinks from China while the order was in effect and the rate of the increase and volume of subsidized goods entering Canada, the CBSA has determined that the rescission of the order is likely to result in the continuation or resumption of subsidizing of stainless steel sinks from China.

Conclusion

[161] For the purpose of making a determination in this expiry review investigation, the CBSA conducted its analysis within the scope of the factors found under subsection 37.2(1) of the SIMR and considering any other factors relevant in the circumstances. Based on the foregoing analysis of pertinent factors and consideration of information on the record, on April 27, 2023, the CBSA made a determination pursuant to paragraph 76.03(7)(a) of SIMA that the rescission of the order made by the CITT on February 8, 2018, in Inquiry No. RR-2017-001 in respect of certain stainless steel sinks originating in or exported from China:

- is likely to result in the continuation or resumption of dumping of the goods from China; and

- is likely to result in the continuation or resumption of subsidizing of the goods from China

Future action

[162] The CITT has now initiated its expiry review to determine whether the continued or resumed dumping and subsidizing are likely to result in injury. The CITT’s Expiry Review schedule indicates that it will make its decision by October 4, 2023.

[163] If the CITT determines that the rescission of the order with respect to the goods is likely to result in injury, the order will be continued in respect of those goods, with or without amendment. If this is the case, the CBSA will continue to levy anti-dumping and/or countervailing duties on dumped and/or subsidized importations of the subject goods.

[164] If the CITT determines that the rescission of the order with respect to the goods is not likely to result in injury, the order will be rescinded in respect of those goods. Anti-dumping and/or countervailing duties would then no longer be levied on importations of the subject goods, and any anti-dumping and/or countervailing duties paid in respect of goods that were released after the date that the order was scheduled to expire will be returned to the importer.

Contact us

[165] For further information, please contact the officers listed below:

- Telephone:

- Nalong Manivong: 343-549-0429

- Alex Wu: 343-573-2930

Doug Band

Director General

Trade and Anti-dumping Programs Directorate

Page details

- Date modified: