We have archived this page on the web

The information on this page is for reference only. It was accurate at the time of publishing but may no longer reflect the current state at the Canada Border Services Agency. It is not subject to the Government of Canada web standards.

Executive Vice-President's Transition Binder 2019

Commercial and Trade Branch (CTB)

Mandate and vision statement

Our vision, put succinctly, is that the Commercial and Trade business line will deliver a modern customs program at the heart of CBSA’s mandate.

The Commercial and Trade Business Line inherits and builds upon the Government of Canada’s Customs legacy to manage the flow of goods across Canada’s borders in a manner that ensures safety and security, promotes efficient trade flows and protects the integrity of revenues.

We work collaboratively, including with government, industry, and international partners. We use leading practices to guide our business. We establish clarity with stakeholders through the consistent and transparent application of a progressive program architecture that leverages technology and a data-driven approach to risk-based compliance.

We promote voluntary compliance to enhance security and revenue collection, and ensure accountability for non-compliance in a systemic and transparent manner.

The Commercial and Trade Branch’s mandate is to ensure goods entering and exiting Canada are compliant with health, safety and security requirements and meet trade obligations by administering programs for:

- Reporting, Admissibility, Release, and Accounting of Commercial Goods (including Export, Postal and Courier)

- POE Compliance and Examinations, including detection tools and technology

- Trusted Trader Programs

- Compliance with Revenue and Trade Rules, including Special Import Measures Act (SIMA) and Trade Agreements

Vice-President biography

In April 2019, Peter Hill was appointed Vice-President, Commercial and Trade Branch, Canada Border Services Agency (CBSA). Prior to this appointment, Peter served as Associate Vice President, Programs Branch, CBSA for five years with responsibility for the development and implementation of national programs; strategies; legal, regulatory and policy frameworks; and CBSA Renewal. Prior to that, Mr. Hill was Director General, Enforcement and Intelligence Programs Directorate, CBSA for five years. Throughout his tenure at the Agency, Mr. Hill has provided leadership on strategic initiatives and partnerships to advance CBSA priorities in collaboration with other government departments and agencies, provincial and foreign governments, industry, non-governmental organisations, and academia.

In May 2015, Peter took on the role of CBSA Champion for Indigenous Peoples and has provided leadership, in partnership with internal and external stakeholders, to enhance the CBSA's role in the Government of Canada's reconciliation efforts, including establishment of the Agency's first Indigenous Framework and Strategy and the creation of the Indigenous Affairs Secretariat (February 2018).

Prior to joining the CBSA, Mr. Hill held executive positions at Communications Security Establishment Canada, Public Safety Canada and Health Canada. He began his career with the Canadian Security Intelligence Service in 1985.

Mr. Hill holds a Masters of Arts degree in Political Science from Carleton University in Ottawa. He is married with two adult children.

Message

As the Vice President of the new Commercial and Trade business line and Branch, I am very pleased to provide our first integrated business plan that aims to establish a modern customs program at the heart of CBSA’s mandate. The plan for fiscal year 2019 to 2020 highlights our context, vision, priorities, resources and implementation strategy for this year of transition.

Implementation of our new functional management model, launched on April 1, 2019, includes a business line approach to better serve the Agency’s program and mandate across three functional areas: Commercial and Trade; Travellers; and Intelligence and Enforcement. The Agency Operations Committee is an important new addition to the CBSA’s established Executive Committee governance framework. These strategic steps towards Agency modernization and sustainability are examples of key outcomes from an extraordinarily productive period during the past two years at CBSA.

The Agency is taking a strategic approach to improve its enforcement, facilitation and duties and taxes collection performance and outcomes.. To achieve these overarching goals, we designed our approach to achieve specific objectives, for example:

- Enhance our workplace, work life, teamwork and support for each other

- Generate new synergies across all branches and regions

- Strengthen collaboration with external partners and stakeholders including government, industry and academia

- Reinforce risk-based compliance and the strategic management and execution of our business operations

- Realign accountability, expertise and capacity for project management in accordance with leading industry standards to enable continuous improvement

- Improve our use of data, information, intelligence, technology, infrastructure and operational assets

Creation of our Branch at headquarters was made possible by bringing together the many talented professionals across a diverse range of disciplines who were working on customs, commercial and trade matters in the Information, Science and Technology; Operations; and Programs branches. Our collective success depends on our working together to support modernization.

In addition, I am very privileged to continue my role as CBSA Champion of Indigenous Peoples. Together with the Circle, the Secretariat, Agency and government colleagues and Indigenous communities across Canada, we will implement the CBSA Indigenous Framework and Strategy to address long-standing issues.

In closing, I am eager to further engage in dialogue with colleagues and to find new ways to work together to bring CBSA renewal to life. Let’s make this year the most meaningful and rewarding ever!

Peter Hill

Vice President, Commercial and Trade Branch

Operating environment

Looking forward, Canada’s international trade environment will continue to be influenced by domestic, North, South, Latin American and global political, economic, social, technological, legal and environmental trends and events. Rare or unprecedented high-impact events affecting Canada’s Trade have been occurring more frequently of late, for example:

- Imposition of United States tariffs on steel and aluminium as a result of alleged national security concerns

- Risk that African Swine Fever, currently an epidemic in China that is spreading across Asia and into Europe, may enter Canada and devastate our $24B industry that is anchored by 70% exports

- Shift from traditional retail to direct-to-consumer on-line purchasing and rapid growth of E-Commerce

- Negotiation of the Canada United States Mexico Agreement (CUSMA) replacing the longstanding North American Free Trade Agreement

- Ongoing Brexit negotiations and consequential uncertainty about Canada-United Kingdom trade relations

- Increasing expectations from an expanding range of stakeholders for enhanced border management enforcement, facilitation, collection of duties and taxes and export controls

- Devastating impacts of fentanyl/opioids on communities, families, health care and emergency first responders

- Legalization of cannabis in Canada

- Continuous significant increases in the volume of people and goods crossing into Canada in virtually every mode

- Imminent implementation, following years of collaboration, of game-changing advances for Canada-United States joint border management through Entry/Exit and Preclearance initiatives

- Ever-present and increasingly sophisticated measures used by criminals, organized crime and terrorist groups to evade border controls associated with over 90 pieces of legislation administered by CBSA

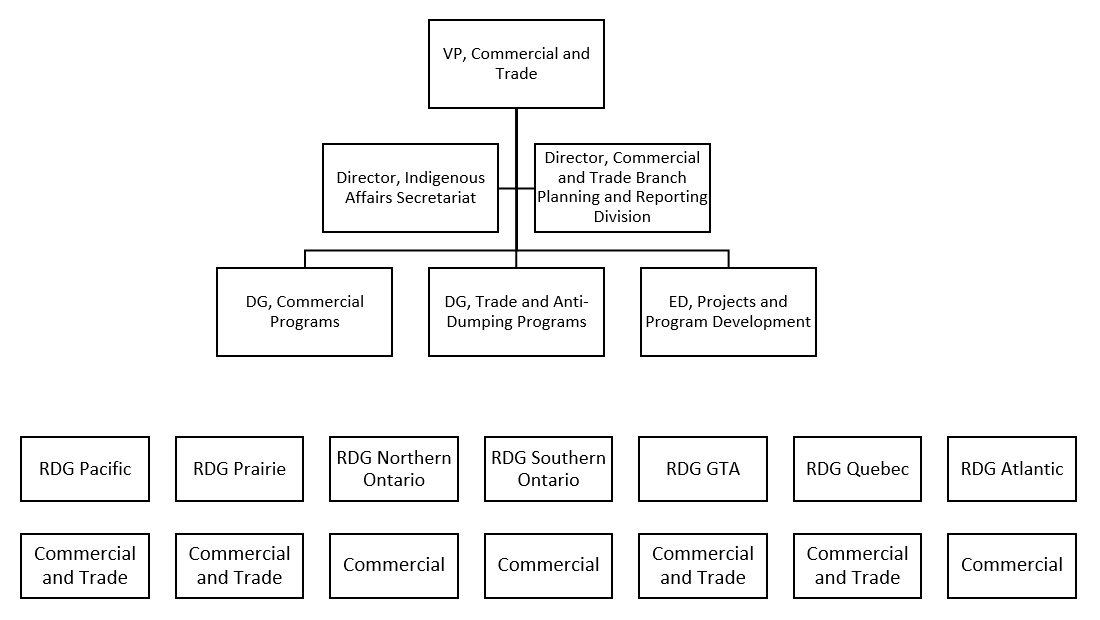

Organization and functional management structure

The diagram below indicates regions where there are currently regional directors for commercial and trade. It provides an overview of the branch and the business line on April 1, 2019. Work is ongoing to further refine and improve the headquarters branch organization structure with the goal of implementation before the end of fiscal year 2019 to 2020.

Image description

-

Vice-President

Commercial and Trade -

Directors

- Indigenous Affairs Secretariat

- Planning and Reporting

-

Directors General

- Commercial Programs

- Trade and Anti-Dumping Programs

- Projects and Program Development

-

Regional Directors General

- Pacific (Commercial and Trade)

- Prairie (Commercial and Trade)

- Northern Ontario (Commercial)

- Southern Ontario (Commercial)

- Grand Toronto Area (Commercial and Trade)

- Quebec (Commercial and Trade)

- Atlantic (Commercial)

Key responsibilities

The Commercial and Trade business line is responsible for delivering in accordance with the Departmental Results Framework as listed below. This is done through strategies for service delivery, integrating risk-based compliance, championing transformative initiatives included in the Border of the Future and Sustainability and Modernization Agenda, as well as implementing the Functional Management Model for the branch that integrates headquarters and regions under a unified Agency governance model.

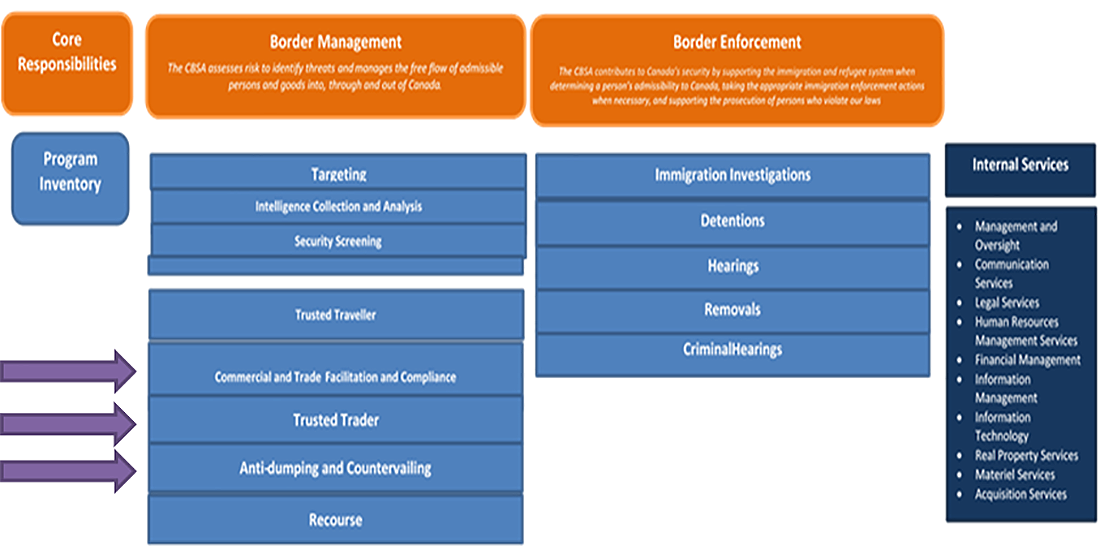

Departmental Results Framework (DRF)

The CBSA provides integrated border services that support national security and public safety priorities and facilitate the free flow of admissible people and goods.

Image description

Core responsibilities

Border management

The CBSA assesses risk to identify threats and manages the free flow of admissible persons and goods into, through and out of Canada.

Program inventory

- Targeting

- Intelligence Collection and Analysis

- Security Screening

- Trusted Traveller

-

Commercial and Trade Facilitation and Compliance (links to business line)

Admissible commercial goods and conveyances are processed (including the collection of revenues) in an efficient manner

- Percentage of time the CBSA met the commercial Highway Border Wait Times (BWT) Service Standard

- Percentage of eligible release decisions provided within established timeframes

- Percentage of high risk commercial goods targeted by the National Targeting Center (NTC) are examined at the border

-

Trusted Trader (links to business line)

Trade partners are compliant with applicable legislation, requirements and measures

- Percentage of commercial examinations that produced a result against a trade partner

- Percentage of penalties applied against trade partners representing continued non-compliance

- Return on investment (ROI) of targeted verifications

- Percentage of targeted trade compliance verifications that produced a result

- Percentages of imports potentially subject to anti-dumping or countervailing duties verified to ensure compliance

-

Anti-Dumping and Countervailing (links to business line)

Trusted Traveller and Trader programs increase processing efficiency of low-risk, pre-approved travellers and trade partners

- Ratio of conventional traders and their goods that are examined at the border compared to Trusted Traders and their goods

- Percentage of trade by value of goods imported into Canada by participants in CBSA’s Trusted Trader programs

- Recourse

Border enforcement

The CBSA contributes to Canada’s security by supporting the immigration and refugee system when determining a person’s admissibility to Canada, taking the appropriate immigration enforcement actions when necessary, and supporting the prosecution of persons who violate our laws.

Program inventory

- Immigration Investigations

- Detentions

- Hearings

- Removals

- Criminal Hearings

Internal services

- Management and Oversight

- Communication Services

- Legal Services

- Human Resources Management Services

- Financial Management

- Information Management

- Information Technology

- Real Property Services

- Material Services

- Acquisition Services

Commercial and Trade Branch

Commercial

- Commercial facilitation activities foster the free flow of legitimate goods into, through and out of Canada.

- Commercial compliance activities mitigate border-related risks from inadmissible goods and ensure compliance with acts and regulations administered by the CBSA.

- Trusted trader activities provide benefits such as time and financial savings for both program members and governments, and allow the CBSA to focus its resources on higher-risk commercial shipments.

Trade and Anti-dumping

- Facilitate trade compliance by providing importers with trade-related support through tariff classification, origin, and valuation activities, assisting importers and exporters to understand Canadian trade laws and international agreements on the movement of goods into Canada, as well as accurately account for goods they import into Canada and assess all duties and taxes owing.

- Conduct investigations to determine whether certain imports are being dumped and/or subsidized to ensure a level playing field for Canadian industry.

Key Performance Indicators

The following table presents an overview of the current key performance indicators used by the Commercial and Trade Branch to measure results against activities in the Departmental Results Framework. These indicators and targets have been developed to reflect regional input and were included in the most recent CBSA Departmental Report.

Commercial and Trade Branch/Business Line performance indicators will be reviewed this fiscal year and renewed in 2020-21 and 2021-22 in a two-step process in alignment with all CBSA business lines to ensure relevance to Canadians and to ensure alignment to the Functional Management Model.

Commercial and Trade Branch priorities for 2019-20 are included in the Improvement activities section.

Performance measures and milestones

| Indicator | Target |

|---|---|

| Percentage of time the CBSA met the commercial Highway border Wait Time Service Standard | Service Standard: 45 minutes (90% of the time, on average) |

| Actual availability of Single Window as a percentage of planned availability | 99% |

| Indicator | Target |

|---|---|

| Percentage of commercial examinations that produced a result against a trader | At most 1.5% |

| Return on investment (ROI) for targeted verifications | At least 8:1 |

| Percentage of revenue-based targeted trade compliance verifications that yielded a result | At least 60% |

| Percentage of imports potentially subject to anti-dumping or countervailing duties verified to ensure compliance | At least 80% of value for duty |

| Indicator | Target |

|---|---|

| Ratio of conventional traders and their goods that are examined at the border compared to Trusted Traders and their goods | At least 2.5 to 1 |

Financial information

The Commercial and Trade Branch’s financial information is presented below. This information will be revised and updated through the end of Q1 to reflect forecasting and FIMC decisions. Additional resources from the Information, Science and Technology Branch will be coming to the new Commercial and Trade Branch, but as discussions remain ongoing, this is not yet fully reflected.

| Resource | Salary | O&M | Sub-Total |

|---|---|---|---|

| Initial allocation | 33,259,340 | 3,954,417 | 37,000,252 |

| Permanent transfer | 288,348 | 0 | 288,348 |

| Collective agreements (reduction of 2017-2018 actuals) | −1,055,287 | 0 | −1,055,287 |

| Collective agreements (ongoing funding) | 4,436,704 | 0 | 4,436,704 |

| Projects now A-Base | 92,196 | 0 | 92,196 |

| FIMC November 26th adjustment | −2,571,973 | −407,197 | −2,979,169 |

| Prioritization | 1,300,000 | 0 | 1,300,000 |

| Policy Funding | 3,548,411 | 620,702 | 4,169,113 |

| Total (HQ) | 39,297,739 | 3,954,417 | 43,252,156 |

Risks

Emerging issues and mitigation strategies

| Issue | Mitigation |

|---|---|

|

Detection technology investments

|

|

|

|

|

The risks and mitigation activities included below were last refreshed for the 2018-2019 fiscal year. These will be reviewed in Q1 of 2019-2020 to inform business planning for the 2020-2021 fiscal year set to begin by Q3.

Business risks

Revenue assessment High

Description: The Agency may not accurately assess customs duties and taxes owed to the Crown.

Mitigation:

- Culpability framework – develop/implement to incentivize voluntary compliance

- CARM - collaborate in design/implementation planning (ARL shift fiscal year 2020 to 2021 and completion 2021 to 2022)

Deterring non-compliance High

Description: The Agency may be unable to deter wilful non-compliance with Canada’s trade requirements.

Mitigation: Progressive architecture – develop framework for risk-based compliance for business line, including trade culpability framework

Importer support Medium

Description: The Agency may not adequately enable importers to accurately voluntarily self-assess commercial importations and comply with Canada’s trade requirements.

Mitigation: CARM - collaborate in design/implementation planning (ARL shift fiscal year 2020 to 2021 and completion 2021 to 2022)

External communications Medium to low

Description: The Agency may not adequately inform trade chain partners about Canada’s commercial and trade requirements.

Mitigation:

- Single Window Initiative - Strong relationship with trade chain through electronic messaging, working groups, email, GcCollab and sustain HQ support to regions for new system implementation

- D17-1-4 Release of Commercial Goods publish update in Q4 2019-20

- D-memos - regularly scheduled updates

- Border Commercial Consultative Committees (BCCC) Export Working Group

- Trade chain partners - consult on new and/or changing requirements through established / ad hoc consultative fora

- Communication plans - policy / program changes

Program promotion Medium to low

Description: The Agency may not adequately market and promote its Trusted Trader Programs to attract new members.

Mitigation: Content review and communication plan - update through various channels, greater use of social media, videos.

Enabling risks

Organizational sustainability High

Description: The Commercial, Trade and Anti-dumping, and Trusted Trader Programs may not have sufficient capacity to meet current and future core service delivery obligations.

Mitigation:

- TTP staffing actions based on Treasury Board approval in June 2018 for Partners in Protection (PIP)/Customs-Trade Partnership Against Terrorism (CTPAT) Harmonization

- Functional guidance - regions to maximize efficiencies/meet program deliverables

- Trusted Trader Renewal - streamline processes via merger of PIP and Customs Self Assessment (CSA) for fiscal year 2019 to 2020

- SIMA – staffing actions based on Treasury Board-approval (2019-20 milestone: 37 new officers since 2018-19)

- Duty Relief Program (DRP) / Duty Deferral Program (DDP) – staffing actions based on Treasury Board approval (2019-20 milestone: 9 new officers by end of 2019-20)

IT systems High to medium

Description: Challenges related to IT infrastructure, applications and support may prevent efficient program delivery.

Mitigation:

- Single Window Initiative / Integrated Import Declaration – implement and decommission legacy OGD release service options

- Canadian Export Reporting System (CERS) – replace Canadian Automated Export Declaration in Q4 2019-20

- Trusted Trade Reporting Portal (TTP) - identify trends/monitor program performance; establish maintenance releases; integrate CARM Portal to evolving commercial program/trusted trader

- Stakeholder engagement - open communication channels minimize risk, technical challenges, complexities

- Secure Corridor Concept (SCC) Phase 2 – advance pilot technology to meet evolving business needs of Trusted Traders

Organizational agility Medium

Description: The Agency may be unable to adapt its commercial policies to keep pace with the evolving needs of the trade community.

Mitigation:

- External stakeholders – consult/engage on how to address changing trade community landscape

- Industry fora – provide leadership/participate at conferences / meetings, be informed of upcoming trends/industry changes

- Secure Corridor Pilot – evolve/adapt/expand implementation to meet needs of Trusted Traders through agile methodology

Improvement activities

The Commercial and Trade Branch has identified the following branch- and directorate-led improvement activities beginning in fiscal year 2019 to 2020.

Priorities

21st Century Customs Framework for the CBSA

-

Modernized Customs Act and Regulations

Scope: Branch and business line -

Strengthened risk based compliance

Scope: Branch and business line -

Renewed key performance indicators

Scope: Branch and business line -

Business expertise strategy

Scope: Branch and business line -

Thinking and working together better

Scope: Branch and business line -

Functional management

Scope: Branch and business line -

Develop an e-commerce strategy

Scope: Commercial lead -

Renew Trusted Trader Program

Scope: Commercial lead -

Readiness for trade enforcement at the border

Scope: Trade lead -

Support CARM design and implementation

Scope: Trade lead -

Strengthen stakeholder engagement

Scope: Branch and business line

These priorities translate into the following improvement activities and milestones for the Commercial and Trade Branch.

Branch

Customs Act Renewal

Review and modernize the Customs Act and regulations to ensure the CBSA has the necessary authorities to carry out its mandate (milestone: proposal by 2019-20).

Risk-Based Compliance Framework

Establish a progressive architecture for strengthened risk-based compliance (i.e. nudge to criminal investigation) to cover the commercial-trade continuum by building on the trade culpability framework (milestone: complete in 2019-20).

Renew key performance indicators

Renew key performance indicators and strengthen quantitative analysis to align with Departmental Results Framework and drive better results. This includes both high-level results and KPIs aligned to the Departmental Results Framework and reported through the Departmental Results Report, as well as program level KPIs used in functional management and reported through an integrated business line report (i.e. Agency Performance Summary) (milestone: complete review in 2019-20 to partially renew 2020-21 and complete in 2021-22).

Business expertise

Develop and implement a strategy to enhance professional expertise of commercial/trade/customs officers and support recruitment, training, career paths and retention to deliver the Agency’s mandate. This includes identifying and addressing gaps in knowledge and skills at headquarters, such as policy development and project management. For the regions this means ensuring commercial and trade capacity is maintained and enhanced, fully leveraging existing training products and identifying gaps, in support of program integrity and effective commercial examinations and trade verifications (milestone: complete strategies 2019-20).

Thinking and working together

Implement measures building on existing synergies between the components forming the new branch to develop a workplace culture that values knowledge and employee contributions, making Commercial and Trade a top performing organization that values and supports its people. This will include actions to address issues highlighted by the Public Service Employee Survey and concerns raised by branch employees (milestone: implement priority initiatives by 2019-20).

Implement functional management in the new branch

Implement functional management model through enhanced integrated business planning, governance, HQ-Regional collaboration and end-state design of HQ-Regional structures (milestone: complete in 2019-20).

Strengthen Stakeholder Engagement

Develop a stakeholder engagement strategy, a renewed stakeholder list for the Commercial and Trade business line, a renewed list of stakeholders will allow for better focused interaction with industry players on key strategic issues (milestone: complete in 2019-20).

Commercial

Develop an e-commerce strategy

The rise in E-Commerce represents a fundamental shift to direct- to-consumer importation; dramatically increasing volumes of small parcel and low-value packages in the postal and express streams. These transactions have increased in complexity and lack quality electronic advance data (EAD) needed to perform risk and revenue assessment. Out-dated business processes, growing volumes, lack of quality advance information, and a lack of system capability and automation contribute to revenue loss, an increase in processing times, and system outages.

The E-Commerce strategy is based on the fundamental principle of leveraging advance information, analytics and automation. To address the challenges E-Commerce presents, the Agency will initially focus on two proofs of concept; an Advance Mail Data Pilot to prove the business value of advance and augmented data sets to enable better risk management and clearing of mail pre-arrival, and an Express Pilot to establish a system for managing transactional data for express shipments.

In 2019-2020, the CBSA will work closely with key partners and stakeholders to:

- Produce a predictive model for mail using supplementary data sets

- [redacted]

- Experiment with cloud computing to manage transactional data for express shipments

- Develop requirements for a system capable of managing transactional data for express shipments

Advance cargo pre-clearance

The Agency will continue to build the foundation for preclearance operations enabled by the coming into force of the 2016 Preclearance Act and ratification of the Agreement on Land, Rail, Marine and Air Transport Preclearance. This will allow the CBSA to conduct customs operations in the US.

For 2019-20, the Agency will focus on the following:

- Identify a funding source in order to unlock the policy authority to commence cargo preclearance proofs of concept in the US

- Create approved investment proposal for cargo pre-clearance proofs of concept (Courier and multi-modal)

- Complete an outcomes document for the Bi-National Rail Cargo Pre-Screening Pilot, with a focus on results and lessons learned, which will be analysed and used to inform future proofs of concept

- Work with Agency subject matter experts to develop a staffing model which includes a staffing and cargo training plan

- Further refine site selection criteria matrix for cargo preclearance locations

- Develop bi-national concept of operations with US CBP and industry stakeholders

Renew Trusted Trader program

The Trusted Trader program has been in place through the Partners in Protection (PIP) and Customs Self-Assessment (CSA) programs for the past two decades. With CBSA Renewal and CARM changing how the Agency manages revenue streams, it is an opportune time to rethink the approach to Trusted Trader programs. The objective of program renewal is to have a modernized program with a single enrolment process integrated in CARM with renewed benefits for a more efficient and valuable partnership for the CBSA and stakeholders. The approach includes the merger of CSA and PIP into one program; changes to current regulations; the renewal of program benefits; and an update of the program’s requirements and delivery model to adapt to new threats and address integrity gaps. Security within the supply chain will become the focus of the Trusted Trader program to ensure the CBSA can support a secure, transparent and predictable trading environment; and in a wider context, help enhance Canada’s economic prosperity.

Single Window Initiative

The SWI is a CBSA-led Government of Canada priority initiative to provide a single point of entry for the electronic declaration of import information by integrating ten Participating Government Department and Agencies’ (PGAs) requirements for 38 programs into a single import transaction. The SWI removes the need to submit a paper form at the border in most scenarios, resulting in a more streamlined and efficient process for both industry and the Agency. Onboarding activities have been completed with well over 95% of stakeholders capable of transmitting, the focus now is on maximizing utilization in order to decommission legacy channels. In 2019-20 the Agency will employ a phased-decommissioning approach including finalizing systems changes to fully allow the use of SWI for all participating programs, conducting stakeholder engagement, and providing sustained support to the regions for new system implementation.

Operational initiatives

The new Branch inherits activities from Border Operations to assess regional needs for BSO recruits and the allocation of new recruits as they complete training in Rigaud. This program continues to undergo significant change in conjunction with the recommendations from the recent Officer Induction Model (OIM) evaluation. The Branch will provide business oversight to the development of the Port of Entry Management System, the maintenance and support of the Shift Planning application and steer initiatives on Border Wait Times, Official Languages and officer mobility.

Tools for front-line operations

To address the needs of front-line operations and ensure tools are in place to support enforcement at the border, the Branch will develop a risk-based allocation process to deliver detection tools to front-line commercial operations. This will make examinations more efficient and lead to improved results. Equipment options include pallet Large-Scale Imaging, fixed or gantry Large-Scale Imaging, and handheld imaging technology.

Trade

Advance the trade vision

The CBSA seeks to improve voluntary trade compliance. In 2019-20, the focus will be to make progress on policy elements of the supporting trade strategy, deter non-compliance, and enable improved trade risking and analytics. Initiatives include:

- Developing the culpability framework to the sub-program level

Milestone: develop culpability framework to sub-program level by March 2020 - Increasing trade administrative and monetary penalties (AMPs) to further incent voluntary compliance

Milestone: completed April 1, 2019 - Identifying detailed trade program requirements for CARM to ensuring risking and analytics capabilities for the Agency to deter non-compliance

Milestone: meet CARM detailed design requirements

Prepare for trade enforcement at border

Plan and implement three pilot projects involving ICECAP officers, BSOs and the National Targeting Centre to test proof of concept for compliance intervention techniques at border.

Milestone: complete pilots by June 2019

CBSA Assessment and Revenue Management (CARM) System

Fulfill branch role as business sponsor in support of the automation and transformation of business processes.

Milestone: enter implementation stage

Strengthen trade compliance

- Ramp up to meet stakeholder expectations for trade remedy protections using Treasury Board-approved funding for the hiring of SIMA officers.

Milestone: reach 37 total new officers hired since 2018-19 - Strengthen service performance and compliance assurance for DRP and DDP using Treasury Board approved funding

Milestone: reach 9 total new officers by the end of 2019-20 - In anticipation of CARM, explore the potential for data analytics to be applied in identifying potential non-compliance

Milestone: identification of targets for trade compliance actions informed by data analytics in 2019-20 for specific compliance initiatives/pilots - Address criticisms from the Auditor General’s report on customs duties, including:

- AMPs – alignment with commercial AMPs levels

- Period allowed for making corrections to import declarations – Conclude review of the merits, risks and limitations of reducing the 4-year period to make adjustments to import declarations

Projects

As part of an important change introduced under the Functional Management Model, the Commercial and Trade Branch has assumed the lead role in the management of projects. Whereas the branch had previously served as “business owner” for a host of projects, under the new model accountability for project management (e.g. project scope, schedule and budget) now resides within the branch. To address this significant shift in responsibility, the branch will develop a plan to build the resource base and skillsets required to deliver high quality project management services. In 2019/20 the branch will put in place a professional services contract to acquire the skills required to establish a Project Management Office. Further, staffing actions will commence and extend for the following two years to attract and retain staff to fill the various roles.

The key projects led by the Commercial and Trade Branch include the following.

Marine container examination facility

To ensure that trade partners are compliant with applicable legislation, requirements and measures, the Agency will continue to improve its commercial examination process. This will include the opening and operation of two new Marine Container Examination Facilities in Vancouver. The construction of the Tsawwassen Marine Container Examination Facility (MCEF) in Roberts Bank, British Columbia in the winter of 2019. Planning for the second facility at Burrard Inlet will utilize lessons learned from the operationalization of the TCEF. We will also continue to increase its examination capacity by developing and deploying new detection tools and procedures within its facilities, including the deployment of a fixed Large Scale Imaging (LSI) device at the MCEF in Roberts Bank by the end of 2019–20.

Postal modernization

Building upon the experience gained from implementation in Vancouver, the Agency will pursue its Postal Modernization Initiative with the Montreal and Toronto mail facilities, by leveraging pre-arrival decisions on quality advanced electronic data. It will also implement an automated tax and duty rating system (the Customs Declaration System) and implement a risk assessment system, the Postal Operations Support Tool (POST).

Expansion of free and secure trade lanes

As part of the Trusted Trader Program Enhancement, Free and Secure Trade (FAST) lane access will be extended to members of Partners in Protection at key Ports of Entry, with a target completion date of March 2020.

Secure corridor concept

Building upon the expedited processing that members of the CBSA’s Trusted Trader Program currently enjoy, the Agency will continue its Secure Corridor Concept – Trusted Trader Pilot (SCC – TTP) and evaluate the feasibility of using a combination of technologies, which are new to the commercial stream, in order to expedite the passage for low risk, eligible commercial shipments and streamline commercial Primary Inspection Line (PIL) processing. Phase 2 of this project, which is set to take place during 2019-20, will see expanded carrier participation and enterprise investments, with a project completion target of 2022.

Port of Entry Management System (POEMS)

Since the inception of the POEMS, POEMS has continued to be focal point for allowing the ports of entry a more streamlined automated method for allocating daily task assignments despite its laborious systems lags. Major land and air border crossings heavily rely on POEMS to automate the daily task assignments and feed the schedules to a large screen kiosk for officers to know which tasks they are to perform throughout the day. The CBSA is modernizing the existing POEMS application in order to maximize system performance and allow for CBSA’s front line to focus on reducing time and vulnerabilities in overseeing daily task assignments. Development is currently underway and is scheduled to be complete in December 2019.

Canadian Automated Export Declaration (CAED) System (replacement)

Currently, the CAED system, owned and operated by Statistics Canada (SC), is the main information system enabling CBSA to perform its export duties and meet its mandate. However, SC is slated to decommission CAED by June 30, 2020, providing the CBSA with an opportunity to invest in the export program, and develop a modern export reporting system that meets its needs. The project will allow the CBSA to maintain the acquisition of export data when the CAED system is decommissioned and will maintain business continuity for the CBSA and its exporting clients. In addition, the solution does not rely on legacy technology that will need to be replaced, and will be scalable so that it can meet the future needs of the Agency’s export program.

eManifest stabilization

The purpose of the eManifest project is to modernize and enhance commercial processes and screening of Canada-bound goods by improving CBSA’s ability to detect shipments that pose a high or unknown risk prior to their arrival, while facilitating the movement of low-risk shipments across the border. The eManifest project has been closed. Outstanding deliverables include the implementation of systems functionality to support electronic house bills. The first of two systems releases was implemented in October 2018. The second release is expected to be implemented in spring 2020. Deliverables that were taken out of the eManifest scope will be evaluated and, if deemed necessary, will be addressed through individual change requests.

Procurement planning and non-salary (O&M)

Procurement plans are in development and will be confirmed through the Q1 forecasting period and pending confirmation of funding for policy initiatives and sustainability and modernization activities through FIMC.

A significant portion of the highest cost procurement relates to meeting key commitments under new initiatives such as Guns and Gangs (G&G), Opioids as well as E-Commerce. The Commercial and Trade Branch is also committed to improving data analytics and its key performance indicators in support of better decision-making. Procurement of SPSS modeller licences relates to and supports these commitments.

Additional procurement amounts relate to the Detector Dog Program (accommodations and equipment which also links to opioids and G&G) and Canadian Automated Export Declaration (CAED) maintenance and system replacement, as well as Other Government Department (OGD) and postal program forms and related supplies in support of operations. Significant non-salary O&M has been allocated for the Data Vendor contract that provides regions with contract resources to undertake data keying activities to support commercial operations. Further, additional O&M is required to support maintenance of POEMS and Shift Planning applications for regional operations. Otherwise, the branch’s planned procurement and non-salary spending is in line with that of previous years (e.g. employee travel, contracts, etc.).

Human resources

Current resources

The Commercial and Trade Branch head count, current as of April 2019, is as follows:

- VPO: 5

- IAS: 8

- BPR: 8

- Commercial: 167

- Commercial Trade Projects and Program Development: 77

- Trade: 168

- Branch Total: 433

Planned staffing

Planned staffing for 2019-20 is under review and will be confirmed through the Q1 forecasting period and pending confirmation of funding for policy initiatives and sustainability and modernization activities through FIMC.

Resource profile

| Directorate | Salary (vote 1) | Salary (vote [redacted]) | O&M (vote 1) | O&M (vote [redacted]) | TotalFootnote 1 |

|---|---|---|---|---|---|

| VPO | 994,279 | [redacted] | 115,135 | [redacted] | 1,109,414 |

| IAS | 975,000 | [redacted] | 185,000 | [redacted] | 1,160,000 |

| CTB PRD | 1,361,606 | [redacted] | 39,320 | [redacted] | 1,400,926 |

| TADP Directorate | 15,983,281 | [redacted] | 1,408,263 | [redacted] | 17,743,928 |

| CARM | - | [redacted] | - | [redacted] | - |

| CP Directorate | 12,353,060 | [redacted] | 2,132,795 | [redacted] | 18,727,080 |

| CARM | 323,578 | [redacted] | - | [redacted] | - |

| eManifest | 2,435,720 | [redacted] | 483,511 | [redacted] | - |

| MCEF | - | [redacted] | 20,000 | [redacted] | - |

| GHIB | 27,714 | [redacted] | - | [redacted] | - |

| CAED | 202,470 | [redacted] | - | [redacted] | - |

| Opioids | - | [redacted] | - | [redacted] | - |

| TTCC/SCC | - | [redacted] | - | [redacted] | - |

| Guns and gangs | 263,742 | [redacted] | 65,028 | [redacted] | - |

| CTPPD Directorate | 2,993,006 | [redacted] | 453,406 | [redacted] | 7,735,800 |

| CARM | - | [redacted] | - | [redacted] | - |

| eManifest | 2,649,770 | [redacted] | 508,690 | [redacted] | - |

| CAED | 651,724 | [redacted] | 135,776 | [redacted] | - |

| Total | 41,214,950 | [redacted] | 5,546,924 | [redacted] | 47,877,148 |

|

Notes:

|

|||||

Training plan for fiscal year 2019 to 2020

Training initiatives for the Commercial and Trade Branch will be developed and elaborated throughout Q1 and Q2.

Initial activities identified for this year include:

- delivery of a 3-day training course on tariff classification for specified employees in several locations across the four trade regions

- review and update training related to the Special Import Measures Act (SIMA) anti-dumping and countervailing program

- delivery of training to meet linguistic and other mandatory requirements for headquarters employees

African swine fever

Question period note: April 9, 2019

Issue

Pork industry stakeholders have raised concerns about an outbreak of African swine fever (ASF) that is spreading across Eastern Europe and Central Asia, including into China. ASF is a highly contagious disease that is fatal to pigs for which there is no treatment or cure. If introduced to Canada, the disease would have severe consequences on Canada’s $20-30 billion pork industry.

Proposed response

- The Government of Canada is taking the threat to the Canadian pork industry posed by the outbreak of African swine fever in Eastern Europe and Central Asia very seriously.

- The CBSA is working closely with the Canadian Food Inspection Agency (CFIA) to ensure goods that pose a threat of spreading African swine fever (ASF) to Canada are interdicted at the border.

- The CBSA has taken steps to ensure all border services officers have been made aware of the impact of the ASF.

- CBSA’s border services officers have been provided with guidance on the application of monetary penalties, up to $1,300, to travellers who fail to declare pork, pork products, or any other meat.

- The CBSA has strategically deployed its resources to focus on flights arriving from ASF-affected countries.

- The CBSA uses a risk management approach to determine if an examination is required. CBSA officers look for indicators of non-compliance and focus their efforts on higher and/or unknown risks. Border services officers also use a variety of detection tools to locate regulated or prohibited goods, such as imaging devices, detector dogs, and many others.

- Budget 2019 announced funding, of up to $31M, which will be distributed over the next five years in accordance with operational plans and resource requirements. The CBSA currently has 64 detector dog teams, working at strategic locations across the country. Of these, 15 teams are dedicated to the detection of prohibited food, plant and animal (FPA) products. Training is underway to add an additional 24 FPA teams (handler and dog) over the next two years to increase the Agency’s current capacity.

- The CBSA will train more food, plant and animal detector dogs, which are the agency’s best tool for detecting undeclared food, plant and animal products.

- The CBSA has conducted outreach to airport authorities and has placed posters at ports of entry to raise public awareness of the ASF threat and the importance of declaring food, plant and animal products.

Background

African Swine Fever (ASF) is a highly contagious viral disease affecting pigs that is spreading rapidly in Asia and Europe. ASF is routinely found in parts of Africa and, since 2007, has spread across Eastern Europe and Central Asia, including into China for the first time in 2018. If introduced to Canada, the disease would have severe consequences on Canada’s $20-30 billion pork industry.

Severe strains of ASF kill almost 100 percent of infected pigs, and there are no known preventative treatments or cures for the disease. There is no evidence that the ASF virus can infect humans, and it is not considered a food safety risk. The disease is unlikely to be eradicated or contained in Asia in the foreseeable future and the threat is likely to be ongoing.

Pork industry stakeholders have raised concerns with the Government about the devastating socio-economic impacts that this disease would have on our pork industry. It requests that the Government of Canada take various steps to prevent ASF from entering the country, including the implementation of stricter border controls on any products from ASF-affected countries. Stakeholders have raised a specific concern about a food, plant and animal (FPA) detector dog shortage, which has been publicized in the media.

The Canadian Food Inspection Agency (CFIA) is the Government of Canada’s lead in responding to ASF. CFIA has implemented strict regulatory import controls to prevent the entry of animals and their products and by-products into Canada from countries where the disease is known to occur. The Canada Border Services Agency (CBSA) is responsible for administering and enforcing CFIA regulations, as they apply at the border and include screening travellers for inadmissible FPA products, and ensuring commercial shipments are released, refused, or referred for CFIA inspection in accordance with CFIA release recommendations.

CBSA border services officers can issue monetary penalties ranging from $800 - $1300 to travellers who fail to declare or illegally import FPA and related products into Canada. Given the very serious violation with respect to the smuggling of pork, a penalty of $1300 under subsection 16(1) of the Health of Animals Act has been deemed as most appropriate. The penalty is reduced by 50% if the traveller pays the penalty within 15 days.

All people, goods and conveyances entering Canada must report to the CBSA and may be subject to an examination. CBSA officers are trained in examination, investigative and questioning techniques. They use a risk management approach to determine if an examination is required. They look for indicators of non-compliance and focus their efforts on higher and/or unknown risks. The CBSA uses a variety of detection tools to locate regulated or prohibited goods, such as imaging devices, detector dogs, and many others. Border services officers may use a multiplicity of techniques, methods and detection tools at their disposal.

CBSA works closely with domestic and international partners in a joint effort to keep respective borders safe and secure. The Agency shares key intelligence, with partners while respecting the strict Canadian legal parameters.

Media Lines

- The CBSA enforces over 90 Acts of Parliament and takes this responsibility seriously.

- CBSA officers thoroughly screen all travellers and goods coming into Canada and examine more closely those that may pose a threat to the safety of Canadians.

- The CBSA works closely with a number of other government departments (OGDs) and agencies, including the Canadian Food Inspection Agency (CFIA), to ensure the health, safety and security of Canadians.

- The CFIA is responsible for establishing the policies that govern the importation of food, plants, animals and related products to Canada. The CBSA is responsible for administering and enforcing these policies to the extent that they apply at Canadian border points of entry.

- Food, plants and animals and related products from other countries can introduce harmful pests, viruses and diseases into Canada. Every traveller entering Canada could impact Canadians' health and the environment with the goods they import.

Canada–United-States–Mexico Agreement (CUSMA) impact on the Canada Border Services Agency (CBSA)

Proposed response

- The CBSA has worked closely with other departments in the negotiations and preparation for the ratification of the CUSMA to ensure Canadians can reap the benefits of this new agreement

- CUSMA will simplify procedures for importers while strengthening protections for our trade community

- For the new Intellectual Property (IP) border measures, amendments to the Copyright Act and the Trademarks Act will enable the CBSA to intercept suspected IP-infringing goods transiting via Canada to other markets and to share information with the rights holders so they can seek legal redress in court

- Amendments to the Customs Act will enable the Agency to conduct verifications of duty evasion on behalf of CUSMA partners

- The Agency will administer the increase of new tiered de minimis threshold for the application of duties and taxes (C$150 for customs duties and C$40 for taxes) as well as for a low value shipment (LVS) threshold from C$2,500 to C$3,300, under which fewer customs formalities will apply

Responsive – Financial implications

- Overall, and in contrast to the North American Free Trade Agreement, the CUSMA will bring few changes for the Agency

- While the implementation of new benefits for the trade community could eventually result in additional pressures on the CBSA’s operational capacity, the Agency will be ready to support the entry into force of CUSMA based on current resources allocations

- The Agency will seek new resources in the future, if necessary

Background

With the signature of the CUSMA on November 30, 2018, the next step is for each Party to prepare for ratification. For Canada, domestic implementation of authorities is required before the Government can ratify this Agreement.

The terms of the Agreement set entry into force on the first day of the third month following the last notification of ratification between parties. As Canada and the United States have yet to ratify the Agreement (Mexico’s Senate approved the agreement on June 19), the entry-into-force date of the CUSMA has yet to be determined. At this time, it is not expected that CUSMA would come into force before the end of this year. In the meantime, all departments, including the CBSA, have been proceeding with the regulatory drafting of their respective amendments.

With respect to Canada’s domestic implementation process, Bill C-100 – An Act to implement the Agreement between Canada, the United States of America and the United Mexican States was introduced in Parliament on May 29. On June 20, the bill was referred to the Standing Committee on International Trade (CIIT). While Parliament is adjourned for the summer recess and would need to be recalled in order to continue to move the legislation forward, the CIIT could decide to continue its review of Bill C-100 over the summer recess. Global Affairs Canada continues to advance work on the implementation of the CUSMA, [redacted].

Overall, and in contrast to the North American Free Trade Agreement, the CUSMA will bring few changes for the CBSA. The CBSA has consulted with other federal departments to ensure that all legislative and regulatory requirements necessary for the CBSA to implement the CUSMA are identified and ultimately ensure that the Agency is ready for the entry into force of the Agreement. The CBSA, at this time, will not be seeking additional resources to implement and administer the CUSMA.

Impact on Trade and Commercial

The CBSA will support the implementation of CUSMA to provide following new benefits to the trade community:

- simplified procedures for importers for the administration of origin procedures and textile and apparel

- new obligation to conduct verifications of duty evasion on behalf of CUSMA partners (as the volumes are not expected to be high)

- new border measures to intercept suspected IP-infringing goods transiting via Canada to other markets and to share information with the rights holders so they can seek legal redress in court pursuant to the Copyright Act and the Trademarks Act (the CBSA will be developing policy documents to support its operations and will ensure that Canada meets these new obligations within existing resources)

- a new tiered de minimis threshold for the application of duties and taxes (C$150 for customs duties and C$40 for taxes) and increase the low value shipment (LVS) threshold from C$2,500 to C$3,300, under which fewer customs formalities will apply (consultation with stakeholders are ongoing to determine the full resource implications and system impacts)

- new provisions aimed at eliminating all forms of forced or compulsory labour, including that of child labour [redacted]

- new market access to support Indigenous trade (e.g. Indigenous handicraft goods)

The CBSA will have to update policy and standard operating procedures, as well as identify new system and operational requirements. Should the implementation of new CUSMA benefits to the trade community add pressure on CBSA operations, resources needs will be reassessed to inform future recommendations to the Minister, as appropriate.

Lastly, to implement market access changes for supply-managed goods resulting from CUSMA, the CBSA will be reaching out to stakeholders to inform them of updates to any policies affecting these sectors and will consult, where appropriate. It is expected that these changes will be closely watched by impacted domestic industries.

Main estimates 2019-2020

Special Import Measures Act (SIMA) Increase in Investigative and Compliance Activity and Improvements to the Steel Import Monitoring Program ($4.6 million)

Key messages

- The Special Import Measures Act (SIMA) is Canada’s enabling legislation for its anti-dumping and countervailing program, which protects Canadian companies from unfair trade practices.

- On April 26, 2018, the Prime Minister announced $29.1 million over five years and $6.5 million ongoing for the CBSA to hire officers and train them to be experts in SIMA.

- At the same time, to address the evolving nature of trade and ensure Canadian companies are competing on a level playing field, Canada modernized its trade remedy system with new regulations. These include scope proceedings, which provide clarity to Canadian companies seeking to understand which goods may be covered by SIMA measures in force, and anti-circumvention investigations, which enable the CBSA to close loopholes and prevent companies from evading anti-dumping and countervailing duties.

- In 2018-2019, the CBSA initiated a record number of SIMA investigations compared to previous years.

- In 2019-2020, the CBSA is receiving $4.6 million (excluding EBP, SSC and PSPC accommodation costs) to enhance its capacity to support the steel industry and for the new measures to address unfair trade practices.

Mains over mains variance (FCMB)

- 2018-2019: $0.0 million ($2.9 million of funding was approved through Supplementary Estimates A)

- 2019-2020: $4.6 million

- YOY variance: $4.6 million

Explanation of funding

In 2019-2020, the CBSA requires $4.6 million (excluding EBP, SSC and accommodation costs) for this initiative.

$4.6 million under Vote 1 – Operating Expenditures:

- $3.8 million in salary

- $0.8 million in O&M

| 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | Total | Ongoing | |

|---|---|---|---|---|---|---|---|

| Amount (in million $) | 2.9Footnote 2 | 4.6 | 5.1 | 5.0 | 5.0 | 22.6 | 5.0 |

| FTEs | 25.77 | 43.14 | 43.14 | 43.14 | 43.14 | 43.14 | 43.14 |

Breakdown of funding 2019-2020 (Commercial and Trade Branch)

Investigations activities $2.8 million

- Conduct investigations, re-investigations, and expiry reviews, including related policy support, in part due to the diversion of steel and aluminum to Canada following the imposition of U.S. tariffs

- Conduct scope proceedings, which, through binding opinions, will give certainty to Canadian industry and importers as to whether specific goods are subject to anti-dumping measures

- Conduct anti-circumvention investigations (follow-up processes to clarify the intent and scope of the original investigation’s decision), which will close loopholes that allow importers to avoid paying anti-dumping duties, such as by changing product descriptions

Compliance activities $1.1 million

Conduct verifications of imports to ensure all applicable SIMA duties are assessed and to prevent evasion, as well as to provide advice and guidance to importers, foreign exporters and customs brokers. Vigorous enforcement is essential for a SIMA finding to remain effective as desired.

Corporate costs $0.7 million

Indirect costs including internal services.

Total: $4.6 million

Initiative to take action against gun and gang violence ($12.2 million)

Key messages

The Guns and Gangs initiative is a horizontal initiative led by Public Safety, in partnership with the CBSA and the Royal Canadian Mounted (RCMP) Police designed to:

- Enhance CBSA’s capacity to stem the flow of inadmissible travellers and illegal firearms entering Canada at vulnerable points of entry

- Prevent smuggling of firearms at the highest risk modes: highway, air and postal

- Implement automated screening system for all inbound air travellers to enhance its detection of known high-risk travellers engaged in significant transnational organised crime or terrorist group activity prior to arrival in Canada

Mains over mains variance (FCMB)

- 2018-2019: $0.0 million

- 2019-2020: $12.2 million

- YOY variance: $12.2 million

[redacted]

Explanation of funding

| 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | 2023-2024 | 2024-2025 | Total | Ongoing | |

|---|---|---|---|---|---|---|---|---|---|

| Amount (in million $) | 5.7 | 12.2 | 29.5 | 10.7 | 10.5 | 9.9 | 7.5 | 86.0 | 6.6 |

[redacted]

Breakdown of funding 2019-2020 (Commercial and Trade Branch)

Illicit guns in postal facilities $0.9 million

Investment in Dual View X-ray technology and Automated Threat Detection Software/Network at all International Postal Processing Facilities to allow the Agency to process all mail in a consistent, efficient, and non-intrusive manner. This technology will be implemented in the postal centres located in areas with higher rates of gang-related homicides [redacted].

Detecting firearms – Detector dog teams $0.4 million

Continue the work being undertaken by the 5 newly trained firearms detector dog teams at select Ports of Entry and build an all-weather facility with kennel capacity to allow for year-round training.

Construction and maintenance of an all-weather facility $3.1 million

Initiate work in order to proceed with the planning and construction of the All-Weather Facility.

Transnational organized crime threat identification – [redacted] $0.3 million

Initiate a feasibility study to automate the CBSA’s [redacted] query capabilities to enhance risk assessment [redacted]. Work will begin by developing a project plan for a feasibility study in order to implement the full automation.

Advanced vehicle concealment techniques course $0.1 million

Test pilot the newly developed national training product to train in the identification and interdiction of crime guns and weapons for the CBSA/ Public Safety partners. Assessment of the current training module will be undertaken and the Agency will be establishing a pilot for the new training course in advance of full implementation.

Air cargo security $7.4 million

Expand use of hand-held and pallet sized x-ray technology and contraband tool outfitted mobile examination trucks (COMETs) into the Air mode [redacted]. Procurement of detection technology equipment will be undertaken.

Total: $12.2 million

Postal modernization initiative ($10.3 million)

Key messages

- The Postal Modernization Initiative (PMI) was undertaken to update and streamline processing of postal imports in CBSA Mail Centres in Vancouver, Toronto and Montreal

- Upgrades include both infrastructure and IT systems so that the CBSA can address operational inefficiencies and improve risk management capabilities by interdicting contraband and collecting duties and taxes in the postal mode

- By implementing the PMI in parallel to the Canada Post Corporation’s (CPC) own Postal Transformation Project, it not only allows the CBSA to resolve operational deficiencies in the short-term, but benefits the government through immediate and sustained savings

- It is important to note that the CBSA is dependent on CPC timeline approval to move forward on implementation

- The Mains over Mains net increase of $10.3 million is as a result of a reprofile request approved in 2017-2018. CBSA’s spending requirements are fully dependent on the CPC’s ability to implement PMI

Overview (Commercial and Trade Branch)

Through the Postal Program, the CBSA is obligated to screen all incoming mail. To carry out this work, the CBSA has been co-located since 1992 in Canada Post Corporation (CPC) facilities (currently Montréal, Toronto and Vancouver). Driven by the need to address outdated infrastructure and systems, the CPC initiated their $1.9 billion Postal Transformation (PT) Project in 2006 to modernize the domestic and international postal network.

Budget 2012 provided the CBSA with funding for its own PMI which had three key objectives: address identified security gaps; automate labour intensive rating activities; and fund the project through anticipated savings. At the time, the projected implementation dates for each of the CBSA Mail Centres were January 2014 (Vancouver), February 2015 (Toronto), and May 2015 (Montreal).

ince that time, the CPC has delayed implementation of all three sites. Vancouver was implemented with only a slight delay from January 2014 to May 2014 and introduced electronic data into the mail stream; two new IT systems to support automated rating (for duties and taxes); and risk assessment functions to enhance postal processing; as well as the brand new Pacific Processing Centre. The CBSA and CPC Presidents met in June 2017 and agreed on a new timeline of 2019 to initiate incremental improvements in Toronto and Montreal to enable the CBSA to capitalize upon its investments in the automated systems.

The CBSA is dependent on the CPC Postal Transformation Project for its own modernization plan for both Toronto and Montréal, CBSA activities cannot be completed independently. As such, until the CPC provides information on their ability to modernize their facilities, the Agency will not be able to complete the upgrades in Toronto and Montreal. A reprofile of remaining project funding was submitted, and subsequently approved by Department of Finance to move this funding to 2019-20 so that the funds would be available when required. The CBSA has briefed Treasury Board on the current status of the PMI and received their agreement to utilize the remaining funding for modernizing Toronto and Montreal.

Mains over mains variance (FCMB)

- 2018-2019: $0.0 million

- 2019-2020: $10.3 million

- YOY ME variance: $10.3 million

Explanation of funding

| 2012-2013 | 2013-2014 | 2014-2015 | 2015-2016 | 2016-2017 | 2017-2018 | 2018-2019 | 2019-2020 | Total | |

|---|---|---|---|---|---|---|---|---|---|

| Amount (in million $) | 1.1 | 12.6 | 5.5 | 1.6 | 0.5 | 11.5 | 0 | 10.3 | 43.1 |

| Reprofile 2017-2018 | (10.3) | 10.3 |

Breakdown of funding 2019-2020 (Commercial and Trade Branch)

Postal operations $0.7 million

Define the changes to the Postal Operation Support Tool (POST) in collaboration with ISTB and work with CPC to determine Customs Declaration System (CDS) local changes required to initiate the design phase for Toronto and Montreal mail centers.

Feasibility of new workstation solution $0.3 million

Explore feasibility of new workstation solution for all 3 mail centres, including x-ray image association (in the absence of the International Conveyor System which was shut down in July 2016).

Assessment systems (Toronto) $2.1 million

Introduction of required data modifications, and the development, testing, and deployment of risk assessment (POST) and rating systems (CDS) into Toronto.

Assessment systems (Montreal) $2.1 million

Introduction of required data modifications, and the development, testing, and deployment of risk assessment (POST) and rating systems (CDS) into Montreal.

Deployment of new workstation solution $2.0 million

Development, testing and deployment of new workstation solution, including infrastructure costs, to all 3 mail centres.

Enhanced assessment systems $3.1 million

Introduction of required data modifications, and the development, testing, and deployment of enhanced rating system to all 3 mail centres, as well as contingency and post operational costs.

Total: $10.3 million

Addressing the opioid crisis ($7.2 million)

Key messages

- The Opioids initiative is a horizontal initiative led by Health Canada, in partnership with the CBSA, the Public Health Agency of Canada, Public Safety and Statistics Canada, designed to:

- Enhance the capacity to identify and intercept illegal substances at the border by equipping border agents with additional tools at ports of entry

- Increase communications related to threat assessment information and intelligence provided to personnel and partnering agencies

- Increase ability to risk assess and identify high risk shipments

- The Mains over Mains net increase of $7.2 million is attributable to funds which were not available at the beginning of the year; funding was approved through TB vote 40 Budget Implementation.

Mains over mains variance

- 2018-2019: $0.0 million ($8.5 million of funding was approved through TB vote 40 budget implementation)

- 2019-2020: $7.2 million

- YOY variance: $7.2 million

Explanation of funding

| 2018-2019 | 2019-2020 | 2020-2021 | 2021-2022 | 2022-2023 | Total | Ongoing | |

|---|---|---|---|---|---|---|---|

| Amount (in million $) | 8.5Footnote 3 | 7.2 | 4.6 | 4.8 | 4.6 | 29.7 | 4.6 |

Breakdown of funding 2019-2020 (Commercial and Trade Branch)

Equipping safe examination areas and regional screening facilities $5.9 million

Expand safe examination capacity for goods suspected to contain highly toxic substances (HTS) by establishing Designated Safe Examination Areas (DSEA) at 25 of the highest volume and highest risk ports of entry, along with equipping a further 50 medium and small ports with fume hoods and detection technology. Procurement and deployment of detection technology and fume hoods is underway with the expectation of establishing the first 15 DSEAs in fiscal year 2018-19 and procuring for the remaining 35 of 60 locations to be established over the next 4 years.

Goods requiring laboratory analysis will be sent to the nearest available regional screening facility or the forensic laboratory. New regional screening facilities for Vancouver, Montreal and Toronto will include laboratory staff and specialized analytical technology to sample and analyse goods sent from regional DSEAs suspected to containing illegal opioids and HTS. CBSA laboratory staff are working closely with regional operations to finalize locations within existing facilities and has begun procurement of necessary technology to equip screening facilities. Additionally, the laboratory is in the process of hiring additional chemists to staff the regional screening facilities.

The combination of DSEA with regional screening facilities will allow CBSA to identify and interdict illegal opioids in a safe manner without lengthy delays, thus increasing the capacity to reduce supply to the domestic market.

Augmenting intelligence and risk assessment capacity $1.0 million

Support the confidential human sources (CHS) program and internal conspiracy teams as well as new resources to work with partners to intercept goods prior to entry. The use of CHS is generating valuable information and enforcement actions for CBSA, with particular success in the large urban centres. [redacted]

Organized crime groups (OCGs) recruit, coerce or bribe individuals employed in legitimate businesses [redacted] to facilitate the smuggling of contraband across Canada’s borders. Investment in internal conspiracy teams [redacted] will further enhance our ability to identify and disrupt illegal opioid shipments destined for Canadian markets. In 2018-19, [redacted].

Enhancement of Detector Dog Program $0.3 million

Continue the work being undertaken by the 6 newly trained detector dog teams to detect opioids at select ports of entry. Detector dogs have proven to be successful in the detection of known illegal cross-border movement of opioids such as fentanyl and analogues. The CBSA will deploy two teams [redacted], (total of six) to address the increased influx of the illegal cross-border movement of opioids at those locations. Increasing the capacity to interdict at the border will be a direct reduction of illegal cross-border movement of opioids in Canada or abroad.

Total: $7.2 million

- Date modified: