Canada Border Services Agency Quarterly Financial Report

For the quarter ended June 30, 2019

Table of contents

- 1. Introduction

- 2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

- 3. Risks and Uncertainties

- 4. Significant Changes in Relation to Operations, Personnel and Programs

- 5. Approval by Senior Officials

- 6. Table 1: Statement of Authorities (Unaudited)

- 7. Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited)

1. Introduction

This Quarterly Financial Report (QFR) has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates, Canada’s Economic Action Plan 2018 (Budget 2018) and Canada’s Economic Action Plan 2019 (Budget 2019).

Information on the reason d’être, mandate, role and core responsibilities of the Canada Border Services Agency (CBSA) can be found in Part III Departmental Plan and Part II of the Main Estimates.

The QFR has not been subjected to an external audit or review.

1.1 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities (Table 1) includes the Department's spending authorities granted by Parliament, and those used by the Department consistent with the Main Estimates (as applicable) for the 2018-19 and 2019-20 fiscal years. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

This section highlights the significant items that contributed to the net increase or decrease in resources available for the year and actual expenditures as of the quarter ended June 30, 2019.

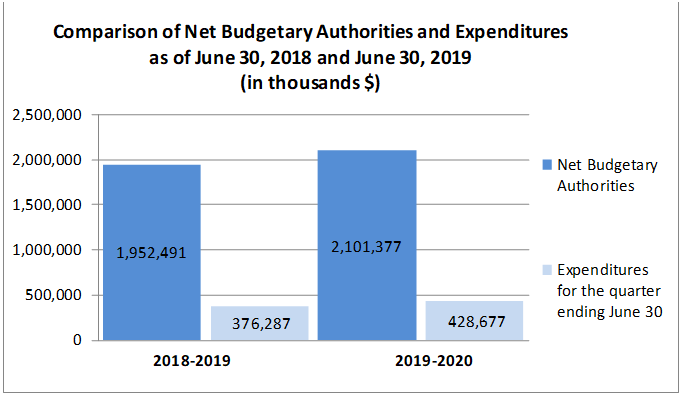

Graph 1: Comparison of Net Budgetary Authorities and Expenditures as of June 30, 2018 and June 30, 2019 (in thousands $)

2.1 Significant Changes to Authorities

For the period ending June 30, 2019, the authorities provided to the CBSA comprise of the Main Estimates and Treasury Board (TB) approved Budget 2019 measures. For the period ending June 30, 2018, the authorities provided to the CBSA comprise of the Main Estimates and Treasury Board (TB) approved Budget 2018 measures.

The Statement of Authorities (Table 1) presents a net increase of $148.9 million or 7.6% in the Agency’s total authorities of $2,101.4 million at June 30, 2019 compared to $1,952.5 million total authorities at the same quarter last year.

This net increase in the authorities available for use is the result of a increase in Vote 1 – Operating Expenditures of $186.2 million, a decrease in Vote 5 – Capital of $72.3 million and an increase in Budgetary Statutory Authorities of $35.0 million, as detailed below:

Vote 1 – Operating

The Agency’s Vote 1 Operating increase by $186.2 million or 11.9%, which is attributed to the net effect of the following significant items (excluding the statutory authorities):

Increases are mainly attributed to:

- *$81.9 million in funding for enhancing the integrity of Canada's borders and asylum system;

- $79.1 million in funding for economic increases for signed collective agreements and salary awards;

- $33.2 million in funding for sustainability and modernization of Canada's border operations;

- $12.4 million in funding for the 2018 to 2020 Immigration Levels Plan;

- $10.8 million in funding for helping travellers visit Canada;

- $4.9 million in funding to address the opioid crisis;

- $4.6 million in funding to strengthen investigative and compliance capacity under the Special Import Measures Act and to monitor imports;

- $4.0 million in funding for addressing the challenges of African swine fever;

- $3.5 million in funding to take action against gun and gang violence; and

- $10.8 million in funding for various other projects.

Decreases are mainly attributed to:

- *$26.0 million in funding for irregular migration enforcement;

- $7.8 million in funding to expand biometrics screening in Canada's immigration proceedings;

- $5.9 million in funding to enhance the Passenger Protection Program (PPP);

- $6.7 million in funding for the Budget 2018 fiscal dividend;

- $1.4 million in funding to remove the visa requirement for citizens of Mexico;

- $1.3 million in funding for the CBSA Assessment and Revenue Management project (CARM); and

- $9.9 million in funding for various other projects.

*Note: Budget 2018 provided 2 year funding for the irregular migration, which comes to an end in 2019-20. In recognition of the continuring activites, Budget 2019 further provided $81.9M in funding for enhancing the integrity of Canada's borders and asylum system.

Vote 5 - Capital

The Agency’s Vote 5 Capital decreased by $72.3 million or 36.4%, which is attributed to the net effect of the following significant items:

Increases are mainly attributed to:

- $10.3 million in a funding reprofile for the Postal Modernization initiative from fiscal year 2017-18 to 2019-20;

- $8.8 million in funding to taking action against gun and gang violence;

- $2.3 million in funding to address the opioid crisis; and

- $2.0 million in funding for various other projects.

Decreases are mainly attributed to:

- $27.9 million in funding due to the completion of the federal infrastructure initiative to improve the physical infrastructure of security agencies;

- $19.3 million in funding for the CBSA Assessment and Revenue Management project (CARM);

- $16.5 million in funding for Immigration Holding Centers;

- $15.0 million in funding for the Border Infrastructure initiative as part of the Beyond the Border Action Plan;

- $13.5 million in funding to expand biometrics screening in Canada's immigration proceedings; and

- $3.5 million in funding for various other projects.

Budgetary Statutory Authorities

The Agency’s Statutory Authority related to the employee benefit plan (EBP) increased by $35.0 million, or 18.8% from the previous year, which is attributed to: $20.1 million for new funding received in the 2019-20 Main Estimates and $14.9 million net increase in new funding received by the Agency at Q1, including in impacts resulting from the EBP rate changing from 20% to 27% in fiscal year 2019-20.

2.2 Explanations of Significant Variances in Expenditures from Previous Year

As indicated in the Statement of Authorities (Table 1), the Agency’s expenditures for the quarter ending June 30, 2019 were $428.7 million, as compared to $376.3 million for the quarter ending June 30, 2018. The net increase of $52.4 million or 13.9% in expenditures is mainly due to the following items:

- Increase of $44.6 million or 13.7% in Vote 1 Operating Expenditures year-to-date used at quarter end ($370.8 million versus $326.2 million same time last year). The bulk of the difference in spending is attributed to an increase in personnel expenditures due to the ratification of the collective agreement for the Border Service Agents which occurred in the second quarter of fiscal year 2018-19, as well as the timing related to the payment for legal services to the Department of Justice.

- Increase of $2.7 million or 35.9% in Vote 5 Capital Expenditures year-to-date used at quarter end ($10.3 million versus $7.6 million same time last year). The increase in expenditures is mainly related to the use of IT consultants to advance the CBSA Assessment and Revenue Management (CARM) project.

- Increase of $5.1 million in statutory expenditures.

As indicated in the Departmental Budgetary Expenditures by Standard Object (Table 2), the increases by standard object are mainly attributed to:

- An increase of $43.8 million in professional costs as a result of the ratification of the collective agreement for the Border Services Group (FB) which occurred in the second quarter of fiscal year 2018-19.

- The remaining net increase is due to timing differences in the payments of contracts for professional and special services.

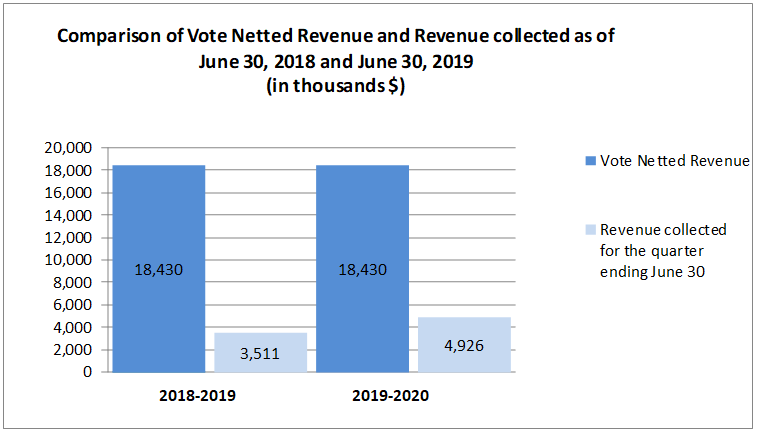

The planned revenue from the sales of services reflects the Agency's revenue respending authority. The year-to-date revenue from the charge of services has increased by $1.4 million or 40.3% due to increases in the NEXUS program.

3. Risks and Uncertainties

The CBSA’s changing operating environment makes the Agency particularly susceptible to external drivers that are largely beyond its control. Together, these drivers have the potential to affect the organization’s ability to adhere to its annual financial plan.

Increased volumes of immigration processing, including increases in asylum claims and related enforcement activities, coupled with increased volumes resulting from eCommerce, have placed excessive demands on limited resources. Budget 2019 provided new funding to assist in managing these workload pressures.

April 2019 saw important initiatives advance under CBSA Renewal: the new Functional Management Model (FMM) and organizational structure and the Nationalization of Internal Services. The FMM is foundational to CBSA Renewal as the transition will provide better support and accountability to its strategic decision-making processes along its three main business lines: traveller, commercial and trade, and intelligence and enforcement.

The Agency is pursuing several large information technology (IT) and physical infrastructure projects. Most are multi-year in nature and represent substantial investments. Specific to information technology, the Agency continues to support services it is expecting to phase out while waiting for the delivery of government-wide corporate solutions which include secure cloud computing and data storage.

Delays can add additional challenges as project costing does not adequately allow for fluctuating costs for materials commodities and other market rate price changes. Inflation also drives up costs on deferred or delayed projects.

The Agency strives to mitigate financial risks by risk-rating its projects, conducting periodic project reviews, and by holding regular budget discussions. The Agency will continue to examine its resource base in an effort to fully align its operations to the priorities of the Government and Canadians.

4. Significant Changes in Relation to Operations, Personnel and Programs

4.1 Key Senior Personnel

Effective April 1, with the combining of the Programs and Operations Branches, three new branches were established, each with accountable Vice-Presidents: Denis R. Vinette, Vice-President Travellers Branch, Peter Hill, Vice-President, Commercial and Trade Branch and Jacques Cloutier, Vice-President, Intelligence and Enforcement Branch, none of which are new to the Agency.

Tina Namiesniowski, Executive Vice-President as well as of Jacqueline Rigg, Vice-President of Human Resources have departed the Agency.

Lastly, Patrick Boucher joined the CBSA as the Vice-President and Chief Transformation Officer.

4.2 Operations

Effective April 1, 2019, the Canada Border Services Agency officially launched its enhanced functional management model. Under this new model, Vice-Presidents of the three business line branches (Travellers, Commercial and Trade and Intelligence and Enforcement) are accountable for program transformation, development, design and delivery, from coast-to-coast and end-to-end with the direct support of all regions. They are the business owners and are accountable for driving major information technology projects within their functional areas, which is an industry best practice and in line with other government departments. The Information, Science and Technology Branch (ISTB) will continue to oversee the technical aspects of these projects. Regional Directors General (RDGs) are now directly accountable to the three Vice-Presidents.

The National Real Property and Accommodations Directorate (NRPAD) completed its national realignment of resources on March 31st 2019. The resulting impact will enable the organization to more effectively and efficiently operationalize key priorities and enhance our capacity to manage the Agency’s custodial, leasehold and legislated portfolios thereby expanding the Directorates ability to support the CBSA renewal initiative. The nationalized model is designed to support a nationally consistent and innovative approach to modernizing the Agency’s border infrastructure by leveraging regional and national project management expertise through integrated investment planning and data-driven reporting strategies. To ensure that the organization is properly positioned to respond to and support the evolving dynamic real property demands of the CBSA, NRPAD is developing a Professional Development Plan (PDP) that will clearly identify the required core competencies and skill sets, strengthen succession planning, generate knowledge transfer and retention, and promote the CBSA as an employer of choice.

In support of the Agency’s sustainable development strategy, the NRPAD re-adjusted its regional base and significantly invested in the Environmental Operations Division to ensure that the Directorate has the necessary capacity to support and advance the agency’s agenda as it embarks on transitioning to a clean economy by reducing its greenhouse gas emissions, and improving its resilience to climate change. In June 2019, the NRPAD Environmental Operations and Material Management team acquired the first Government of Canada zero emissions hydrogen vehicle for use at the Jean-Lessage International Airport in Québec City.

Additionally, following the Budget 2019 funding decision, the Directorate has established the organizational framework required to deliver the Port of Entry replacement projects identified in the Land Border Crossing Project.

The Agency continues to make progress on the re-alignment of its material management portfolio with an expected completion date of spring 2020.

4.3 New Programs

Looking forward, our Agency is committed to the vision of CBSA Renewal, which is designed to maximize the potential of technology and further implement innovation to enable our officers to stand strong and provide effective service amidst rising volumes and ever evolving security threats.

5. Approval by Senior Officials

Approved by:

John Ossowski

President

Ottawa, Canada

Date: August 29, 2019

Jonathan Moor

Chief Financial Officer

Ottawa, Canada

Date: August 29, 2019

6. Table 1: Statement of Authorities (Unaudited)

| Total available for use for the year ending March 31, 2020* | Used during the quarter ended | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,753,955 | 370,779 | 370,779 |

| Vote 5 - Capital Expenditures | 126,529 | 10,252 | 10,252 |

| Statutory Authority - Contributions to employee benefit plans | 220,893 | 47,614 | 47,614 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 1 | 1 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 31 | 31 |

| Total budgetary authorities | 2,101,377 | 428,677 | 428,677 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 2,101,377 | 428,677 | 428,677 |

| Note: Numbers may not add due to rounding. * Includes only Authorities available for use and granted by Parliament at quarter end. |

|||

| Total available for use for the year ending * | Used during the quarter ended | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,567,765 | 326,146 | 326,146 |

| Vote 5 - Capital Expenditures | 198,790 | 7,546 | 7,546 |

| Statutory Authority - Contributions to employee benefit plans | 185,936 | 42,586 | 42,586 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 0 | 0 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 9 | 9 |

| Total budgetary authorities | 1,952,491 | 376,287 | 376,287 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 1,952,491 | 376,287 | 376,287 |

| Note: Numbers may not add due to rounding. * Includes only Authorities available for use and granted by Parliament at quarter end. |

|||

7. Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited)

| Planned expenditures for the year ending * | Expended during the quarter ended | Year-to-date used at quarter end | |

|---|---|---|---|

| Expenditures | |||

| Personnel | 1,578,430 | 363,967 | 363,967 |

| Transportation and communications | 44,413 | 11,118 | 11,118 |

| Information | 15,444 | 836 | 836 |

| Professional and special services | 271,795 | 45,332 | 45,332 |

| Rentals | 7,200 | 822 | 822 |

| Repair and maintenance | 41,604 | 5,082 | 5,082 |

| Utilities, materials and supplies | 13,164 | 1,694 | 1,694 |

| Acquisition of land, buildings and works | 58,942 | 1,350 | 1,350 |

| Acquisition of machinery and equipment | 67,779 | 1,190 | 1,190 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 21,036 | 2,212 | 2,212 |

| Total gross budgetary | 2,119,807 | 433,603 | 433,603 |

| Less revenues netted against expenditures | |||

| Sales of Services | 18,430 | 4,927 | 4,927 |

| Other Revenue | 0 | (1) | (1) |

| Total revenues netted against expenditures | 18,430 | 4,926 | 4,926 |

| Total net budgetary expenditures | 2,101,377 | 428,677 | 428,677 |

| Note: Numbers may not add due to rounding. * Includes only Authorities available for use and granted by parliament at quarter-end. |

|||

| Planned expenditures for the year ending * | Expended during the quarter ended | Year-to-date used at quarter end | |

| Expenditures | |||

|---|---|---|---|

| Personnel | 1,384,584 | 320,216 | 320,216 |

| Transportation and communications | 44,381 | 8,890 | 8,890 |

| Information | 8,320 | 181 | 181 |

| Professional and special services | 257,271 | 37,391 | 37,391 |

| Rentals | 6,594 | 1,142 | 1,142 |

| Repair and maintenance | 32,238 | 3,837 | 3,837 |

| Utilities, materials and supplies | 20,588 | 1,870 | 1,870 |

| Acquisition of land, buildings and works | 87,751 | 1,307 | 1,307 |

| Acquisition of machinery and equipment | 107,133 | 2,501 | 2,501 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 22,061 | 2,463 | 2,463 |

| Total gross budgetary expenditures | 1,970,921 | 379,798 | 379,798 |

| Less revenues netted against expenditures | |||

| Sales of Services | 18,430 | 3,511 | 3,511 |

| Other Revenue | 0 | 0 | 0 |

| Total revenues netted against expenditures | 18,430 | 3,511 | 3,511 |

| Total net budgetary expenditures | 1,952,491 | 376,287 | 376,287 |

| Note: Numbers may not add due to rounding. * Includes only Authorities available for use and granted by Parliament at quarter-end. | |||

- Date modified: