Canada Border Services Agency Quarterly Financial Report:

Table of contents

- 1. Introduction

- 2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

- 3. Risks and uncertainties

- 4. Significant changes in relation to operations, personnel and programs

- 5. Approval by senior officials

- 6. Table 1: Statement of authorities (unaudited)

- 7. Table 2: Departmental budgetary expenditures by standard object (unaudited)

1. Introduction

This Quarterly Financial Report (QFR) has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates, Canada’s Economic Action Plan 2019 (Budget 2019) and Canada's COVID-19 Economic Response Plan.

Information on the ‘raison d’être’, mandate, role and core responsibilities of the Canada Border Services Agency (CBSA) can be found in Part III Departmental Plan and Part II of the Main Estimates.

The QFR has not been subjected to an external audit or review.

1.1 Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying statement of authorities (Table 1) includes the department's spending authorities granted by Parliament, and those used by the department consistent with the Main Estimates and Supplementary Estimates (as applicable) for the 2019 to 2020 and 2020 to 2021 fiscal years. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of fiscal quarter and fiscal year-to-date (YTD) results

This section highlights the significant items that contributed to the net increase or decrease in resources available for the year and actual expenditures as of the quarter ended .

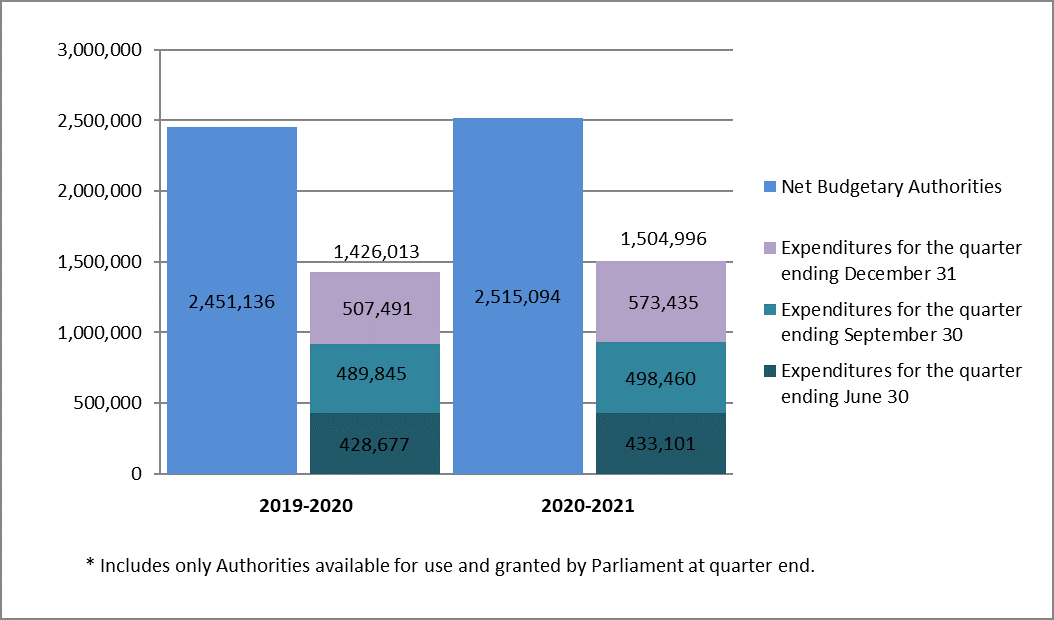

Graph 1: Comparison of net budgetary authorities and expenditures as of and

(in thousands $)

Image description

| 2019 to 2020 | 2020 to 2021 | |

|---|---|---|

| Net budgetary authorities | 2,451,136 | 2,515,094 |

| Expenditures for the quarter ending December 31 | 507,491 | 573,435 |

| Expenditures for the quarter ending September 30 | 489,845 | 498,460 |

| Expenditures for the quarter ending June 30 | 428,677 | 433,101 |

| Total expenditures for the quarter ending June 30 & September 30 & December 31 | 1,426,013 | 1,504,996 |

| Includes only Authorities available for use and granted by Parliament at quarter end. | ||

2.1 Significant changes to authorities

For the period ending , the authorities provided to the CBSA comprise of the 2020 to 2021 Main Estimates, Supplementary Estimates B, and any unused spending authorities carried forward from the previous fiscal year.

The Statement of Authorities (Table 1) presents a net increase of $64.0 million or 2.6% in the Agency’s total authorities of $2,515.1 million at compared to $2,451.1 million total authorities at the same quarter last year.

This net increase in the authorities available for use is the result of an increase in Vote 1 – Operating Expenditures of $27.3 million, an increase in Vote 5 – Capital of $53.6 million and a decrease in Budgetary Statutory Authorities of $16.9 million.

2.2 Explanations of significant variances in expenditures from previous year

As indicated in the statement of authorities (Table 1), the Agency’s expenditures for year-to-date, at quarter end were $1,505.0 million, as compared to $1,426.0 million for year-to-date, quarter ending . The net increase of $79.0 millionfootnote 1 or 5.5% in expenditures is mainly due to the following items:

- Increase of $51.3 million or 4.2% in Vote 1 Operating Expenditures year-to-date used at quarter end ($1,262.0 million versus $1,210.7 million same time last year). This increase can mostly be attributed to a $43.7 million increase in overall Salary and Wages (including allowances)

- Increase of $16.0 million or 22.3% in Vote 5 Capital Expenditures year-to-date used at quarter end ($88.1 million versus $72.0 million same time last year). This increase can mostly be attributed to an increase in Facilities Capital Projects and an increase in Information Technology Consultants

- Increase of $11.7 million in statutory expenditures

As indicated in the Departmental Budgetary Expenditures by Standard Object (Table 2), the increases by standard object are mainly attributed to:

- Increase of $58.2 million in Personnel mainly attributable to the ratification of collective bargaining agreements for the Education and Library Science (EB) Group, the Operation Services (SV) Group, the Program and Administration Services (PA) Group and the Technical Services (TC) Group, which is offset by a decrease in total overtime paid

- Decrease of $22.5 million in Transportation and communications which can be mainly attributed to a $20.8M decrease in total travel and a $1.2M decrease in total relocation expenses. The decrease in travel and relocation can be attributed to the Covid-19 pandemic

- Increase of $21.4 million in Professional and special services can be mainly attributed to an increase in Information Technology Consultants

- Increase of $10.6 million in Acquisition of land, buildings and works due to an increase in Facility Capital Projects

- Decrease of $5.5 million in Acquisition of machinery and equipment is attributed to a decrease in computer equipment and a decrease in telecommunications equipment

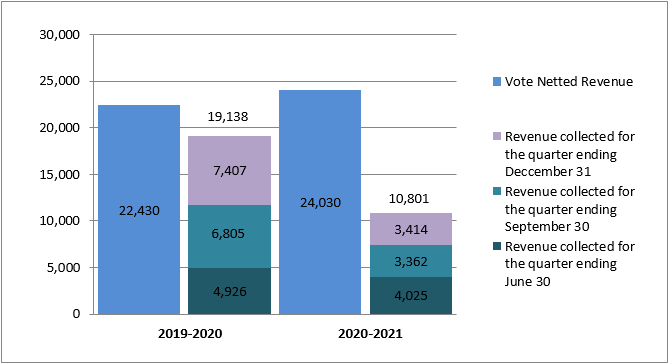

Graph 2: Comparison of vote netted revenue and revenue collected as of and

(in thousands $)

Image description

| 2019 to 2020 | 2020 to 2021 | |

|---|---|---|

| Vote netted revenue | 22,430 | 24,030 |

| Revenue collected for the quarter ending December 31 | 7,407 | 3,414 |

| Revenue collected for the quarter ending September 30 | 6,805 | 3,362 |

| Revenue collected for the quarter ending June 30 | 4,926 | 4,025 |

| Total revenue collected for the quarter ending June 30 & September 30 & December 31 | 19,138 | 10,801 |

The planned revenue from the sales of services reflects the Agency’s revenue respending authority. The year-to-date revenue from the charge of services has decreased by $8.3 million or 43.6% due to the COVID-19 pandemic.

3. Risks and uncertainties

The CBSA’s changing operating environment makes the agency particularly susceptible to external drivers that are largely beyond its control. Together, these drivers have the potential to affect the organization’s ability to adhere to its annual financial plan.

The agency is pursuing several large information technology (IT) and physical infrastructure projects. Most are multi-year in nature and represent substantial investments. The COVID-19 pandemic necessitated a re-prioritization of certain agency activities to address pressing matters, which may result in scheduling delays for some projects.

In addition, because the CBSA depends on other government departments and/or external stakeholders for the development and implementation of many of its major projects, scheduling delays are even more likely. As each organization must also manage the repercussions the COVID-19 pandemic is having on its own operations, assisting the CBSA in the advancement of its projects in a timely basis can become challenging due to conflicting priorities.

Beyond the effects of re-prioritization on the way resources are allotted, the COVID-19 pandemic will also likely prompt a need for adjustments to the design of certain projects, which could further delay the execution and delivery of projects and result in funding lapses.

Delays can lead to other challenges as project costing does not always allow for fluctuating costs for materials, commodities and other market rate price changes. Inflation also drives up costs on deferred or delayed projects.

The agency strives to mitigate financial risks by risk-rating its projects, conducting periodic project reviews, and by holding regular budget discussions. Such activities are informed and supported by agency quarterly integrated project reporting processes.

4. Significant changes in relation to operations, personnel and programs

4.1 Key senior personnel

There have been no changes to key senior personnel in the third quarter of 2020 to 2021.

4.2 Operations

The COVID-19 pandemic has had continued significant impacts on agency operations. Travel restrictions were in place for the entirety of Q3 at all Canadian international border crossings. Travel of an optional or discretionary nature, including tourism, recreation and entertainment, is covered by these measures across all ports of entry in all modes of transportation: land, marine, air and rail. This has resulted in a dramatic decrease in traveller border volumes.

New safety protocols and procedures have been developed to handle ongoing commercial volumes, continuing non-discretionary travel and to prepare for when discretionary travel resumes. Front line staff reassignments have also occurred to address the increasing volumes seen in the postal and courier streams.

Thousands of non-frontline employees continue to telework in light of the COVID-19 pandemic. This has brought about new methods for communicating and collaborating, and while some limitations exist, the IT infrastructure has largely been able to successfully support this transition.

5. Approval by senior officials

Approved by:

John Ossowski

President

Ottawa, Canada

Date:

Jonathan Moor

Chief Financial Officer

Ottawa, Canada

Date:

6. Table 1: Statement of authorities (unaudited)

| Total available for use for the year ending Tablenote 2 | Used during the quarter ended | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 1: Operating expenditures | 2,008,691 | 482,915 | 1,261,960 |

| Vote 5: Capital expenditures | 298,824 | 38,836 | 88,058 |

| Statutory authority: Contributions to employee benefit plans | 207,579 | 51,646 | 154,940 |

| Statutory authority: Refunds of amounts credited to revenues in previous years | 0 | 0 | 0 |

| Statutory authority: Spending of proceeds from the disposal of surplus Crown assets | 0 | 38 | 38 |

| Total budgetary authorities | 2,515,094 | 573,435 | 1,504,996 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 2,515,094 | 573,435 | 1,504,996 |

| Total available for use for the year ending Tablenote 3 | Used during the quarter ended | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 1: Operating expenditures | 1,981,407 | 419,921 | 1,210,684 |

| Vote 5: Capital expenditures | 245,219 | 39,714 | 72,025 |

| Statutory authority: Contributions to employee benefit plans | 224,510 | 47,614 | 142,841 |

| Statutory authority: Refunds of amounts credited to revenues in previous years | 0 | 10 | 13 |

| Statutory authority: Spending of proceeds from the disposal of surplus Crown assets | 0 | 232 | 450 |

| Total budgetary authorities | 2,451,136 | 507,491 | 1,426,013 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 2,451,136 | 507,491 | 1,426,013 |

7. Table 2: Departmental budgetary expenditures by standard object, in thousands of dollars (unaudited)

| Planned expenditures for the year ending Tablenote 4 | Expended during the quarter ended | Year-to-date used at quarter end | |

|---|---|---|---|

| Expenditures | |||

| Personnel | 1,801,285 | 417,825 | 1,168,100 |

| Transportation and communications | 55,296 | 6,493 | 13,856 |

| Information | 1,578 | 106 | 686 |

| Professional and special services | 351,923 | 103,997 | 232,288 |

| Rentals | 11,430 | 2,675 | 6,443 |

| Repair and maintenance | 34,405 | 13,433 | 23,185 |

| Utilities, materials and supplies | 15,796 | 5,406 | 11,989 |

| Acquisition of land, buildings and works | 127,161 | 20,253 | 35,411 |

| Acquisition of machinery and equipment | 131,581 | 8,253 | 17,539 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 8,669 | (1,592) | 6,300 |

| Total gross budgetary expeditures | 2,539,124 | 576,849 | 1,515,797 |

| Less revenues netted against expenditures | |||

| Sales of services | 24,030 | 3,414 | 10,801 |

| Other revenue | 0 | 0 | 0 |

| Total revenues netted against expenditures | 24,030 | 3,414 | 10,801 |

| Total net budgetary expenditures | 2,515,094 | 573,435 | 1,504,996 |

| Planned expenditures for the year ending Tablenote 5 | Expended during the quarter ended | Year-to-date used at quarter end | |

|---|---|---|---|

| Expenditures | |||

| Personnel | 1,781,701 | 372,432 | 1,109,940 |

| Transportation and communications | 47,248 | 13,995 | 36,362 |

| Information | 19,953 | 374 | 1,311 |

| Professional and special services | 328,635 | 86,122 | 210,847 |

| Rentals | 7,448 | 2,420 | 7,480 |

| Repair and maintenance | 47,365 | 10,072 | 19,586 |

| Utilities, materials and supplies | 13,861 | 3,151 | 8,361 |

| Acquisition of land, buildings and works | 93,883 | 13,151 | 24,811 |

| Acquisition of machinery and equipment | 107,994 | 14,640 | 23,002 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 25,478 | (1,459) | 3,451 |

| Total gross budgetary expenditure | 2,473,566 | 514,898 | 1,445,151 |

| Less revenues netted against expenditures | |||

| Sales of services | 22,430 | 7,417 | 19,151 |

| Other revenue | 0 | (10) | (13) |

| Total revenues netted against expenditures | 22,430 | 7,407 | 19,138 |

| Total net budgetary expenditures | 2,451,136 | 507,491 | 1,426,013 |

- Date modified: