Determining the Composition of Uppers of Footwear

Memorandum D10-14-37

ISSN 2369-2391

Ottawa, June 18, 2015

This document is also available in PDF (389 KB) [help with PDF files]

In Brief

1. The editing revisions made to this memorandum do not affect or change any of the existing policies or procedures.

2. Appendices have been modified in order to add an explanation of "waterproof footwear" of Heading 64.01.

This memorandum explains the administrative policy used by the Canada Border Services Agency (CBSA) to determine the composition of uppers in respect of footwear of Chapter 64 of the Customs Tariff Schedule.

Legislation

Section 11

Chapter 64 – Headings 64.01 to 64.05, Notes 3 and 4

Explanatory Notes to the Harmonized Commodity Description and Coding System

General Explanatory Note (D) to Chapter 64

Guidelines and General Information

1. As stated in Section 11 of the Customs Tariff, in interpreting the headings and subheadings, regard must be given to the Explanatory Notes to the Harmonized Commodity Description and Coding System.

2. "Waterproof Footwear" is classified in heading 64.01. See Appendix A for a detailed description of qualifying waterproof footwear of heading 64.01.

3. Much of footwear produced today has rubber or plastic outer soles and uppers made solely of plastic (woven fabric with an external layer of plastics being visible to the naked eye), leather or textile. This footwear is classified under headings 64.02, 64.03 and 64.04.

4. Footwear with natural leather uppers are classified in heading 64.03. Footwear with composition or imitation leather uppers are classified in heading 64.05. Synthetic and artificial footwear look and feel like leather, but are not genuine leather. The classification of these goods is explained in detail in Appendix B.

5. The upper is the portion of the footwear above the sole. The sole includes the outer sole, midsole, insole and anything in between, including stiffeners. Insoles that are removable and that resemble liners are also considered to be part of the sole. Please note that, in complex footwear, the demarcation between the sole and the upper is not always apparent from the exterior of the footwear. In some instances, the insole may appear to extend up the sides of the footwear, such as in the instep and/or heel areas of the foot. The demarcation line between the sole and the upper is to be determined by where the top edge of the insole meets the side of the footwear, projected horizontally through to the exterior of the footwear. [see Appendix C (1) and (2)]

6. If the uppers are composed of different materials, the external component having the greatest surface area determines the classification. Accessories or reinforcements such as ankle patches, protective or ornamental strips or edging, or other ornamentation (e.g. tassels, pompons or braid), buckles, tabs, eyelet stays, laces or slide fasteners are not included in this calculation.

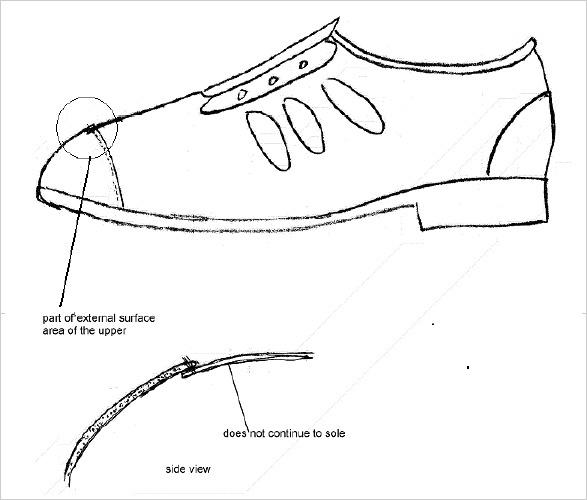

7. The surface areas of components having the same exterior composition are combined and considered together. Where different components are joined in overlapped seams (such as by sewing or gluing), the line formed by the edge of the outermost component will define the edge of the respective surfaces. Accordingly, the line of stitches in an overlapped sewn seam will not define the edge of the respective components [see Appendix C (3) and (4)].

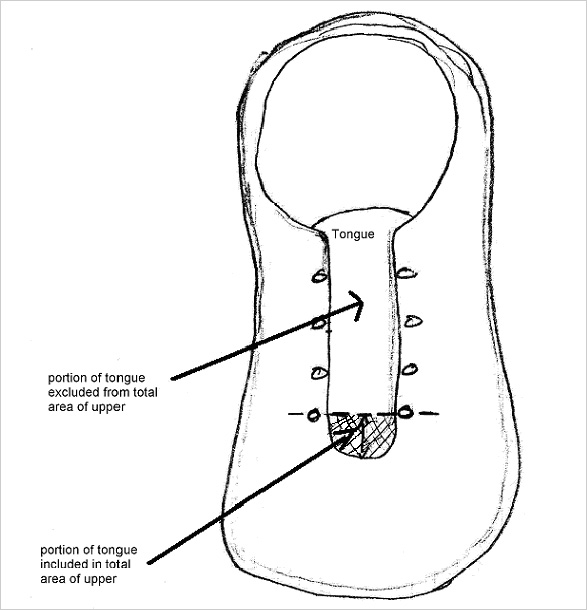

8. The tongue is considered to be an accessory. In lace-up footwear, the tongue is typically made of the same material as the upper; however, exceptions are common. The Explanatory Notes to Chapter 64 do not address how the tongues of footwear are to be treated in determining the material of the upper having the greatest surface area. For CBSA purposes, the external surface area of the tongue below an imaginary line drawn through the middle of the bottom eyelet is included when determining the predominant material of the upper. The remaining portion of the tongue above this imaginary line is excluded. In the case of footwear with Velcro® closures, the external surface area of the tongue below the closed lowest Velcro® strap is included [see Appendix C (5)].

9. Overlays are accessories or reinforcements stitched or glued on existing portions of the external surface of the upper. They provide ornamentation or reinforcement to add strength and possibly stiffness to the upper. They often serve as stays to anchor the shoelace eyelets and as protectors in the toe and heel areas.

10. Much of the lace-up footwear produced today is constructed of different components with different functions. In some footwear, reinforcements and decorations may cover a large part of the upper. As a result, the upper may only be visible in small areas. For this type of footwear, the construction may only become evident after taking it apart.

11. In accordance with General Explanatory Note (D) to Chapter 64, accessories or reinforcements, including the overlays described above, are not included when determining the external surface area of the upper.

12. Illustrations of footwear constructed with accessories or reinforcements, including overlays, are contained in Appendix C (6) to (8) — the overlays have been labelled for ease of reference. Appendix C (8) illustrates footwear where the toe covering appears to be an overlay, but it is in fact attached at the top edge to the upper and is part of the external surface area of the upper.

13. Since footwear construction varies considerably, it can be difficult to determine the surface area of the different components and whether they are accessories or reinforcements. In some cases, the footwear will need to be taken apart.

14. Representative samples should be analyzed in the following cases:

- (a) when the footwear construction is not clearly evident;

- (b) when it is difficult to determine whether the footwear upper is made of leather; or

- (c) to determine the surface area of uppers composed of different materials.

Additional Information

15. For certainty regarding the tariff classification of a product, importers may request an advance ruling for tariff classification. Details on how to make such a request are found in Memorandum D11-11-3, Advance Rulings for Tariff Classification.

16. For more information, call contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (webform)

Contact Us at the CBSA website

Appendix A

Waterproof Footwear

For tariff classification purposes, "water footwear" of heading 64.01 is footwear that keeps the foot dry. The outer soles and uppers of rubber or of plastic must be assembled in such a way as to prevent seepage of water through the shoe. Such assembly methods do not include stitching, riveting, nailing, screwing, plugging or similar processes.

The uppers of waterproof footwear of heading 64.01shall cover both sides and top of the foot, such that water cannot penetrate the surface below the upper rim, regardless of the height of the upper rim.

For footwear to be considered waterproof, it must keep the interior dry when submerged in water for 24 hours.

Waterproof footwear of heading 64.01 will not have an upper which simply consists of straps or thongs (for example, sandals) because they do not prevent the foot from getting wet.

Appendix B

Uppers of Footwear That Have the Appearance and Feel of Leather

This appendix provides further information on leather and imitation or artificial leather used for uppers in footwear.

Many imitation leathers cannot be distinguished from natural leathers without chemical analysis. Some artificial or synthetic leathers are of high quality and are so similar to real leather in feel, texture, smell and appearance that they too cannot be distinguished without chemical analysis. In fact, some have wear characteristics superior to real leather and may have been treated with leather finishing agents to give them the odour of real finished leather.

Uppers of footwear that have the appearance and feel of leather may be made from:

- (a) natural leather —

- whether full grain, patent, patent laminated or sueded, of Chapter 41 of the Customs Tariff Schedule. Patent leather and patent laminated leather are described in the Explanatory Notes to heading 41.14. Note that patent leather has a lustrous, mirror-like surface resulting from a varnish or lacquer coating or from the application of a sheet of plastics. Such coatings or sheets must not exceed a thickness of 0.15 millimetres (mm). Patent laminated leather has been laminated with a sheet of plastics of a thickness greater than 0.15 mm but less than half the total thickness of the product. Footwear with uppers of patent leather and patent laminated leather are classified under heading 64.03. Leather covered with a pre-formed sheet of plastics exceeding 0.15 mm but greater than one half of the total thickness is a good of Chapter 39. Footwear with such uppers is classified under headings 64.02 and 64.05.; or

- (b) composition leather —

- Footwear with an upper of composition leather is classified under heading 64.05; or

- (c) imitation leather —

- Also referred to as "artificial leather" and "synthetic leather". The words "artificial" and "synthetic" here are do not fall under the definitions of artificial and synthetic fibres of Chapter 54 notes 1 (a) and (b). Imitation leather is "leather-like" and has the appearance and the feel of either full grain leather or sueded leather. Imitation leather is neither made from, nor contains any natural leather. Imitation leather is used as a substitute for the leathers of Chapter 41 and may consist of the following:

(i) A sheet of plastics or rubber, which has been embossed to give the appearance of a full grain leather, or abraded to give the appearance of a sueded leather. This footwear is classified under headings 64.01, 64.02 and 64.05 as having an upper of rubber or plastics; or

(ii) A coated textile fabric, nonwoven or felt of Chapters 39, 40, 56 and 59, which has been coated or laminated with an external layer of plastics or rubber, visible to the naked eye. The coating has been embossed to give the appearance of grained leather, or abraded to give the appearance of sueded leather. This footwear is classified under headings 64.01, 64.02 and 64.05 as having an upper of plastics or rubber [Chapter 64, Note 3(a)]. Note that in this case, the presence of the fabric is not taken into consideration.; or

(iii) A brushed textile fabric, nonwoven or felt, which has been impregnated with plastics or rubber and abraded to show the fibres of the nonwoven on the surface to give the appearance of a sueded leather (i.e. the fibres of the non-woven show on the surface). This footwear is classified under headings 64.04 and 64.05 as having an upper of textile materials.; or

(iv) A substrate of any material (usually of plastics, rubber or textile) with a glued-on surface of leather dust or textile flock to give the appearance and feel of sueded leather. Such materials on a base of plastics or rubber are considered to be products of Chapters 39 and 40, respectively. This footwear is classified under headings 64.01, 64.02 and 64.05. Sueded materials on a base of textiles are considered to be products of heading 59.07. This footwear is classified under headings 64.04 and 64.05 as having an upper of textile materials.

Appendix C

Illustrations of Shoes With Their Descriptions

(1) Interior of shoe as viewed from rear.

(2) Illustration in 3 photos of a shoe cut in half showing its interior as viewed from rear.

(3) Drawing of a shoe describing components that overlaps.

(4) Illustration in 2 photos of a shoe sideways showing that component A is not lasted to the sole; it is stitched to component B.

(5) Drawing of shoe with a description of the tongue.

(6) Drawing describing reinforcements and overlays.

(7a) Illustration of shoe sideways with numbered descriptions (1 to 5).

Components listed from the outer-most layer to the inner-most layer:

- outer-most overlay (reinforcing)

- overlay (reinforcing)

- overlay (reinforcing)

- overlay (reinforcing)

- UPPER - textile material (knitted fabric)

(7b) Illustration of unstitched shoe sideways.

(8) Illustration of shoe with overlay at the toe.

References

- Issuing office:

- Trade and Anti-dumping Programs Directorate

- Headquarters file:

- HS 6404.11

- Legislative references:

-

Customs Tariff

General Rules for the Interpretation of the Harmonized System

Chapter 64, Notes 3 and 4 - Other references:

- Memorandum D11-11-3

- Superseded memorandum D:

- D10-14-37 dated March 23, 2006

Page details

- Date modified: