Interpretation of Tariff Item 9986.00.00 – Religious Articles

Memorandum D10-15-12

ISSN 2369-2391

Ottawa, August 27, 2014

This document is also available in PDF (251 KB) [help with PDF files]

In Brief

This memorandum has been revised to more fully reflect the Canada Border Services Agency’s administration of tariff item 9986.00.00.

Table of Contents

- Legislation

- Guidelines and General Information

- Religious statues and statuettes

- Medals and crosses

- Religious figures and plaques, mounted or not

- Ancestral shrines

- Communion sets

- Oil stocks

- Crosiers

- Benitiers

- Sprinklers

- Incensers

- Incense boats

- Baptismal shells or fonts

- Scapulars

- Chapelets

- Rosaries

- Scroll sets

- Chanukah candlesticks

- Kiddush sets

- Mezuzah boxes

- Havdalah sets

- Seder plates

- Additional Information

- References

This memorandum outlines the policy of the Canada Border Services regarding the interpretation of tariff item 9986.00.00 of the Customs Tariff.

Legislation

Tariff item 9986.00.00:

Religious statues, statuettes, medals, crosses, figures, plaques or ancestral shrines, and communion sets, oil stocks, crosiers, benitiers, sprinklers, incensers, incense boats, baptismal shells or fonts, scapulars, chapelets, rosaries, Scroll sets, Chanuka candlesticks, Kiddush sets, Mezuzah boxes, Havdalah sets or Seder plates;

Parts of all the foregoing.

Guidelines and General Information

1. Tariff item 9986.00.00 is a list of specific religious goods. If an item is not included in that list, it cannot be eligible for the benefits of the tariff item.

2. Tariff item 9986.00.00 provides for articles:

- (a) used in religious services, or

- (b) used as explicit witness of a religious affiliation or devotion.

3. Articles simply incorporating a religious motif do not qualify for importation under tariff item 9986.00.00, if they are not generally regarded as having a religious function or purpose.

4. Examples of such articles are paper weights, jewellery for the adornment of the person, bookends, pencils and pens, and tombstones incorporating a religious design or symbol.

5. The provisions of tariff item 9986.00.00 apply to all religious persuasions.

6. A religion need not be currently practised for an object related to qualify; for example, a statue of the ancient Egyptian Bast Cat was deemed by the Canadian International Trade Tribunal to qualify for the benefits of the tariff item.

7. Articles of mythology that are based on religious ideology or dogma are eligible for the benefits of tariff item 9986.00.00; however, articles for entertainment purposes that are related to mythological narratives are not.

8. The provisions for oil stocks, crosiers, benitiers, sprinklers, incensers, incense boats, baptismal shells or fonts include complete sets of same, matched through harmony of design and consisting of complimentary items, such as matching trays, stands and dispensing utensils.

9. Carrying cases and accessories specific to a listed good, for example candles, candlesticks, stoles, altar cloths, etc., will be allowed its benefits when imported with that item. However, if those same carrying cases and accessories are imported separately they are not eligible for the benefits of the tariff item and remain classified under their respective tariff items in Chapters 1 through 97.

10. Portable communion sets, oil stock sets, sprinklers and baptismal kits qualify under the tariff.

11. The parts provision of tariff item 9986.00.00 provide only for parts for the repair or maintenance of goods enumerated in the tariff item.

12. Articles and materials imported for use in the manufacture of goods admissible under the tariff item are not eligible under the tariff item and are classified in their own right.

13. Goods of the tariff item can be made of any material.

14. Religious articles, such as medals, crosses and Mezuzah boxes, do not qualify for the benefits of the tariff item if they are:

- (a) incorporated into articles worn as jewellery such as earrings, brooches, tie pins and clips, cufflinks, dress studs, buttons, buckles, barrettes, dress combs, and other hair ornaments;

- (b) attached to a chain or bracelet, packaged with a chain or bracelet or invoiced with a chain or bracelet under one price;

- (c) incorporated in or affixed to other articles, such as paperweights, bookends, fancy boxes and watch bands;

- (d) jewellery findings and stampings that require further manufacturing in Canada.

15. The importer may be asked to provide a certification attesting that articles claimed under the tariff item are in fact for religious devotion. The certificate must:

- (a) be from an appropriate religious administration (e.g. Catholic or Anglican Diocese, Jewish Synagogue, Hindu Temple, Moslem Mosque) that has charitable status from the Canada Revenue Agency;

- (b) be signed by an ordained member of clergy (e.g. priest, minister, rabbi, imam) with a degree or certificate in divinity from a recognized university, seminary or other institution of religious studies;

- (c) briefly describe the article;

- (d) explain how it is used in religious services or why it is an explicit witness of a religious affiliation or devotion; and

- (e) be on the letterhead of the religious administration delivering it.

16. Should the importer not be able to provide such a certification, the goods will not be entitled to the benefits of the tariff item.

Religious statues and statuettes

17. Religious statues are carved, modeled, or cast life forms, predominately of a single religious entity, life size or larger. Statuettes are carved, modeled, or cast life forms that are less than life-size.

18. Goods entered under this item provision are:

- (a) necessary to perform religious sacraments or ceremonies;

- (b) symbolically convey a meaningful aspect of a faith or religion; or

- (c) enhance the beauty, or meaningfulness of a building or sanctuary dedicated to the worship of an ultimate reality or deity.

19. If the principal function of the good is other than what is provided for in this tariff item, it is not admissible. For example, the principal function of a Christmas tree ornament in the form of an angel is for mounting on a Christmas tree for decoration purposes.

Medals and crosses

20. Religious medals bear the representation of a religious image or design. Examples include: St. Christopher and other patron Saint medals, miraculous medals, Buddha and Hindu deity amulets.

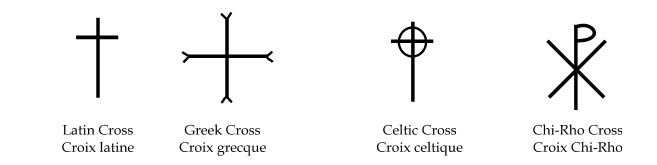

21. Crosses are ancient symbols that have religious significance to many groups. Examples of traditional crosses include:

Examples of stylized or modern crosses include:

22. Slip rings, if affixed to crosses or medals, are considered part of the goods.

Religious figures and plaques, mounted or not

23. A figure is a representation of a religious personage, shape or symbol. Three dimensional religious representations, shapes or symbols that are not considered to be statues, statuettes, or plaques but are similar, can be considered to be religious figures. These could include, for example, Star of David, a stylized fish, Morgen Davids, Buddhist dorjes, Hindu deities.

24. Similarly, a plaque is a flat wall hanging with decoration or lettering on it. The decoration or script must be of a religious nature, such as a prayer.

25. Such prayers do not have to be found in religious manuscripts, such as the Bible, Torah, or Quran, for them to be religious. It can be any personal communication, reverent petition, praise or thanksgiving to God, deities, other spiritual entities, such as angels and saints, or objects of worship, such as the sun.

26. Other articles, such as religious pictures and mottos, decoration plates, tapestries and tombstones and grave markers, do not qualify for the benefits of the tariff item, as their primary use is not for religious service or as a witness of a religious affiliation or devotion.

27. Monuments and commemorative plaques incorporating a religious plaque or statue qualify for the tariff item.

Ancestral shrines

28. A religious ancestral shrine is as a holy or sacred place, which is dedicated to a specific deity, ancestor, hero, martyr, saint, daemon or similar figure of awe and respect. Ancestral shrines often contain idols, relics, photos, cult images or other such objects associated with the figure being venerated. They may contain an altar, a small shelf, or a full table top. It can also be constructed to set apart a site which is thought to be particularly holy.

29. Many are small and consist of a statue on a pedestal or in an alcove, niche or grotto, or can be elaborate booths without ceilings.

30. Shrines are located within buildings designed specifically for worship, such as churches, temples, cemeteries, or in the home. They can also be portable. These shrines are usually the centre of attention in the building and are given a place of prominence.

31. Shrines can also be set up outdoors often at a significant site.

32. An ancestral shrine should not be confused with a temple. Temples do not qualify for tariff item 9986.00.00. A temple is a building devoted to the worship of a God or Gods.

Communion sets

33. A communion set is a set of utensils for use in religious communion services. It may consist of two or more of the following articles: chalices, ciboria, communion cups, communion cup tray, glasses, cruets, cruet sets, flagons, patens, bread plates, absolution and host boxes, pyxes, viaticums, spoons and ladles, tweezers, intinction sets, ostensorium, lunula, monstrances, thabors, reliquaries, and lavabo bowls.

Oil stocks

34. Oil stocks refer only to the containers or vessels in which various oils used in religious services are held, not to the oil itself.

35. Large jars, or other containers, simply used to store oil are not considered to be oil stocks.

Crosiers

36. Crosiers are stylized shepherds' hooked staffs that are part of a bishop's regalia.

Benitiers

37. Benitiers are open holy water containers, into which worshippers dip their fingers before blessing themselves.

38. Benitiers come in a wide variety of styles. They may:

- (a) be simple shallow bowls, to place on a table or stand;

- (b) have brackets or apparatus allowing them to be affixed to walls; or

- (c) be free-standing models in one or more pieces.

39. Wall brackets or other apparatus for affixing a benetier to a wall that are included with at the time of importation are eligible for the tariff item; as are stands specifically designed as supports for a benetier. However, tables or other unattached stands on which benitier dishes may be set are not eligible.

Sprinklers

40. Sprinklers are hand-held batons used to sprinkle holy water on congregations or objects during religious ceremonies. There are two types:

- (a) One has a solid metal handle with a ball on the end. The ball is dipped in a bucket of water and the water adhering thereto is sprinkled onto worshippers or objects being blessed. This type usually comes as part of a set including a matching bucket and stand and the whole qualifies under the tariff item.

- (b) The other holds the water in a reservoir in the handle.

Incensers

41. Incensers, sometimes referred to as censers, are vessels used for the burning of incense during religious ceremonies, and available in a variety of sizes. They may include chains and stands.

42. The incense itself does not qualify for the benefits of the tariff item.

Incense boats

43. Incense boats are vessels specifically designed to hold and dispense incense. Mustard dishes, relish dishes, and other similar covered condiment dishes are not considered to be incense boats.

Baptismal shells or fonts

44. Baptismal fonts hold holy water for use during a baptism, be it by aspersion, affusion or immersion.

45. Commonly of tone or ceramic, they range from shallow bowls to high-walled tubs or tanks.

46. To qualify for this tariff item, baptismal tubs and tanks are to be of the type permanently installed in churches.

47. A font bowl imported together with a specifically designed base or support qualifies under the tariff items. However, unrelated tables or stands do not.

Scapulars

48. Scapulars may be either:

- (a) Monastic - A short cloak covering the shoulders, originally prescribed by the Order of St. Benedict, to be worn by monks when engaged in manual labour or worn as a sign of devotion in church services.

- (b) Devotional - An article composed of two small squares of woolen cloth, wood or laminated paper, a few inches in size, fastened together by long strings passing over the shoulders. Most bear a devotional scripture and image.

49. Scapulars are commonly worn as a badge of affiliation to the religious order that presents it.

Chapelets

50. Chaplets are beads strung together and used for counting prayers. They are used by various religions and may each have their own design. Chaplets may have devotional medals, crosses, crucifixes, or tassels attached to them.

Rosaries

51. Rosaries are a specific type of prayer beads, usually consisting of a string of 175 beads divided into 15 sets. Each set has ten small and one large bead. Some, referred to as lesser rosaries, contain only 55 beads.

52. They may be made of any material, such as wood, metal, plastic, glass, semi-precious gems.

53. Most rosaries also contain crosses, crucifixes, and devotional medals.

54. Kits consisting of all the necessary articles and materials required to assemble a rosary, for example beads, string, medals, crosses, and crucifixes, qualify for the benefits of the tariff item.

55. The Roman Catholic Church recognizes rosaries in the form of bracelets provided they can be used to count a whole rosary.

Scroll sets

56. Scroll sets may be either:

- (a) religious phylactery scroll sets known as tefillin. These are small boxes, usually made of leather, which contain small pieces of religious parchments with phrases from the Torah (Old Testament); or

- (b) Torah scrolls of handwritten parchments of the first five books of Moses. These sets usually include:

- (i) Wooden rollers around which the scroll is rolled;

- (ii) Ties used to bind the two sides of the scroll together;

- (iii) A cloth (mantle), metal or wooden box used to cover the scroll;

- (iv) the crown (Keter) used to "top" the covered pair of wooden rollers (Maklot);

- (v) The breast plate (Tzit) to hang over the mantle or wooden box;

- (vi) The pointer (Yad) used to track the text;

- (vii) Headpieces used to cap the ends of the wooden rollers;

- (viii) The cloth on which the scroll is laid.

Chanukah candlesticks

57. Chanukah candlesticks are nine pronged candelabrum. They include menorahs, which may use candles or oil and wick. Chanukah candlesticks and menorahs may have more than one Shammash, which is the flame by which the Chanukkah lights are lit, and which have a defined position.

Kiddush sets

58. A Kiddush set may consist of any combination of a wine decanter, a goblet(s), a candle holder, a tray(s), or a bread board(s) or container(s) with a cloth to cover the loaves. They are usually matched through harmony of design. .

Mezuzah boxes

59. Mezuzah boxes are small cases, of any material, containing a scroll which depicts a religious blessing or prayer. They are usually tubular in shape, three to four inches tall, and may come with brackets or attachments to affix it to a door post.

Havdalah sets

60. A complete Havdalah set commonly includes a carrying case, goblet(s), candle holder, spice box, and a single intertwined candle with multiple wicks. When imported separately, the unique items would also qualify as parts of the set.

Seder plates

61. Seder plates are most often large dishes, of any material, meant to hold the ceremonial foods during the Passover feast. They are usually divided into sections.

62. Only the plates qualify under the tariff item. Complete sets of dishes with pots and pans used during the Passover feast do not qualify.

Additional Information

63. For certainty regarding the tariff classification of a particular good, importers may request an advance ruling. Details on how to make such a request are found in Memorandum D11-11-3, Advance Rulings for Tariff Classification.

64. For more information, call contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (webform)

Contact Us at the CBSA website

References

- Issuing office:

- Trade and Anti-dumping Programs Directorate

- Headquarters file:

- HS 9986.00

- Legislative references:

- Customs Tariff

- Other references:

- D11-11-3

- Superseded memorandum D:

-

D10-15-12 dated ; and

Interim D10-15-12 dated

Page details

- Date modified: