CUSMA Countries of Origin Marking Rules

Memorandum D11-3-3

ISSN 2369-2391

Ottawa,

This document is also available in PDF (329 KB) [help with PDF files]

In Brief

1. This Memorandum is part of an overall revision of the D Memoranda series to reflect the implementation of the Canada-United States-Mexico Agreement (CUSMA).

2. The “Guidelines and General Information” contained herein provide policy and procedural information related to the administration of this free trade agreement.

This memorandum outlines and explains the legislation, regulations, and general guidelines that apply to the country of origin marking for goods imported from a Canada-United States-Mexico Agreement (CUSMA) country (i.e., the United States or Mexico).

Information pertaining to the country of origin marking for goods imported from a non-CUSMA country is found in Memorandum D11-3-1, Marking of Imported Goods.

Legislation

Customs Act

Customs Tariff

Currency Act

Determination of Country of Origin for the Purpose of Marking Goods (CUSMA Countries) Regulations

CUSMA Rules of Origin Regulations

CUSMA Tariff Preference Regulations

Canada-United States-Mexico Agreement (CUSMA)

Guidelines and general information

Definitions

1. The “Interpretation” section of the CUSMA Rules of Origin Regulations and the Determination of Country of Origin for the Purpose of Marking Goods (CUSMA Countries) Regulations contain definitions that are important in understanding the administration of both Regulations. For purposes of this memorandum, the following terms are also important:

- accessories, spare parts or tools

- means goods that are delivered with a good, whether or not they are physically affixed to that good, and that are used for the transport, protection, maintenance or cleaning of the good, for instruction in the assembly, repair or use of that good, or as replacements for consumable or interchangeable parts of that good.

- country of origin

- means the country of origin that must be marked on the good by the application of the rules set out in Sections 4 through 10 of the Determination of Country of Origin for the Purpose of Marking Goods (CUSMA Countries) Regulations.

- countries of origin

- means the countries of origin that must be marked on the good by the application of the rules set out in Sections 5 through 7 or 10 of the Determination of Country of Origin for the Purpose of Marking Goods (CUSMA Countries) Regulations.

- CUSMA country

- means a Party to the Canada-United States-Mexico Agreement.

- HS

- means the Harmonized Commodity Description and Coding System that is used for the classification of goods.

- packaging materials and containers

- means materials and containers in which a good is packaged for retail sale.

- packing materials and containers

- means materials and containers that are used to protect a good during transportation, but does not include packaging materials and containers.

- paragraph

- means a subset of a section of Regulations (for example paragraph 7(a) of the Determination of Country of Origin for the Purpose of Marking Goods (CUSMA Countries) Regulations sets out the method for determining the country of origin for marking a good when the good is produced by minor processing).

- section

- means a portion of Regulations (for example: Section 9 of the Determination of Country of Origin for the Purpose of Marking Goods (CUSMA Countries) Regulations pertains to Production Outside Canada).

- subsection

- means a subset of a section of Regulations (for example subsection 2(1) of the Determination of Country of Origin for the Purpose of Marking Goods (CUSMA Countries) Regulations sets out the definitions found in the Regulations).

- the Regulations

- means the Determination of Country of Origin for the Purposes of Marking Goods (CUSMA Countries) Regulations.

General

2. This memorandum applies to goods that have been imported from a CUSMA country. For the purposes of marking, the imported goods do not need to “originate” within the meaning of the CUSMA Rules of Origin Regulations.

3. The requirement for country of origin marking should not be confused with labelling requirements of other government departments, such as Agriculture and Agri-Food Canada or Innovation, Science and Economic Development Canada (ISED). For example, ISED's regulations require that certain product-related information, such as fabric content of wearing apparel, be shown on the product label.

4. All goods, which contain a description that might mislead a person as to the country of origin of the goods, are prohibited entry into Canada under the provisions of tariff item 9897.00.00. Information concerning the provisions of tariff item 9897.00.00 is set out in Memorandum D9-1-9, False Description of Geographical Origin of Goods and Goods With Trade Marks – Tariff Item 9897.00.00.

5. Only certain goods are required to be marked to clearly indicate the country in which the goods were made. Those goods that are required to be marked are set out in Schedule I of the Determination of Country of Origin for the Purposes of Marking Goods (CUSMA Countries) Regulations (the Regulations) and Appendix A to Memorandum D11-3-1.

6. Certain types of goods, or goods imported under specific conditions, may be exempt from the requirement for country of origin marking. There are 21 exemptions that apply to goods imported from a CUSMA country. These exemptions are listed in Schedule II of the Regulations and Appendix B to Memorandum D11-3-1.

7. Under section 4 of the Regulations, reference is made to Schedule III, the “Tariff Shift Rules.” The Tariff Shift Rules are set out in Schedule III of the Regulations and can also be found on the Department of Justice Web site.

8. For goods imported from a CUSMA country, the purpose of the marking requirement is to inform the ultimate purchaser of the country or countries of origin of the goods. The ultimate purchaser is the last person in Canada who purchases the goods in the form in which they are imported, whether or not that purchaser is the last person to use the goods in Canada. In order to have an ultimate purchaser, a purchase or transaction must occur.

Methods of determining the country of origin for marking

9. When determining the country of origin for the marking of goods imported from a CUSMA country, a set of marking rules is used. These are technical rules that are applied systematically to determine the country or countries of origin that are to be marked on the goods. These rules are set out in Sections 4 through 7 of the Regulations.

10. Section 4, paragraphs 7(b) and 7(c) and Section 8 of the Regulations only allow for a single country of origin to be marked on a good.

11. Sections 5 and 6 and paragraph 7(a) of the Regulations allow for either a single country or multiple countries of origin to be marked on a good.

12. Section 9 of the Regulations can affect the country or countries of origin determined under Sections 4 through 7.

13. Section 10 of the Regulations can affect which country or countries of origin may be marked on a fungible good.

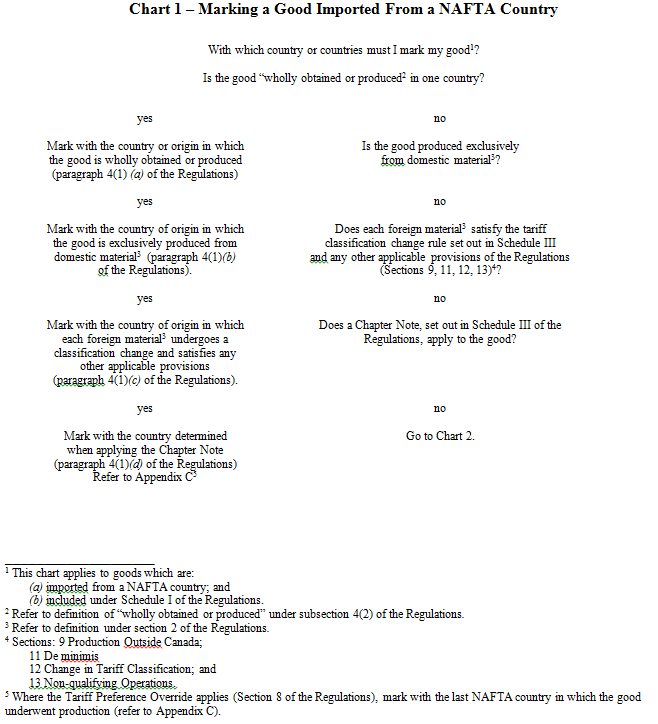

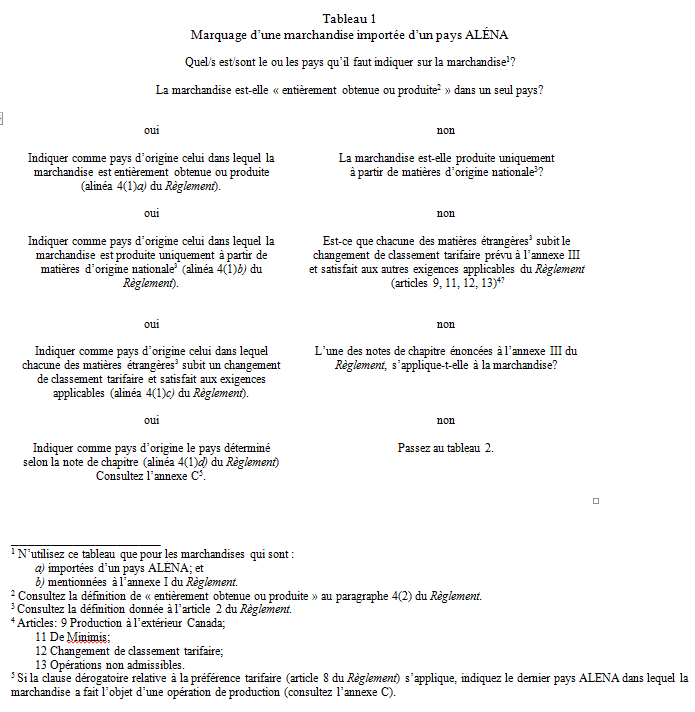

14. Appendices A and B provide charts (Charts 1 and 2 respectively) to assist in the understanding of the application of Sections 4 through 7 of the Regulations. The charts should be used in conjunction with the application of these sections and not in isolation. Place cursor over Charts 1 and 2 for a pop-up window to appear with additional information.

Application of Section 4 of the Regulations (refer to chart 1 in Appendix A)

15. Paragraph 4(1)(a) of the Regulations allows that a single country be marked on a good if the good is wholly obtained or produced in one country. “Wholly obtained” does not mean a good purchased in one country. The definition of “wholly obtained or produced” is set out in subsection 4(2) of the Regulations.

- Example 1: Dormant crocus bulbs are wholly obtained in the United States, as stipulated in paragraph 4(1)(a). They are harvested from crocus plants grown in the United States. Therefore, the bulbs are marked as a product of the United States by the application of paragraph 4(2)(b) of the Regulations.

- Example 2: Leather gloves are produced in Mexico. They are made from leather wholly produced from a cattle born and raised in Mexico. Therefore, the gloves are wholly produced in Mexico, as stipulated in paragraph 4(1)(a), and would be marked as such by the application of paragraph 4(2)(j) of the Regulations.

16. Paragraph 4(1)(b) of the Regulations allows that a single country be marked on a good if the good is produced exclusively from domestic materials. This means that the components or materials that are incorporated into the good, each qualifies in its own right as being either “wholly obtained or produced,” or meeting a tariff classification change rule under Schedule III of the Regulations. The materials must qualify as a domestic material (i.e., the same country as that in which the good is produced).

- Example: Wax candles of heading No. 34.06 of the Customs Tariff with a cotton wick are produced in the United States. The paraffin wax is a mixture of hydrocarbons obtained from petroleum extracted from the soil in the United States. The wax is therefore “wholly obtained or produced” and is considered to be a domestic material for purposes of paragraph 4(1)(b) of the Regulations. Cotton yarn of Chapter 52 is imported from Mexico to produce cotton wicks of heading No. 59.08 in the United States. This cotton yarn is a “foreign” material (i.e., it is from a country different from that in which a good, for example the cotton wick, is being produced). In order for the candles to be determined to be made “exclusively” from domestic materials, the cotton yarn must meet a change in tariff classification under Schedule III of the Regulations. The applicable rule for wicks does provide for a change in tariff classification from the “foreign” cotton yarn. Therefore, the candles would be made exclusively of domestic materials and could be marked as a product of the United States.

17. Paragraph 4(1)(c) of the Regulations allows that a single country be marked on a good, provided that each of the foreign materials incorporated in the good undergoes a change in tariff classification as set out in Schedule III of the Regulations and meets any other applicable provisions of the Regulations, such as sections 12 and 13.

- Example: Ladies' kid leather gloves of heading No. 42.03 of the Customs Tariff are made in the United States from Mexican kid leather of heading No. 41.06. The leather gloves can be marked as a product of the United States only if the Mexican material (for example the foreign materials) meets the tariff classification change rule for the ladies' leather gloves. The tariff change rule for leather gloves of 42.03 reads as follows: “a change to heading Nos. 42.03 through 42.06 from any other heading, including another heading within that group.” The Mexican kid leather meets the rule as the materials are classified outside of the heading numbers set out in the rule. Therefore, the leather gloves could be marked as a good of the United States.

18. If a foreign material that is incorporated into a good does not make a tariff classification change as set out in Schedule III of the Regulations, section 11, de minimis, may be applicable (refer to Section 11: De Minimis).

19. Paragraph 4(1)(d) of the Regulations allows that a single country of origin be marked on a good as set out by an applicable Chapter Note in Schedule III of the Regulations.

20. If, by the application of paragraph 4(1)(d) of the Regulations, a single CUSMA country cannot be determined, Section 8 may be applied (refer to Section 8: Tariff Preference Override).

21. When a single country of origin cannot be determined under section 4, then section 5 of the Regulations would be considered.

Application of Section 5 of the Regulations (refer to chart 2 in Appendix B)

22. Section 5 of the Regulations is applicable to all goods, except those that are described as a set in Schedule I of the Customs Tariff, or are classified as a set by the application of Rule 3 of the General Rules for the Interpretation of the Harmonized System. If the good is described or classified as a set, proceed directly to section 6 of the Regulations.

23. Section 5 of the Regulations provides that the country or countries of origin of the single material that imparts the essential character of the goods shall be the country or countries of origin marked on the goods. The definition of essential character is found in subsection 2(2) of the Regulations.

24. For purposes of determining the materials that impart the essential character of goods under sections 5 to 7, only materials that are incorporated into those goods and in respect of which there is not an applicable change in tariff classification shall be considered. These include materials produced by the producer of the goods and materials that are classified under the same tariff provision as that under which the goods are classified.

25. The materials which are taken into consideration are as follows:

- (a) any foreign material incorporated into the good, which does not meet the marking rule for the good as set out in Schedule III of the Regulations,

- (b) any foreign material incorporated into the good, that is classified under the same tariff provision as the good,

- (c) any domestic material that is classified the same as the foreign material which does not meet the marking rule for the good as set out in Schedule III of the Regulations,

- (d) any domestic material that is classified under the same tariff provision as the good, and

- (e) any material, produced by the producer of the goods, that is classified under the same tariff provision as the foreign material that does not meet the marking rule for the good as set out in Schedule III of the Regulations.

26. Furthermore, the factors to be taken into consideration for the purpose of determining the materials that impart the essential character of goods are as follows:

- (a) the nature of each of the materials, such as the volume, weight and value of the material,

- (b) the quantity of each of the materials, and

- (c) the role of each of the materials with regard to the use of the goods.

27. Under subsection 5(1) of the Regulations, where a single material imparts the essential character of a good, the good can be marked with the country or countries of origin of that material.

- Example: A US company produces wall clocks of subheading No. 9105.29 of the Customs Tariff. All the components are wholly obtained or produced in the United States except for the Swiss clock movement of heading No. 91.09. The country of origin of the clocks cannot be determined by the application of section 4 of the Regulations, as the foreign clock movements do not meet the change in tariff classification as set out in Schedule III of the Regulations. The clock movement is determined to be the single material that imparts the essential character of the clocks. In turn, the origin of the clock movement is determined to be Switzerland under the Regulations. Therefore, the clocks would be marked as a good of Switzerland.

28. Under subsection 5(2) of the Regulations, if the single material that imparts the essential character of the goods is fungible (i.e. interchangeable) and commingled (physically combined or mixed) in inventory so that the direct physical identification of the country or countries of origin of the single material is not practical, then the goods shall be marked with the country or countries of origin of each fungible material by the application of either subsection 5(1) or 5(2).

- Example: A company in the United States produces wool blankets of subheading No. 6301.20 of the Customs Tariff from woven wool fabric of heading No. 51.12. By the application of the Regulations, the countries of origin of the woven fabric are determined to be the US and England. When the bolts of woven wool fabric arrive at the US plant, they are covered in shrink-wrap plastic that indicates the country of origin of the fabric. The shrink wrap is removed when the bolts of fabric are placed in inventory. The fabric is fungible and commingled, and physical identification of the countries of origin of each of the fungible materials is not practical. In this instance the wool blankets would be marked as a good of the United States and England by the application of subsection 5(1) of the Regulations.

29. Furthermore, under subsection 5(2) of the Regulations, if the single material that imparts the essential character of the goods is fungible (i.e. interchangeable) and commingled (physically combined or mixed) in inventory, so that the direct physical identification of the country or countries of origin of the single material is not practical, then the goods shall be marked with the country or countries of origin of each fungible material on the basis of an inventory management method set out in Part 1 of Schedule 8 of the CUSMA Rules of Origin Regulations.

- Example: A company in Mexico produces cotton blankets of subheading No. 6301.30 of the Customs Tariff from woven cotton fabric of heading No. 52.08. The countries of origin of the cotton fabric are determined to be India and the US under the Regulations. The country of origin of the fabric is woven into the selvage edge of each bolt of fabric. The fabric is fungible and commingled in inventory so that physical identification of the countries of origin of each of the fungible materials is not practical. However, the Mexican company uses an approved inventory management method as set out in Part 1 of Schedule 8 to the CUSMA Rules of Origin Regulations. In this instance, the cotton blankets would be marked as a good of either the United States or India by the application of subsection 5(2).

30. Under subsection 5(3) of the Regulations, the country of origin of the single material that imparts the essential character of complete or finished television receivers is determined by the application of a Chapter Note to goods of Chapter 85 of the Customs Tariff. The Chapter Note can only be applied in certain circumstances to goods of subheading Nos. 8528.10 and 8528.20. The Note is found in Schedule III of the Regulations.

31. Section 8 of the Regulations: Tariff Preference Override may be applicable if a single CUSMA country or multiple CUSMA countries cannot be determined under Section 5 (refer to Section 8 ).

Application of Section 6 of the Regulations (refer to chart 2 in Appendix B)

32. This section is only applicable to goods which are specifically described in the Customs Tariff as a set or a mixture, or are classified as a set, a mixture or composite good by the application of Rule 3 of the General Rules for the Interpretation of the Harmonized System (HS).

- Example 1: Mechanical train sets of HS classification No. 9503.70.10.10 would be an example of a good described as a set in Schedule I of the Customs Tariff.

- Example 2: A travel kit consisting of a shaving brush (heading No. 96.03 of the Customs Tariff), a razor (heading No. 82.12), a hair brush (heading No. 96.03), a toothbrush (heading No. 96.03) and a comb (heading No. 96.15) put up in a leather case (heading No. 42.02) is classified under heading No. 96.03 as a set by the application of Rule 3 of the General Rules for the Interpretation of the Harmonized System.

33. Section 6 of the Regulations provides that the country or countries of origin of the goods shall be the country or countries of origin of all the materials that merit equal consideration as imparting the essential character of the good.

- Example: A US company produces plastic mechanical train sets of subheading No. 9503.70 of the Customs Tariff. The sets consist of an engine, a caboose, six cars, track, signal equipment, and lift pieces. The engine is from England, the caboose from Germany and the cars are from Denmark. The balance of the components is of US origin. All of the components are also classified in subheading No. 9503.70.

34. The country of origin of the plastic mechanical train sets cannot be determined by the application of section 4 of the Regulations, as the goods are not wholly obtained or produced, they are not made exclusively from domestic material, there is no change in tariff classification and there is no Chapter Note set out in Schedule III of the Regulations. Section 5 does not provide for goods described as sets, therefore that section cannot be applied.

35. By the application of the Regulations, the engine, caboose and cars would be considered as imparting the essential character of the train sets. Therefore, by the application of section 6 of the Regulations, the sets would be marked as a product of England, Germany and Denmark.

36. Section 8 of the Regulations, the Tariff Preference Override may be applicable for determining the country of origin to be marked on the imported goods (refer to section 8).

Application of Section 7 of the Regulations (refer to chart 2 in Appendix B)

37. When goods are produced by minor processing only, the country or countries of origin of the goods are determined by the country or countries of origin of all the materials which impart the essential character of the goods by the application of paragraph 7(a) of the Regulations. Note that the Tariff Preference Override (section 8) is not applicable when goods are produced by minor processing.

- Example: A US company sources bicycle components worldwide. The saddles (8714.95 of the Customs Tariff) are from France, the frame parts (8714.91) from Mexico, the hubs (8714.93) from Japan, the wheel rims and spokes (8714.92) from Germany. All the other bicycle components are wholly obtained from England. The US company packages, but does not assemble, the bicycle components into boxes for exportation to Canada.

38. The country of origin of the goods (i.e. bicycles) cannot be determined by the application of section 4 of the Regulations, as the goods are not wholly obtained or produced, they are not made exclusively from domestic material, there is no change in tariff classification and there is no Chapter Note set out in Schedule III of the Regulations. When the factors for determining essential character are applied, the frame parts from Mexico, or the wheel rims and spokes from Germany could be used to determine the essential character of the bicycle. Therefore, section 5 is not applicable as this section only allows for a single material. The bicycle is not a set, mixture or composite good, therefore section 6 is not applicable.

39. The bicycles are produced by merely packaging the bicycle components. This is a form of minor processing as described in subsection 2(2) of the Regulations. Therefore paragraph 7(a) can be used to determine the country or countries of origin of the bicycles. Since the frame parts and the wheel rims and spokes merit equal consideration as imparting the essential character of the bicycles, the bicycles would be marked as a good of Mexico and Germany.

40. Under paragraph 7(b) of the Regulations, the country of origin of the goods is determined by the country of origin of the parts that determine the essential character of the goods. Multiple countries of origin cannot be determined by the application of paragraph 7(b) because the parts must be from the same country. In addition, the good must be produced by simple assembly. The Tariff Preference Override may apply if a single CUSMA country cannot be determined (refer to section 8).

- Example: A US company produces leather purses of subheading No. 4202.21 of the Customs Tariff. The purses are made from Brazilian bovine and crocodile leather cut components of heading Nos. 41.04 and 41.07. Each purse consists of only three pieces.

41. The country of origin of the purses cannot be determined by the application of section 4 of the Regulations, as the goods are not wholly obtained or produced, they are not made exclusively from domestic materials, the tariff shift rule is not met, and there is no Chapter Note set out in Schedule III of the Regulations. As either the bovine or crocodile leather could be used to determine the essential character of the purses, section 5 cannot be applied. Section 5 only allows for a single material. The purses are not a set, mixture or composite good, therefore section 6 is not applicable.

42. The good is produced by simple assembly. Therefore, paragraph 7(b) of the Regulations can be used to determine the origin of the purses. The bovine and crocodile leather components merit equal consideration as imparting the essential character of the purses and both components are from Brazil. Therefore, by the application of paragraph 7(b), the country of origin of the purses would be determined to be Brazil.

43. Paragraph 7(c) of the Regulations can only be applied when the country of origin for marking of goods cannot be determined under sections 4 through 6, or by paragraphs 7(a) or 7(b). The country or countries of the goods shall be the last country in which the good underwent production. The Tariff Preference Override may apply if a single CUSMA country cannot be determined (refer to section 8).

- Example: A Mexican company produces artificial flowers of heading No. 67.02 of the Customs Tariff from components imported from Singapore and Taiwan. The components consist of petals, stamens, leaves and stems that are also classified under heading No. 67.02. The petals and leaves are made from silk, the stems from plastic and the stamens of rubber.

44. The country of origin of the artificial flowers cannot be determined by the application of sections 4, 5 or 6 of the Regulations, therefore, section 7 must be reviewed.

45. The artificial flowers are produced by more than minor processing; therefore, paragraph 7(a) of the Regulations is not applicable. There are more than five foreign components, from two different countries, that are to be assembled. Therefore, paragraph 7(b) cannot be used to determine the country of origin of the goods. By the application of paragraph 7(c), the artificial flowers would be marked as a product of Mexico as that is the last country in which the goods underwent production.

Section 8 of the Regulations: Tariff Preference Override

46. This section must be applied where a single CUSMA country has not been determined under sections 4 or 5 of the Regulations, therefore the country of origin for marking purposes will be the last CUSMA country where the goods underwent production, other than minor processing.

47. This section may only apply to goods that qualify as “originating” under the CUSMA Rules of Origin Regulations and for which a CUSMA certification of origin has been completed and signed. If it is determined that the production is by minor processing, then section 8 of the Regulations is not applicable.

Section 9 of the Regulations: Production Outside Canada

48. This section is only applicable where:

- (a) a good is determined to be of Canadian origin by the application of sections 4 to 7 of the Regulations; and

- (b) the good has undergone production in another CUSMA country; and

- (c) any production that occurred in the other CUSMA country is more than minor processing, then the goods would be marked with that last CUSMA country.

49. If the production is determined to fall within the definition of minor processing (refer to the definition in subsection 2(2) of the Regulations), then the country of origin for marking of the goods would remain as Canada.

Section 10 of the Regulations: Fungible Goods

50. Subsection 10(1) of the Regulations deals with the commingling of two or more fungible goods where direct physical identification of the country or countries of origin of the goods can be determined.

51. Subsection 10(2) of the Regulations deals with the commingling of fungible goods where direct physical identification of the country or countries of origin of the goods is not practical.

52. Subsection 10(2) of the Regulations allows the importer of the goods a choice of the following:

- (a) multiple countries of origin under subsections 10(1) of the Regulations; or

- (b) a single country of origin on the basis of an inventory management method set out in Part 2 of Schedule 8 to the CUSMA Rules of Origin Regulations.

Section 11 of the Regulations: De Minimis

53. This section is only applicable when the country of origin is being determined under paragraph 4(1)(c) of the Regulations.

54. For the purposes of paragraphs 11(1)(a) and 11(1)(b) of the Regulations, any foreign materials that are incorporated into goods and do not undergo an applicable change in tariff classification can be disregarded when determining the country or countries of origin of the goods, if:

- For textiles and textile articles of Chapters 50 to 63 of the Customs Tariff, the combined weight of the foreign materials does not exceed 10% of the total weight of the goods;

- For goods classified under any other Chapter of the Customs Tariff, other than under any of Chapters 1 to 4, 6 to 8, 11, 12, 15, 17 and 20, the value of the foreign materials is not more than 10% of the value of the goods; or

- For beverages, spirits and vinegar classified in Chapter 22 of the Customs Tariff, the value of the foreign materials is not more than 10% of the value of the goods.

55. As stated above, the de minimis provision does not apply to materials that are incorporated into goods that are classified under Chapters 1 to 4, 6 to 8, 11, 12, 15, 17, and 20 of the Customs Tariff.

56. For the purposes of subsection 11(2) of the Regulations, the importer of the goods can determine the “value of materials” in two ways. The first method, set out in paragraph 11(2)(a), provides that the value of materials is the value for duty as determined according to sections 45 to 56 of the Customs Act. The reference to the Currency Act in section 55 of the Customs Act should be read as subsection 2(1) of the CUSMA Rules of Origin Regulations.

57. The second method, set out in paragraph 11(2)(b) of the Regulations, provides that the value of materials is determined according to Schedule 6 of the CUSMA Rules of Origin Regulations.

58. For purposes of subsection 11(3) of the Regulations, the “value of any goods” is determined by the same method that the importer chose to determine the “value of materials.” In other words, paragraph 11(3)(a) provides that the value of any good is the value for duty as determined according to sections 45 to 56 of the Customs Act. The reference to the Currency Act in section 55 of the Customs Act should be read as subsection 2(1) of the CUSMA Rules of Origin Regulations. Paragraph 11(3)(b) provides that the value of any goods is the value as determined according to Schedule 6 of the CUSMA Rules of Origin Regulations. Any reference in Schedule 6 to material should be read as a reference to goods.

Section 12 of the Regulations: Change in Tariff Classification

59. When paragraph 4(1)(c) of the Regulations is used to determine the country of origin for the marking of goods, Section 12 lists certain materials that are to be disregarded when applying the tariff shift rules. The materials that are to be disregarded are as follows:

- (a) accessories, spare parts or tools that are delivered, classified and shipped with the goods;

- (b) packing materials and containers in which goods are packed for shipment; and

- (c) indirect materials.

60. Accessories, spare parts and tools include such articles as an operational manual for a television, bicycle tool kit, brush or other tool to clean out a machine, and electrical cords and power bars for use with electronic goods.

61. Indirect materials include such goods as fuel and energy, tools, dies and moulds, gloves, glasses, footwear and safety equipment. For a complete definition of indirect materials, refer to subsection 2(1) of the Regulations.

62. Under subsection 12(2) of the Regulations, a change to a good from another good/material that is classified under the same HS classification as the finished good, is only allowed when such a change is set out in a rule in Schedule III of the Regulations.

- Example: The rule for battery powered toys of subheading No. 9503.49 of the Customs Tariff reads as follows: “A change to a toy of subheading Nos. 9503.41 through 9503.49 from parts or accessories of those subheadings, whether or not there is also a change from any other heading.” In other words, this rule allows for a change to battery powered toys of subheading No. 9503.49 from parts of subheading No. 9503.49 (i.e. goods provided for under the same HS classification as the finished good).

Section 13 of the Regulations: Non-qualifying Operations

63. When determining if a foreign material undergoes an applicable change in tariff classification in Schedule III of the Regulations or satisfies any other applicable requirements, Section 13 of the Regulations defines certain operations that cannot be used to qualify the good.

Tariff Treatment

64. The marking rules are to be used to determine the tariff treatment for agricultural goods described under Article 3.1 of the CUSMA, and textile and apparel goods described under Chapter 4 and Chapter 6 of the CUSMA, as set out in the CUSMA Tariff Preference Regulations (refer to Memorandum D11-4-35, The Determination of When Goods are Entitled to the Benefit of the United States Tariff or Mexico Tariff under CUSMA).

65. For example, paragraph 4(1)(d) of the Regulations provides that the country of origin of a good is the country in which the good is considered to originate by an applicable Chapter Note set out in Schedule III of the Regulations.

- Example: Worn clothing from Mexico and the United States is collected and packaged in Mexico prior to exportation to Canada. Worn clothing is classified under HS heading No. 63.09 of the Customs Tariff. An examination of the applicable rule for goods classified under HS heading No. 63.09 indicates that Chapter Note 1 is applicable. The note states that “for purposes of heading No. 63.09, the country of origin of such a good shall be the country in which the good is last collected and packaged for shipment.” Therefore, as the worn clothing is last collected and packaged in Mexico, the goods would be entitled to the Mexico Tariff.

66. For more information concerning tariff treatments under CUSMA, refer to Memorandum D11-4-35.

Additional Information

67. For more information, contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Email: contact@cbsa-asfc.gc.ca

Contact Us at the CBSA website may also be accessed for information.

Appendix A

Appendix B

References

- Issuing office:

- Trade and Anti-dumping Programs Directorate

- Headquarters file:

- Legislative references:

-

Customs Act

Customs Tariff

Currency Act

Determination of Country of Origin for the Purposes of Marking Goods (CUSMA Countries) Regulations

CUSMA Rules of Origin Regulations

CUSMA Tariff Preference Regulations

Canada-United States-Mexico Agreement (CUSMA) - Other references:

- D9-1-9, D11-3-1, D11-4-35

- Superseded memorandum D:

- D11-3-3 dated

Page details

- Date modified: