Memorandum D11-6-11: Post-Accounting Obligations of Authorized Agents as Importer of Record

ISSN 2369-2391

Ottawa,

This document is also available in PDF (914 KB)

Note: This memoranda comes into effect

Plain language summary

Target audience: Importers of commercial goods and their agents

Key content: Liability for duties assumed by authorized agents, who are considered to be the importer of record.

Keywords: accounting, commercial goods, importer, importer of record, customs brokers, authorized agents.

On this page

- Definitions

- Guidelines

- Trade Culpability Framework

- Authorized agent as importer of record

- Shipping terms indicate owner of the goods at the time of release

- Due diligence and accountability

- Post-final accounting obligations, liabilities and compliance verifications

- Refunds

- Confidentiality

- Liability framework when an authorized agent is the importer of record

- References

- Contact us

Definitions

For the purposes of this memorandum:

- Authorized agents:

Include customs brokers and authorized persons.

- Authorized persons:

Include express couriers (i.e., CLVS participants) who have obtained an authorization under paragraph 3(3) of the Persons Authorized to Account for Casual Goods Regulations to account for casual goods in lieu of the importer or owner, or a person not resident in Canada authorized by the minister, the president, or their delegate under paragraph 32(7) to account for goods in lieu of the importer or owner of those goods. Authorized persons are a category of authorized agents.

- Business numbers:

15-digit numbers that uniquely identify a business's import-export accounts. It comprises the business's 9-digit Canada Revenue Agency business number appended by a 6-digit alpha-numerical number. The RM number is used by the Canada Border Services Agency (CBSA) to identify the business at the time of import to process customs documents and for compliance purposes.

- Casual entity:

A person other than a “commercial entity” who imports goods for personal or household use. A casual shipper is a person who exports goods to Canada without financial considerations, such as sending gifts, donations, bequests, bequeathments, or the like.

- Commercial entity:

Can be a business, partnership, corporation, trust or a body that is a society, union, club, association, commission or other organization.

- The Courier Low-Value Shipment (CLVS):

Program that streamlines reporting, release and accounting procedures for qualifying goods valued at CAD $3,300 or less and transported into Canada by authorized couriers.

- Customs brokers:

Include CBSA-licenced persons under section 10 of the Customs Act who account for the goods on the importer's or owner's behalf.

- Delivered duty paid:

A term used in international trade to indicate that the seller is responsible for delivering the goods to the buyer and is responsible for paying duties.

- Delivered duty unpaid:

A term used in international trade to indicate that the seller is responsible for delivering the goods to the buyer but is not responsible for paying duties. The purchaser is responsible for paying duties.

- Duties:

Have the same meaning as defined in section 2(1) of the Customs Act and include duties or taxes levied or imposed on imported goods under the Customs Tariff, the Excise Act, 2001, the Excise Tax Act, the Special Import Measures Act, or other acts of Parliament.

- Importer:

Usually the person(s) who brings the goods into Canada or causes the goods to be imported into Canada.

- Importer of record:

The person identified as the importer on customs declaration when goods are accounted for under subsection 32(1), (2), (3) or (5) of the Act. The importer identifies themselves by citing their business number during the CBSA release and accounting processes.

- Owner:

The person who owned the goods when the agency released them.

- Vendors:

Include foreign sellers, selling agents, platforms, and marketers directly involved in the financial transaction of goods for export to Canada.

Guidelines

Trade Culpability Framework

1. The Trade Culpability Framework (the framework) is the policy cornerstone of CBSA's trade compliance strategy. The framework guides operational efforts to nudge, direct or enforce compliance based on the relative risk posed at an entity and transaction level. The framework is behaviour-based and integrates the recognition that there are different degrees of non-compliance. By developing a variety of tools to address these varying circumstances, the CBSA is in a position to respond to trade chain partners (TCPs) in a manner best suited to foster compliance in a consistent manner.

2. The CBSA's preferred compliance instrument for low-value shipments outside the CLVS Program is a compliance validation letter. The use of this instrument over time provides important feedback to the industry on the strength of its internal controls and quality assurance systems to ensure ongoing voluntary compliance.

Authorized agent as importer of record

3. CBSA Memorandum D17-2-5: Duty Liability of Importer of Record clarifies the importer of record is the primary contact for verifications and the entity with direct liability for post-accounting obligations, including record keeping, making corrections, and payment of duties.

4. Persons who present themselves as the importer of record and who are not authorized to account for goods by the CBSA and the importer or owner may be subject to sanctions and penalties under the Customs Act (the act) in addition to being the primary contact for verifications and the entity that has direct liability for post-accounting obligations including record keeping, making corrections, and payment of duties.

5. Importers or owners sometimes contract authorized agents to be the importer of record and reimburse them for duties and fees.

6. The CBSA considers the entity that reimburses the authorized agents for duties and fees to be the importer or owner of the goods.

7. As with any importer of record, an authorized agent is the primary subject for CBSA verifications and the entity with direct liability for post-accounting obligations, including record keeping, making corrections, and payment of duties.

8. The nature of the person who reimburses the authorized agent determines the post-accounting trade program liability regime.

9. CBSA's commercial trade compliance, reason to believe, reassessment, and refund programs apply if a commercial entity reimburses the authorized agent.

10. CBSA's casual-goods compliance and refund programs apply if a casual (non-commercial) entity reimburses the authorized agent.

Shipping terms indicate owner of the goods at time of release

11. Internationally recognized shipping and sales terms may indicate the goods' owner at the time of CBSA release. This is particularly relevant when an authorized agent identifies themselves as the importer of record, and it is not self-evident to the CBSA who are the importer and owner of the goods.

12. “Delivered duty unpaid” (DDU) is a sales and shipping term that means the seller is responsible for delivering the goods to the buyer, but is not responsible for paying duties. The purchaser is responsible for paying duties.

13. When goods sold under DDU terms arrive in Canada, the carrier notifies the consignee to arrange customs accounting. The consignee may account for the goods directly with the CBSA or use the services of an authorized agent. When an authorized agent is the importer of record, the CBSA's:

- casual-goods record keeping, compliance, reassessment and refund programs apply when a casual (non-commercial) entity reimburses the authorized agent

- commercial-goods record-keeping, trade compliance, reason to believe, reassessment and refund programs apply when a commercial entity reimburses the authorized agent

14. Under a “delivered duty paid” (DDP) shipping agreement, the vendor or shipper is responsible for all transportation costs, brokerage fees, import duties, and other requirements. The Canadian consignee may have no relationship with the authorized agent or involvement in customs reporting or accounting.

15. The CBSA considers the vendor to be an owner of the goods at the time of release when the shipping terms include a variation of the DDP agreement as they are either the importer of record or reimburse an authorized agent who is the importer of record. CBSA's commercial trade compliance programs apply when a commercial entity reimburses the authorized agent.

16. Authorized agents who account for goods under an agreement with commercial entities should encourage those clients to become the importer of record .

17. The CBSA encourages all trading partners, including vendors, purchasers, importers, owners, authorized agents, and importers of record, to share clear and transparent provisions explaining how they will manage duty refunds and liability between the parties.

Due diligence and accountability

18. The CBSA maintains that consumers who reimburse authorized agents to account for goods for household use will not be obligated to maintain records, make corrections, or be the subject of routine audits.

19. While the CBSA appreciates that authorized agents who account for goods as the importer of record refer to the information provided by supply chain partners, the CBSA expects authorized agents to use sound judgment, risk management practices, and industry knowledge to assess if the information provided by their supply chain partners is reliable and sufficient to substantiate the declarations the tariff classification, valuation, and tariff treatment.

20. The CBSA expects authorized agents to gather and assess sufficient information to make an informed declaration of tariff classification, origin, and valuation by final accounting.

21. Sufficient information in this context refers to the level of detail and the quality of evidence. The CBSA expects authorized agents to know what level of detail they require to determine tariff classification, tariff treatment, and valuation.

22. Assessing the quality of the evidence requires a subjective assessment of the supplier of the information, collaboration with other sources, evaluation of risk indicators, and industry experience. The CBSA expects authorized agents to use heightened diligence and business risk management when they lack confidence in the quality of the information their supply chain partners provide.

23. The CBSA expects that when authorized agents who account for goods believe, on reasonable grounds, that information is unreliable or insufficient (in detail or quality) to support the transaction value method, they will appraise the goods using an alternate valuation method and advise their client accordingly. The CBSA expects authorized agents to assist their clients with their rights to redress should they request a reappraisal of the value for duty.

Post-final accounting obligations, liabilities, and compliance verifications

24. Persons who assume the role of importer of record for commercial importations should refer to CBSA Memorandum D11-6-8: Verification of Origin (Non-free Trade Agreements), Tariff Classification, and Value for Duty of Imported Goods, which provides information on trade program verifications conducted under section 42.01 of the Customs Act.

25. CBSA memoranda D11-6-6: ‘Reason to Believe’ and Self-adjustments to Declarations of Origin, Tariff Classification, and Value for Duty and D11-6-10: Reassessment Policy contain the policy and guidelines concerning "reason to believe" and corrections to the declarations of origin, tariff classification, and value for duty.

26. As with other commercial verifications, CBSA officers will verify and confirm the tariff classification, tariff treatment, and value of goods based primarily on the verifiable and sufficient information provided by or through the importer of record.

27. Importers of record who do not meet their statutory and regulatory obligation to provide records may be subject to sanctions and penalties under the Act.

28. Without sufficient and verifiable records provided by the importer of record, the CBSA may render re-determinations or further re-determinations based on available information. Where an importer of record cannot substantiate the declared value with sufficient and verifiable information, the CBSA may reappraise the goods under an alternate valuation method.

29. An importer of record who disagrees with the CBSA's determination, re-determination, or further re-determination of origin, tariff classification, or value for duty can submit a request for a re-determination or a further re-determination. For more information, refer to Memorandum D11-6-7: Request under Section 60 of the Customs Act for a Re-determination, a further Re-determination or a Review by the Canada Border Services Agency President.

Refunds

30. Eligibility for refunds is defined in the Customs Act. Various business models exist, including ones where the importer of record pays the duties and taxes and, therefore, is eligible for a refund.

31. CBSA Memorandum D6-2-6: Refund of Duties and Taxes on Non-commercial Importations outlines and explains the procedures for the refund of duties, goods and services tax (GST), harmonized sales tax (HST), provincial sales tax (PST), provincial tobacco and alcohol taxes, and levies under the Special Import Measures Act (SIMA) for non-commercial importations brought into Canada by mail, courier, or hand carried by the traveller.

32. CBSA Memorandum D6-2-3 Refund of Duties provides the legislation and explains the policy and procedures for refunds of duties on commercial importations.

Confidentiality

33. Information obtained from verifications will be subject to the restrictions on use and disclosure under section 107 of the act.

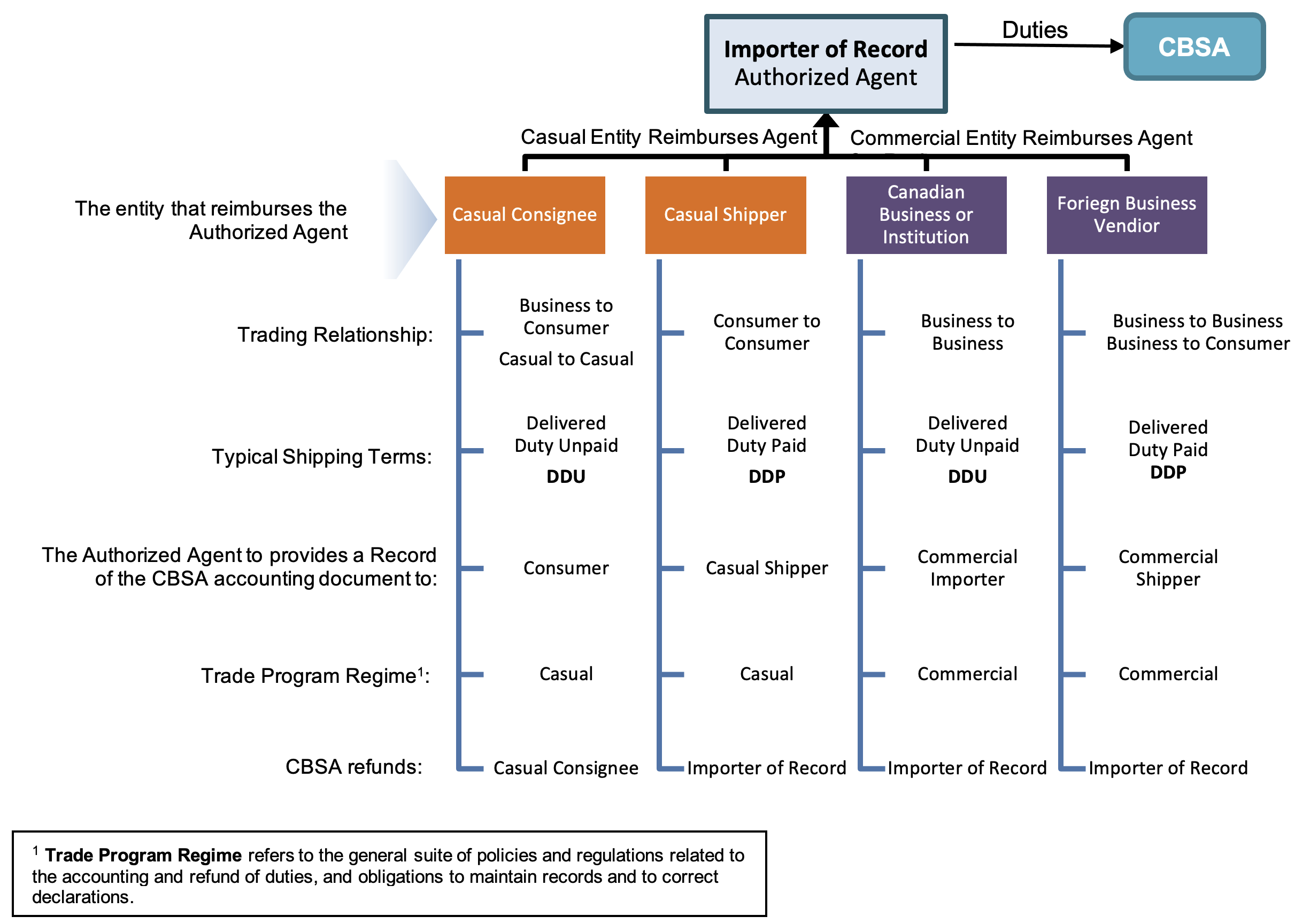

Liability framework when an authorized agent is the importer of record

Text version

The importer of record or authorized agency is ultimately liable, or responsible, for paying duties to the CBSA. Before that transaction can occur, 2 categories of entity are responsible for reimbursing the authorized agent: casual entities and commercial entities.

| Casual consignee | Casual shipper | Canadian business or institution | Foreign business vendor | |

|---|---|---|---|---|

| Trading relationship | Business to consumer Casual to casual |

Consumer to consumer | Business to business | Business to business Business to consumer |

| Typical shipping terms | Delivered duty unpaid (DDU) | Delivered duty paid (DDP) | Delivered duty unpaid (DDU) | Delivered duty paid (DDP) |

| Authorized agent provides a record of the CBSA accounting document to this entity | Consumer | Casual shipper | Commercial Importer | Commercial shipper |

| Trade program regime 1 | Casual | Casual | Commercial | Commercial |

| CBSA refunds | Casual consignee | Importer of record (authorized agent) | Importer of record (authorized agent) | Importer of record (authorized agent) |

1 Trade program regime refers to the general suite of policies and regulations related to the accounting and refund of duties, and obligations to maintain records and to correct declarations.

References

Applicable legislation

The legislation governing this memorandum's guidelines and general information is found in sections 9(3), 17(3), 17(4), 32(6), 32(7), 32.2, 42.01, and 59 of the Customs Act.

Applicable regulations

- Verification of Origin (Non-Free Trade Partners), Tariff Classification and Value for Duty of Imported Goods Regulations

- Determination, Re-determination and Further Re-determination of Origin, Tariff Classification and Value for Duty Regulations

Related D memoranda

- Memorandum D17-2-5: Duty Liability of Importer of Record

- Memorandum D17-4-0: Courier Low-Value Shipment Program

- Memorandum D17-1-3: Casual Importations

- Memorandum D17-1-21:Maintenance of Records in Canada by Importers

Issuing office

Commercial and Trade

Trade and Anti-dumping Programs Directorate

Policy Integration, Planning and Performance

Contact us

CBSA border information services

Calls within Canada and the United States (toll-free): 1-800-461-9999

Calls outside Canada and the United States (long-distance charges apply):

1-204-983-3500 or 1-506-636-5064

Page details

- Date modified: