Memorandum D17-1-4: Release of Commercial Goods

ISSN 2369-2391

Ottawa,

This document is also available in PDF (589 KB)

Plain language summary

Target audience: Importers of commercial goods.

Key content: Terms and conditions for the release of commercial goods; how to submit a release request; documents required for release; release options and processing; making a correction to documentation; cancelling a release request.

Keywords: Release of goods; customs brokers; importers; CARM; commercial importation; temporary importation; split shipments; short-shipped goods.

On this page

- Updates made to this D-memo

- Legislation

- Guidelines

- General

- Release prior to payment

- Importer business number

- Transaction number

- Electronic submission of release request

- Use of customs brokers

- Hours of release: Regular office hours

- After-hours procedures

- Electronic longroom service

- Inland Alternate Service Program

- Non-terminal office

- Compliance verification of interim accounting documents

- Timeframes for release of goods

- Proof of release

- Documentation requirements for release

- Release options

- Integrated import declaration

- Pre-Arrival Review System

- Release on minimum documentation

- Commercial Accounting Declaration

- Electronic transmission of documentation

- Paper release requests

- Release processing

- Consolidated release documents

- Courier Low Value Shipments Program rejects

- Postal importations (commercial goods exceeding $3,300 Canadian dollars)

- Customs self-assessment program

- Temporary importations

- Returning Canadian vehicles

- Form C6: Permission for Special Purposes

- Corrections to interim accounting documents using Form A48

- Corrections to invoice information

- Corrections after final accounting

- Cancelling a release request

- Release rejected, not on file or not yet reviewed

- Split shipments: Air mode

- Short-shipped goods

- Hand-carried goods release process

- Appendix A: Form BSF243 (Y50)—Reject Document Control

- Appendix B: EDI Exception Lead Sheet

- Appendix C: Release Information Sheet

- References

- Contact us

Updates made to this D-memo

This memorandum replaces Memorandum D17-1-4 dated . The following changes have been made:

- Updated content to reflect changes introduced with the CBSA Assessment Revenue Management (CARM) initiative

- Removed references to release service options SO 117 and SO 257 which were sunset on

- Removed content regarding proof of release—Release Notification System (RNS) as it is housed in Memorandum D4-1-4: Customs Sufferance Warehouses

- Added content related to high volume casual/commercial importations

- Provided content related to Canadian vehicles returning

- Various other minor policy updates and clarifications throughout the document

This memorandum outlines and explains the terms and conditions for the release of goods from the Canada Border Services Agency (CBSA).

Legislation

Importers and customs brokers who want to obtain release of goods must account for them as described in sections 32 and 33 of the Customs Act. In addition, goods will not be eligible for release until the goods have been reported in accordance with section 12(1) and 12.1 of the Customs Act (unless otherwise exempt from reporting) and the goods have arrived at the destination release office.

Guidelines

General

1. Importers and customs brokers can obtain release of goods from the CBSA, by:

- submitting a properly completed interim accounting document (release request), along with all required supporting documentation (refer to paragraph 32);

- submitting a properly completed accounting document, Commercial Accounting Declaration (CAD) Type C, along with all required supporting documentation (refer to paragraph 32).

Release prior to payment

2. Release prior to payment (RPP) privilege allows importers to submit an interim accounting document (herein used interchangeably with release or release request) to obtain release of goods before duties and taxes are paid. Importers may utilize RPP if they post security with the CBSA, account for the goods within the prescribed time limit, and pay duties and taxes owing in full by the billing due date. Refer to Memorandum D17-1-8: Release Prior to Payment Privilege and Memorandum D1-7-1: Posting Security for Transacting Bonded Operations. Refer to Memorandum D17-1-5: Registration, Accounting and Payment for Commercial Goods, for information on customs accounting requirements and payment of duties.

Importer business number

3. Importers must have a Business Number (BN) with an importer account when submitting release information. More information on the BN, including how to obtain a BN can be found in Memorandum D17-1-5: Registration, Accounting and Payment for Commercial Goods, Section 4—Business Number Registration.

Transaction number

4. Each release request is identified by a unique 14-digit transaction number. This transaction number is used to identify shipments at various times throughout the customs process.

5. Information on the transaction number is available in Memorandum D17-1-10: Coding of Customs Accounting Documents.

Electronic submission of release request

6. Release requests must be submitted electronically using Electronic Data Interchange (EDI) unless otherwise exempted. Refer to paragraph (41) for a list of exceptions to mandatory EDI.

7. EDI allows for the electronic transmission of integrated import declaration (IID) and Pre-Arrival Review System (PARS) release requests directly to the Accelerated Commercial Release Operations Support System (ACROSS). Border services officers (BSOs) review the information and transmit the release status back to the client via the Release Notification System (RNS) and/or eManifest notices system.

8. Advanced Commercial Information (ACI)/eManifest notices offer importers and customs brokers visibility into the status of the shipment as it travels (in-bond) through Canada. The “reported” notice can be transmitted to importers and customs brokers when the shipment arrives and is processed at the first port of arrival (FPOA). This notice is available to importers and customs brokers, as well as carriers and freight forwarders.

9. Clients using EDI must abide by the requirements outlined in the applicable Electronic Commerce Client Requirements Document (ECCRD) or Participants Requirements Document (PRD).

10. Copies of the applicable ECCRD or PRD can be obtained by contacting the Technical Commercial Client Unit at tccu-ustcc@cbsa-asfc.gc.ca.

Use of customs brokers

11. Importers may choose to transact business directly with the CBSA or they may authorize a licensed customs broker to conduct business on their behalf. Customs brokers are not government employees and importers are charged a fee by the brokerage company for their services. The CBSA does not regulate fees charged by brokerage companies.

12. For additional information on customs brokers, refer to Memorandum D17-1-5: Registration, Accounting and Payment for Commercial Goods.

Hours of release: Regular office hours

13. The CBSA will process a release request and examine shipments during authorized hours of service. If release is requested outside the authorized service hours, special service charges may apply. Memorandum D1-2-1: Special Services contains additional information concerning service hours and special service charges. CBSA office locations and business hours are available at Directory of CBSA offices and services.

14. Release requests may be transmitted electronically 24 hours a day, 7 days a week without imposition of special service fees. However, should a shipment require examination, the examination will be conducted in accordance with the related CBSA business hours.

After-hours procedures

15. Documentation requirements for goods released outside business hours are the same as authorized hours. Release documents must be submitted electronically unless otherwise exempted. Refer to paragraph (41) for a list of EDI exceptions.

Electronic longroom service

16. The electronic longroom (e-Longroom) service offers an alternate way to submit documentation to the CBSA. In lieu of submitting paper documents in person, select documents may be submitted by email using a PDF file. Note: Effective , customs broker licensing has transitioned from local licensing to a national licensing model. This change allows licensed customs broker to transact business at any customs office in Canada.

17. For a list of ports offering e-Longroom services, refer to e-Longroom—Release. For more information on the e-Longroom process and accepted documents, refer to Submitting import documents using the Electronic Longroom.

Inland Alternate Service Program

18. Under the Inland Alternate Service (IAS) Program, a number of small, designated CBSA service sites no longer have a physical CBSA presence. Commercial services for these de-staffed offices are provided by larger offices, referred to as a hub or a central office. Importers and customs brokers provide documentation to the CBSA for processing, at the central office via e-Longroom, mail, courier, or fax. Refer to paragraph (41) for a list of EDI exceptions. The central office is responsible for processing paper and EDI release requests, examining shipments, and processing other documentation, when required, on behalf of the IAS site.

19. Importers or customs brokers needing to conduct business at an IAS location should contact the central office, as indicated in the directory of CBSA offices, should they require assistance. Refer to Inland Alternate Service for a list of offices.

Non-terminal office

20. The CBSA does not accept electronic release requests at non-terminal offices (NTOs). Importers or brokers seeking release at these offices must submit the release request in paper format. Please refer to Non-terminal office for a list of NTOs.

Compliance verification interim accounting documents

21. The CBSA monitors all release and accounting documents for completeness and accuracy of information. Importers must comply with the statutory or regulatory provisions for release to the same extent as final accounting.

22. Information is verified at the time of release by the CBSA to ensure it meets all government requirements. For documents submitted through EDI, when an error is detected the CBSA will transmit the reject to the importer or customs broker electronically. For a paper release request, it will be returned for correction with a Form BSF243 (Y50): Reject Document Control (Appendix A), indicating the reason for rejection. An entry which has been rejected will not be eligible to be released until the CBSA receives the corrected documents or data.

23. The CBSA will facilitate the release of goods whenever possible and will not delay release requests due to minor errors in the paperwork. However, the BSO retains the right to ask for information to ensure the goods comply with all applicable legislation.

24. Voluntary disclosure of errors to the CBSA by importers or customs brokers is encouraged at all times. Such disclosure may lead to waiver of penalties and a reduction of interest. For more information on voluntary disclosure, refer to Memorandum D11-6-4: Relief of Interest and/or Penalties Including Voluntary Disclosure.

Timeframes for the release of goods

25. Goods are eligible for release upon arrival at the final destination in Canada. (i.e., port of destination as indicated on the associated cargo/electronic house bill (eHB) documents).

26. Shipments will be eligible for release only after all related cargo documents attain “arrived” status. Cargo will be considered arrived in CBSA systems only when the cargo reaches the port of destination specified in the cargo document. Before release can occur, all associated cargo(s) must be accepted and attain arrived status before a release decision (via RNS or eManifest notices) is transmitted to the importer or customs broker. Note: in scenarios where a shipment contains multiple containers, when the first container is arrived, the cargo control number (CCN) (cargo/eHB) attains arrived status.

27. Importers or customs brokers seeking release using PARS, or the IID release service options may submit their release to the CBSA as early as 45 days for PARS and 90 days for IID, before the goods have arrived at their final destination (arrived at the customs office of release or related sufferance warehouse) or 40 days after the goods have been reported to CBSA. For paper release on minimum documentation (RMD), importers and brokers can submit up to 45 days pre-arrival and 40 days after report to CBSA.

28. Importers or customs brokers seeking release post-arrival, may use the IID, PARS or CAD after the goods have arrived at their final destination (arrived at the customs office of release or related sufferance warehouse).

29. For more information on the cargo reporting requirements please refer to: Memorandum D3-2-1: Air Pre-arrival and Reporting Requirements, Memorandum D3-3-1: Freight Forwarder Pre-arrival and Reporting Requirements, Memorandum D3-4-2: Highway Pre-arrival and Reporting Requirements, Memorandum D3-5-1: Marine Pre-load/Pre-arrival and Reporting Requirements and Memorandum D3-6-6: Rail Pre-arrival and Reporting Requirements.

Proof of release

30. As per Section 31 of the Customs Act, no goods shall be removed from a customs office, sufferance warehouse, bonded warehouse or duty free shop by any person other than an officer in the performance of his or her duties under this or any other Act of Parliament unless the goods have been released by an officer or by any prescribed means.

31. For more information on sufferance warehouses and when goods can be removed from a warehouse, refer to Memorandum D4-1-4: Customs Sufferance Warehouses.

Documentation requirements for release

32. An importer or customs broker opting to submit interim accounting documentation must provide the following information to the CBSA, regardless if submitting in EDI or paper format:

- commercial invoice information from a Canada customs invoice or another acceptable supporting document, such as a bill of sale, or both, containing the following:

- vendor’s name and address

- consignee/ultimate consignee's name and address

- purchaser’s name and address (if other than consignee/ultimate consignee):

- in cases where both a purchaser and a consignee/ultimate consignee are identified on the invoice, the purchaser, not the consignee/ultimate consignee, will be the importer of record

- where only a consignee/ultimate consignee is listed, the consignee/ultimate consignee will be the importer of record

- the party identified as the importer at the time of release must be the party identified as the importer at the time of final accounting

- importer’s BN

- clients with more than one import-export program account (RM) account must specify the account identifier and enter all 15 characters of the BN (e.g., 123456789RM0003)

- the name of the importer of record must correspond with the name under which the company registered for its RM account

- unit of measure and quantity of goods

- value of the goods and currency of settlement

- detailed description of the goods

- 10-digit harmonized system (HS) code for all commodities/lines

- when multiple-page paper invoices are presented, all the HS code(s) must also be shown on the first page

- importers and customs brokers are encouraged to use bar-coded format, if available

- CSA importers, using interim accounting (e.g., PARS, RMD or IID release options) are exempt from providing HS codes at time of release, unless the goods are subject to other government department (OGD) or participating government departments and agencies (PGA) requirements

- country of origin of the goods

- transaction number (bar-coded) for paper format as outlined in Memorandum D17-1-10: Coding of Customs Accounting Documents (the requirement for the bar-coded format does not apply to goods released through a sub-agent at a non-terminal CBSA office)

- permits, licences, certificates, and/or any other documentation or authorizations required by OGDs/PGAs

- CCN, as both electronic and paper release documents require that a CCN be provided

Release options

33. Several types of release requests are available:

- (a) IID

- (b) PARS

- (c) RMD

- (d) CAD C-type

Integrated import declaration

34. The integrated import declaration (IID) allows importers and brokers to submit interim accounting documentation to CBSA for review and processing to obtain release of goods. The IID can be submitted electronically up to a maximum of 90 calendar days before the goods arrive at the CBSA office of release. One IID document can link up to 999 related cargo control documents using the related CCN, reducing the need for multiple release document submissions.

35. The IID is designed to accommodate the CBSA and PGA data requirements for regulated goods. Importers or brokers will transmit the IID to CBSA and a BSO will review the IID information. Once the BSO has completed their review, the ACROSS system will be updated with a recommendation for whether to release or refer the goods for examination. For regulated goods, information will be verified by the applicable PGA(s) and validated on the importers behalf.

36. In accordance with PGA legislative requirements and/or international agreements, the document image functionality (DIF) allows importers and brokers to transmit paper licences, permits, certificates and other documents (LPCOs) electronically, as images through EDI. Please refer to the D memoranda D-19 Series: Acts and Regulations of Other Government Departments for additional information.

Pre-Arrival Review System

37. The Pre-Arrival Review System (PARS) allows importers and customs brokers to submit pre- or post-arrival interim accounting documentation to obtain release of goods. The BSO reviews the PARS information, and updates the CBSA systems with a decision to release or refer the goods. PARS can be submitted electronically up to a maximum of 45 calendar days before the goods arrive at the CBSA office of release or 40 days after the goods have been reported.

Release on minimum documentation

38. Release on minimum documentation (RMD) allows importers and customs brokers to submit paper interim accounting documentation to CBSA for review and processing to obtain release of goods both pre- and post-arrival, and allows submission of multiple CCNs. RMDs can only be submitted in paper format and only when an exception to EDI applies. Refer to paragraph (41) for a list of exceptions to mandatory EDI.

Commercial Accounting Declaration

39. The Commercial Accounting Declaration (CAD) C-type is a customs document used to obtain release and account for imported goods. For more information on this form, refer to Memorandum D17-1-10: Coding of Customs Accounting Documents.

Electronic transmission of documentation

40. Importers and customs brokers using interim accounting must transmit their documentation electronically as per guidelines stipulated by the applicable IID ECCRD or ACROSS PRD. Contact the Technical Commercial Client Unit at tccu-ustcc@cbsa-asfc.gc.ca for a copy of the ECCRD/PRD.

41. Certain exceptions to the requirement to transmit interim accounting documentation electronically using EDI apply. The exceptions are as follows:

- goods are subject to the requirements of another government department or agency and the required information cannot be transmitted using the IID

- the invoice for the release transaction contains more than 999 invoice lines

- shortages, either entered to arrive or value included

- there is more than one warehouse sub-location code per release transaction

- the CBSA has issued a paper Form BSF243 (Y50): Reject Document Control to the importer or customs broker for shipments refused clearance through the Courier Low Value Shipment Program

- goods are moved into a bonded warehouse for long term storage using the paper RMD (grey wrapper)

- goods are to be released from a Queen’s warehouse

- CBSA or client system outages

- regulated goods qualify for tariff classification 9813 or 9814 (Canadian Goods Returning) (note: paper release package must include both chapter specific Tariff code and 9813/14)

- goods are to be released at non-terminal offices

Paper release requests

42. A paper interim accounting release request will only be accepted if one of the above exceptions apply. An EDI Exception Lead Sheet (Appendix B) must accompany the paper release package indicating the applicable exception. The BSO retains the right to refuse the paper package if it does not meet one of the exceptions listed in paragraph (41).

43. Importers who are not set up to transmit electronic release documentation to the CBSA will be required to submit Form CAD Type C in order to obtain release of their goods. An EDI Exception Lead Sheet is not required when submitting a CAD C-type.

44. For paper submissions of RMD, the documents must be submitted to the CBSA in the following order:

- EDI exception lead sheet (refer to Appendix B: Exception Lead Sheet)

- OGD or PGA required documentation (e.g. permits, licences, certificates)

- CBSA documentation, invoice(s), release information sheet—optional (refer to Appendix C: Release Information Sheet) and supporting documentation

45. The transaction number or CCN must be in bar coded format on paper release requests submitted to the CBSA. Technical specifications for bar-coded CCNs can be found in Memorandum D3-1-1: Policy Respecting the Importation and Transportation of Goods.

46. When shipments do not arrive within 45 days, documents, paper permits, etc., are returned to the importer or customs broker.

47. Effective , customs broker licensing has transitioned from local licensing to a national licensing model. This change allows licensed customs brokers to transact business at any customs office in Canada.

Release processing

48. Release requests, whether submitted in EDI or paper formats, are processed in the same manner by the BSO in the ACROSS system and are subject to the same validation, admissibility and risk assessment rules.

49. The exporter/vendor provides information on the goods to be imported to the importer or customs broker, e.g., weight, quantity etc. Documentation may include an invoice or bill of lading. The importer or customs broker submits a release request to CBSA. If using IID, the importer or broker can submit the release request a maximum of 90 calendar days before the goods arrive at the CBSA office of release. If using PARS (EDI) or RMD (paper), the release request can be submitted a maximum of 45 calendar days before the goods arrive at the CBSA office of release.

50. Cargo will be considered “arrived” in CBSA systems only when the cargo reaches the port of destination specified in the cargo document. Before release can occur, all associated cargo(s) must be accepted and attain arrived status before a release decision (via RNS or ACI/eManifest notices) is transmitted to the importer or customs broker. The sub-location code on the release request (if provided) and the port of destination sub-location code on the associated cargo control documents should match. When the ports match, this will reduce corrections after the goods have been released.

51. The BSO reviews the release request and updates ACROSS with a recommendation whether to release or refer the goods when they arrive, or will make a final decision if the goods have arrived at their final destination in Canada.

52. For importers seeking release at the first point of arrival (FPOA), once the conveyance arrives at the FPOA, all cargo and electronic house bill (eHB) documents associated to the conveyance will be placed in “reported” status. In addition, any cargo or eHB with a port of destination equal to FPOA will be placed in “arrived” status. If the release request is on file and in good standing, the corresponding release or refer for examination notices will be transmitted to all relevant parties, including the importer or customs broker.

53. For importers or customs brokers seeking release in-land at a sufferance warehouse, the warehouse operator will advise the CBSA when the goods have arrived. Once the CBSA accepts and processes the warehouse arrival certification message (WACM), and if the release request is on file and in good standing the corresponding release or refer for examination notices will be transmitted to all relevant parties, including the importer or customs broker, if trade chain partners (TCPs) are signed up to receive these notices.

Consolidated release documents

54. Importers and customs brokers are encouraged to utilize the functionality available on all release requests that consolidate (group together) imported shipments by the same importer, within the same release document.

55. Multiple shipments with multiple CCNs can be accommodated and transmitted to CBSA using a single release request if managing shipments in such a manner is beneficial to the importer or customs broker. Consolidated release requests grouped together into a single release request reduce the number of EDI transmissions and simplify the processing at time of release. All pertinent invoice/release data requirements remain the same, regardless of whether the release request is consolidated or not.

56. It's important to structure release requests so that the CBSA can clearly determine which invoices and commodities are related to which shipments in multi-shipment consolidated scenarios.

57. The commercial stream can accommodate both commercial and casual (non-commercial) goods using the IID or PARS electronic release service options. However, commercial and causal goods should not be transmitted within the same release transaction, even when being imported by the same importer.

58. Invoice data (please refer to paragraph 32 for more information) for EDI or paper is required for commercial or casual goods imported using the commercial stream. The entity to whom the goods are consigned, often called the end user or ultimate consignee, must be included if different from the importer/owner accounting for the goods. The IID was developed with these considerations in mind and can accommodate several different approaches to providing the required information. For example, importers or customs brokers can group ultimate consignee by commodity or list each commodity and ultimate consignee separately, all within the same invoice, or provide ultimate consignee at the invoice level for multiple commodities.

59. At time of release, if an entity exists, other than the importer or owner, where the goods will be delivered, that entity name and address (as ultimate consignee) must be provided to the CBSA. This information will ensure the CBSA can properly determine who caused the goods to be imported and their final destination in Canada. The CBSA will use this information to complete a risk assessment, compliance verification and determine admissibility on behalf of OGDs/PGAs.

60. The IID and PARS release service options allow up to 999 invoice lines to be transmitted electronically, if imported by the same importer, and captured in a single release document. More information on the IID or other release option limitations can be found in the applicable ECCRD or PRD.

Courier Low Value Shipment Program rejects

61. Goods imported through the Courier Low Value Shipment (CLVS) Program, that are removed post-arrival by the CBSA from the cargo/release list, must be submitted as a paper release request or accounting package (CAD) to the CBSA office that issued the reject notice. An EDI Exception Lead Sheet (Appendix B) must accompany the paper release request. Note: when submitting the paper release package and EDI Exception Lead Sheet, the importer or broker is encouraged to include a copy of the Y50 with the paper package, to reduce delays and ensure smooth operational processing.

62. Should a CLVS Program participant identify that a shipment no longer qualifies for report and release privileges under the CLVS Program prior to the shipment's arrival in Canada, there is an obligation to provide ACI/eManifest pre-load/pre-arrival data to the CBSA within specified advance timeframes. In addition, an electronic release or accounting package (CAD) must also be submitted.

63. For more information on the CLVS program, refer to Memorandum D17-4-0: Courier Low Value Shipment Program.

Postal importations (commercial goods exceeding $3,300 Canadian dollars)

64. In the case where commercial goods have been imported through the mail stream and the value for duty exceeds $3,300 Canadian dollars (CAD), the importer or customs broker can obtain release of the goods by presenting the appropriate documentation to a CBSA office or submit an electronic release request to CBSA using “E14-” as the carrier code in the cargo control number (CCN) field. This will ensure a related cargo document is not required to release the shipment. Where the importer has posted the required security for release prior to payment privileges, electronic release is permitted. Once the release documentation has been approved, the CBSA commercial office advises the applicable International Mail Centre to release the mail shipment to the Canada Post Corporation (CPC) for delivery.

65. For more information on postal processing, including accounting instructions for commercial goods exceeding CAD $3,300, refer to Memorandum D5-1-1: International Mail Processing.

Customs self-assessment program

66. Customs self-assessment (CSA) streamlines the import process for pre-approved Canadian importers by using their internal business systems and processes in place of the traditional customs process. Under CSA, most elements of the import process from release, accounting, adjustment and payment of duties are modified.

67. CSA-approved importers may use IID or PARS service options for release when goods/carriers do not qualify for the CSA process.

68. For more information on CSA, refer to Memorandum D23-3-1: Customs Self-Assessment Program for Importers.

Temporary importations

69. Memorandum D8-1-4: Administrative Procedures Related to Form E29B, Temporary Admission Permit and Memorandum 8-1-7: Use of A.T.A. Carnets and Canada/Chinese Taipei Carnets for the Temporary Admission of Goods outline the documentation requirements for goods temporarily imported into Canada.

Returning Canadian vehicles

70. Canadian goods returning to Canada, (including Canadian registered vehicles), from a foreign country are considered an importation by the CBSA.

71. If the vehicle is being transported back to Canada by someone other than the importer/owner, the Canadian resident may utilize the services of a customs broker to release and account for their vehicle as Canadian goods returning using tariff code 9813/14, and any other goods contained therein. A broker may submit an EDI PARS release request to CBSA for the purposes of getting release of the vehicle. Note: the IID should not be used to release returning Canadian vehicles. One invoice line is to be used for the Canadian registered vehicle and additional lines for additional goods. The hand carried goods (HCG) release process may be utilized depending on the individual who is transporting the vehicle, or when the vehicle is being driven back to Canada by a third party service provider (e.g. drive-away company) that is not a commercial carrier. Refer to paragraphs (113-121) for more information on the HCG release process.

72. If the importer/owner hires a transportation company (carrier) to provide transport of the vehicle back to Canada, the importer/owner may utilize the services of a customs broker. However, the HCG release process may not be used, as ACI (cargo and conveyance) information will be required and the release request must be linked to the cargo document. For more information on returning Canadian vehicles, see Vehicles transported back to Canada from the U.S. by commercial carrier.

Form C6: Permission for Special Purposes

73. A CBSA Regional Director General may authorize a paper Form C6: Permission for Special Purposes in the following situations:

- to allow raw leaf tobacco to be delivered directly to a licensed packer or licensed manufacturer to determine the standard weight prior to preparation of the final accounting

- to allow imported spirits to be delivered directly to a distillery to determine the quantity and strength prior to preparation of the final accounting

- to obtain release of imported bulk cargoes, which have to be weighed or gauged prior to preparation of the final accounting documentation

- allow an importer or customs broker to open a parcel in a warehouse to get documents that are needed to obtain release of goods

74. The importer or customs broker should state on the form why permission is required before submitting it to the local CBSA office. Note: Form C6 should not be used for scenarios other than those provided above.

Corrections to interim accounting documents using Form A48

75. Importers and customs brokers submitting interim accounting documentation to CBSA must present true, accurate and complete information. However, when errors occur, the CBSA will accept corrections to certain data elements using Form A48: RMD Correction.

76. Form A48 can only be submitted after release, but prior to final accounting (CAD).

77. Form A48 can be used to correct any interim accounting document, including IID and PARS, as well as a paper RMD.

78. Form A48 can only be used to correct the following data elements:

- importer BN

- transaction number

- CCN

- container number(s)

- sub-location code

- customs office

79. The CBSA will only process a Form A48 that contains the proper supporting documentation. Importers or customs brokers are encouraged to submit Form A48 to the CBSA as soon as the error is discovered to avoid the possibility of late accounting penalties.

Corrections to importer business number using Form A48

80. A change to the business number (BN) after the goods have been released poses a higher level of concern to the CBSA. Such requests may result in additional questioning regarding why the error occurred. In addition to Form A48, a waybill, purchase order, commercial invoice (not Canada Customs Invoice) or a similar document which clearly establishes that the claimant is the true importer of record, must be presented as supporting documentation.

81. The A48 is not to be used for changes to the importer BN once final accounting has been submitted to the CBSA. For procedures on corrections to the importer BN after final accounting, please refer to Memorandum D17-2-3: Importer Name/Account Number or Business Number Changes.

Corrections to transaction numbers using Form A48

82. A completed Form A48 from the proper customs broker (or designate) responsible for the accounting will be required. The A48 must be signed by both customs broker managers (or supervisor/senior staff person) and attached to a hard copy paper release package or CAD Type C entry, submitted through the CARM portal. The original date of release will be used as the date of release for the corrected transaction. Sub-agents acting on behalf of another customs broker must ensure they provide the primary customs broker’s bar coded transaction number.

Corrections to cargo control number, container number(s) using Form A48

83. When providing a correction to the CCN(s), the client must provide the corrected CCN(s) on Form A48. A paper copy of the cargo control document can be provided. The correct CCN(s) and/or container number(s) must be in a valid cargo status for purposes of release.

84. The IID does not contain a container number(s) data element. Importers or brokers cannot send this data element when submitting the IID to CBSA and therefore form A48 should not be submitted to CBSA for the purposes of correcting container numbers on the IID, as the IID does not contain this field.

Corrections to the customs office of release or sub-location code using Form A48

85. Form A48 requesting a change to the CBSA office of release and sub-location code are to be submitted to the CBSA office where the goods are physically located and will only be accepted if the goods are still under CBSA control (i.e., they have not been removed/released from the sufferance warehouse).

86. An RNS message and/or ACI/eManifest notice will be generated by the CBSA for the client and the applicable sufferance warehouse.

Corrections to invoice information

87. Form A48 is not to be used to make corrections to invoice information.

88. Importers and customs brokers can make electronic corrections to invoice information using the IID, up until the IID has been released by the CBSA. Corrections to invoice information can be completed using the “amend” function after arrival, but before release and is only available on the IID. Details on the amend function can found in the IID ECCRD. PARS corrections to invoice information can be completed electronically up until the associated cargo has attained reported/arrived status.

89. If a correction is required to invoice data after release and before final accounting, the importer or broker must submit a paper RMD release package (in a salmon wrapper) with the correction(s) highlighted. The same transaction number should be used as the original release. The BSO will cancel the original transaction and enter the new information based on the paper RMD release package presented.

Corrections after final accounting

90. Changes requested to interim accounting after final accounting (CAD) has been submitted will only be considered in circumstances where the goods are still under CBSA control in a sufferance warehouse (e.g., changes to CCN, sub-location code or container number). If accepted, the importer or broker must submit a paper RMD release package (in the salmon wrapper) with the original transaction number and the correction(s) highlighted.

91. Depending on the correction, an RNS message and/or ACI/eManifest notice may be generated by CBSA for the client and the applicable sufferance warehouse.

Cancelling a release request

92. Importers or customs brokers can electronically cancel a release request at any time before the associated cargo(s) linked to the release request have been reported to CBSA. Once the related cargo/eHB documents have attained reported/arrived status, the release request becomes locked by the CBSA and can no longer be amended.

93. Importers or customs brokers seeking to cancel a release request after the associated cargo documents have been reported or arrived must do so by requesting a cancellation in writing on a company letter head explaining the reason for the cancellation. Similarly, if the release request has been released, but a CAD has not been submitted, the same procedures apply.

94. In cases where a cancellation to a release request has been requested after final accounting has been submitted, consideration to this request will be given depending on the circumstances.

Release rejected, not on file or not yet reviewed

95. If the shipment has arrived at destination and the warehouse operator has submitted a WACM, a small delay can be expected until the BSO reviews the transaction(s) and makes a release or refer decision. In most cases, the shipment is released with little delay.

96. When a shipment arrives at its final destination (as stipulated in the cargo/eHB document) and the release request is not on file, the goods will be held until the release request is submitted and processed accordingly. In the highway mode, cargo/eHB which have attained arrive status at the FPOA are normally released when a release request is on file and in good standing. If the importer or customs broker failed to submit the release request the goods may not be released at FPOA (this scenario is commonly referred to as Failed PARS). The carrier and importer/customs broker have two options to have the goods released.

- The goods can be held at the FPOA until the release request is submitted and processed by the CBSA

- The shipment can be moved to an in-land location for release at a sufferance warehouse. If the goods are moved in-land the carrier should notify the importer or customs broker of the change in location of the release office

97. In cases where a shipment arrives and the release request is in a reject status, the onus is on the importer or customs broker to make the correction before release can occur. A note is often provided in the reject message identifying the cause of the reject and the corrective actions that must be taken.

Split shipments: Air mode

98. Please refer to Memorandum D3-2-1: Air Pre-arrival and Reporting Requirements for information regarding split shipments in the air mode.Short-shipped goods

99. Goods are ”short-shipped” when the quantity of goods originally reported to the CBSA is different from that received by the importer or customs broker. There are two short shipped situations that may occur:

- the total number of packages originally reported does not match the number of packages received by the consignee or importer. These short-shipped goods can be documented on an enter to arrive (ETA) release request

- the number of articles originally reported as contained in a package does not match the contents of the package. These short-shipped goods can be documented on a value included (VI) release request

100. Goods cannot be released under ETA and VI release options when:

- the importer or customs broker is aware that the entire quantity of the goods reported on the invoice will not be in the shipment when it arrives in Canada

- the BSO finds that the quantity reported does not match the quantity found during examination of the goods

- the goods are reported to be on back-order

- the goods are bonded warehouse shortages. Refer to Memorandum D7-4-4: Customs Bonded Warehouses

101. A full shortage occurs when the entire shipment was never delivered to the importer. In this situation, the entered to arrive (ETA)/value included (VI) process should not be used. Instead, full shortages will be processed as a separate and unique importation, requiring the importer or customs broker to submit a new release request. In the scenario where the original transaction has attained released status, but has not yet been acquitted (final accounting has not been submitted), the importer/broker may request to cancel the original transaction. If the original transaction has been acquitted, the importer or customs broker must request a refund.

Short-shipped goods processing

102. ETA and VI shipments must be presented as paper release requests only, regardless of the service option used for the original release request.

103. If a shortage is discovered after release but before final accounting, the importer or customs broker has two options:

- to account for the total quantity and have the balance of the goods released as an ETA or VI when they arrive

- to provide the CBSA with evidence of the shortage with the final accounting document and account for the goods on hand only. When the remaining goods arrive, they should not be reported as a shortage. Instead, standard release procedures will apply

104. When goods are released as an ETA or VI, the accounting time limits will start on the date of release of the first shipment.

105. If the shortage is discovered after final accounting, either the balance of the short-shipped goods may be released as an ETA or VI, or a claim may be made for a refund if the importer does not expect the goods to be delivered at a later date. To obtain a refund, a claim, with evidence of the shortage, must be submitted to any CBSA office in the region where the goods were released. Memorandum D6-2-3: Refund of Duties contains further information on refund procedures.

Short-shipped goods documentation

106. The documents required to release short-shipped goods as ETA are:

- one copy of the documentation supporting the claim for the shortage, e.g., a shipping order or letter from the shipper/carrier, vendor or manufacturer indicating that the goods were not shipped

- Reference to the original cargo control document (CCD) including the CCN, and the CCN for the new CCD. When more than one carrier is involved, a loading sheet from the original carrier is required to substantiate the shortage. Note: ACI (cargo and conveyance) data is required for all ETA shipments

- two copies of the invoices covering the original shipment. This invoice should contain the following information:

- importer BN

- transaction number of the original shipment

- notation “ETA Shortage”

- indication of which goods were short-shipped

- original CBSA release office

107. The documents required for short-shipped goods to be released as a VI transaction are:

- two copies of the original documentation supporting the claim for the shortage

- reference to the original CCD including the CCN, and the CCN for the new CCD. Ensure a reference to the original shipment in the description field is required. Note: ACI (cargo and conveyance) data is required for all VI shipments

- two copies of an invoice containing an accurate description of the short-shipped goods. This invoice should contain the following information:

- importer BN

- transaction number of the original shipment (a new transaction number is not acceptable)

- a notation “VI shortage”

- name of the original CBSA release office

- invoice page and line number for the original transaction relating to the short-shipped goods

Known short shipments

108. A commodity invoiced as a single transaction may have to be imported in separate loads due to the nature of the shipment. For example, certain machinery, equipment, and large systems such as an oil rig must be shipped in multiple loads over time. In these cases, the entire quantity of goods will be accounted for when the first shipment arrives, and the remainder will be processed on importation as ETA. All the ETA shipments have to be processed within 12 months from the date of accounting of the first shipment.

109. Before the goods arrive, a written request must be submitted to the chief or superintendent at the CBSA office where the first shipment is to be imported. The request should include the following information:

- reason for shortage

- name and BN of the importer

- name of the exporter

- unit of measure and quantity of goods

- value of the goods

- harmonized system tariff number

- detailed description of the goods

- country of origin

- number of ETAs

- estimated date(s) of arrival including the completion date

110. If the request is approved, the CBSA will send a letter of authorization to the importer or customs broker and retain the information pending arrival of the first shipment and all ETAs.

111. For the first shipment, the importer or customs broker must submit a paper release request with the letter of authorization to the designated CBSA office.

Known short shipments documentation

112. The documents required for this type of ETA release are:

- a copy of the letter of authorization

- Reference to the CCD, including the CCN —note: ACI (cargo and conveyance) data is required for all ETA shipments

- two copies of the invoice(s) covering the original shipment containing the following information:

- importer BN

- transaction number of the original shipment

- name of the original customs release office

- notation “ETA Shortage”

- actual quantity being released

Hand-carried goods release process

113. The hand-carried goods (HCG) release process provides importers and customs brokers with the option of using PARS, IID, or paper RMD release options in order to obtain release of commercial goods being transported to Canada by an individual who is not a carrier. Note: HCG release requests must be submitted electronically unless an EDI exception applies.

114. The HCG release process is applicable to all modes for qualifying shipments and may be used as an alternative release option to submitting a paper CAD Type C.

115. Release must occur at FPOA. In-bond shipments are not eligible for the HCG release process.

Qualifying shipments authorized to use the hand-carried goods release process

116. Commercial shipments qualifying for release using the HCG release process are strictly limited to shipments being transported by an individual who does not meet the definition of a “carrier.” Examples of qualifying shipments include:

- Commercial goods carried by paying passengers on board traveller commercial conveyances (bus, taxi, plane, ship, ferry, etc.)

- Commercial goods being transported by and accounted for at the FPOA by the owner of a business, or an employee, driving a “not for hire,” conveyance

- Commercial shipments being imported into Canada by any individual who does not meet the criteria of “carrier” and who is not required under regulations to have, use and maintain a valid CBSA-issued carrier code

- Commercial vehicle or conveyance being imported into Canada where a non-carrier is driving the vehicle into Canada (e.g., where the conveyance is the good being imported, e.g., dealer, drive-away company)

- Importation of new Canadian aircraft

- Canadian aircraft returning to Canada after having been repaired abroad and to account for those repairs

- Non-Canadian aircraft temporarily being imported into Canada for repairs

Shipments not eligible to use the hand-carried goods release process

117. Shipments transported to Canada by a carrier are not considered hand-carried goods (HCG). As such, the shipment cannot be released using the HCG release process.

118. If the release request doesn't meet the criteria of the HCG release process, the CBSA will reject the release request and the importer or customs broker may have to account for the goods using CAD Type C submitted through the CARM portal.

Hand-carried goods carrier codes

119. All release requests require a CCN (assigned by the importer or their customs broker) to be accepted in ACROSS. In order to facilitate the release of qualifying shipments under the hand-carried goods (HCG) release process using any release option, mode-specific HCG codes have been designated. The importer or customs broker seeking to use the HCG release process will use the applicable 4-character HCG code in order to assign the required CCN needed to process a release request.

The mode-specific HCG codes are shown below:

| Mode-specific HCG code | Mode of import/transport | Release option |

|---|---|---|

| HCGA | Air | PARS-EDI, IID, paper RMD or CAD Type C |

| HCGM | Marine | PARS-EDI, IID, paper RMD or CAD Type C |

| HCGH | Highway | PARS-EDI, IID, paper RMD or CAD Type C |

| HCGR | Rail | PARS-EDI, IID, paper RMD or CAD Type C |

120. For purposes of the HCG release process only, the HCG CCN is not required to be in bar coded format. Handwritten HCG CCNs will be accepted provided they are legible. Technical specifications for bar-coded CCNs can be found in Memorandum D3-1-1: Policy Respecting the Importation and Transportation of Goods.

121. Paper RMD release requests will only be accepted if the shipment is excluded from mandatory EDI. Exceptions to mandatory EDI are listed in paragraph 42.

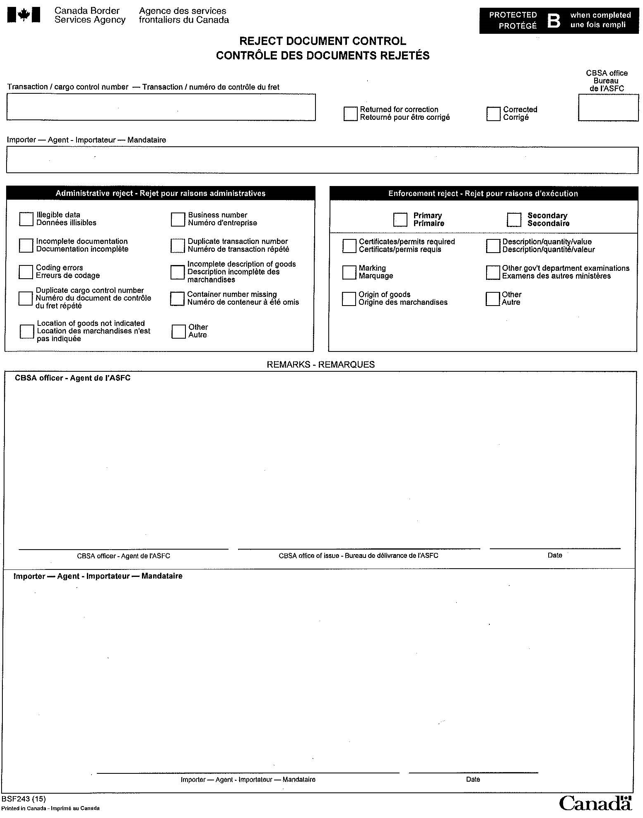

Appendix A: Form BSF2Y3 (Y50)—Reject Document Control

Figure 1: Text version

This Protected B form is issued by the Canada Border Services Agency.

The top of the form has sections to note:

- the transaction or cargo control number

- whether the entry was returned for correction or has been corrected

- the CBSA office

- the importer

Next, the form provides selections for administrative and enforcement rejection.

Reasons for administrative rejection:

- illegible data

- incomplete documentation

- coding errors

- duplicate cargo control number

- location of goods not indicated

- business number

- duplicate transaction number

- incomplete description of goods

- container number missing

- other

Reasons for enforcement rejection:

- certificates/permits required

- marking

- origin of goods

- description/quantity/value

- other government department examinations

- other

Finally, the form has sections for the border services officer and/or importer to provide remarks and sign.

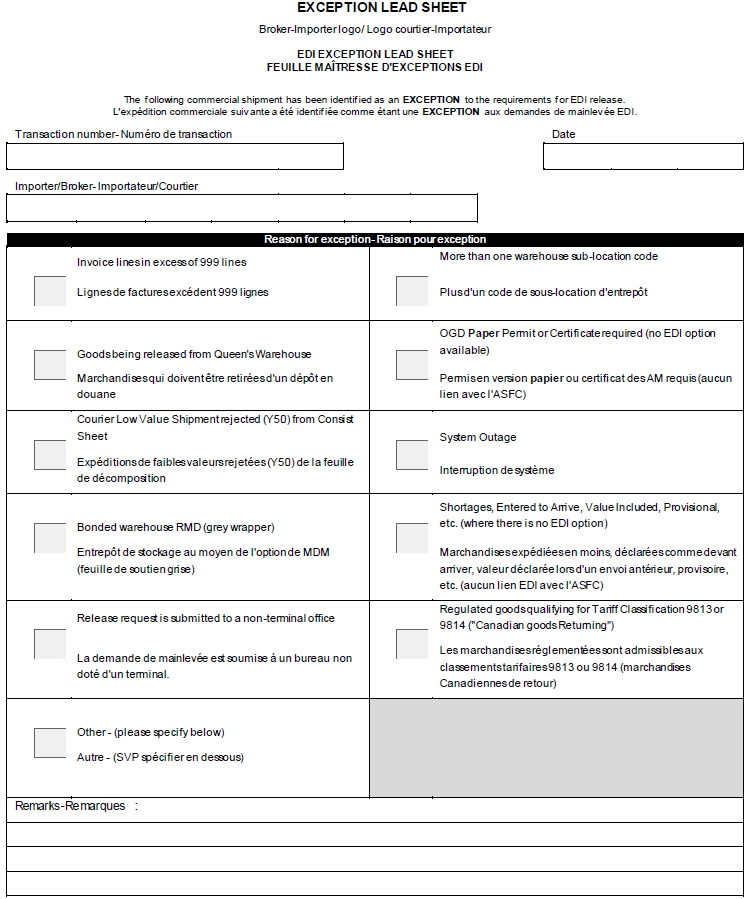

Appendix B: Exception Lead Sheet

Figure 2: Text version

Sample template of an EDI exception lead sheet to be used when a commercial shipment has been identified as an exception to mandatory EDI.

The top of the form has sections to note:

- the transaction number

- date

- the importer/broker

Next, the form provides selections the reason for exception.

Reasons for exception:

- Invoice lines in excess of 999 lines

- goods being released from a Queen’s warehouse

- Courier Low Value Shipment rejected (Y50) from Consist Sheet

- bonded warehouse RMD (grey wrapper)

- release request is submitted to a non-terminal office

- more than one warehouse sub-location code

- OGD Paper Permit or Certificate required (no EDI option available)

- system Outage

- shortages, entered to arrive, value included, provisional, etc. (where there is no EDI option)

- regulated goods qualifying for tariff classification 9813 or 9814 (Canadian Goods Returning)

- other

Finally, the form has sections for importer and/or broker to provide remarks.

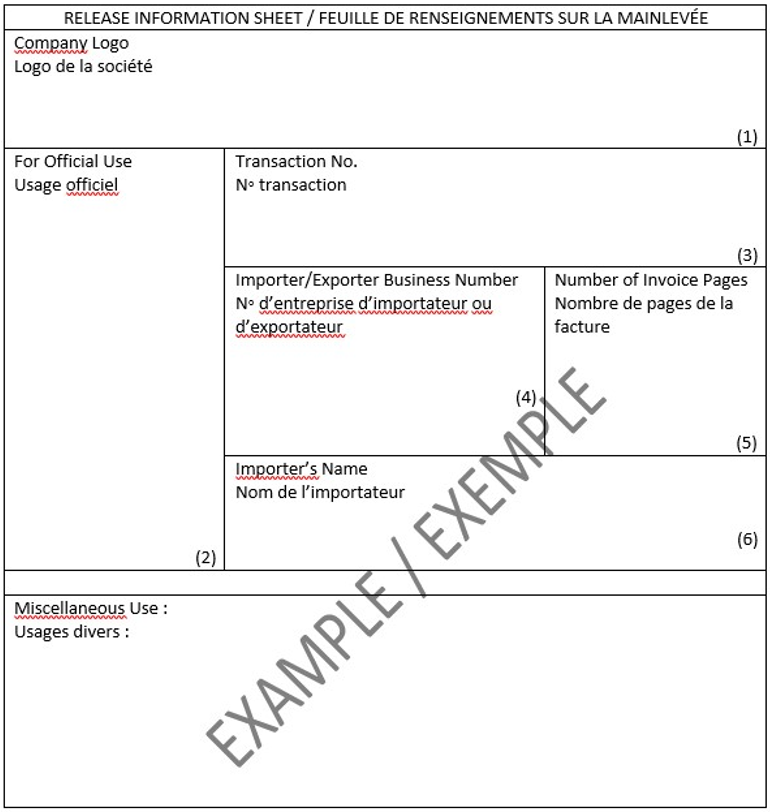

Appendix C: Release Information Sheet

Figure 3: Text version

Sample template of an release information sheet (optional) to be included in a paper release package.

The form has sections to note:

- company logo

- section for official use

- the transaction number

- importer/exporter business number

- number of invoice pages

- the importers name

- miscellaneous use

References

Consult these resources for further information.Applicable legislation

Customs Act, sections 31, 32, 33, and 35

Related D memoranda

- Memorandum D 1-2-1: Special Services

- Memorandum D 1-7-1: Posting Security for Transacting Bonded Operations

- Memorandum D 3-1-1: Policy Respecting the Importation and Transportation of Goods

- Memorandum D 3-2-1: Air Pre-arrival and Reporting Requirements

- Memorandum D 3-3-1: Freight Forwarder Pre-arrival and Reporting Requirements

- Memorandum D 3-4-2: Highway Pre-arrival and Reporting Requirements

- Memorandum D 3-5-1: Marine Pre-load/Pre-arrival and Reporting Requirements

- Memorandum D 3-6-6: Rail Pre-arrival and Reporting Requirements

- Memorandum D 4-1-4: Customs Sufferance Warehouses

- Memorandum D 5-1-1: International Mail Processing

- Memorandum D 6-2-3: Refund of Duties

- Memorandum D 7-4-4: Customs Bonded Warehouses

- Memorandum D 8-1-4: Administrative Procedures Related to Form E29B, Temporary Admission Permit

- Memorandum D 8-1-7: Use of A.T.A. Carnets and Canada/Chinese Taipei Carnets for the Temporary Admission of Goods

- Memorandum D 11-6-4: Relief of Interest and/or Penalties Including Voluntary Disclosure

- Memorandum D 17-1-5: Registration, Accounting and Payment for Commercial Goods

- Memorandum D 17-1-8: Release Prior to Payment Privilege

- Memorandum D 17-1-10: Coding of Customs Accounting Documents

- Memorandum D 17-2-3: Importer Name/Account Number or Business Number Changes

- Memorandum D 17-4-0: Courier Low Value Shipment Program

- Memorandum D 19 Acts and Regulations of Other Government Departments

- Memorandum D 23-3-1: Customs Self-Assessment Program for Importers

Superseded D memoranda

D17-1-4 dated

Issuing office

Exporter and Release Programs Unit

Program and Policy Management Division

Commercial Program Directorate

Contact us

Page details

- Date modified: