Imported Tobacco Products and the Return of Canadian Manufactured Tobacco Products

Memorandum D18-2-1

Ottawa, June 27, 2018

ISSN 2369-2391

This document is also available in PDF (209 KB) [help with PDF files]

In Brief

Changes were made only in paragraph 4 (c) and (d).

This memorandum describes the packaging, stamping and labelling requirements and procedures for weighing imported tobacco products when determining customs duties. It also outlines the procedures to be followed for the return of Canadian manufactured tobacco products.

Table of Contents

Guidelines and General Information

Definitions

1. The following definitions pertain to the tobacco industry:

- cigar

- "cigar" means every description of cigar, cigarillo and cheroot, and any roll or tubular construction intended for smoking that consists of a filler composed of pieces of natural or reconstituted leaf tobacco, a binder of natural or reconstituted leaf tobacco in which the filler is wrapped and a wrapper of natural or reconstituted leaf tobacco.

- cigar stamp

- "cigar stamp" means any stamp required by the Excise Act and the regulations to be affixed to a cigar or package of cigars imported into Canada, to indicate that the additional customs duty has been paid under the Customs Act and the Customs Tariff on the cigars.

- cigarette

- "cigarette" means every description of cigarette and any roll or tubular construction intended for smoking, other than a cigar or a tobacco stick, and where any cigarette exceeds one hundred and two millimeters (102 mm) in length, each seventy six millimeters (76 mm) or fraction thereof shall be deemed to be a separate cigarette.

- in bond

- "in bond" means under the control of customs. Goods may be in bond while in a mode of transport or in a warehouse.

- package

- "package" means the smallest container in which the cigars or manufactured tobacco, as the case may be, are normally offered for sale to the general public, including any outer wrapping that is customarily displayed to the customer.

- manufactured tobacco

- "manufactured tobacco" means every article, other than cigars, made by a tobacco manufacturer from raw leaf tobacco by any process whatever, and includes cigarettes, tobacco sticks and snuff.

- tobacco products

- "tobacco products" means manufactured tobacco or cigars.

- tobacco stamp

- "tobacco stamp" means any stamp required by the Excise Act and the regulations to be impressed on, printed on, marked on, indented into or affixed to a cigarette or a package of manufactured tobacco imported into Canada, to indicate that the additional customs duty has been paid under the Customs Act and the Customs Tariff on the manufactured tobacco.

General Requirements

2. Persons who import tobacco products will ensure that the goods are put in packages that contain the information and tobacco or cigar stamps required by the Tobacco Departmental Regulations.

3. The labelling and stamping requirements of the Tobacco Departmental Regulations do not apply when an individual imports five or less units of packaged tobacco that are for consumption either by the individual or by another person at the expense of the individual.

4. For the purposes of this Memorandum, one unit is:

- 200 cigarettes;

- 50 cigars;

- 200 tobacco sticks; or

- 200 g of manufactured tobacco.

Labelling Requirements

5. Every package containing tobacco products will be clearly marked with the name and address or the registered number of the manufacturer who packaged it.

6. Where a manufacturer packages tobacco products for another person, the identity and principal place of business of the other person may be shown on the package instead of the manufacturer if the manufacturer advises customs that:

- he assumes responsibility for the contents of the packages so marked; and

- he can identify the packages.

7. Currently, there is no legal requirement to display health messages and information concerning toxic emissions on tobacco packages. Packages of tobacco products must, however, meet requirements related to tobacco product promotion. Please contact one of the Health Canada contacts listed in Appendix D for more information regarding these and other requirements of the Tobacco Act.

Stamping Requirements

8. A tobacco or cigar stamp must be affixed to every package of imported tobacco products in a conspicuous place that also seals the package.

9. The tobacco and cigar stamps required on tobacco packages are set out in Schedule I (cigarettes), Schedule II (cigars) and Schedule III (manufactured tobacco other than cigarettes) of the Tobacco Departmental Regulations. Each schedule is divided into two parts, allowing the importer flexibility in selecting the format of the applicable stamp. Schedule I, Schedule II, and Schedule III of the Tobacco Departmental Regulations are attached as Appendix A, Appendix B, and Appendix C to this Memorandum.

Products That Do Not Meet the Stamping or Packaging Requirements

10. Where packages of imported tobacco products are not stamped or put in packages containing the information required by the Tobacco Departmental Regulations, the packages will either be:

- exported;

- abandoned to the Crown under section 36 of the Customs Act; or

- entered into a customs sufferance warehouse where the importer will stamp or repackage the tobacco products.

11. Special services charges will be applied when a customs officer is asked to verify that packages in a sufferance warehouse are stamped or repackaged to meet the Regulations. For more information on special service charges, refer to Memorandum D1-2-1, Special Services.

Responsibility to Acquire Proper Stamps

12. Importers are responsible for ensuring that tobacco and cigar stamps are in the format required by the Tobacco Departmental Regulations.

13. The colour of the tobacco and cigar stamps may be of the importer's choice provided that:

- the colour does not affect the legibility of the required information on the stamp; and

- a specific colour is not required by provincial Acts and regulations.

14. Questions relating to the packaging, stamping, and labelling requirements for tobacco products may be directed to the following address:

Excise Duty Operations

Canada Customs and Revenue Agency

20th floor

Place de Ville, Tower A

320 Queen Street

Ottawa ON K1A 0L5

Telephone: (613) 957-8831

Fax: (613) 954-2226

Weighing Cigars and Cigarettes

15. Additional customs duty may be assessed on tobacco products based on their weight when they are imported.

16. The following procedures will be followed to determine the weight of imported cigars and cigarettes:

- not less than 50 cigars or cigarettes are to be weighed at one time of each brand in any importation;

- fractions less than 3.543625g are disregarded;

- a record of the weight, brand and other particulars of all imported cigars and cigarettes is kept at the customs office(s) where they are imported;

- bands and tips (mouth pieces permanently affixed to the cigar) are included in the mass for determination of duty;

- cellophane wrappers on individual cigars and metal tubes and other coverings are not included in the mass for determining duty. Cigars with coverings are weighed, and then weighed a second time after the coverings have been removed to determine the weight of the wrappers. A record of the weight of 50 or 100 of these wrappers for all brands and sizes is kept so that it is not necessary to remove them for subsequent importations;

- in the case of cigarettes not exceeding 102 mm in length, excluding the length of any attached filter:

- the number of cigarettes is to be the actual number of cigarettes; and

- the mass per thousand cigarettes is to be actual mass of the tobacco and the wrapper of paper or other material but does not include the mass of attached filters;

- in the case of cigarettes exceeding 102 mm in length, excluding the filter,

- the number of cigarettes is established on the basis of each 76 mm or fraction thereof, as being a separate dutiable cigarette; and

- the weight per thousand cigarettes is established using the following formula:

(actual number of long cigarettes multiplied by × mass excluding filters) divided by ÷ number of separate dutiable per M long cigarettes equals = mass per M for duty purposes

Return of Canadian Manufactured Tobacco Products

17. Tobacco products manufactured in Canada and subsequently exported may only be returned in bond to the Canadian manufacturer if they are stale dated, unsaleable, or shipped not according to order. These tobacco products can only be returned to the manufacturer's excise bonding warehouse in bond provided that the following procedures are observed:

- the tobacco products must be reported to customs at first point of arrival in Canada;

- prior to moving in bond, the importer must present a letter from excise confirming that the tobacco products:

- were manufactured in Canada;

- are either stale dated, unsaleable, or were shipped not according to order; and

- are being returned to the manufacturer's excise bonding warehouse in Canada.

- a licensed customs Bonded Carrier must be used to move the goods in bond to the manufacturer's excise bonding warehouse;

- Form A8A, Customs Cargo Control Document, must be presented to customs with a copy of the letter from Excise Duty Operations, as outlined in paragraph 17 (b); and

- after the movement, the broker/importer must identify that the tobacco products have arrived at the manufacturer's excise bonding warehouse by providing a copy of Form B60, Excise Duty Entry, to the customs office of report, to acquit the cargo inventory.

18. The shipment will not be permitted to move in bond unless the letter from Excise Duty Operations Operations and Form A8A are presented to customs, and a customs bonded carrier is used.

19. Any importation of foreign manufactured tobacco products is required to meet the regular reporting, release, and accounting procedures.

20. For more information, call contact the CBSA Border Information Service (BIS):

Calls within Canada & the United States (toll free): 1-800-461-9999

Calls outside Canada & the United States (long distance charges apply):

1-204-983-3550 or 1-506-636-5064

TTY: 1-866-335-3237

Contact Us online (webform)

Contact Us at the CBSA website

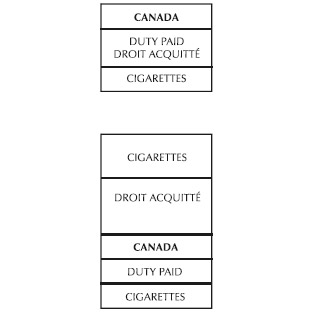

Appendix A

Tobacco Stamps for Packages of Cigarettes

Part I

Part II

![]()

Letters to be a minimum of 1.6 mm in height

Appendix B

Tobacco Stamps for Packages of Cigars

Part I

Part II

![]()

Letters to be a minimum of 1.6 mm in height

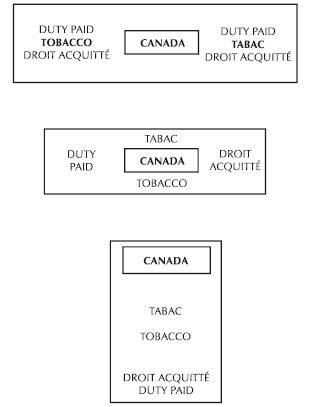

Appendix C

Tobacco Stamps for Manufactured Tobacco (Other than Cigarettes)

Part I

Part II

![]()

Letters to be a minimum of 1.6 mm in height

Appendix D

Health Protection Branch Contacts Health Canada

Atlantic Region

(Prince Edward Island, New Brunswick, Nova Scotia and Newfoundland)

Jean Landry

Inspector

Health Protection Branch

1st floor, GCB

10 Highfield Street

Moncton NB E1C 9V5

Telephone: (506) 851-7011

Fax: (506) 851-3197

Quebec Region

(Quebec)

Louise Kane

Supervisor, Tobacco Products Unit

Health Protection Branch

1001 St-Laurent Street West

Longueuil QC J4K 1C7

Telephone: (450) 646-1353

Fax: (450) 928-4144

Ontario Region

(Ontario)

John Zawilinski

Head, Tobacco Enforcement Unit

Health Protection Branch

2301 Midland Avenue

Scarborough ON M1P 4R7

Telephone: (416) 952-0929

Fax: (416) 954-3655

Central Region

(Saskatchewan and Manitoba)

Del Stitt

Chief, Product Safety and Tobacco Division

Health Protection Branch

510 Lagimodière Boulevard

Winnipeg MB R2J 3Y1

Telephone: (204) 983-2844

Fax: (204) 984-0461

Western Region

(Alberta, British Columbia, Northwest Territories and Yukon)

Dale Loewen

Tobacco Manager

Health Protection Branch

3155 Wellingdon Green

Burnaby BC V5G 4P2

Telephone: (604) 666-5005

Fax: (604) 666-3149

References

- Issuing office:

- Entry Accounting and Adjustment Policy,

Operational Policy and Coordination Directorate - Headquarters file:

- 4822-8, 7605-0, 8100-5

- Legislative references:

- Excise Act, subsection 203(1) and section 204

- Other references:

- N/A

- Superseded memorandum D:

- D18-2-1 dated November 7, 2017

Page details

- Date modified: