Technical guide for the Canadian Export Reporting System (CERS) portal — Business rules

: Portal access issues

The CBSA is experiencing intermittent issues (GCKey and others) that may affect access to its portals, including the CARM Client Portal (CCP), the eManifest, the Trusted Trader and the Canadian Export Reporting System (CERS) portals. We are taking corrective measures and intend to improve access to the portals soon.

Document navigation for Electronic Commerce Client Requirements

4.0 Business rules

Exporters are responsible for electronically submitting all applicable data to the CBSA for processing within the time frames specified in the Reporting of Exported Goods Regulations. This is in accordance with the technical requirements, specifications and procedures that are set out in this ECCRD: Chapter 25—CERS Portal. The CBSA will then validate the data and provide applicable status notifications to exporters and CSPs.

The following section outlines the business rules and process flows involved when providing export declarations to the CBSA using CERS export declarations and summary reports submitted through the CERS Portal.

4.1 CERS export declaration and summary report business rules

4.1.1 CERS export declaration

The exporter or CSP is required to provide CERS Export declarations to the CBSA within the time frames specified in the Reporting of Exported Goods Regulations. The CERS export declarations must be accepted by the CBSA within the prescribed time frames as shown in the chart below:

| Vessel | Air | Rail | Other | |

|---|---|---|---|---|

| 2 hours prior to delivery to the post office where the goods are mailed | 48 hours prior to loading onto the vessel | 2 hours prior to loading on board the aircraft | 2 hours prior to the rail car on which the goods have been loaded is assembled to form part of a train for export | Immediately prior to exportation |

Electronic declarations submitted to the CBSA through the CERS Portal must include all mandatory data elements: and conditional elements, where applicable: identified on the appropriate CERS Portal export document screen and in Appendix A of this document.

When using CERS, the exporter (including a sole proprietor, partnership, corporation, trust or other organization) must have a business number (BN9) and RM program identifier active for export (i.e. Exporter Program) and all related information up-to-date.

To register for a BN and/or export RM program identifier, the exporter must complete the Exporter Program Enrolment process using the CBSA Assessment and Revenue Management CARM Client Portal.

For assistance, please contact the CARM Client Support Help Desk by completing the web form.

As noted, CERS Portal declarations must be received and validated by the CBSA within the time frames specified in the Reporting of Exported Goods Regulations. It is solely the exporter's responsibility to ensure the submission of declarations is in compliance with regulations.

All information must be submitted to the CBSA in either English or French.

Please see Appendix A at the end of this document for required export data elements.

4.1.2 One-time submission

A one-time submission is a feature available in the CERS Portal to exporters who do not have an existing business number (BN). This one-time submission can only be used by a CSP on behalf of an exporter that does not have an existing BN or business account with CBSA, by allowing them to submit a one-time declaration.

When a CSP uses the CERS Portal to complete a one-time submission on behalf of an exporter, the associated export declaration will automatically be assigned the following information:

- The CSP's BN

- The CSP's one-time Authorization ID

- The CSP's standard Authorization ID

Note that the CSP's one-time Authorization ID will contain a "Z" in the second character position, and that the CSP's standard Authorization ID may possess a different prefix letter and/or numeric suffix value than the CSP's one-time authorization ID. (Example: CSP Authorization ID: FN9725; CSP one-time Authorization ID: ZZ2544)

Please refer to Appendix A for more details on these data elements.

4.1.3 Summary Reporting Program

The Summary Reporting Program (SRP) enables approved exporters of bulk or homogeneous goods (if such goods meet the eligibility criteria) to submit a monthly summary of their exports after the goods have been exported.

SRP participants are required to submit a report, which covers the previous calendar month, within five business days following the end of the month in which the goods were exported. To avoid potential penalties from the CBSA, exporters must submit their reports using the prescribed format and within the specified time frame.

Summary Reports can be uploaded in the CERS Portal at the end of each month. To ensure the information in the summary report upload is captured correctly, exporters and/or CSP will need to save the document in the prescribed “.xml” format. For more information on the summary report upload, please see Appendix C.

If there is nothing to report for a particular month, a NIL report is required to be submitted within five business days after the end of the month indicating that no exports have taken place for that month.

Note: Businesses can report their exports using a combination of other available methods. Also, a company could report non-restricted goods by one method and restricted goods by another.

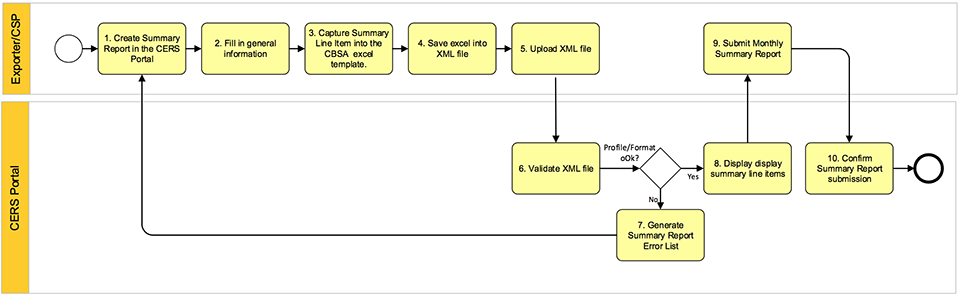

Long description

Steps to submit a summary report

- Step 1: exporter/CSP creates summary report in the CERS Portal

- Step 2: exporter/CSP fills in the general information

- Step 3: exporter/CSP captures summary line item into the CBSA excel template

- Step 4: exporter/CSP saves excel into XML file

- Step 5: exporter/CSP uploads XML file

- Step 6: CERS Portal validates XML file

- Step 7: If the profile or format is incorrect, a summary report error list is generated and sent to the exporter/CSP

- Step 8: If the profile or format is correct, the CERS Portal will display the summary line items

- Step 9: exporter/CSP submits monthly summary report

- Step 10: CERS Portal confirms the submission of the summary report

For more information and the eligibility criteria on the SRP, please visit Appendix B in the exporter Reporting D-Memo.

To apply for this Program, please visit the Summary Reporting Program Application Form.

4.1.4 Bulk load

Bulk load functionality enables an exporter or CSP to submit one or more declarations simultaneously from a locally stored input file. When using the "bulk load" method, an exporter or CSP can have the CERS application extract data records from a source text file and automatically create one or more Export declaration forms at a time.

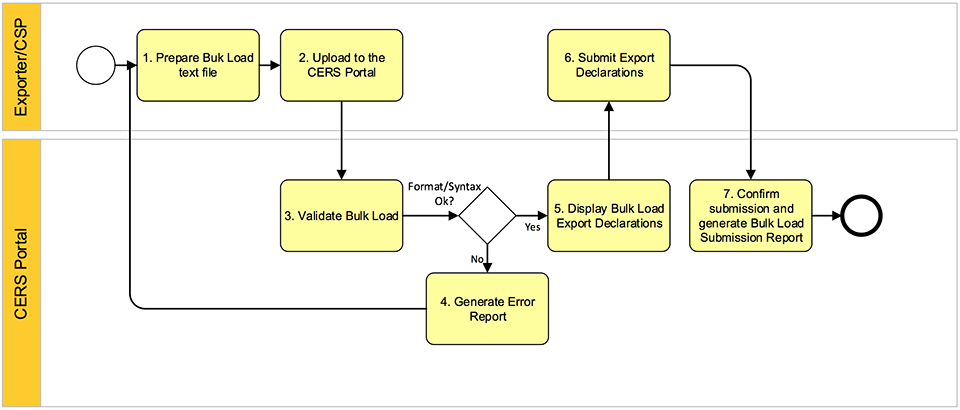

Long description

Steps to use the buck load functionality

- Step 1: exporter/CSP prepares the bulk load text file

- Step 2: exporter/CSP uploads the file to the CERS portal

- Step 3: CERS Portal validates the bulk load

- Step 4: If the format/syntax is incorrect, an error report is generated and sent to the exporter/CSP

- Step 5: If the format/syntax is correct, the CERS Portal will display the bulk load export declarations

- Step 6: exporter/CSP submits the export declarations

- Step 7: CERS Portal confirms the submission and generates a bulk load submission report

Note: A CSP must submit using their own account, not using an exporter's account.

For more information on file structure, please refer to Appendix E.

For a sample of the bulk load text file, please refer to Appendix F.

4.2 A special note for exporters and CSP who also transmit trade data using EDI

For more information on the G7 process, please see the G7 EDI export reporting page.

Export data transmitted by an exporter or CSP through EDI cannot be viewed or modified through the CERS Portal.

Document navigation for Electronic Commerce Client Requirements

Page details

- Date modified: