Proof of Export, Canadian Ownership, and Destruction of Commercial Goods

Memorandum D20-1-4

Ottawa, December 9, 2008

This document is also available in PDF (378 Kb) [help with PDF files]

In Brief

1. This In Brief page has been revised to denote changes made as a result of the Government of Canada's Paperwork Burden Reduction Initiative. This revision replaces the In Brief page dated September 17, 2008.

2. This memorandum is revised as a result of the Paper Burden Reduction Initiative. The revisions are aimed at eliminating obsolete and duplicated requirements, streamlining certain commercial processes and modifying complex policies and forms. As well, this memorandum has been revised to update terminology used by the Canada Border Services Agency.

This memorandum outlines and explains the options available to those who are required to prove for customs purposes either that goods entering the country are of Canadian origin, or that temporarily imported goods have been exported or destroyed.

Guidelines and General Information

1. Businesses are required to substantiate their claim for relief of duty and/or excise taxes by providing documents that prove that the goods in question originated from Canada, were exported, or destroyed. The term "originated from Canada" refers to both domestic products and to previously imported, duty-paid products returning to Canada.

2. Where possible, the CBSA has attempted to align its documentation requirements for proof of export, destruction, or Canadian origin with existing commercial documents. The commercial documents must describe the goods in sufficient detail to enable CBSA officers to verify that the goods exported or destroyed were the same as the goods temporarily imported or that goods returning to Canada are of Canadian origin. The claimant can add to these commercial documents, any other information useful to the CAD officer such as make, model, serial number, reason for export, nature of repair, cost of repair, exported for which show.

3. Almost any reasonable form of proof is acceptable to the CBSA as documentary evidence. However, it should be noted that failure to present any conclusive proof may result in denial of relief of duties and/or taxes. The description of the goods on the bill of lading or similar document must be the same as on the import invoice. For example, a bill of lading would not be acceptable if, in the description field, it stated "one crate" or "wearing apparel". A more appropriate description would be "men's shirts".

4. To help the importing community substantiate an entitlement to relief of payment of duties and/or taxes, Appendix A contains a table indicating the following elements:

- (a) related directives;

- (b) reasons requiring a company to prove that a shipment was either exported or destroyed;

- (c) circumstances which may affect the type of documentation required; and

- (d) type of documentation acceptable to the CBSA as proof of export or destruction in each particular case.

5. When no documentation exists to prove export or destruction, the CBSA will examine a shipment prior to its export or destruction and certify form E15, Certificate of Destruction/Exportation. In cases where one company requests many export inspections (for example, submission of more than twenty E15 forms per month), local offices may request that a Regional Operational Services officer or a Commercial Operations Directorate, Entry Section officer consult with the exporter/broker to find an alternate process.

6. In cases of destruction, where a claimant wishes to use a document other than form E15, an application may be made to the Regional Collector to use alternate forms of proof regularly. An example of this would be the paper work of the disposal company. Regional Operational Services will consult with the Regional CAD Unit and either reject or approve the proposal. Appendix B contains an example of form E15 along with procedures and completion instructions.

7. Reimported commercial goods, such as lap top computers, commercial samples, artwork, will not require formal accounting, when the goods have been identified on a form Y38, Identification of Articles for Temporary Exportation, and are accompanying the traveller. An example of form Y38, as well as an explanation of the conditions under which formal accounting will not be required, can be found in Appendix C.

8. Reimported non-commercial goods are subject to the conditions governing proof of Canadian origin found in Memorandum D2-6-5, Documentation of Personal Articles for Temporary Exportation (form Y38 procedures).

9. Proof of origin for Canadian goods returning to Canada must be provided at the time release of the goods is being requested from the CBSA.

Artwork

10. It is necessary to prove a work of art is of Canadian origin to import it free of GST after it has been temporarily exported.

11. If the artwork accompanies the traveller, a properly completed form Y38 will suffice to prove Canadian origin and no customs accounting document will be necessary.

12. Bills of lading that describe the artwork in sufficient detail to enable the CBSA to verify that the artwork entering Canada is the same as that described on the export bill of lading will also be acceptable to prove Canadian origin.

13. In lieu of the documentation outlined in paragraphs 11 and 12, members of CARFAC (Canadian Artists' Representation) can obtain a Certificate of Canadian Origin from the national office of Canadian Artists' Representation, B1-100 Gloucester Street, Ottawa, Ontario, K2P 0A4, Telephone: 613 231-6277. The form will be considered as proof of Canadian origin if it is properly completed, stamped, dated and signed by the Director, or delegated representative, of the Canadian Artists' Representation. A copy of the form must accompany the accounting document at the time of import, if the artwork does not accompany the traveller.

Penalty Information

14. The Customs Act provides for penalties if any false declaration is made upon the exportation or importation of goods.

Appendix A - Documentation Acceptable as Proof of Export/Destruction

| D-Memorandum | Reason for Proof of Export/ Destruction | Circumstance | Acceptable Documentation |

|---|---|---|---|

| D3-5-7 Temporary Importation of Vessels | Partial relief (1/120 basis) of duties and/or taxes may be applicable for ships, rail cars and railway equipment imported on a temporary basis. To qualify for such relief, the export of the goods must be proven. | A vessel imported temporarily on which 1/120 of the duty was paid. | A General Declaration, form A6 (outward report), must be filed and the CBSA office of departure must be made aware that the vessel was imported on a 1/120 basis, or the CBSA must be advised in writing that the vessel is no longer being used for dutiable purposes. |

| A railway car or equipment temporarily imported, on which 1/120 of the duty was paid. | A US entry or landing certificate should be used as proof of export. If these are not available, the railway companies' records will be considered. | ||

| D6-2-2 Refund of Duties | Proof of export or destruction is required to substantiate a claim for refund of duties and taxes when the goods received are defective, are of inferior quality or are not the goods ordered. Besides the proof of export requirement, this directive outlines the other documents required to substantiate the original payment of duty and the condition of the goods. | A refund claim of more than $100 duty and taxes excluding GST where the goods are transported out of the country by commercial carrier. | A bill of lading which clearly describes the goods, or a US landing certificate. |

| A refund claim of more than $100 duty and taxes excluding GST where the goods are destroyed. | Form E15, Certificate of Destruction/Exportation. | ||

| A refund claim of more than $100 duty and taxes excluding GST where the goods are transported out of the country by a non-commercial carrier and therefore no bill of lading is available. | Foreign customs documentation fully completed and certified by a customs officer of the country to which the goods were exported which fully describes the goods or form E15. | ||

| A refund claim of more than $100 duty and taxes excluding GST where the goods are transported out of the country by Canada Post Corporation. | If the goods are exported through a customs mail centre and the refund claim (form B2G non-commercial/B2 commercial) is prepared at that time, the officer will write EXPORTATION VERIFIED on the claim and date stamp it. A postal receipt that indicates the goods, the destination and the date such as postal insurance, postal registration, or the GST Exempt postal receipt which is issued for foreign postal destinations is acceptable. | ||

| A refund claim of less than $100 duty and taxes excluding GST. | Any of the above documents or if not available, an attestation of exportation placed on the refund claim and signed by the claimant or his agent. | ||

| D7-2-3 Obsolete or Surplus Goods | Proof of destruction is required to obtain a drawback of duties under the Obsolete or Surplus Goods program. | Destruction under CBSA supervision | A certified form E15, Certificate of Destruction/Exportation. |

| D7-3-2 Motor Vehicles Exported Drawback Regulations | A drawback may be paid for some new motor vehicles purchased and used temporarily in Canada before being exported. To obtain the drawback, the export of the vehicle must be proven. Documentation as described in this directive is required to substantiate | Motor vehicles, exported for drawback, driven across the border | A sales contract (or like document stamped by the CBSA officer) on which the exporter has annotated the odometer reading upon export, the make of vehicle, ID number, date of delivery, license number, and province of issue (where applicable). A copy of the foreign registration is also required. |

| D7-4-1 Duty Deferral Program | Proof of export is required to obtain relief from payment of customs duties levied under Schedule I of the Customs Tariff, with respect to goods used in the processing of goods in Canada which are subsequently exported. Other documentation as outlined in this directive is also required to substantiate the relief. | Consumable and expendable goods. | Bills of lading or foreign customs documentation fully completed and certified by a customs officer of the country to which the goods were exported which fully describes the goods. |

| D7-4-2 Duty Drawback Program | A drawback may be paid in respect of certain goods manufactured in Canada and exported. To obtain the drawback, the export must be proven. A drawback may be paid in respect of certain goods imported into Canada and exported. To obtain the drawback, the export must be proven. |

Imported goods used in manufactured goods in Canada and subsequently exported. Export of goods subject to drawback. |

A sales invoice and bill of lading are required in addition to other documents to substantiate the drawback claim. In cases where goods are delivered to a bonded warehouse or duty-free shop for exportation, the claim shall also be accompanied by a copy of form B3, Canada Customs Coding Form. A sales invoice, bill of lading, credit and debit memorandums are required, in addition to other documents, to substantiate the drawback claim. In cases where goods are delivered to a bonded warehouse or duty-free shop for exportation the claim shall also be accompanied by a copy of the B3 form. |

| D8-1-1 Temporary Importation Regulations | Partial relief (1/60 basis) of duties and/or taxes may be applicable for goods imported on a temporary basis. To qualify for such relief, the export or destruction of the goods must be proven. | 1/60 basis. | Bills of lading, providing they fully describe the goods and can be related to the imported goods. Also acceptable are foreign customs documents fully completed and certified by a customs officer of the country to which the goods were exported which fully describe the goods. An attestation as to the presence of the goods in a foreign country, signed and certified by a foreign customs agency, may also be acceptable. If none of the above are available, form E15 may be used. |

| D8-1-2 International Events and Conventions Services Program | Proof of export is required for display goods temporarily imported under tariff item No. 9819.00.00, side shows and concessions, and goods imported for meetings or conventions of foreign organizations. | Display goods, side shows and concessions, foreign conventions. | At the time of exportation, goods which were granted temporary importation with the importer's copies of the Temporary Admission Permit (form E29B) or the ATA Carnet, must be presented to the CBSA for examination and certification. Also acceptable are consumption accounting documents or landing certificates fully completed and certified by a customs officer of the country to which the goods were exported or a US Certificate of Disposition of Imported Merchandise (D.F. 3227) fully completed and certified by a US customs officer. If none of the above are available, form E15 may be used. |

| D8-1-2 International Events and Conventions Services Program | When goods are imported in an emergency, they should be documented on form E29B. Goods consumed or destroyed in Canada may be accounted for on form B3. | Emergency goods. | Form B3 should contain a signed statement attesting to the destruction or consumption of the goods in Canada. See Memorandum D8-1-6 for qualified signees. |

D8-1-4 Form E29B, Temporary Admission Permit D8-1-7 Use of ATA Carnets for the Temporary Admission of Goods |

Goods may be temporarily entered on ATA Carnets or E29B forms where the document is subsequently lost. | Lost ATA Carnets or forms E29B. | Export may be substantiated by foreign customs documentation fully completed and certified by a customs officer of the country to which the goods were exported. If this cannot be obtained, form E15 can be used. |

| D8-2-1 Canadian Goods Abroad D8-2-3 Non-commercial Importations Remission Order |

Canadian goods after having been temporarily exported for repair, addition or further processing are entitled to relief of duties and taxes. To substantiate the claim, it must be proven that the goods were exported from Canada and are not new importations. | Commercial Canadian goods abroad. | A work order or contract from the Canadian owner with a commercial invoice for the repairs. In the case of private vehicles, the registration will verify that it is Canadian. Summary reports which include work orders and commercial invoices. |

| D8-3-8 Repair Abroad of Canadian Civil Aircraft, Canadian Aircraft Engines and Flight Simulators Remission Order D8-4-2 Summary Reporting of Vehicle Repairs by Highway Carriers |

Vehicle repairs to highway carriers. | ||

| D10-14-11 Canadian Goods and Goods Once Accounted for, Exported and Returned | When Canadian goods are returned to Canada after a temporary exportation, their origin must be proven. | Commercial products carried out and into Canada by a traveller. | Form Y38, Identification of Articles for Temporary Exportation. Note that the goods must accompany the traveller. |

| Jewellery. | An appraisal certificate. | ||

| Canadian art work. | Bills of lading, a properly completed Y 38 if the artwork accompanies the traveller, or a Certificate of Canadian Origin certified by the Canadian Artists' Representation. Form E15 can be used if none of the above are available. | ||

| Commercial items which do not fall into any of the above categories. | Bills of lading, consumption entries or landing certificates fully completed and certified by a customs officer of the country to which the goods were exported. Evidence that the goods have not been advanced in value or improved in condition by any process of manufacture or other means, or combined with any other article abroad. If none of the above are available, form E15 can be used. |

Appendix B - Form E15, Certificate of Destruction/Exportation

1. Form E15 is an identification document used to describe goods exported or destroyed under CBSA supervision. Each shipment documented on form E15 must be examined by a CBSA officer and the officer must certify that the goods have been exported or destroyed.

2. The importer/exporter or his agent is responsible for the completion of form E15. The form must be submitted in duplicate with the goods to be examined. When packing or crating is necessary, consideration must be given to the fact that CBSA officers are required to identify the goods before exportation or destruction. A service charge is applicable when a CBSA officer must leave the CBSA office to verify exportation or destruction.

3. An uncertified form E15 is invalid as proof of exportation or destruction.

4. The CBSA officer shall complete fields 12, 13, 14, and 15, of form E15 and sign, date stamp and place his/her badge number in the appropriate spaces upon completion of the examination.

5. Both copies of the form E15 are returned to the applicant.

6. Methods of returning the certified forms E15 to the applicant vary. It is very important that the applicant receive certified copies of the form E15 in a dependable and timely fashion because they will be needed to substantiate claims for relief of duty. It is the CBSA's responsibility to see that the applicant receives the copy.

7. All goods for export presented for identification at an inland CBSA office shall be forwarded in bond to the point of exit unless they are transported by a commercial bonded carrier on a through bill of lading under a cargo control document. The E15 form will be signed, stamped and returned to the exporter at the examining office. At the discretion of the examining office, the shipment may be forwarded under seal. In this case, a photocopy of form E15 should be sent with the shipment to be used for verification purposes should the seal not be intact. The Regulations relating to bonding requirements are found in Memorandum D3-1-1, Regulations Respecting the Importation, Transportation and Exportation of Goods.

Form E15 Completion Instructions

The following instructions are intended to assist in the completion of form E15. They are numbered to correspond with the numbered fields (boxes) on form E15 (sample is attached).

Field No. 1 – Name and full address of the applicant (for example importer of record, owner, exporter or consignor).

Field No. 2 – Page number and total number of pages.

Field No. 3 – Applicant's reference number – This is an optional field which can be used by the applicant to reference the merchandise in the company's, own record keeping system. Purchase order numbers, packing slip numbers or invoice numbers are typical.

Field No. 4 – Reason for certification – Mark the appropriate box to designate the circumstance involved in obtaining relief of duty.

Field No. 5 – Gross shipping weight as shown on the waybill, bill of lading or similar transportation document if applicable.

Field No. 6 – If the goods were previously imported, state the import transaction number, accounting date and the CBSA office where the import accounting document was presented for each line in field 8.

Field No. 7 – Marks and numbers on the packages – For carload, truckload or container load shipments, show the car, trailer or container number.

Field No. 8 – Describe the articles to be exported or destroyed (in detail) showing serial numbers, part numbers, model numbers, catalogue numbers and any other identifying marks and numbers where applicable.

Field No. 9 – Quantity and unit of measure for each line in field 8.

Field No. 10 – Invoice unit price per item as given in field 8.

Field No. 11 – Invoice value per line – This value must be FOB place of lading, exclusive of freight, handling, insurance or similar charges.

Field No. 12 – CBSA use only (comments on discrepancies, condition of articles, scrap statement, method of destruction, etc.) – Where the CBSA officer believes that part of the goods have been used or damaged, a notation should be made specifying the quantity, description of the used or damaged goods, and the apparent use.

Field No. 13 – Point of destruction/exportation.

Field No. 14 – CBSA use only – Indicate the disposition of the scrap derived from the destruction. The appropriate box is to be checked by the officer and any comments should appear in field 5.

Field No. 15 – CBSA use only – The officer indicates the condition of goods before exportation or destruction.

Field No. 16 – CBSA use only – Inspector's signature and badge number.

Field No. 17 – Type or print the full return address, including the postal code in order to show in a window envelope.

Field No. 18 – CBSA use only – date-stamp.

Sample of Form E15, page 1 of 1

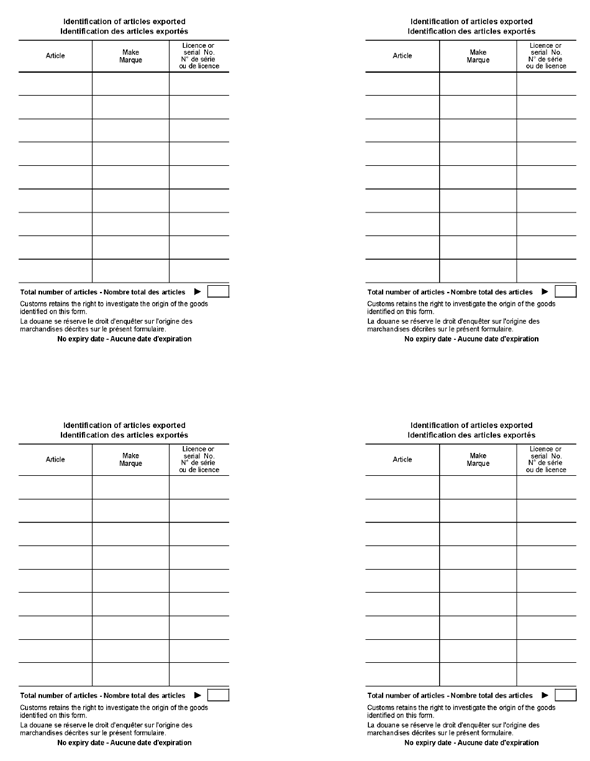

Appendix C - Form Y38, Identification of Articles for Temporary Exportation

This Appendix outlines and explains the conditions under which formal accounting is not required for reimported commercial goods which accompany the traveller.

1. Many Canadian manufacturers seeking to establish export markets for their products often travel with promotional equipment, product samples, personal computers, VCRs, artwork, etc., which they intend to use abroad and bring back with them.

2. At the time the goods are reimported into Canada, it is the responsibility of the traveller to account for the goods. This normally includes the preparation of an accounting document with supporting documentation to establish that the goods were initially taken out of Canada.

3. To assist frequent business travellers in meeting this requirement, the CBSA has developed a procedure by which goods may be documented on an identification card before their removal from Canada. At the time of reimportation, the card will be accepted by the CBSA as satisfactory evidence as to the origin of the goods. Upon presentation of form Y38, the traveller will have fulfilled his responsibility to account for the goods, and therefore form B 3, Canada Customs Coding Form, will not be required. This procedure, while not mandatory, is provided as a service free of charge at all CBSA offices across Canada.

Documentation

4. Commercial goods being temporarily exported and accompanying the traveller, may be presented for identification at any CBSA office before or at the time of departure from Canada.

5. Following examination and identification by a CBSA officer, the article will be documented on a wallet-size card, form Y38.

6. Where available, serial numbers or other identifiable marks that uniquely identify an article must be shown on the Y38. In cases where no unique or identifiable numbers or marks are available, trade marks, model numbers, and a clear and complete description of the article, including colour, size, material, etc., must be provided to enable the CBSA to relate the description on form Y38 to the articles being entered.

7. The traveller/company representative will be asked to sign a declaration statement on the face of form Y38 attesting that the goods were, to the best of his or her knowledge, either produced in Canada or lawfully entered by the CBSA.

8. As there is no expiry date on the form, it may be retained and used by the traveller as long as it remains legible.

9. Goods which have been documented on form Y38 must not be advanced in value, improved in condition or combined with any other article while abroad. The product must remain in the same style, shape, make, etc., as it was when form Y38 was issued. Information on documentation of goods exported for such purposes is contained in Memorandum D8-2-1, Canadian Goods Abroad.

10. Goods documented on form Y38 are not to be individually reported for export on form B13A, Export Declaration, or included in the monthly Summary Reporting of exports.

Requirements of Other Government Departments

11. Commercial goods exported and imported on form Y38 are subject to the requirements of other government departments and all necessary permits, certificates, etc., must be presented to the CBSA each time the subject goods are exported. The requirements of other government departments are listed in the D19 series of Memoranda.

Sample of Form Y38, page 1 of 2

Sample of Form Y38, page 2 of 2

References

- Issuing office:

- Inspection and Control Division

- Headquarters file:

- 7605-6

- Legislative references:

- Other references:

- D2-6-5, D3-1-1, D3-5-7, D7-2-3, D7-3-2, D7-4-1, D7-4-2, D8-1-1, D8-1-2, D8-1-4, D8-1-7, D8-2-1, D8-2-3, D8-3-8, D8-4-2, D10-14-11, D19 series

- Superseded memorandum D:

- D6-2-3, August 28, 1990

D20-1-4, September 13, 1993

Interim D20-1-4, August 3, 1993

- Date modified: