Canada Border Services Agency

Quarterly Financial Report

For the quarter ended September 30, 2017 (Revised)

Table of contents

- Erratum

- 1. Introduction

- 2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

- 3. Risks and Uncertainties

- 4. Significant Changes in Relation to Operations, Personnel and Programs

- 5. Approval by Senior Officials

- 6. Table 1: Statement of Authorities (Unaudited)

- 7. Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited)

Erratum

Date: February 2, 2018

Location: 2016-2017 Departmental Budgetary Expenditures by Standard Object Table (Unaudited) (Section 7, Table 2)

Revision: The “Planned expenditures for the year ending March 31, 2017” column were erroneously transcribed, as such the reader is advised to see the updated column for the revised correct figures.

Rationale: Original amounts reported were the “Planned expenditures for the year ending March 31, 2016” instead of the “Planned expenditures for the year ending March 31, 2017”.

1. Introduction

This Quarterly Financial Report (QFR) has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates, Supplementary Estimates A, Canada’s Economic Action Plan 2016 (Budget 2016) and Canada’s Economic Action Plan 2017 (Budget 2017).

A summary description of the Canada Border Services Agency (CBSA) program activities can be found in Part II of the Main Estimates, and a detailed description in Part III-Departmental Plan.

The QFR has not been subject to an external audit or review.

1.1 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities (Table 1) includes the department's spending authorities granted by Parliament, and those used by the department consistent with the Main Estimates and Supplementary Estimates (as applicable) for the 2017-2018 fiscal year. This quarterly report has been prepared using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before money can be spent by the Government. Approvals are given in the form of annually approved limits through appropriation acts, or through legislation in the form of statutory spending authority for specific purposes

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

This section highlights the significant items that contributed to the net increase or decrease in resources available for the year and actual expenditures as of the quarter ended September 30, 2017.

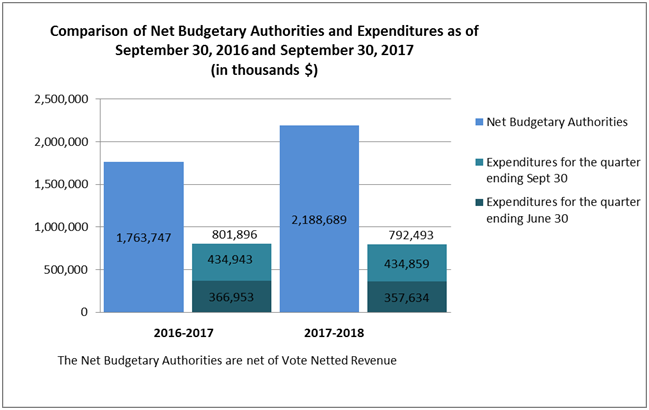

Graph 1: Comparison of Net Budgetary Authorities and Expenditures as of September 30, 2016 and September 30, 2017 (in thousands $)

2.1 Significant Changes to Authorities

For the period ending September 30, 2017, as well as the same period ending last fiscal year, the authorities provided to the CBSA are comprised of the Main Estimates and Supplementary Estimates A and any unused spending authorities carried forward from the previous fiscal year.

The Statement of Authorities (Table 1) presents a net increase of $424.9 million or 24.1% in the Agency’s total authorities of $2,188.7 million at September 30, 2017 compared to $1,763.7 million total authorities at the same quarter last year.

This net increase in the authorities available for use is the result of an increase in Vote 1 – Operating Expenditures of $308.0 million, an increase in Vote 5 – Capital of $118.4 million and a decrease in Budgetary Statutory Authorities of $1.5 million, as detailed below:

Vote 1 – Operating

The Agency's Vote 1 Operating increased by $308.0 million or 22%, which is mainly attributed to the net effect of the following significant items:

Increases totaling $313.5 million are mainly attributed to:

- $230.4 million in increases as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2017;

- $83.1 million in increases due to a larger carry forward of unused spending authorities. $122.5 million of unused spending authorities at the end of 2016-2017 were carried into 2017-2018 as compared to $39.4 million of unused spending authorities from 2015-2016 carried forward into 2016-2017.

Decreases totaling $5.5 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2017.

Vote 5 - Capital

The Agency’s Vote 5 Capital increased by $118.4 million or 67.1%, which is mainly attributed to the net effect of the following significant items:

Increases totaling $140.2 million are mainly attributed to:

- $79.1 million in increases as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2017;

- $61.1 million in increases due to a larger carry forward of unused spending authorities. $86.9 million of unused spending authorities at the end of 2016-2017 were carried into 2017-2018 as compared to $25.8 million of unused spending authorities from 2015-2016 carried forward into 2016-2017.

Decreases totaling $21.8 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2017.

Budgetary Statutory Authorities

The Agency’s Statutory Authority related to the employee benefit plan decreased by $1.5 million, or 0.8% from the previous year. The decrease is mainly due to the annual adjustment in the employee benefit plan rate set by the Treasury Board Secretariat.

2.2 Explanations of Significant Variances in Expenditures from Previous Year

As indicated in the Statement of Authorities (Table 1), the Agency’s expenditures for the quarter ending September 30, 2017 were the same as the quarter ending September 30, 2016 at $434.9 million. The Agency's year-to-date expenditures total $792.5 million as compared to $801.9 million at the same time last year. The decrease of $9.4 million or 1.2% in expenditures is primarily due to the following items:

- Decrease of $5.9 million or 0.9% in Vote 1 Operating Expenditures year-to-date used at quarter end ($675.6 million versus $681.5 million same time last year). The bulk of the difference in spending is attributed to a decrease in professional and legal services for the fiscal year 2017-2018;

- Decrease of $7.0 million in statutory and other spending;

- Increase of $4.2 million or 15.6% in Vote 5 Capital Expenditures year-to-date used at quarter end ($31.4 million versus $27.2 million same time last year) due to an increase in capital projects.

As indicated in the Departmental Budgetary Expenditures by Standard Object (Table 2), the decreases by standard object are mainly attributed to the following offsetting factors:

- A decrease of $29.8 million year-to-date used at quarter end in professional and special services due to a decrease in legal services as a result of a timing difference for invoices received from the Department of Justice and a decrease in information technology consultants and Shared Services information technology;

- An increase of $9.8 million year-to-date used at quarter end due to an increase in project spending under acquisition of land, building and works;

- An increase of $7.2 million year-to-date used at quarter end in personnel due to an increase in overtime statutory holiday pay and collective bargaining reimbursement.

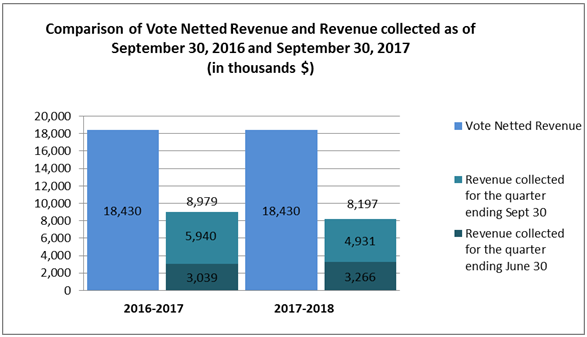

The planned revenue from the sales of services reflects the Agency's revenue respending authority. The year-to-date revenue from the sales of services decreased by $0.8 million or 8.7% due to decreases in the Remote Area Border Crossing Permit, the Detector Dog Learning Services and the NEXUS program.

Graph 2: Comparison of Vote Netted Revenue and Revenue collected as of September 30, 2016 and September 30, 2017 (in thousands $)

3. Risks and Uncertainties

The complexity of the operating environment of the CBSA can be seen in the broad scope of external drivers. Developments in geopolitical relations, in the global economy, in environmental matters, and in human and animal health cascade down into Canada’s trade, immigration, tourism and refugee patterns, affecting volumes and introducing security and facilitation challenges. Continued growth in both global trade and the virtual economy has benefitted legitimate business and criminal enterprises alike, and presents more complexity in managing Canada’s supply chain and physical borders.

Collective bargaining negotiations between the Government of Canada and bargaining agents continue to unfold. The outcome of these negotiations will have implications for all departments including the CBSA.

There has been a substantial number of asylum seekers entering Canada from the United States at CBSA’s ports of entry (POE). The current volume of asylum claimants has impacted the operational and financial capacity of CBSA and its partners. The Agency is currently taking steps to manage the surge of asylum seekers crossing the border, including adjusting its financial capacity and operations to process claimants as quickly as possible without compromising the safety or security of Canadians.

Lastly, the CBSA operates in a rapidly changing border environment with increasingly complex security and immigration demands, changing traveler volumes, higher infrastructure costs and rising trade volumes, all of which contributed to a strain on the Agency’s finances. To ensure it can continue to deliver in this context in a sustainable manner, the CBSA is undertaking a strategic exercise that will: examine its current resource base; fully align its operations to the priorities of the Government and Canadians; and work to ensure the sustainability of those operations for years to come.

In considering these factors, the CBSA has embarked on various initiatives that will allow the organization to be even more efficient and effective in the way it does business through increased efforts to address threats early and facilitate trade and travel. To improve its ability to successfully deliver on its initiatives, the Agency regularly examines its enterprise risk landscape, updates its Enterprise Risk Profile and takes appropriate action to mitigate its top risks and the associated financial impacts. The Agency’s top risks and associated responses are communicated in its Departmental Plan.

4. Significant Changes in Relation to Operations, Personnel and Programs

4.1 Key Senior Personnel

The appointment of Jacqueline Rigg to the position of Vice President, Human Resources Branch who had previously been acting in the position for Jean-Stéphen Piché who was leading the work on CBSA Renewal and has now been appointed as Senior Assistant Deputy Minister of Cultural Affairs at Canadian Heritage.

The acting appointment of Gino Lechasseur as Vice-President of Information, Science and Technology Branch (ISTB) replacing Maurice Chénier who was appointed to the newly created position of Chief Transformation Officer within the Agency.

4.2 Operations

The Agency continues to enhance border security and ensures the facilitation of legitimate travellers and goods with modernizations of and enhancements to security screening procedures, trusted traveller initiatives, immigration detentions, and infrastructure at our Ports of Entry across the country as per the Departmental Plan for 2017-18.

The CBSA also maintains a key role in delivering on the Government of Canada priorities such as supporting the increase in Canada’s immigration levels and the implementation of the Gordie Howe International Bridge project.

4.3 New Programs

The CBSA will adapt and expand operations in order to support Canada’s commitment to process up to 300,000 new immigrants this year in collaboration with partner organizations.

In addition, in recognition of an increasingly complex and rapidly changing border environment, a review of all areas of the Agency is underway with the aim to better position the CBSA to meet current demands and operational realities, and future expectations.

5. Approval by Senior Officials

Approved by:

John Ossowski

President

Ottawa, Canada

Date: November 24, 2017

Christine Walker

Chief Financial Officer

Ottawa, Canada

Date: November 24, 2017

6. Table 1: Statement of Authorities (Unaudited)

| (in thousands of dollars) | Total available for use for the year ending March 31, 2018* | Used during the quarter ended September 30, 2017 | Year-to-date used at quarter end |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,710,022 | 367,532 | 675,651 |

| Vote 5 - Capital Expenditures | 294,792 | 24,622 | 31,399 |

| Statutory Authority - Contributions to employee benefit plans | 183,875 | 42,668 | 85,337 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 28 | 44 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 9 | 62 |

| Total budgetary authorities | 2,188,689 | 434,859 | 792,493 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 2,188,689 | 434,859 | 792,493 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter end.

6. Table 1: Statement of Authorities (Unaudited)

| (in thousands of dollars) | Total available for use for the year ending March 31, 2017* | Used during the quarter ended September 30, 2016 | Year-to-date used at quarter end |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,401,992 | 369,290 | 681,556 |

| Vote 5 - Capital Expenditures | 176,373 | 19,319 | 27,161 |

| Statutory Authority - Contributions to employee benefit plans | 185,382 | 46,178 | 92,356 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 0 | 15 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 156 | 808 |

| Total budgetary authorities | 1,763,747 | 434,943 | 801,896 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 1,763,747 | 434,943 | 801,896 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter-end.

7. Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited)

| (in thousands of dollars) | Planned expenditures for the year ending March 31, 2018* | Expended during the quarter ended September 30, 2017 | Year-to-date used at quarter end |

|---|---|---|---|

| Expenditures | |||

| Personnel | 1,336,979 | 344,627 | 658,744 |

| Transportation and communications | 77,117 | 9,479 | 16,412 |

| Information | 4,281 | 80 | 217 |

| Professional and special services | 390,255 | 52,630 | 82,567 |

| Rentals | 12,290 | 1,924 | 2,547 |

| Repair and maintenance | 35,268 | 5,174 | 7,517 |

| Utilities, materials and supplies | 22,662 | 3,285 | 5,188 |

| Acquisition of land, buildings and works | 127,956 | 12,789 | 14,017 |

| Acquisition of machinery and equipment | 165,031 | 6,457 | 8,673 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 35,280 | 3,317 | 4,764 |

| Total gross budgetary expenditures | 2,207,119 | 439,762 | 800,646 |

| Less revenues netted against expenditures | |||

| Sales of Services | 18,430 | 4,931 | 8,197 |

| Other Revenue | 0 | -28 | -44 |

| Total revenues netted against expenditures | 18,430 | 4,903 | 8,153 |

| Total net budgetary expenditures | 2,188,689 | 434,859 | 792,493 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by parliament at quarter-end.

7. Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited)

| (in thousands of dollars) | Planned expenditures for the year ending March 31, 2017 * | Expended during the quarter ended September 30, 2016 | Year-to-date used at quarter end |

|---|---|---|---|

| Expenditures | |||

| Personnel | 1,262,636 | 336,593 | 651,571 |

| Transportation and communications | 47,964 | 9,384 | 16,423 |

| Information | 2,237 | 97 | 296 |

| Professional and special services | 233,294 | 74,976 | 112,399 |

| Rentals | 9,169 | 1,444 | 2,393 |

| Repair and maintenance | 25,251 | 5,045 | 8,049 |

| Utilities, materials and supplies | 17,066 | 2,564 | 4,519 |

| Acquisition of land, buildings and works | 81,448 | 3,965 | 4,238 |

| Acquisition of machinery and equipment | 80,056 | 4,460 | 8,233 |

| Transfer payments | 0 | 0 | 0 |

| Other subsidies and payments | 23,056 | 2,355 | 2,739 |

| Total gross budgetary expenditures | 1,782,177 | 440,883 | 810,860 |

| Less revenues netted against expenditures | |||

| Sales of Services | 18,430 | 5,940 | 8,979 |

| Other Revenue | 0 | 0 | -15 |

| Total revenues netted against expenditures | 18,430 | 5,940 | 8,964 |

| Total net budgetary expenditures | 1,763,747 | 434,943 | 801,896 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter-end.

- Date modified: